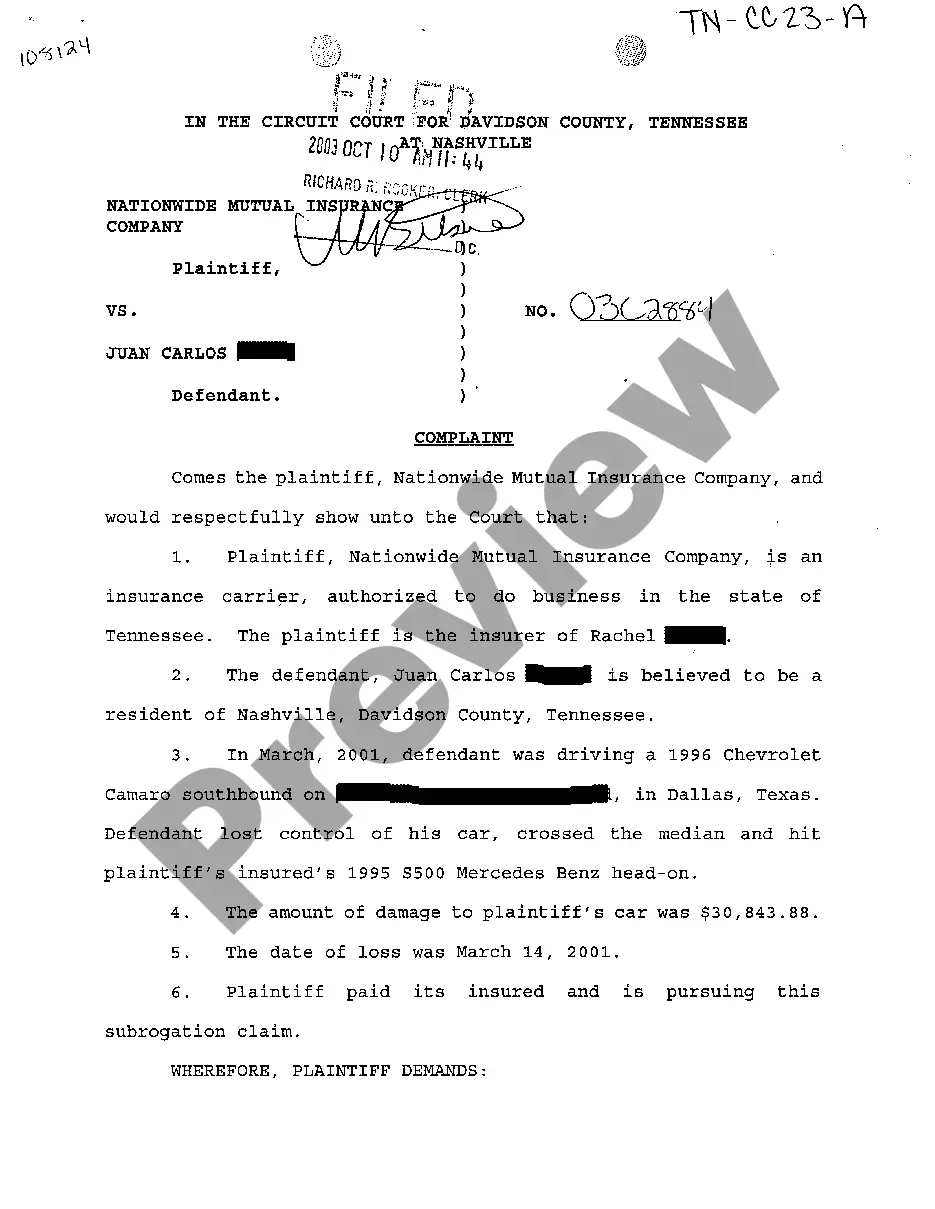

Title: Murfreesboro Tennessee Complaint by Insurance Company to Recover Costs of Property Damage to Vehicle Introduction: In Murfreesboro, Tennessee, insurance companies frequently deal with complaints related to property damage to vehicles. When policyholders experience accidents or incidents that result in vehicle damage, they often file claims seeking financial assistance to cover repair costs. However, in some cases, insurance companies may become the complainant themselves, filing a complaint to recover the funds they previously disbursed to policyholders. This article will delve into the various types of Murfreesboro Tennessee complaints by insurance companies seeking reimbursement for property damage to vehicles. 1. Uninsured/Under insured Motorist Claims: One type of complaint made by insurance companies in Murfreesboro involves uninsured or under insured motorists. These claims arise when an insured individual's vehicle sustains damage due to an accident with an at-fault driver who either lacks insurance coverage or possesses insufficient coverage to fully cover the costs. In such cases, the insurance company provides compensation to their policyholder and, subsequently, files a complaint against the uninsured/under insured motorist to recover the expenses incurred. 2. Subrogation Claims: Insurance subrogation arises when an insurance company steps into the shoes of its policyholder following a covered loss or damage to a vehicle. If the insured party is not at fault for the accident, the insurance company will first pay for the repairs and other expenses. Later, the insuring company can file a subrogation claim against the responsible party or their insurer, aiming to recover the funds paid to their policyholder. These subrogation complaints often include detailed evidence, such as police reports, witness statements, and repair invoices, to support the insurance company's claim for reimbursement. 3. Comprehensive/Collision Coverage Claims: Insurance companies may also file complaints under comprehensive or collision coverage. These types of claims typically involve vehicular damage caused by non-collision incidents, such as theft, vandalism, fire, or natural disasters. When an insured individual files a claim under these coverage types, the insurance company may seek reimbursement from third parties who might be responsible for the damage or from the policyholder themselves if the incident was due to their negligence. Consequently, a complaint will be filed by the insurance company to recover the cost of property damage to the vehicle. Conclusion: Murfreesboro, Tennessee, witnesses various types of complaints by insurance companies aimed at recovering the costs associated with property damage to vehicles. These complaints can include uninsured/under insured motorist claims, subrogation claims, and comprehensive/collision coverage claims. Understanding these different categories of complaints can help both insurers and policyholders navigate the complex processes involved in resolving property damage disputes and ensuring financial indemnification.

