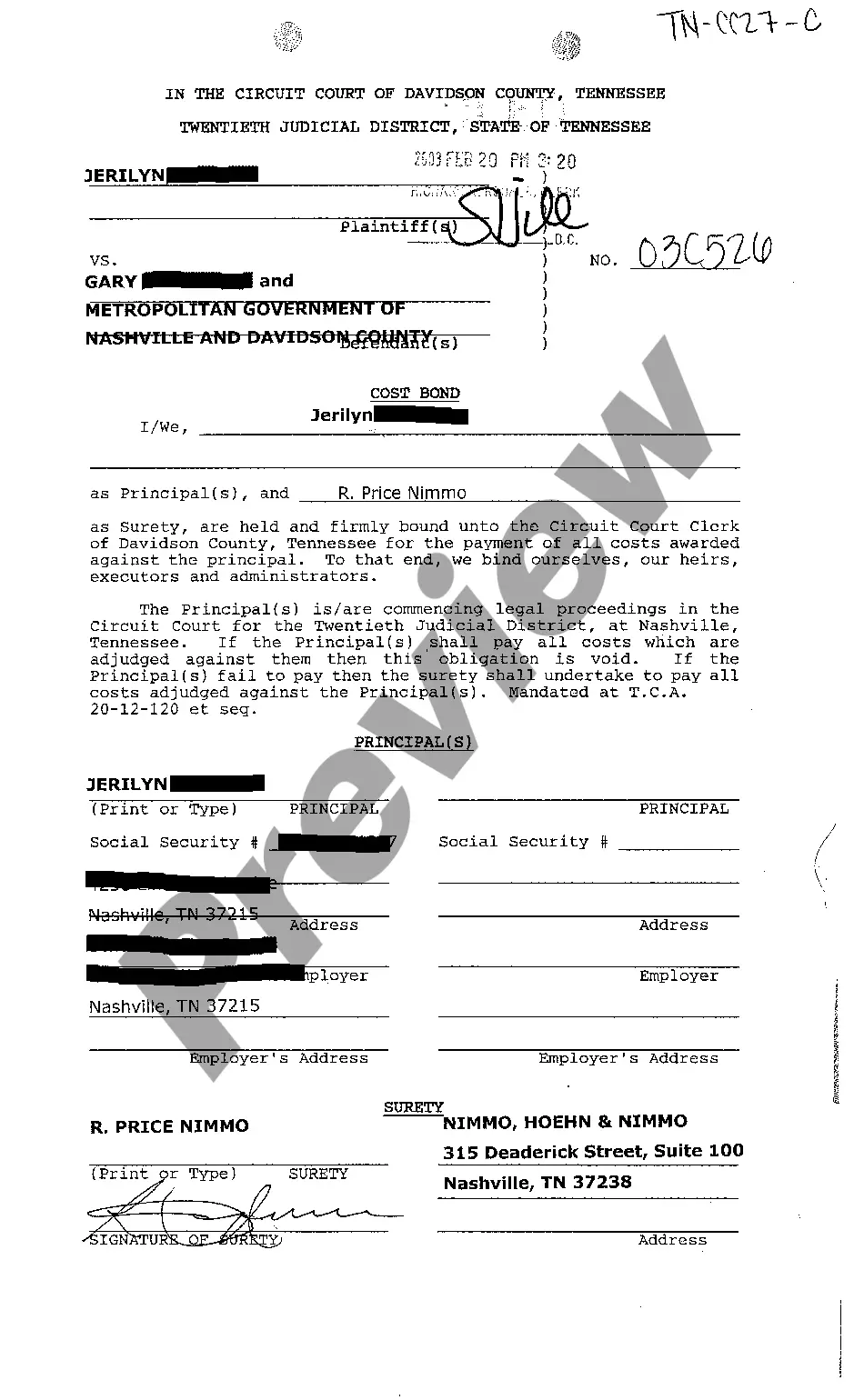

