Title: Chattanooga Tennessee Subpoena To Testify of Insurance Employee — A Comprehensive Overview Introduction: In the legal process, a Chattanooga Tennessee subpoena to testify of insurance employee refers to a summons issued by the court, commanding an insurance employee to appear and provide their testimony under oath. This crucial document plays a significant role in insurance claims, litigation, and investigations. This article will delve into the various types of subpoenas related to insurance employees and shed light on their purpose and implications. 1. Types of Chattanooga Tennessee Subpoenas to Testify of Insurance Employee: 1.1. Subpoena Ducks Cecum: A subpoena duces tecum compels an insurance employee to produce specific documents, records, or evidence relevant to a particular case. The insurance employee must ensure compliance with the subpoena by gathering and presenting the requested materials during their testimony. 1.2. Subpoena Ad Testificandum: This type of subpoena requires an insurance employee to appear and testify orally in a court proceeding. The employee is obligated to answer questions truthfully, based on their knowledge and involvement within the insurance industry. 1.3. Subpoena Ducks Cecum and Ad Testificandum: In certain cases, a subpoena may incorporate both duces tecum and ad testificandum elements. In such instances, the insurance employee is required to attend a court hearing and provide testimony while also producing relevant documents, records, or evidence. 2. Purpose of Chattanooga Tennessee Subpoenas to Testify of Insurance Employee: 2.1. Verifying Claim Details: A subpoena may be issued to an insurance employee to verify the accuracy of an insurance claim. By compelling their testimony, the court aims to gather pertinent information and determine the legitimacy or fraudulent nature of the claim. 2.2. Witness Testimony and Depositions: Subpoenas to testify of insurance employees often function to obtain essential witness testimony or deposition statements. They serve to elicit insight into insurance policies, coverage terms, claim procedures, or any other relevant information that can aid in resolving disputes or verifying crucial facts in a case. 2.3. Investigating Insurance Fraud: Authorities may issue subpoenas to insurance employees to help investigate fraudulent activities within the insurance industry. The testimony of these employees can shed light on any fraudulent practices, forged documents, or false claims, thereby assisting in identifying and prosecuting the culprits. 3. Legal implications and Process: 3.1. Compliance: A subpoena is a legal mandate, and failure to comply can result in severe consequences. Insurance employees summoned under a subpoena must appropriately coordinate with their employers to ensure they adhere to the court's instructions promptly. 3.2. Legal Representation: An insurance employee subpoenaed to testify may choose to seek legal counsel to understand their rights, obligations, and potential ramifications associated with their testimony. Legal representation can help protect their interests and provide guidance throughout the legal process. Conclusion: Chattanooga Tennessee subpoenas to testify of insurance employees serve as vital tools in legal proceedings involving insurance claims, fraud investigations, and resolving insurance-related disputes. Whether it involves producing crucial documents or providing oral testimony, the cooperation of insurance employees is essential to ensure a fair and just legal system.

