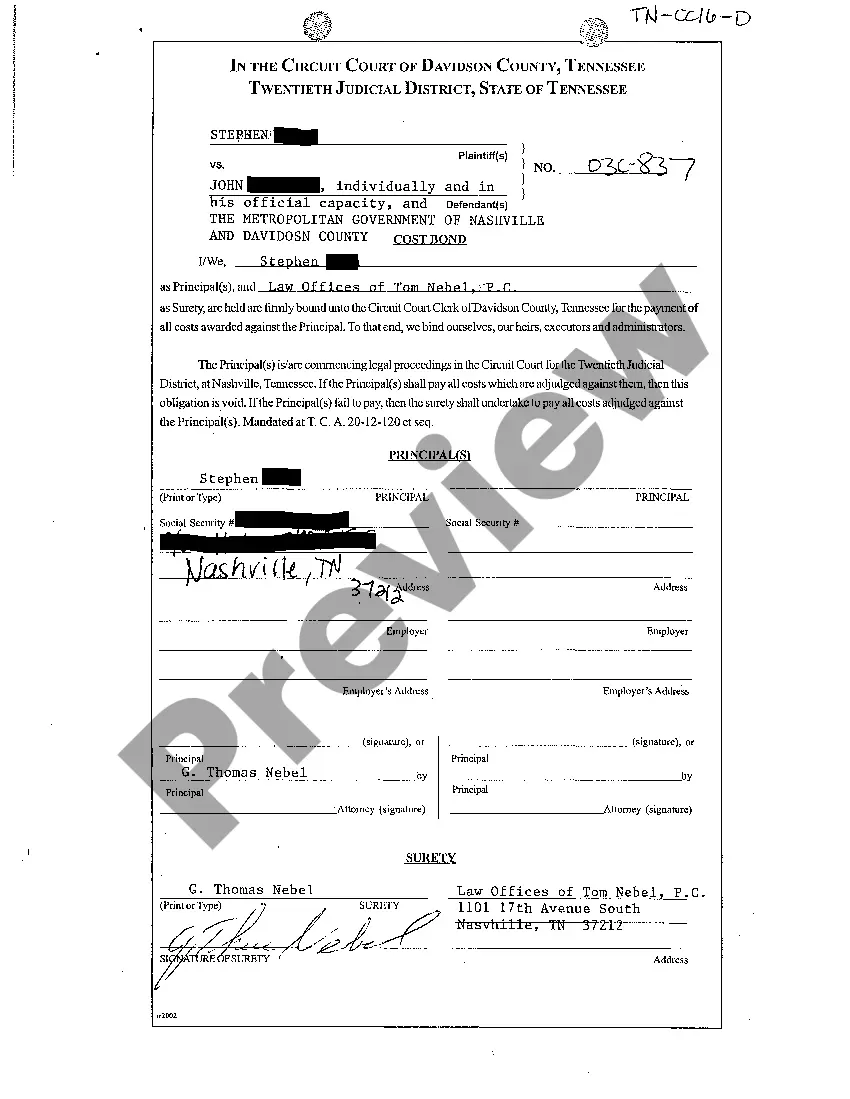

A Knoxville Tennessee Cost Bond is a type of surety bond that serves as a financial guarantee for the payment of costs awarded against the principle. When someone is involved in a legal case and is required to pay costs to the opposing party, they may be asked to obtain a cost bond to ensure that these costs will be paid in a timely manner. The purpose of a Knoxville Tennessee Cost Bond is to provide assurance to the court and the opposing party that the principal has the financial resources to cover the awarded costs. This bond is typically required when there is a possibility that the principal may not be able to fulfill their financial obligations. There are different types of Knoxville Tennessee Cost Bonds that can be used to act as surety for payments of costs awarded against the principle. The most common types include: 1. Plaintiff's Cost Bond: This bond is obtained by the plaintiff in a lawsuit to guarantee payment of costs that may be awarded against them if they fail to prevail in the case. 2. Defendant's Cost Bond: This bond is obtained by the defendant in a lawsuit to ensure payment of costs that may be awarded against them if they are unsuccessful in defending the case. 3. Appeal Cost Bond: This bond is required when a party wishes to appeal a court's decision and needs to secure the costs that may be awarded against them if the appeal is unsuccessful. 4. Execution Cost Bond: This bond is obtained in cases where the court has issued a judgment for costs against the principle, but the principal wishes to delay payment of those costs while pursuing an appeal or other legal remedies. It's important to note that the specific requirements for a Knoxville Tennessee Cost Bond may vary depending on the court and the nature of the case. The bond amount will typically be determined by the court, and the principal will need to work with a licensed surety bond company to obtain the bond. In summary, a Knoxville Tennessee Cost Bond is a type of surety bond that acts as a guarantee for the payment of costs awarded against the principle in a legal case. By obtaining this bond, the principal can demonstrate their financial responsibility and ensure that they will fulfill their obligations.

Knoxville Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal

Description

How to fill out Knoxville Tennessee Cost Bond To Act As Surety For Payments Of Costs Awarded Against The Principal?

Benefit from the US Legal Forms and get immediate access to any form sample you want. Our beneficial platform with a huge number of templates simplifies the way to find and get almost any document sample you will need. You can download, complete, and sign the Knoxville Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal in just a matter of minutes instead of surfing the Net for several hours seeking the right template.

Utilizing our library is an excellent way to increase the safety of your record filing. Our professional attorneys regularly check all the documents to make sure that the templates are appropriate for a particular state and compliant with new acts and polices.

How can you obtain the Knoxville Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal? If you have a subscription, just log in to the account. The Download button will appear on all the samples you look at. Furthermore, you can find all the earlier saved files in the My Forms menu.

If you haven’t registered a profile yet, follow the tips listed below:

- Open the page with the form you need. Make sure that it is the form you were hoping to find: check its name and description, and use the Preview feature when it is available. Otherwise, utilize the Search field to find the needed one.

- Launch the saving procedure. Select Buy Now and select the pricing plan you prefer. Then, create an account and pay for your order with a credit card or PayPal.

- Export the file. Choose the format to obtain the Knoxville Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal and change and complete, or sign it according to your requirements.

US Legal Forms is probably the most significant and reliable document libraries on the internet. Our company is always happy to assist you in any legal process, even if it is just downloading the Knoxville Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal.

Feel free to make the most of our service and make your document experience as convenient as possible!