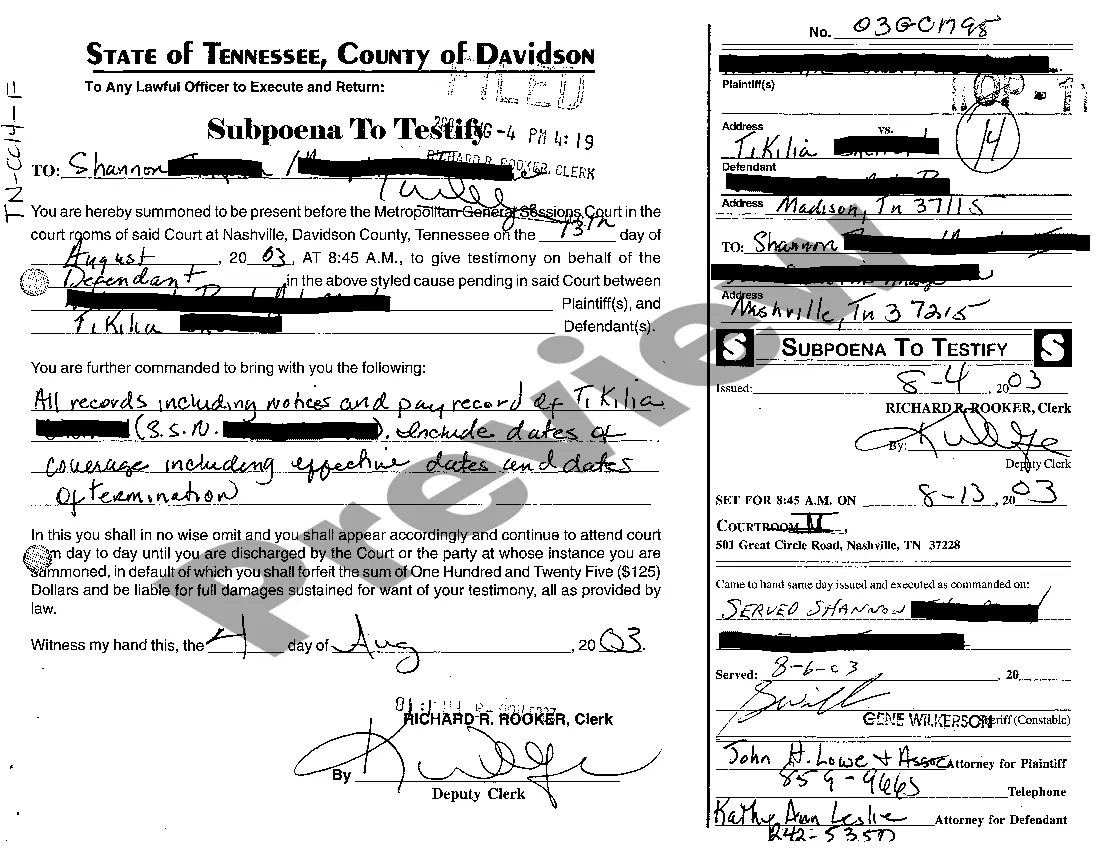

Murfreesboro Tennessee Subpoena To Testify of Insurance Employee: A Comprehensive Guide to the Legal Process If you find yourself involved in a legal matter pertaining to insurance claims or investigations in Murfreesboro, Tennessee, it is crucial to understand the intricacies of a subpoena to testify as an insurance employee. This article aims to provide you with a detailed description of what a Murfreesboro Tennessee subpoena entails, as well as introduce you to different types of subpoenas that may be relevant to insurance employees. What is a Subpoena? A subpoena is a legal document issued by the court, usually at the request of a party involved in a lawsuit or investigation, requiring an individual to testify or provide documents pertinent to the case. In the context of insurance cases, a subpoena to testify compels an insurance employee to appear before the court or a deposition to testify under oath regarding their knowledge and involvement in a particular insurance claim or investigation. Role of Insurance Employees in Subpoenas to Testify: Insurance employees who may receive a subpoena to testify can include claims adjusters, investigators, underwriters, or any personnel involved in the processing and evaluation of insurance claims. These professionals possess unique insight into the intricacies of claims handling and investigation, making their testimony vital in legal proceedings. Types of Murfreesboro Tennessee Subpoenas To Testify of Insurance Employees: 1. Subpoena Ducks Cecum: In situations where an insurance employee is required to provide specific documents related to a case, a subpoena duces tecum may be issued. This subpoena not only demands the employee's appearance but also requests the production of relevant documents, such as claim files, policy documents, correspondence, or any other paperwork that could aid in the resolution of the legal matter. 2. Subpoena Ad Testificandum: This type of subpoena exclusively focuses on obtaining the testimony of an insurance employee. It commands the individual to appear in court, before the judge or a deposition setting, to provide their statement under oath regarding their involvement and knowledge of the insurance claim or investigation. Responding to a Murfreesboro Tennessee Subpoena To Testify of Insurance Employee: When served with a subpoena to testify as an insurance employee, it is crucial to consult with legal counsel promptly. Your attorney will guide you through the legal process and help ensure compliance with the subpoena in a manner that protects your rights and interests. Failure to comply with a subpoena can result in legal consequences, including contempt of court. In conclusion, a Murfreesboro Tennessee subpoena to testify as an insurance employee is a legal instrument that compels individuals involved in insurance claims or investigations to provide their testimony or relevant documents. Understanding the different types of subpoenas and seeking legal advice promptly when served can help navigate the legal landscape effectively and protect your rights as an insurance employee.

Murfreesboro Tennessee Subpoena To Testify of Insurance Employee

State:

Tennessee

City:

Murfreesboro

Control #:

TN-CC14-05

Format:

PDF

Instant download

This form is available by subscription

Description

A06 Subpoena To Testify of Insurance Employee