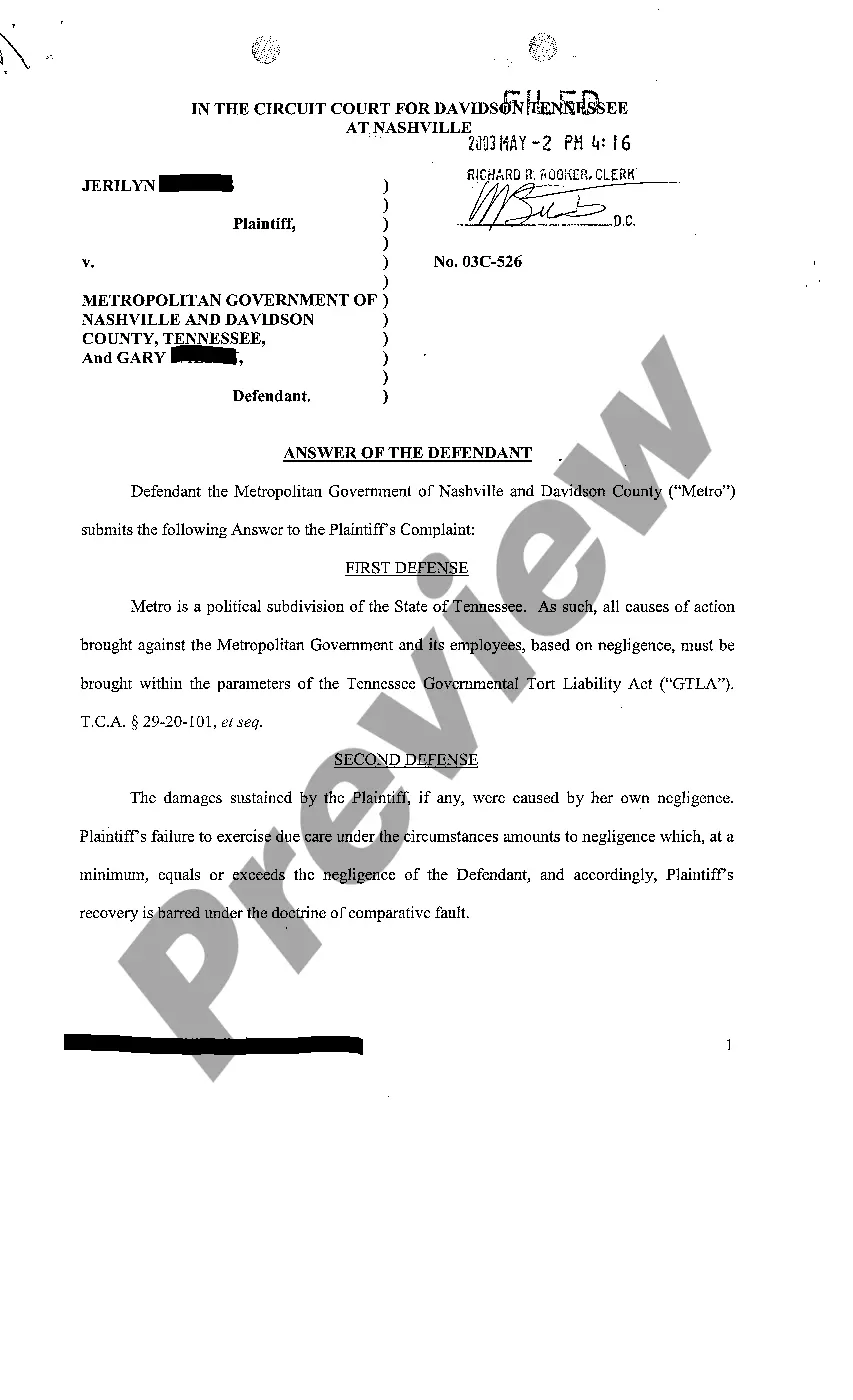

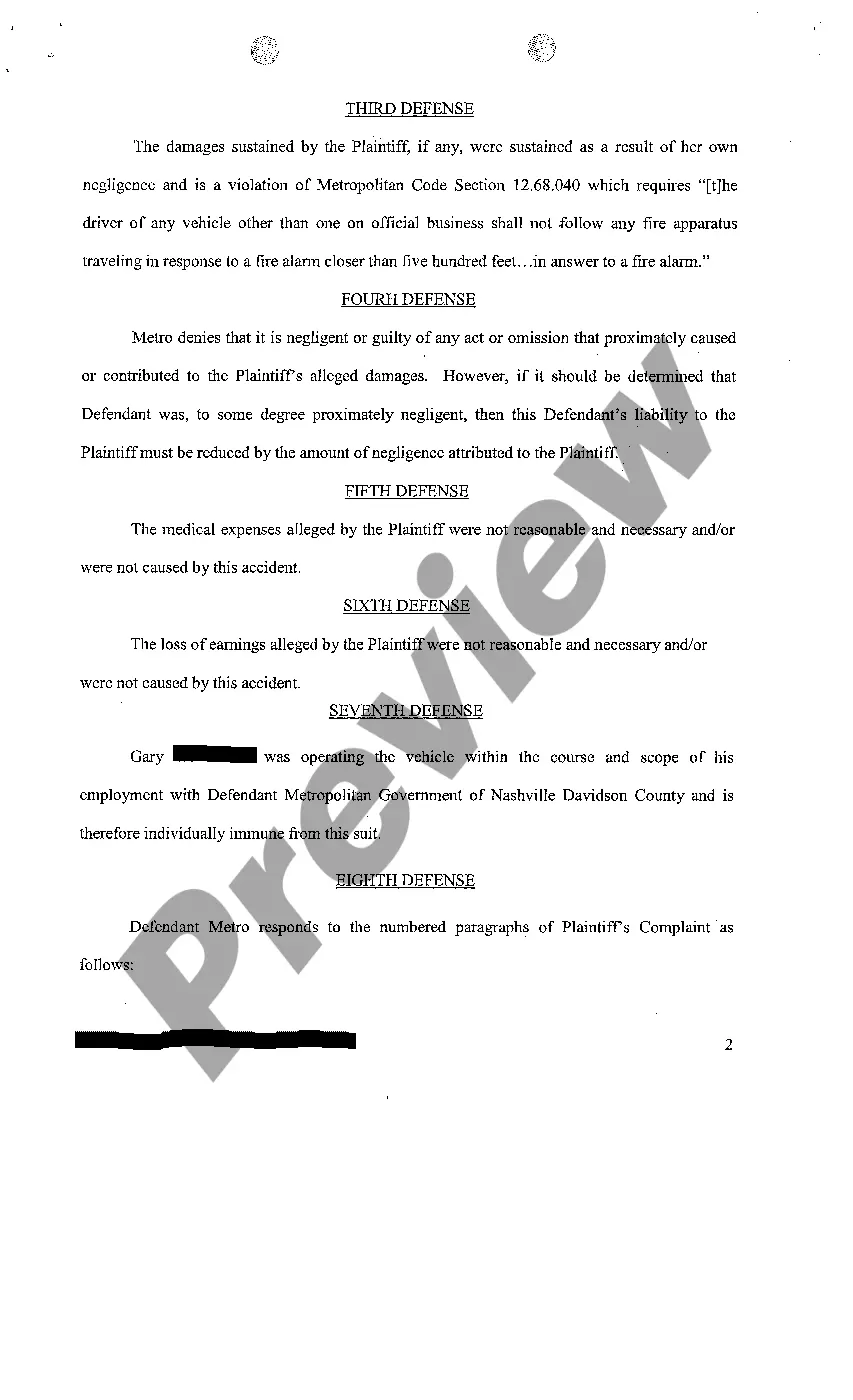

