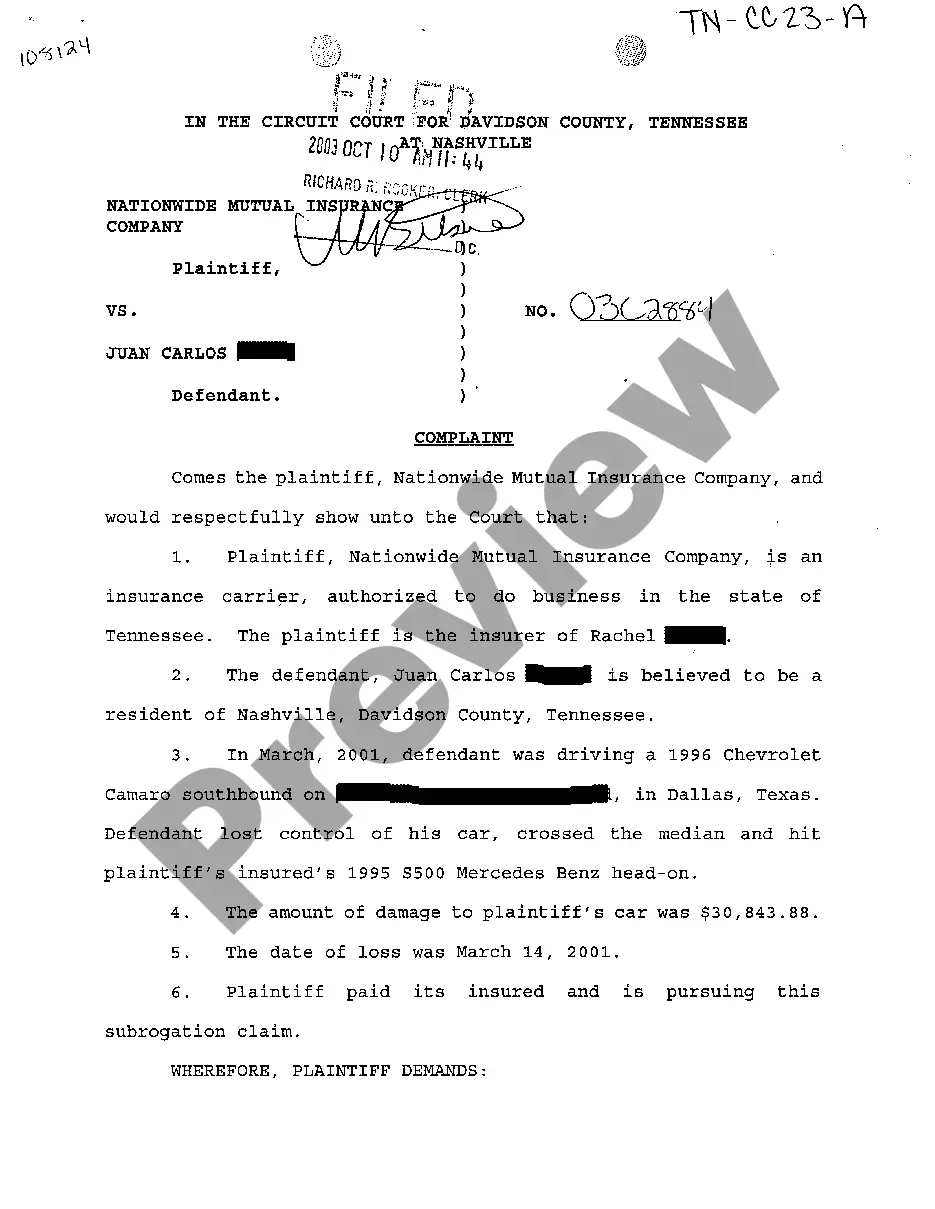

Title: Chattanooga Tennessee Complaint by Insurance Company to Recover Cost of Property Damage to Vehicle: Comprehensive Guide Introduction: In Chattanooga, Tennessee, insurance companies often handle complaints related to property damage to vehicles. These complaints primarily revolve around seeking compensation for the incurred costs. This article aims to provide a detailed description of the different types of Chattanooga Tennessee complaints filed by insurance companies to recover the cost of property damage to vehicles. 1. Collision Damage Complaint: One common type of complaint involves collisions. If a policyholder's vehicle sustains damage due to an accident caused by another party's negligence, insurance companies may file a complaint to recover the cost of repairing or replacing the damaged vehicle. Keywords: Chattanooga, Tennessee, complaint, insurance company, collision damage, property damage, vehicle, cost, accident, negligence, policyholder, repairing, replacing. 2. Hit and Run Damage Complaint: When a vehicle suffers damage from a hit-and-run incident, insurance companies may lodge a complaint on behalf of their policyholder. These complaints aim to recover the cost of repairs or replacement when the responsible party remains unidentified. Keywords: Chattanooga, Tennessee, complaint, insurance company, hit-and-run damage, property damage, vehicle, cost, policyholder, repairs, replacement, unidentified. 3. Vandalism and Theft Damage Complaint: In cases of vandalism or theft-related vehicle damage, insurance companies may file a complaint to recover the cost of repairs or replacement. These complaints usually require policyholders to provide detailed evidence, such as police reports and supporting documentation. Keywords: Chattanooga, Tennessee, complaint, insurance company, vandalism, theft, property damage, vehicle, cost, repairs, replacement, evidence, police reports, documentation. 4. Extreme Weather Damage Complaint: Severe weather events like hailstorms, floods, or tornadoes frequently result in significant damage to vehicles. Insurance companies can file complaints to recover the cost of repairs or replacement when such damage is covered under the policyholder's comprehensive or collision coverage. Keywords: Chattanooga, Tennessee, complaint, insurance company, extreme weather damage, property damage, vehicle, cost, repairs, replacement, policyholder, comprehensive coverage, collision coverage, hailstorms, floods, tornadoes. Conclusion: Chattanooga, Tennessee, witnesses various complaints by insurance companies aiming to recover the cost of property damage to vehicles. These complaints can span different scenarios such as collisions, hit-and-run incidents, vandalism and theft, or damage caused by extreme weather. Understanding these categories and related keywords can help both policyholders and insurance companies navigate the claims process effectively.