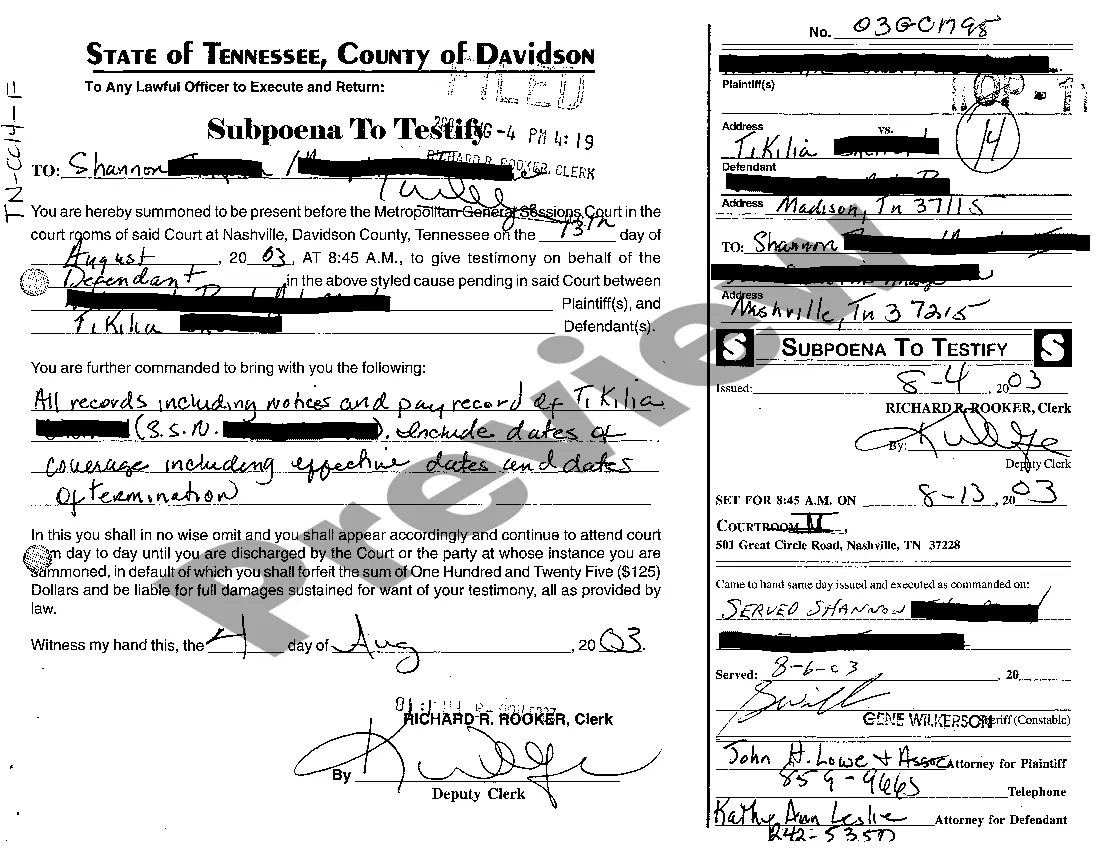

Chattanooga Tennessee Subpoena To Testify of Insurance Employee

Description

How to fill out Chattanooga Tennessee Subpoena To Testify Of Insurance Employee?

If you are looking for a relevant form template, it’s impossible to find a better service than the US Legal Forms website – one of the most considerable online libraries. With this library, you can find thousands of document samples for business and personal purposes by categories and regions, or key phrases. With the high-quality search feature, discovering the newest Chattanooga Tennessee Subpoena To Testify of Insurance Employee is as easy as 1-2-3. Additionally, the relevance of every file is confirmed by a group of expert attorneys that regularly review the templates on our website and revise them according to the most recent state and county demands.

If you already know about our system and have a registered account, all you need to get the Chattanooga Tennessee Subpoena To Testify of Insurance Employee is to log in to your user profile and click the Download button.

If you use US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have opened the form you want. Read its information and make use of the Preview feature to explore its content. If it doesn’t suit your needs, use the Search field near the top of the screen to discover the needed file.

- Confirm your selection. Choose the Buy now button. Following that, select your preferred subscription plan and provide credentials to register an account.

- Make the transaction. Use your credit card or PayPal account to finish the registration procedure.

- Get the template. Pick the file format and save it on your device.

- Make adjustments. Fill out, revise, print, and sign the received Chattanooga Tennessee Subpoena To Testify of Insurance Employee.

Each template you add to your user profile does not have an expiry date and is yours forever. You always have the ability to gain access to them via the My Forms menu, so if you want to get an extra copy for modifying or creating a hard copy, feel free to return and export it once more at any time.

Make use of the US Legal Forms extensive library to gain access to the Chattanooga Tennessee Subpoena To Testify of Insurance Employee you were looking for and thousands of other professional and state-specific templates on a single website!