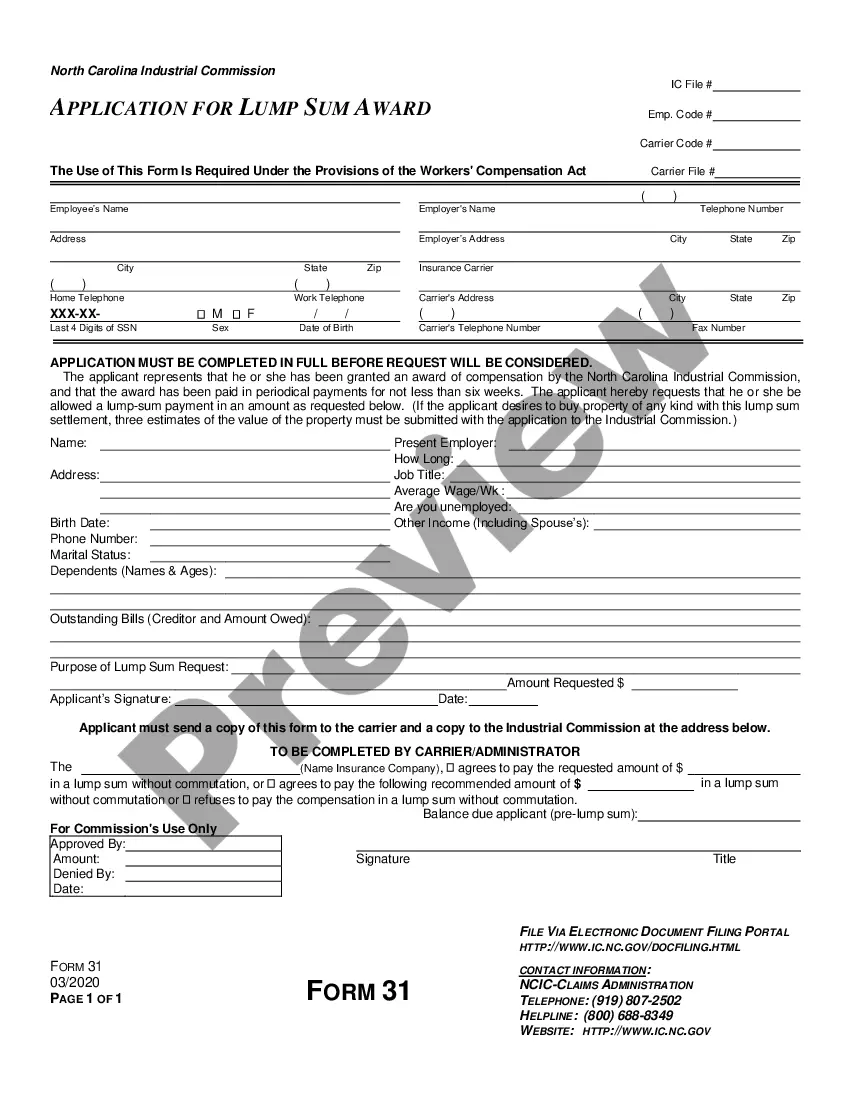

