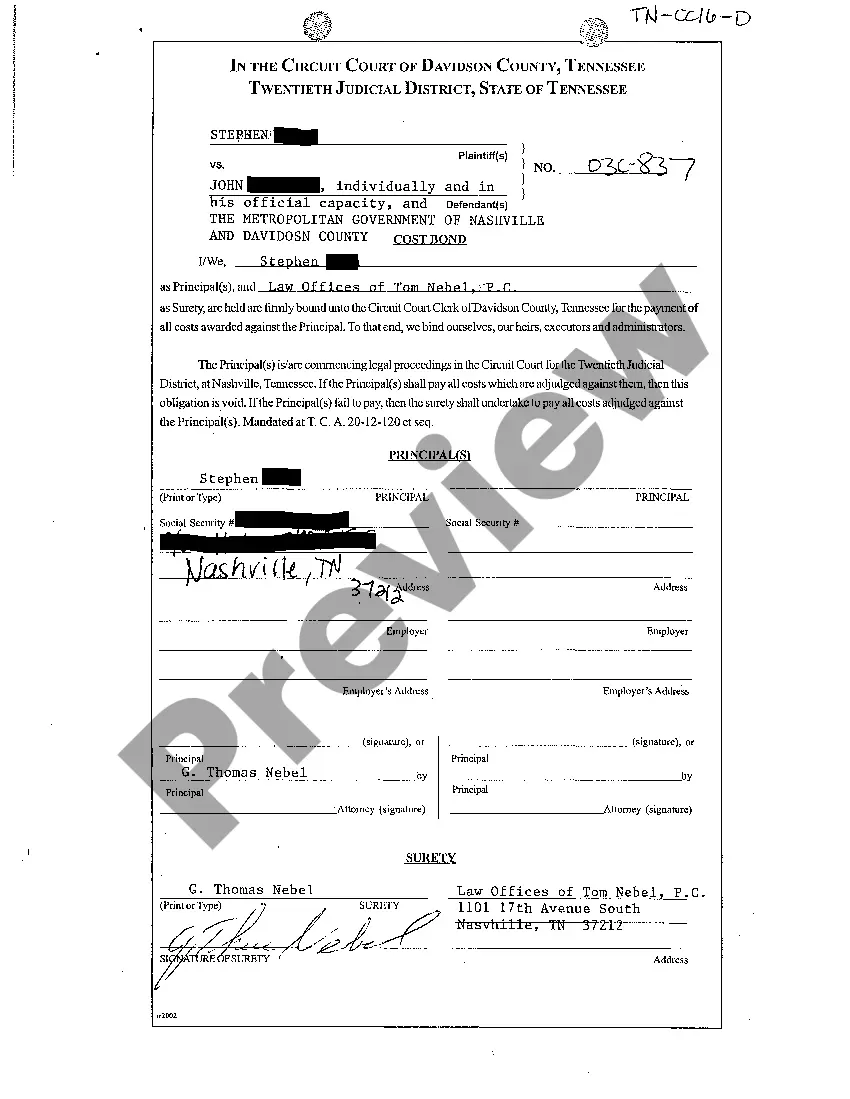

A Memphis Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principle is a type of bond that provides financial protection to the courts in the event that a principal fails to pay costs awarded against them in a legal proceeding in Memphis, Tennessee. In legal cases, the court may order the losing party to pay certain costs incurred by the prevailing party, such as court filing fees, deposition fees, expert witness fees, and other litigation expenses. However, there are instances where the losing party may refuse or be unable to make these payments. In such cases, the Memphis Tennessee Cost Bond serves as a guarantee that these costs will be covered. The bond is typically obtained by the principal, who is the party liable for the costs, and is issued by a surety bond company. The surety bond acts as an assurance that the costs awarded will be paid by the principal or by the surety if the principal defaults on their payment obligations. There are different types of Memphis Tennessee Cost Bonds available based on the specific requirements of the court. These may include appeal cost bonds, stay cost bonds, and supersedes cost bonds. — Appeal Cost Bond: This type of bond is required when a losing party wishes to appeal a court decision and wants to postpone the payment of costs pending the outcome of the appeal process. — Stay Cost Bond: A stay cost bond is utilized when a party wants to suspend the enforcement of a judgment until a higher court reviews the case. The bond ensures that the costs awarded will be paid if the judgment is ultimately upheld. Supersedesas Cost Bond: A supersedeas cost bond is a specialized form of bond that is required in cases where the losing party wants to delay the execution of a judgment during the appeals process. It covers not only the costs awarded but also any additional damages that may accrue during the pendency of the appeal. Obtaining a Memphis Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principle is an important requirement imposed by the court system to ensure that parties involved in legal proceedings fulfill their obligation to pay costs when ordered to do so. By obtaining this bond, the principal provides the court with a financial guarantee that these costs will not go unpaid, thus promoting the integrity and efficiency of the legal process.

Memphis Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal

Description

How to fill out Memphis Tennessee Cost Bond To Act As Surety For Payments Of Costs Awarded Against The Principal?

If you are searching for a valid form template, it’s difficult to choose a more convenient platform than the US Legal Forms site – probably the most considerable libraries on the web. Here you can get thousands of templates for company and individual purposes by types and regions, or keywords. With the advanced search feature, finding the most up-to-date Memphis Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal is as easy as 1-2-3. Additionally, the relevance of every document is confirmed by a team of professional lawyers that regularly check the templates on our website and update them according to the latest state and county requirements.

If you already know about our platform and have a registered account, all you need to receive the Memphis Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal is to log in to your profile and click the Download button.

If you utilize US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have discovered the form you require. Check its explanation and make use of the Preview feature to see its content. If it doesn’t meet your needs, utilize the Search option at the top of the screen to find the needed file.

- Confirm your decision. Click the Buy now button. After that, pick your preferred pricing plan and provide credentials to sign up for an account.

- Make the transaction. Make use of your bank card or PayPal account to finish the registration procedure.

- Get the template. Choose the format and save it on your device.

- Make adjustments. Fill out, revise, print, and sign the obtained Memphis Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal.

Every single template you save in your profile has no expiry date and is yours forever. It is possible to access them via the My Forms menu, so if you need to have an additional version for editing or creating a hard copy, you may return and save it once again at any time.

Take advantage of the US Legal Forms extensive library to gain access to the Memphis Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal you were seeking and thousands of other professional and state-specific templates in a single place!