Murfreesboro Tennessee Subpoena To Testify of Insurance Employee: A Comprehensive Guide to the Legal Process If you find yourself involved in a legal matter pertaining to insurance claims or investigations in Murfreesboro, Tennessee, it is crucial to understand the intricacies of a subpoena to testify as an insurance employee. This article aims to provide you with a detailed description of what a Murfreesboro Tennessee subpoena entails, as well as introduce you to different types of subpoenas that may be relevant to insurance employees. What is a Subpoena? A subpoena is a legal document issued by the court, usually at the request of a party involved in a lawsuit or investigation, requiring an individual to testify or provide documents pertinent to the case. In the context of insurance cases, a subpoena to testify compels an insurance employee to appear before the court or a deposition to testify under oath regarding their knowledge and involvement in a particular insurance claim or investigation. Role of Insurance Employees in Subpoenas to Testify: Insurance employees who may receive a subpoena to testify can include claims adjusters, investigators, underwriters, or any personnel involved in the processing and evaluation of insurance claims. These professionals possess unique insight into the intricacies of claims handling and investigation, making their testimony vital in legal proceedings. Types of Murfreesboro Tennessee Subpoenas To Testify of Insurance Employees: 1. Subpoena Ducks Cecum: In situations where an insurance employee is required to provide specific documents related to a case, a subpoena duces tecum may be issued. This subpoena not only demands the employee's appearance but also requests the production of relevant documents, such as claim files, policy documents, correspondence, or any other paperwork that could aid in the resolution of the legal matter. 2. Subpoena Ad Testificandum: This type of subpoena exclusively focuses on obtaining the testimony of an insurance employee. It commands the individual to appear in court, before the judge or a deposition setting, to provide their statement under oath regarding their involvement and knowledge of the insurance claim or investigation. Responding to a Murfreesboro Tennessee Subpoena To Testify of Insurance Employee: When served with a subpoena to testify as an insurance employee, it is crucial to consult with legal counsel promptly. Your attorney will guide you through the legal process and help ensure compliance with the subpoena in a manner that protects your rights and interests. Failure to comply with a subpoena can result in legal consequences, including contempt of court. In conclusion, a Murfreesboro Tennessee subpoena to testify as an insurance employee is a legal instrument that compels individuals involved in insurance claims or investigations to provide their testimony or relevant documents. Understanding the different types of subpoenas and seeking legal advice promptly when served can help navigate the legal landscape effectively and protect your rights as an insurance employee.

How to fill out Murfreesboro Tennessee Subpoena To Testify Of Insurance Employee?

If you’ve already used our service before, log in to your account and save the Murfreesboro Tennessee Subpoena To Testify of Insurance Employee on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Make certain you’ve located the right document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Murfreesboro Tennessee Subpoena To Testify of Insurance Employee. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!