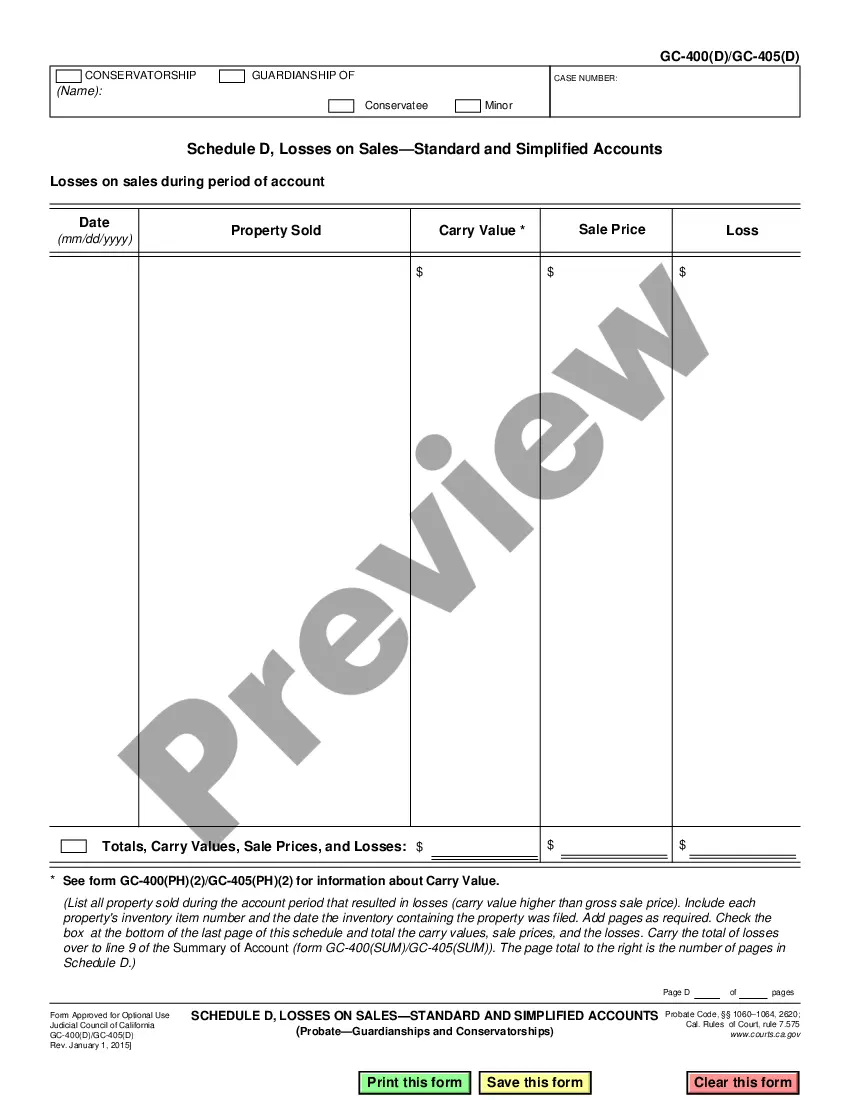

A Chattanooga Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principle is a type of surety bond that guarantees the principal will cover any costs awarded against them in a legal proceeding. This bond provides financial security to the court or the opposing party by ensuring that the principal will fulfill their obligation to pay for any costs incurred during the legal process. The purpose of this bond is to protect the interests of the opposing party and the court by ensuring that the principal will not evade their responsibility to cover the costs awarded against them. It serves as a guarantee that the principal will fulfill their financial obligations related to the legal proceedings. There are various types of Chattanooga Tennessee Cost Bonds to Act as Surety for Payments of Costs Awarded Against the Principle, including: 1. Litigation cost bond: This type of bond is typically required in civil cases and guarantees the payment of costs awarded against the principle in a lawsuit. It covers expenses like court fees, attorney fees, witness fees, or any other costs deemed appropriate by the court. 2. Appellate cost bond: If the principal is appealing a court decision, they may be required to obtain an appellate cost bond. This bond ensures that the principal will pay for any costs associated with the appeal, such as printing briefs, transcripts, or other expenses related to the appellate process. 3. Probate cost bond: In cases involving probate court, where the principal is acting as an executor or administrator of an estate, they may be required to obtain a probate cost bond. This bond guarantees the payment of any costs awarded against the principle related to the administration of the estate. It is important for the principal to understand that a Chattanooga Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principle is not an insurance policy. It is a financial guarantee that the principal will fulfill their obligation to cover the costs awarded against them. Failure to do so may result in the surety company paying the costs on behalf of the principal, followed by the surety seeking reimbursement from the principal. Overall, a Chattanooga Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principle is an essential tool to ensure that the opposing party and the court are protected financially in legal proceedings. It provides peace of mind to all parties involved, knowing that the costs awarded will be covered regardless of the principal's ability to pay.

