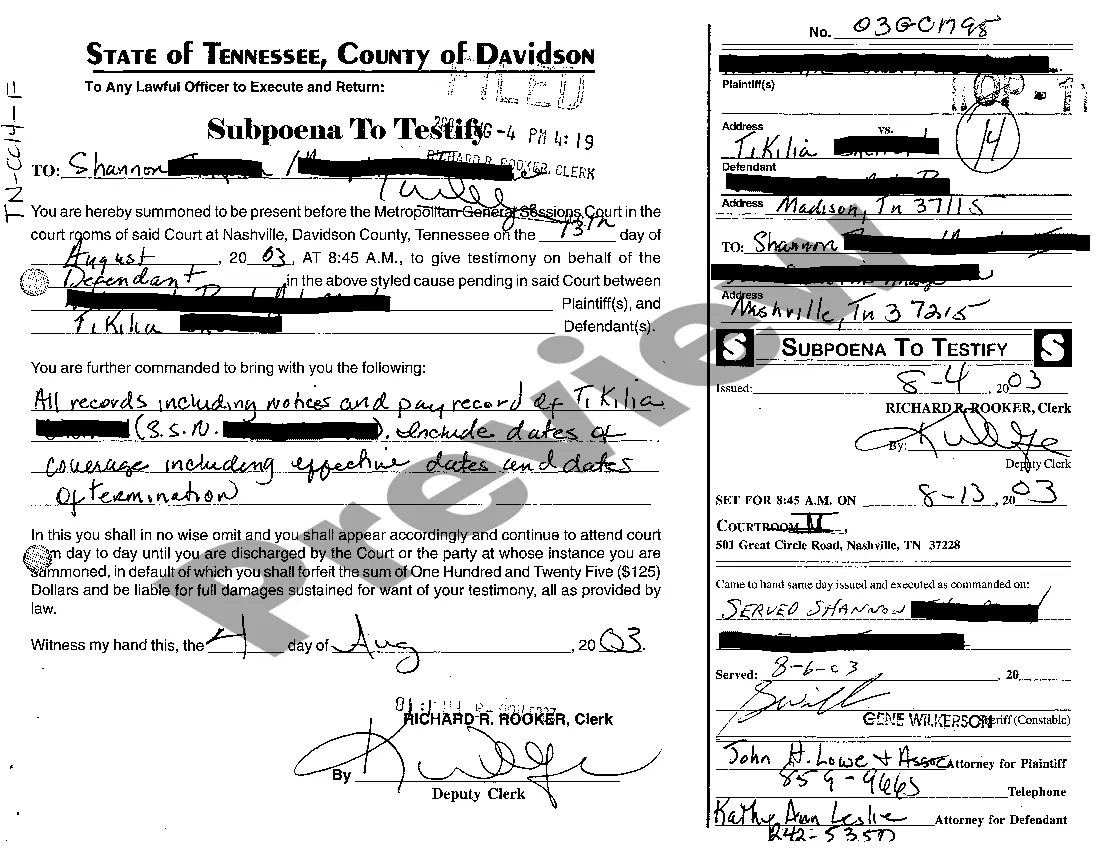

Clarksville Tennessee Subpoena to Testify of Insurance Employee: A Clarksville Tennessee subpoena to testify of an insurance employee is a legal order issued by the court to require the presence and testimony of an individual who works in the insurance industry. This individual may be summoned to testify as a witness in a specific legal case in which they possess relevant information or expertise. The Clarksville Tennessee subpoena to testify of an insurance employee plays a pivotal role in judicial proceedings, especially those involving insurance-related matters such as insurance claims, disputes, or fraud investigations. It serves as a tool for attorneys and legal professionals to obtain crucial insights from the knowledgeable insurance employee, ensuring a fair and just resolution of the case at hand. Different types of Clarksville Tennessee subpoena to testify of insurance employee may include: 1. Subpoena to Testify Regarding Insurance Coverage: This type of subpoena aims to secure the testimony of an insurance employee who can provide information about the terms, conditions, and extent of insurance coverage. This testimony may be essential in cases where claimants or insured parties seek clarification or validation of their coverage or policy limits. 2. Subpoena to Testify on Insurance Claim Investigation: When insurance claims are under investigation for potential fraud or misrepresentation, a subpoena can be issued to an insurance employee who possesses relevant knowledge or expertise in claim adjustment or fraud detection. This type of subpoena aims to gather information or evidence needed to establish the validity or invalidity of a claim. 3. Subpoena to Testify on Insurance Policy Interpretation: In cases where disputes arise due to differences in interpreting policy language or clauses, a subpoena can be issued to an insurance employee who is well-versed in policy interpretation. This type of subpoena seeks to shed light on the intent, meaning, and scope of the insurance policy to assist the court in making an informed decision. 4. Subpoena to Testify as an Expert Witness in Insurance Industry: In complex insurance-related litigation, such as professional liability claims or insurance fraud cases, a subpoena may be issued to an insurance employee who possesses specialized knowledge and expertise in the insurance industry. This type of subpoena allows the employee to testify as an expert witness, providing professional opinions, analyses, and interpretations that can help the court understand intricate insurance matters. Overall, a Clarksville Tennessee subpoena to testify of an insurance employee plays a crucial role in gathering relevant information and ensuring a fair and just resolution in legal matters related to insurance. It enables attorneys to obtain essential insights, clarifications, and evidence from knowledgeable insurance employees, ultimately facilitating the attainment of justice for all parties involved in the case.

Clarksville Tennessee Subpoena To Testify of Insurance Employee

Description

How to fill out Clarksville Tennessee Subpoena To Testify Of Insurance Employee?

Getting verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Clarksville Tennessee Subpoena To Testify of Insurance Employee becomes as quick and easy as ABC.

For everyone already familiar with our library and has used it before, obtaining the Clarksville Tennessee Subpoena To Testify of Insurance Employee takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a few more steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make certain you’ve picked the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Clarksville Tennessee Subpoena To Testify of Insurance Employee. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!