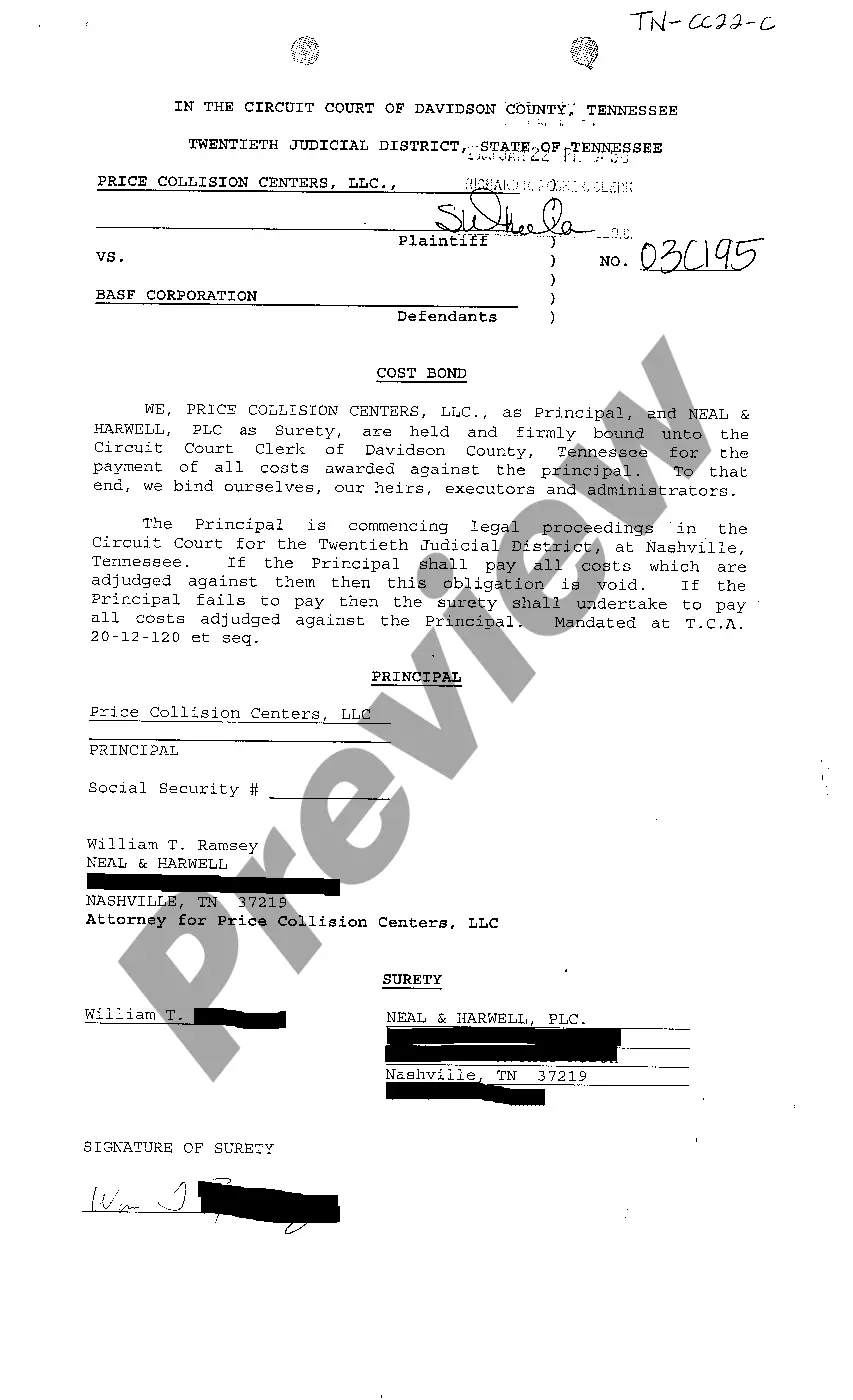

A Chattanooga Tennessee Cost Bond is a type of surety bond that acts as a guarantee for the payment of costs awarded against the principle in a legal case. This bond is designed to ensure that the principal fulfills their financial obligations related to the case, including court fees, attorney fees, and other costs. There are different types of Chattanooga Tennessee Cost Bonds depending on the specific purpose they serve. Some common variations include: 1. Payment of Costs Bond: This type of bond specifically guarantees the payment of costs that may be awarded against the principle in a legal proceeding. It provides assurance to the court and other parties involved that the principal will cover all expenses related to the case. 2. Surety for Principal Bond: This bond acts as a form of security for the principal involved in a legal matter. It assures the court and other interested parties that the principal will fulfill their obligations and responsibilities throughout the case. The Chattanooga Tennessee Cost Bond, regardless of its specific type, is an essential requirement in legal proceedings, primarily when the principal may face financial liability due to the outcome of the case. It provides financial protection to the plaintiffs and ensures that the court's orders are satisfied. To obtain a Chattanooga Tennessee Cost Bond, the principal will need to work with a licensed surety company that specializes in providing these types of bonds. The surety company will evaluate the principal's financial stability and creditworthiness to determine the bond premium. In summary, a Chattanooga Tennessee Cost Bond is a type of surety bond that guarantees the payment of costs awarded against the principle in a legal case. It provides financial protection to the plaintiffs and ensures the fulfillment of the principal's obligations.

Chattanooga Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal to Act as Surety for Principal in the Case

Description

How to fill out Chattanooga Tennessee Cost Bond To Act As Surety For Payments Of Costs Awarded Against The Principal To Act As Surety For Principal In The Case?

We always want to minimize or avoid legal damage when dealing with nuanced law-related or financial matters. To accomplish this, we apply for attorney services that, usually, are very costly. Nevertheless, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of using services of an attorney. We offer access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Chattanooga Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal to Act as Surety for Principal in the Case or any other document easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again from within the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the Chattanooga Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal to Act as Surety for Principal in the Case adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Chattanooga Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal to Act as Surety for Principal in the Case is suitable for you, you can pick the subscription option and proceed to payment.

- Then you can download the form in any available file format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!