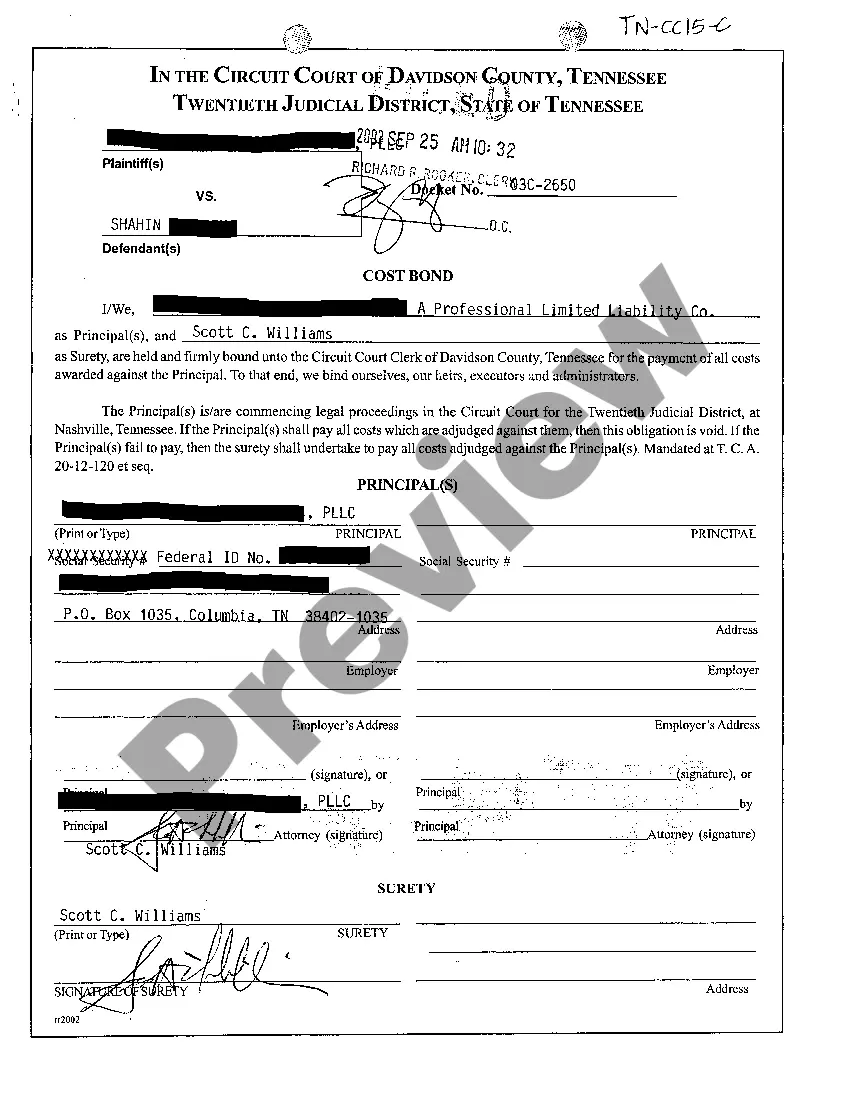

A Murfreesboro Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principle is a type of bond that provides a guarantee for the payment of costs awarded against the principle. This bond is required in various legal and financial transactions and acts as a form of financial security. The purpose of a Murfreesboro Tennessee Cost Bond is to ensure that the principal, typically an individual or a business entity, fulfills their financial obligations and covers any costs that may be awarded against them by a court or other legal authority. These costs may include court fees, attorney fees, witness fees, and other expenses related to a legal case. There are different types of Murfreesboro Tennessee Cost Bonds available depending on the specific requirements of the situation. Some common types include: 1. Civil Court Cost Bonds: This type of bond is required when a party is involved in a civil court case and needs to provide a guarantee for the payment of potential costs awarded against them. 2. Appellate Cost Bonds: When a party chooses to appeal a court decision, they may be required to obtain an appellate cost bond. This bond ensures that any costs associated with the appeal process will be covered. 3. Probate and Estate Cost Bonds: In probate and estate matters, a cost bond may be necessary to ensure the payment of costs related to the administration of the estate, such as attorney fees and other expenses. 4. Bankruptcy Cost Bonds: When a debtor files for bankruptcy, they may be required to secure a cost bond to cover any costs that may arise during the bankruptcy proceedings. To obtain a Murfreesboro Tennessee Cost Bond, the principal must typically work with a licensed surety bond company that specializes in providing this type of financial guarantee. The bond amount required will vary depending on the specific circumstances of the case or transaction. It is important for the principal to understand that a Murfreesboro Tennessee Cost Bond is a legal contract, and failure to fulfill the financial obligations outlined in the bond could result in severe consequences, such as financial penalties or legal action. In summary, a Murfreesboro Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principle is a vital financial guarantee that provides security for parties involved in various legal matters. By obtaining this bond, the principal ensures that any costs awarded against them will be paid promptly and in accordance with legal requirements.

A Murfreesboro Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principle is a type of bond that provides a guarantee for the payment of costs awarded against the principle. This bond is required in various legal and financial transactions and acts as a form of financial security. The purpose of a Murfreesboro Tennessee Cost Bond is to ensure that the principal, typically an individual or a business entity, fulfills their financial obligations and covers any costs that may be awarded against them by a court or other legal authority. These costs may include court fees, attorney fees, witness fees, and other expenses related to a legal case. There are different types of Murfreesboro Tennessee Cost Bonds available depending on the specific requirements of the situation. Some common types include: 1. Civil Court Cost Bonds: This type of bond is required when a party is involved in a civil court case and needs to provide a guarantee for the payment of potential costs awarded against them. 2. Appellate Cost Bonds: When a party chooses to appeal a court decision, they may be required to obtain an appellate cost bond. This bond ensures that any costs associated with the appeal process will be covered. 3. Probate and Estate Cost Bonds: In probate and estate matters, a cost bond may be necessary to ensure the payment of costs related to the administration of the estate, such as attorney fees and other expenses. 4. Bankruptcy Cost Bonds: When a debtor files for bankruptcy, they may be required to secure a cost bond to cover any costs that may arise during the bankruptcy proceedings. To obtain a Murfreesboro Tennessee Cost Bond, the principal must typically work with a licensed surety bond company that specializes in providing this type of financial guarantee. The bond amount required will vary depending on the specific circumstances of the case or transaction. It is important for the principal to understand that a Murfreesboro Tennessee Cost Bond is a legal contract, and failure to fulfill the financial obligations outlined in the bond could result in severe consequences, such as financial penalties or legal action. In summary, a Murfreesboro Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principle is a vital financial guarantee that provides security for parties involved in various legal matters. By obtaining this bond, the principal ensures that any costs awarded against them will be paid promptly and in accordance with legal requirements.