Chattanooga Tennessee Complaint by Insurance Company to recover cost of property damage to vehicle

Description

How to fill out Chattanooga Tennessee Complaint By Insurance Company To Recover Cost Of Property Damage To Vehicle?

No matter what social or professional status, filling out legal forms is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for a person without any legal background to draft this sort of papers cfrom the ground up, mainly due to the convoluted terminology and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our platform provides a massive catalog with more than 85,000 ready-to-use state-specific forms that work for almost any legal situation. US Legal Forms also is a great resource for associates or legal counsels who want to save time using our DYI tpapers.

Whether you require the Chattanooga Tennessee Complaint by Insurance Company to recover cost of property damage to vehicle or any other paperwork that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Chattanooga Tennessee Complaint by Insurance Company to recover cost of property damage to vehicle quickly using our reliable platform. If you are presently a subscriber, you can go on and log in to your account to download the appropriate form.

Nevertheless, in case you are new to our library, ensure that you follow these steps before obtaining the Chattanooga Tennessee Complaint by Insurance Company to recover cost of property damage to vehicle:

- Ensure the form you have chosen is specific to your location considering that the regulations of one state or county do not work for another state or county.

- Review the document and read a short description (if provided) of cases the document can be used for.

- If the form you picked doesn’t suit your needs, you can start again and look for the needed document.

- Click Buy now and choose the subscription plan that suits you the best.

- Access an account {using your login information or create one from scratch.

- Pick the payment method and proceed to download the Chattanooga Tennessee Complaint by Insurance Company to recover cost of property damage to vehicle as soon as the payment is done.

You’re all set! Now you can go on and print the document or complete it online. In case you have any issues locating your purchased forms, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.