Chattanooga Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal

Description

How to fill out Chattanooga Tennessee Cost Bond To Act As Surety For Payments Of Costs Awarded Against The Principal?

Are you in search of a dependable and affordable legal forms provider to purchase the Chattanooga Tennessee Cost Bond to serve as Surety for Payments of Costs Adjudicated Against the Principal? US Legal Forms is your ideal choice.

Whether you need a simple agreement to establish guidelines for living with your partner or a suite of forms to expedite your separation or divorce through the court, we have you covered. Our platform features over 85,000 current legal document templates for personal and business needs. All templates we provide are not generic and are tailored to the specifications of individual states and regions.

To acquire the document, you must Log In to your account, locate the required template, and click the Download button next to it. Please remember that you can download your previously purchased document templates at any time from the My documents section.

Are you a newcomer to our site? No problem. You can easily create an account, but before doing so, ensure that you.

Now you can create your account. After that, choose a subscription plan and move on to payment. Once the payment is verified, you can download the Chattanooga Tennessee Cost Bond to serve as Surety for Payments of Costs Adjudicated Against the Principal in any format available. You can revisit the website whenever you wish and redownload the document free of charge.

Locating up-to-date legal forms has never been simpler. Try US Legal Forms today and stop spending countless hours searching for legal documentation online.

- Verify if the Chattanooga Tennessee Cost Bond to serve as Surety for Payments of Costs Adjudicated Against the Principal meets the standards of your state and locality.

- Review the form's description (if available) to understand who can benefit from the document and its applicable use.

- Restart your search if the template does not suit your specific needs.

Form popularity

FAQ

Tennessee Supersedeas Bond (Appeal Bond ~ Tennessee) A judicial bond is a type of financial assurance filed with the court that guarantees that should the appellant NOT prevail that he or she will comply with the original judgment and with any other orders issued by the court pertaining to the same.

You only have 60 days to appeal after you find out that there is a problem. You can ask someone to help you file an appeal. Usually, your appeal is decided within 90 days after you file it.

An appeal bond, sometimes called a supersedeas bond, is required when a defendant wants to appeal an adverse judgment or order. The bond guarantees that if the defendant (principal) loses the appeal, the amount of the judgment and, in some cases, accrued interest, expenses and legal fees, will be paid.

- The appeal to the Court of Appeals in cases decided by the Regional Trial Court in the exercise of its original jurisdiction shall be taken by filing a notice of appeal with the court which rendered the judgment or final order appealed from and serving a copy thereof upon the adverse party.

To get a Tennessee surety bond, people generally go to a surety bonding company. You are able to get a surety bond through a general insurance company, but choosing a surety bond company often means you can get better quotes.

An appeal is the legal process to ask a higher court to review a decision by a judge in a lower court (trial court) because you believe the judge made a mistake. A litigant who files an appeal is called an appellant. A litigant against whom the appeal is filed is called an appellee.

