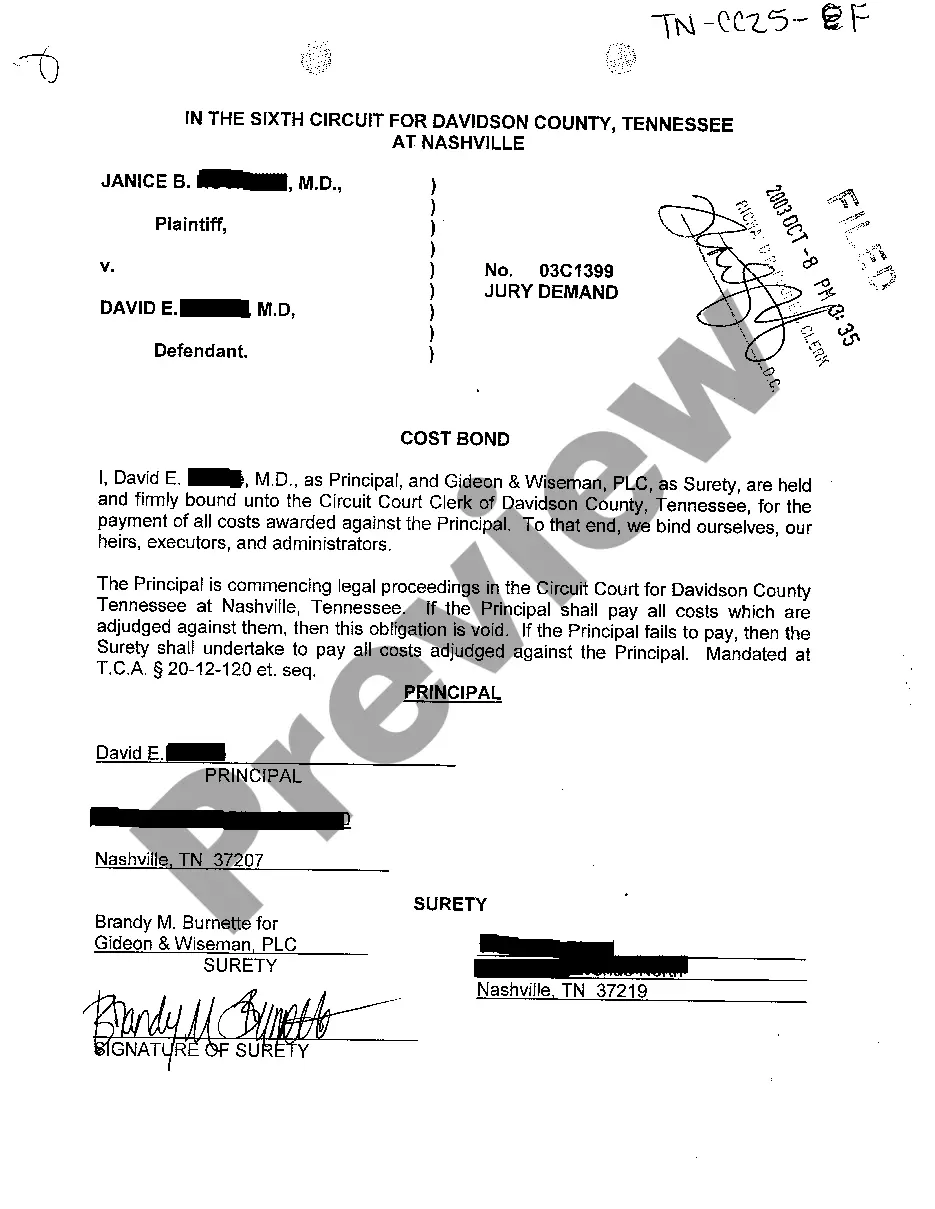

A Knoxville Tennessee cost bond is a type of surety bond that is required by the court to act as collateral for the payments of costs awarded against the principle in a legal proceeding. This bond ensures that if the principal is unable to pay the costs that are awarded to the opposing party, the surety company will step in and make the payment on behalf of the principal. The Knoxville Tennessee cost bond is a crucial requirement in legal cases, particularly in civil lawsuits. It ensures that the winning party in a case will be reimbursed for the various costs incurred during the litigation process, such as court fees, attorney fees, expert witness fees, and other related expenses. There are different types of Knoxville Tennessee cost bonds available depending on the specific circumstances of the case. Some common variations include: 1. Plaintiff's cost bond: This type of bond is typically required when the plaintiff brings a lawsuit against the defendant. The bond ensures that if the defendant is found liable and ordered to pay costs, the plaintiff will be promptly reimbursed. 2. Defendant's cost bond: In certain cases, the defendant may be allowed to file a counterclaim against the plaintiff or request costs if they prevail in the case. A defendant's cost bond serves as a guarantee that the defendant can cover the costs if they are awarded in their favor. 3. Appellate cost bond: If a party decides to appeal a decision, they may be required to post an appellate cost bond. This bond covers the potential costs that may arise during the appeal process, such as transcript fees, court reporter fees, and other associated expenses. To obtain a Knoxville Tennessee cost bond, the principal needs to contact a licensed surety bond company. The surety company will assess the principal's financial standing, determine the bond amount required by the court, and charge a premium based on the principal's creditworthiness. It is important to note that failure to obtain and maintain the required cost bond can result in serious consequences for the principal. The court may not accept filings, postpone hearings, or even dismiss the case outright if the cost bond requirements are not met. In summary, a Knoxville Tennessee cost bond is a type of surety bond that acts as surety for payments of costs awarded against the principle in a legal proceeding. It is a crucial requirement in civil lawsuits and ensures that the winning party will be reimbursed for the various costs incurred during the litigation process. Different types of cost bonds exist, including plaintiff's cost bonds, defendant's cost bonds, and appellate cost bonds. Failure to obtain and maintain the required bond can have severe consequences for the principal involved in the case.

