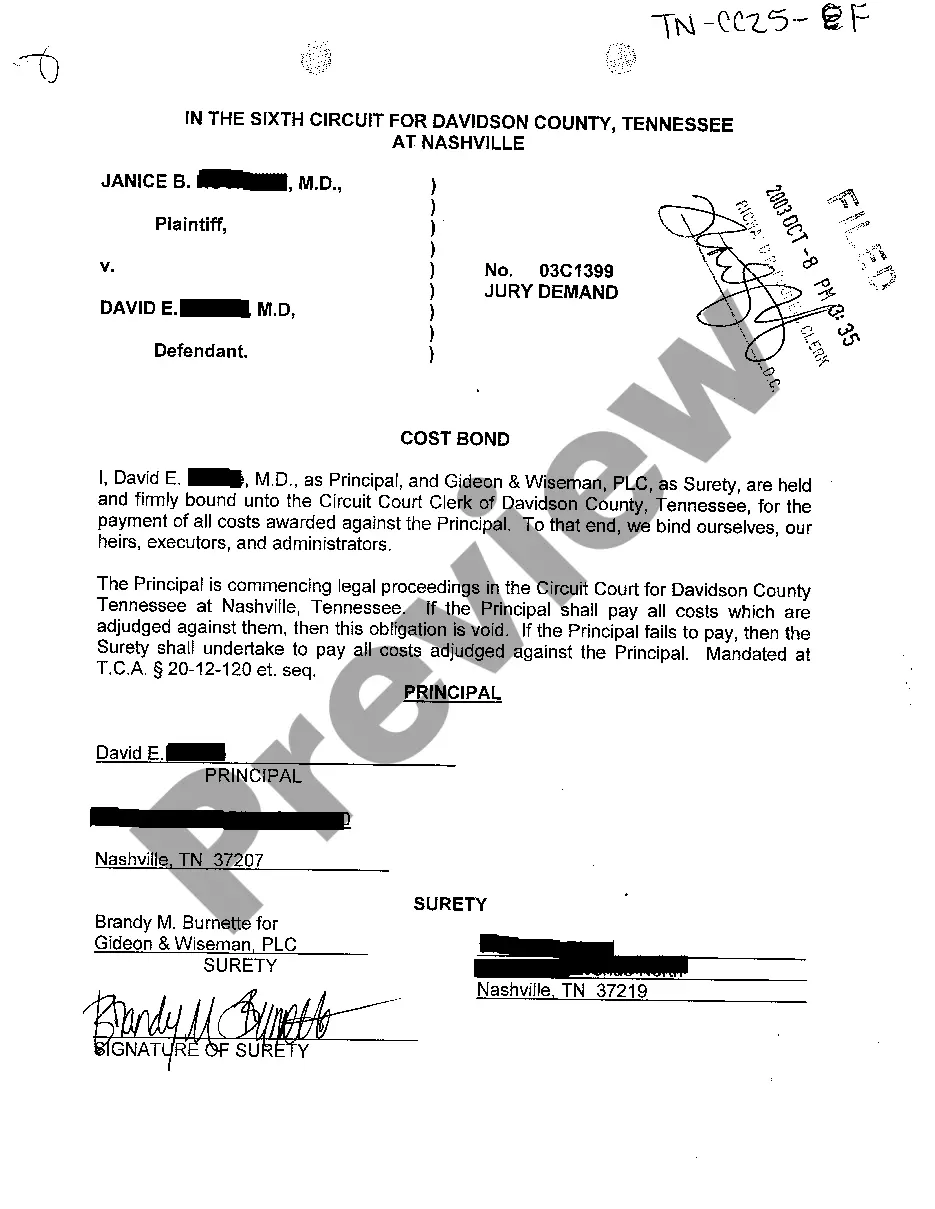

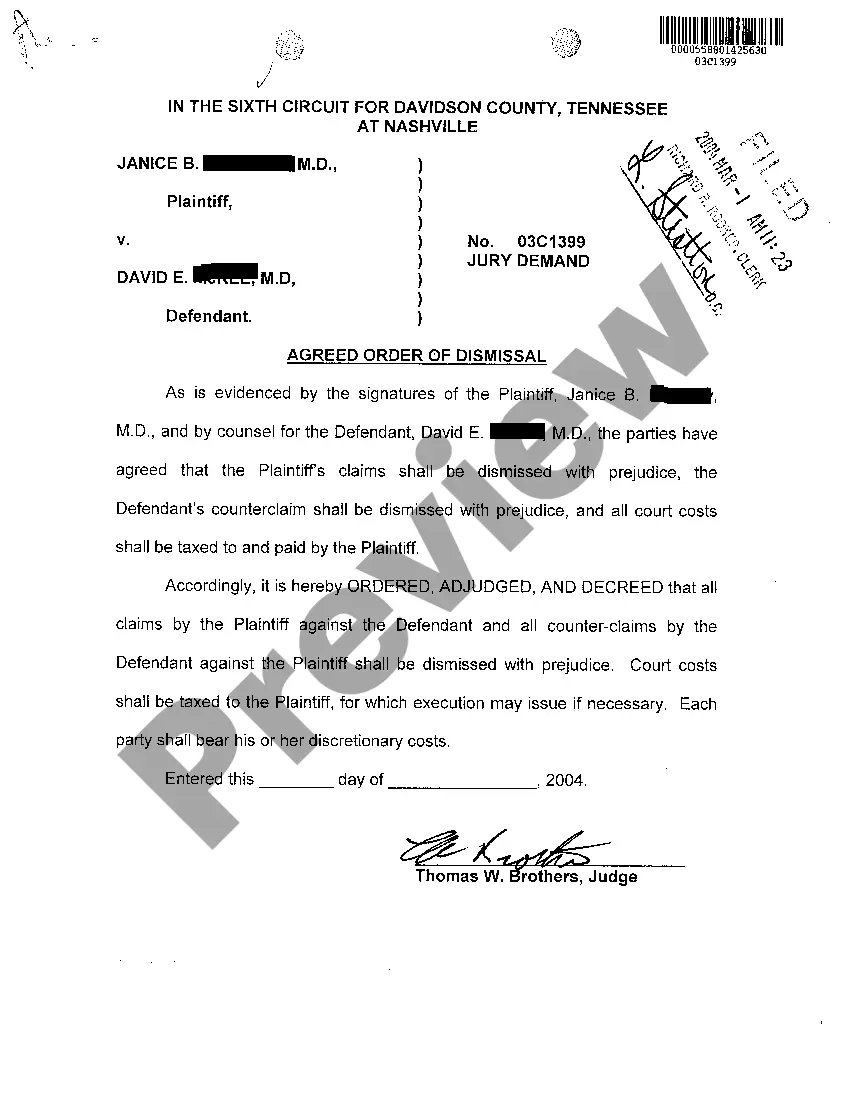

A Chattanooga Tennessee cost bond is a type of surety bond that is required in certain legal proceedings. It is designed to act as a financial guarantee for payments of costs that may be awarded against the principle in these proceedings. The bond ensures that the principal will fulfill their financial obligations and cover any costs that may arise from the litigation. The Chattanooga Tennessee cost bond is commonly used in various legal situations, including lawsuits, appeals, and other court actions. It serves as a way to protect the parties involved and ensure that the prevailing party will be able to recover their costs. By requiring the principal to obtain a cost bond, the court can have confidence in the financial ability of the principal to cover any potential costs. There are different types of Chattanooga Tennessee cost bonds available, depending on the specific legal situation. Some common types include appeal bonds, injunction bonds, and payment bonds. An appeal bond is required when a party wishes to appeal a court decision and provides assurance that they will abide by the outcome of the appeal. An injunction bond is used when a court grants an injunction and guarantees that the party granted the injunction will compensate any damages suffered by the restrained party if it is later determined that the injunction should not have been granted. A payment bond is utilized when a contractor is required to provide financial security for payments to subcontractors and suppliers involved in a construction project. To obtain a Chattanooga Tennessee cost bond, the principal must typically work with a licensed surety bond provider. The provider will assess the principal's financial standing and determine the bond premium, which is typically a percentage of the required bond amount. Once the premium is paid, the bond will be issued, and the principal can present it to the court as proof of their financial responsibility. In conclusion, a