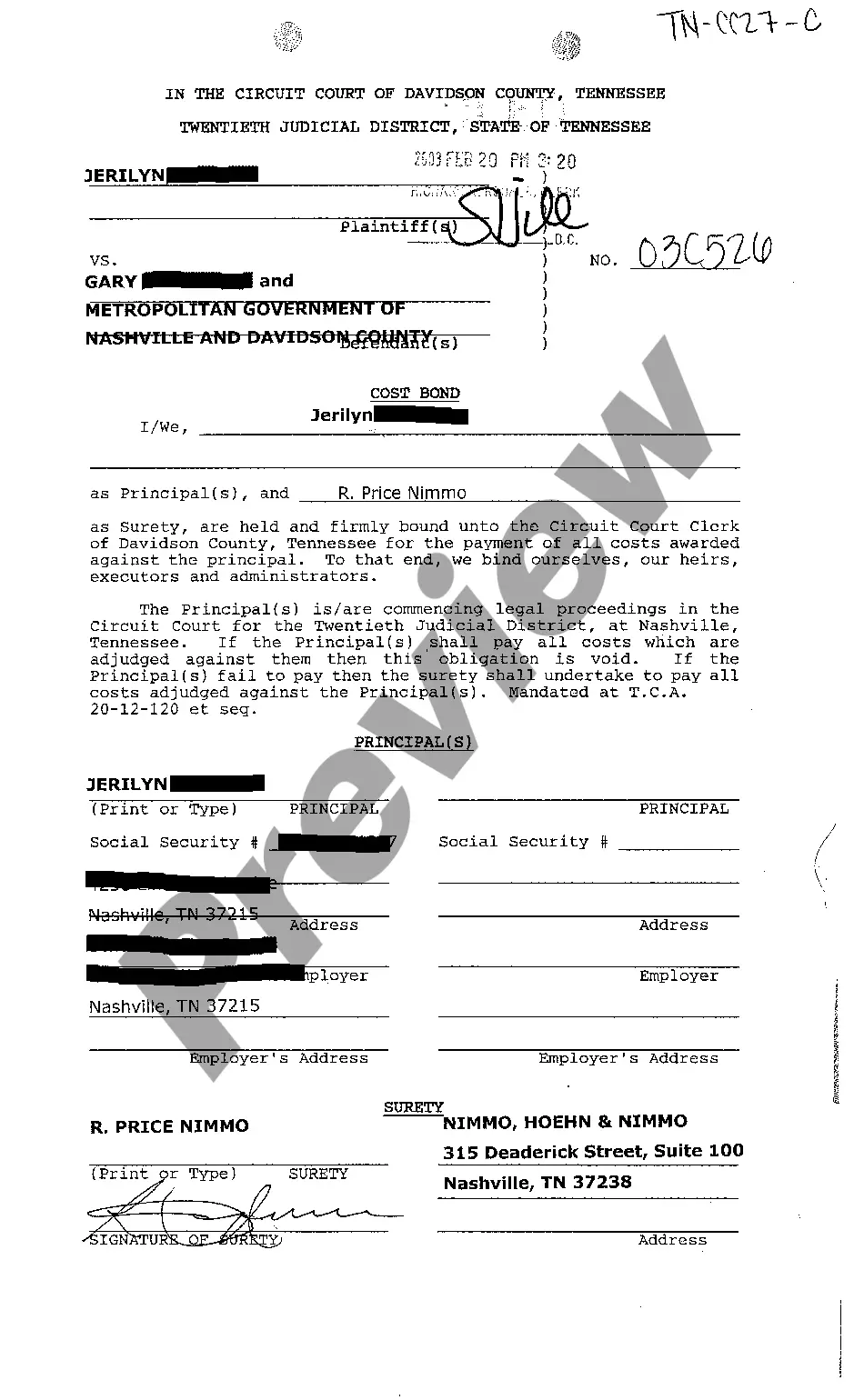

COST BOND. as Surety, are held and firmly bound unto the Circuit Court Clerk of Davidson County, Tennessee, for the payment of all costs awarded against the Principal(s). To that end, we bind ourselves, our heirs, executors, and administrators.

A cost bond is a kind of surety bond that guarantees payment of court expenses. Generally speaking, surety bonds form a legally binding contract, involving three parties: the principal, the obligee, and the surety. The party requesting the bond is the obligee. The party obligated to buy the bond is the principal.