Knoxville Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal

Category:

State:

Tennessee

City:

Knoxville

Control #:

TN-CC25-06

Format:

PDF

Instant download

This form is available by subscription

Description

A06 Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal

Free preview

How to fill out Knoxville Tennessee Cost Bond To Act As Surety For Payments Of Costs Awarded Against The Principal?

Obtaining confirmed templates pertinent to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

It is an online collection of over 85,000 legal documents for various personal and business requirements and real-world circumstances.

All the paperwork is appropriately classified by area of application and jurisdictional boundaries, making it straightforward as pie to find the Knoxville Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal.

Maintaining paperwork organized and compliant with legal requirements is critically important. Utilize the US Legal Forms repository to consistently have vital document templates for any requirements right at your fingertips!

- For those already familiar with our service and have previously availed it, acquiring the Knoxville Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal requires merely a few clicks.

- All you have to do is Log In to your account, select the document, and hit Download to store it on your device.

- New users will have a few additional steps to finalize the process.

- Adhere to the instructions below to begin with the most comprehensive online form collection.

- Examine the Preview mode and form description. Ensure you’ve picked the right one that fulfills your needs and completely aligns with your local jurisdiction standards.

Form popularity

More info

For more details on how your bond price is formulated, check out our surety bond cost page. Can I get bonded with bad credit?If the Principal(s) fail to pay, the surety shall pay all court costs adjudged against the. Principal(s). Mandated at T.C.A. §20-12-120 et seq. UT departments may authorize payment of some charges and fees for eligible students. You will need to fill out the appeal documents, pay a fee to the court clerk and possibly post a bond in order to properly appeal your case to a higher court. When should a mechanics lien be used in the payment process? No Prohibition on Consumer Payment of Upfront Points and Fees. Observe loan charges limitations found in the Thrift Act, including the gen- eral prohibition against prepayment penalties. Thus, to export the rate, the.