Chattanooga Tennessee cost bond is a surety bond required in legal proceedings to ensure that the principal will cover any costs that may be awarded against them. It acts as a financial guarantee for the prevailing party and provides assurance that the principal will fulfill their financial obligations. Different types of cost bonds are available, including appeal bonds, injunction bonds, and payment bonds, depending on the specific legal situation. Obtaining a cost bond involves working with a licensed surety bond provider and paying a premium.

Chattanooga Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal

Description

How to fill out Chattanooga Tennessee Cost Bond To Act As Surety For Payments Of Costs Awarded Against The Principal?

Do you need a reliable and affordable legal forms supplier to get the Chattanooga Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal? US Legal Forms is your go-to solution.

No matter if you require a simple arrangement to set regulations for cohabitating with your partner or a set of forms to advance your divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked in accordance with the requirements of separate state and area.

To download the document, you need to log in account, locate the required template, and click the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Chattanooga Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal conforms to the laws of your state and local area.

- Read the form’s details (if provided) to find out who and what the document is intended for.

- Start the search over if the template isn’t suitable for your specific situation.

Now you can create your account. Then pick the subscription option and proceed to payment. As soon as the payment is done, download the Chattanooga Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal in any provided format. You can return to the website at any time and redownload the document free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about spending hours researching legal paperwork online for good.