Murfreesboro Tennessee Complaint by Insurance Company to recover cost of property damage to vehicle

Description

How to fill out Murfreesboro Tennessee Complaint By Insurance Company To Recover Cost Of Property Damage To Vehicle?

Take advantage of the US Legal Forms and have instant access to any form sample you require. Our helpful platform with a large number of documents simplifies the way to find and obtain virtually any document sample you need. You are able to export, complete, and certify the Murfreesboro Tennessee Complaint by Insurance Company to recover cost of property damage to vehicle in a matter of minutes instead of surfing the Net for hours searching for an appropriate template.

Utilizing our library is a wonderful strategy to increase the safety of your form filing. Our experienced attorneys on a regular basis review all the records to make sure that the templates are relevant for a particular state and compliant with new laws and polices.

How do you obtain the Murfreesboro Tennessee Complaint by Insurance Company to recover cost of property damage to vehicle? If you already have a subscription, just log in to the account. The Download option will be enabled on all the samples you view. In addition, you can find all the previously saved files in the My Forms menu.

If you don’t have a profile yet, stick to the instructions below:

- Open the page with the template you require. Make sure that it is the template you were hoping to find: examine its name and description, and use the Preview feature when it is available. Otherwise, use the Search field to look for the needed one.

- Start the saving procedure. Select Buy Now and choose the pricing plan that suits you best. Then, create an account and pay for your order using a credit card or PayPal.

- Export the document. Select the format to obtain the Murfreesboro Tennessee Complaint by Insurance Company to recover cost of property damage to vehicle and revise and complete, or sign it for your needs.

US Legal Forms is one of the most considerable and trustworthy document libraries on the web. We are always happy to assist you in virtually any legal process, even if it is just downloading the Murfreesboro Tennessee Complaint by Insurance Company to recover cost of property damage to vehicle.

Feel free to take full advantage of our platform and make your document experience as straightforward as possible!