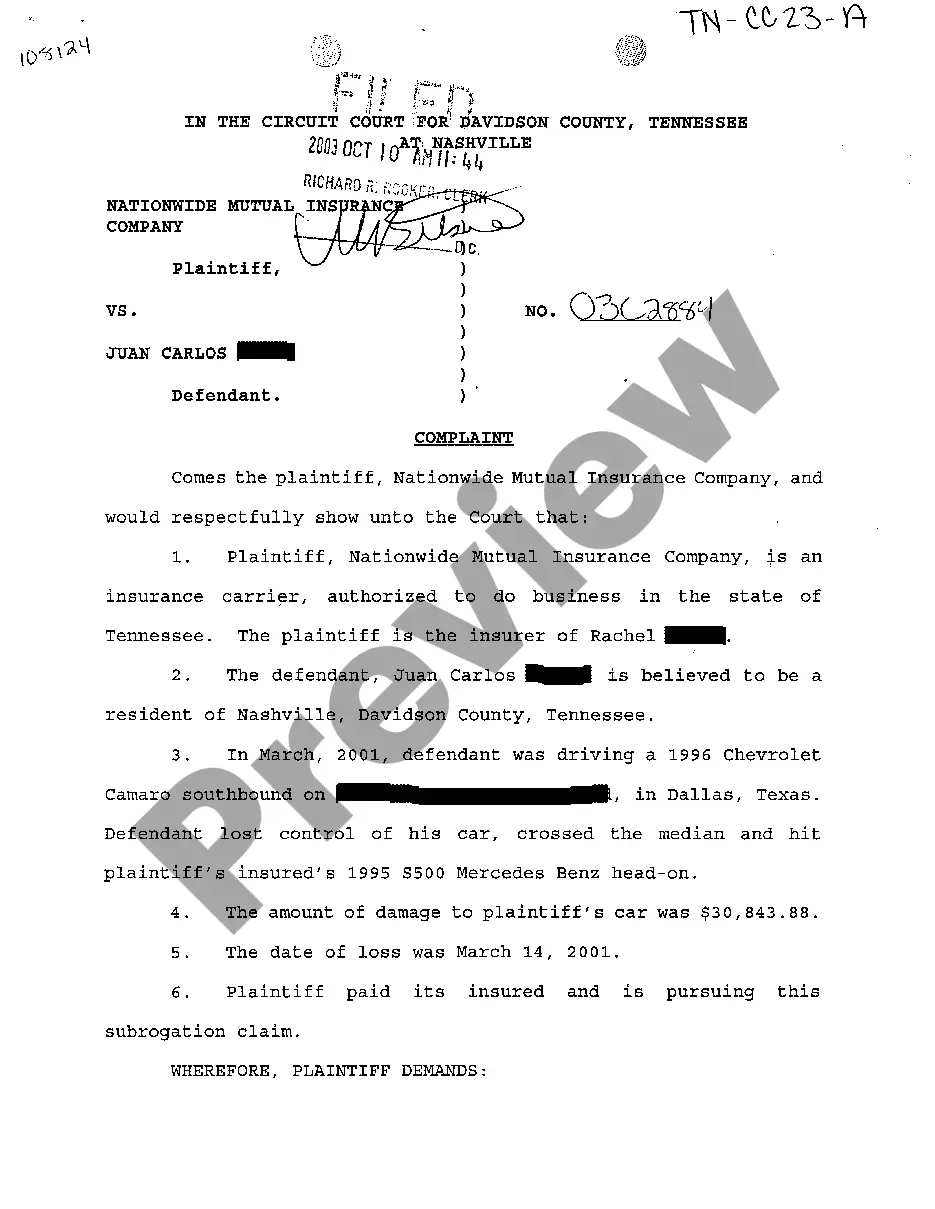

Title: Nashville Tennessee Complaint by Insurance Company to Recover Cost of Property Damage to Vehicle Keywords: Nashville Tennessee, insurance company, complaint, property damage, vehicle, cost recovery Introduction: When it comes to resolving property damage claims for vehicles in Nashville, Tennessee, insurance companies often resort to filing complaints to recover the costs incurred. This comprehensive guide will provide an in-depth description of the various types of complaints insurance companies may file in Nashville to seek the reimbursement for property damage expenses for insured vehicles. 1. Comprehensive Coverage Claim Complaint: Insurance companies may file a comprehensive coverage claim complaint in Nashville if the vehicle's property damage resulted from non-collision incidents. This could include incidents such as theft, fire, vandalism, or weather-related damages. In such cases, the insurance company initiates the complaint process to recover the costs associated with repairing or replacing the damaged property. 2. Collision Coverage Claim Complaint: When a vehicle is involved in a collision accident, insurance companies may file a collision coverage claim complaint in Nashville to recover the expenses incurred in repairing or replacing the damaged property. These complaints are typically initiated when the insured driver is at fault or when the third party responsible fails to provide appropriate compensation. 3. Uninsured/Under insured Motorist Coverage Claim Complaint: In situations where an uninsured or under insured driver causes property damage to an insured vehicle in Nashville, insurance companies may file an uninsured/under insured motorist coverage claim complaint. This type of complaint aims to recover costs from the insurance company of the at-fault driver or from the insured driver's own policy. 4. Direct Action Complaint: When a policyholder in Nashville faces difficulties obtaining a fair settlement from the at-fault party's insurance company, an insurance company may file a direct action complaint. This type of complaint allows the insurance company to pursue recovery directly from the negligent party in order to cover the property damage costs sustained by the insured vehicle. 5. Bad Faith Complaint: In rare cases, an insurance company may file a bad faith complaint against another insurance company in Nashville. This type of complaint asserts that the defendant company failed to handle the property damage claim accurately and in good faith, and it seeks recovery of the costs for property damage inflicted on the insured vehicle. Conclusion: Understanding the different types of complaints filed by insurance companies in Nashville, Tennessee, to recover costs for property damage to vehicles is crucial for policyholders and legal professionals. Whether it's a comprehensive coverage claim complaint, collision coverage claim complaint, uninsured/under insured motorist coverage claim complaint, direct action complaint, or bad faith complaint, knowing the specific nature of the claim will help navigate the legal landscape, ensuring fair compensation for vehicle property damage.

