Title: Understanding Knoxville Tennessee Subpoena To Testify of Insurance Employee: A Comprehensive Overview Keywords: Knoxville Tennessee, subpoena, testify, insurance employee Introduction: In Knoxville, Tennessee, a subpoena to testify of an insurance employee is a legal document issued by a court that compels an individual employed within the insurance industry to provide testimony regarding a specific case. The purpose of such subpoenas is to obtain relevant information, statements, or documents related to insurance claims, fraud investigations, or other legal matters. Let's explore the different types of Knoxville Tennessee Subpoena To Testify of Insurance Employee and the process involved. Types of Knoxville Tennessee Subpoena To Testify of Insurance Employee: 1. Insurance Fraud Investigation Subpoena: This type of subpoena is typically served on an insurance employee who may possess critical information related to a suspected insurance fraud case. The insurance employee may be required to provide testimony about potential fraudulent behavior, including false claims, staged accidents, or any other fraudulent activities they might have observed or been involved in. 2. Subpoena for Testimony in Insurance Claim Dispute: In situations where an insurance company denies a claim or a policyholder contests a settlement, a subpoena may be issued to an insurance employee to provide evidence or testimony related to the claim. This aims to uncover any discrepancies, insurance policy misrepresentations, or potential bad faith practices by the insurance company or the policyholder. 3. Subpoena to Testify as Expert Witness: Sometimes, an insurance employee with specialized knowledge or expertise may be required to testify as an expert witness in insurance-related litigation. They may be called upon to explain insurance policies, claims processing procedures, or industry practices assisting the court in reaching a fair and informed decision. Process of Issuing and Responding to Knoxville Tennessee Subpoena To Testify of Insurance Employee: 1. Subpoena Issuance: The process begins when an attorney representing a party in a legal matter files an application with the court requesting a subpoena. The court reviews the application, ensuring it meets the necessary requirements and is relevant to the case's proceedings. If approved, the court issues the subpoena, which commands the insurance employee's appearance to testify. 2. Subpoena Service: The subpoena is then served to the insurance employee either by a process server, law enforcement officer, or certified mail. The employee must receive the subpoena and acknowledge its contents. 3. Compliance with Subpoena: Upon receiving the subpoena, the insurance employee is legally obligated to comply and testify at the specified date, time, and location mentioned in the document. Failure to comply without a valid reason can result in legal consequences, such as contempt of court charges. 4. Consultation with Legal Counsel: Where necessary, the insurance employee may consult their legal counsel to understand their rights, obligations, and any potential privilege that may apply. Legal counsel can also help prepare the employee for testimony and guide them through the process. 5. Testimony and Documentation: During the deposition or court appearance, the insurance employee must truthfully answer questions posed by the lawyers involved. If requested, they may need to produce relevant documents or records relating to the case. Conclusion: A Knoxville Tennessee Subpoena To Testify of Insurance Employee plays a vital role in gathering crucial information within the insurance industry. This legal process ensures transparency, helps resolve disputes, and aids in the pursuit of justice. It is essential for the insurance employee to understand their rights, seek legal advice if needed, and cooperate in good faith to provide accurate and reliable testimony.

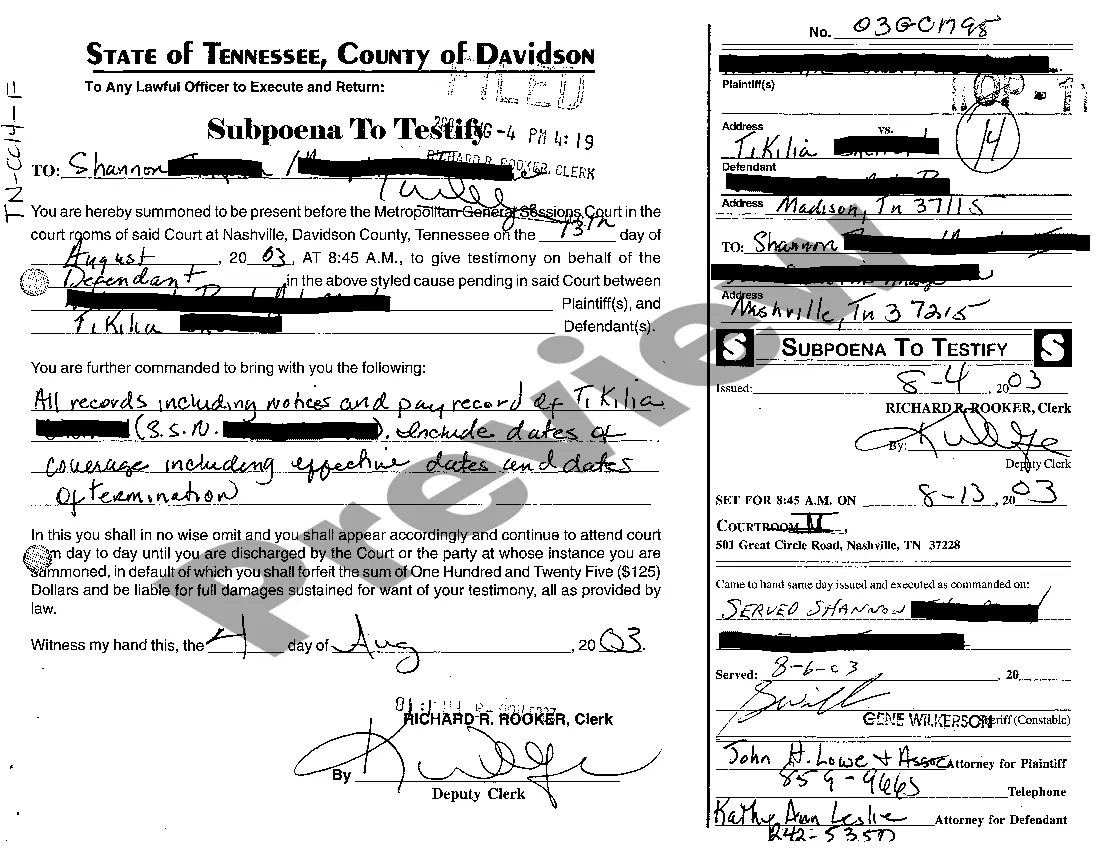

Knoxville Tennessee Subpoena To Testify of Insurance Employee

Description

How to fill out Knoxville Tennessee Subpoena To Testify Of Insurance Employee?

We always want to reduce or prevent legal damage when dealing with nuanced legal or financial affairs. To accomplish this, we sign up for attorney services that, as a rule, are extremely expensive. However, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of an attorney. We provide access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Knoxville Tennessee Subpoena To Testify of Insurance Employee or any other document quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again in the My Forms tab.

The process is equally effortless if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Knoxville Tennessee Subpoena To Testify of Insurance Employee complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Knoxville Tennessee Subpoena To Testify of Insurance Employee would work for you, you can pick the subscription option and proceed to payment.

- Then you can download the document in any available file format.

For over 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!