Nashville Tennessee Complaint by Insurance Company to recover cost of property damage to vehicle

Description

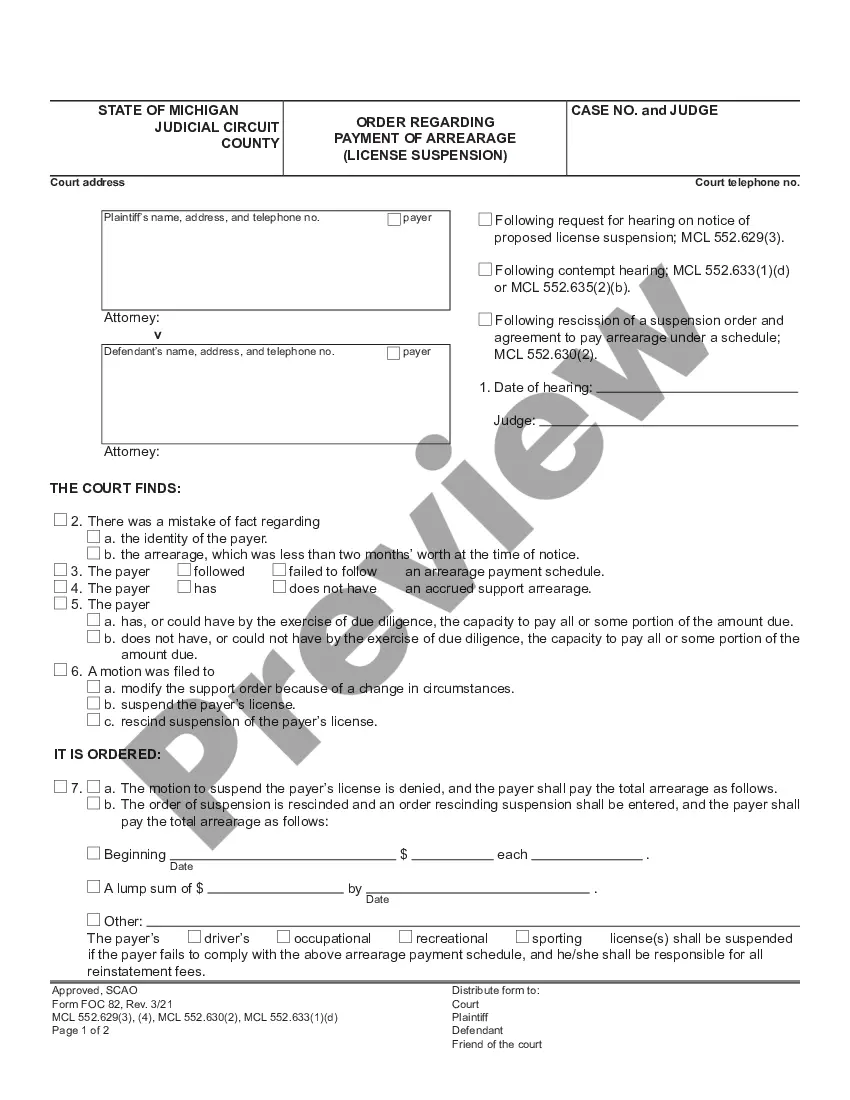

How to fill out Nashville Tennessee Complaint By Insurance Company To Recover Cost Of Property Damage To Vehicle?

We always want to minimize or avoid legal damage when dealing with nuanced legal or financial affairs. To accomplish this, we sign up for attorney solutions that, usually, are very expensive. Nevertheless, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of turning to an attorney. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Nashville Tennessee Complaint by Insurance Company to recover cost of property damage to vehicle or any other document easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again from within the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the Nashville Tennessee Complaint by Insurance Company to recover cost of property damage to vehicle adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Nashville Tennessee Complaint by Insurance Company to recover cost of property damage to vehicle is suitable for you, you can pick the subscription option and make a payment.

- Then you can download the form in any suitable file format.

For over 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!