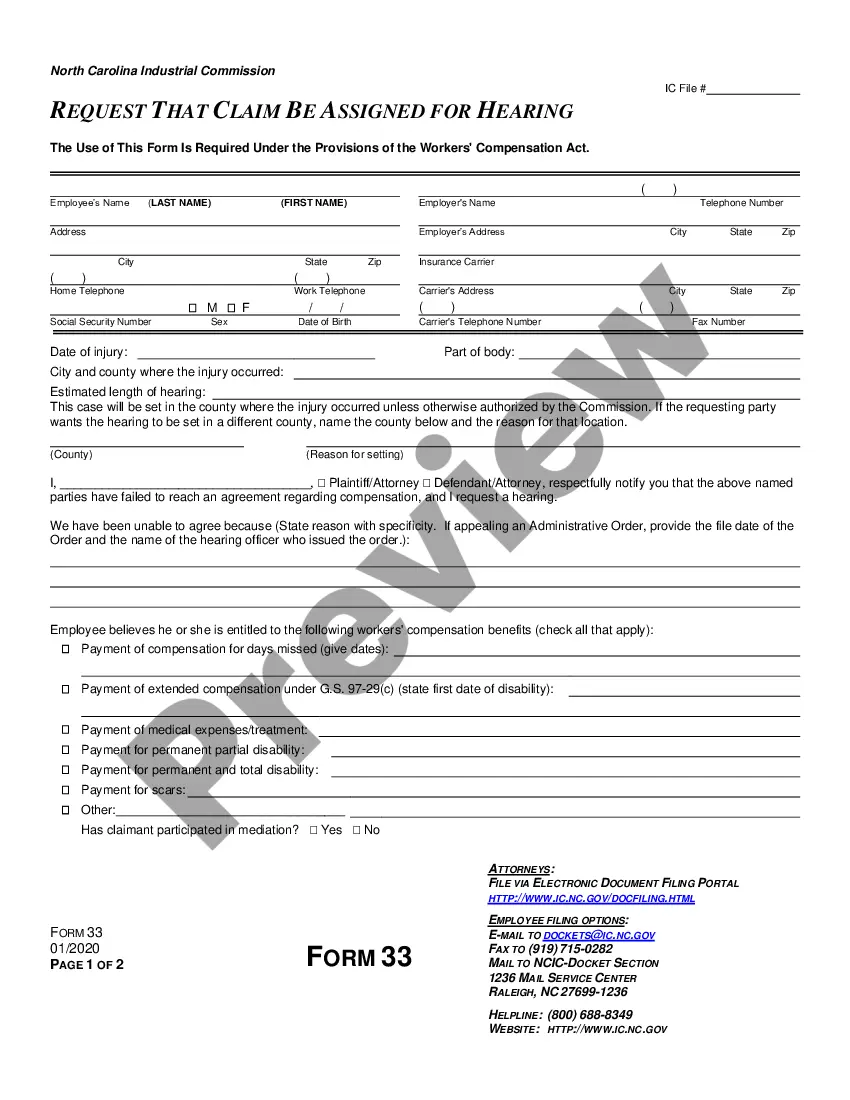

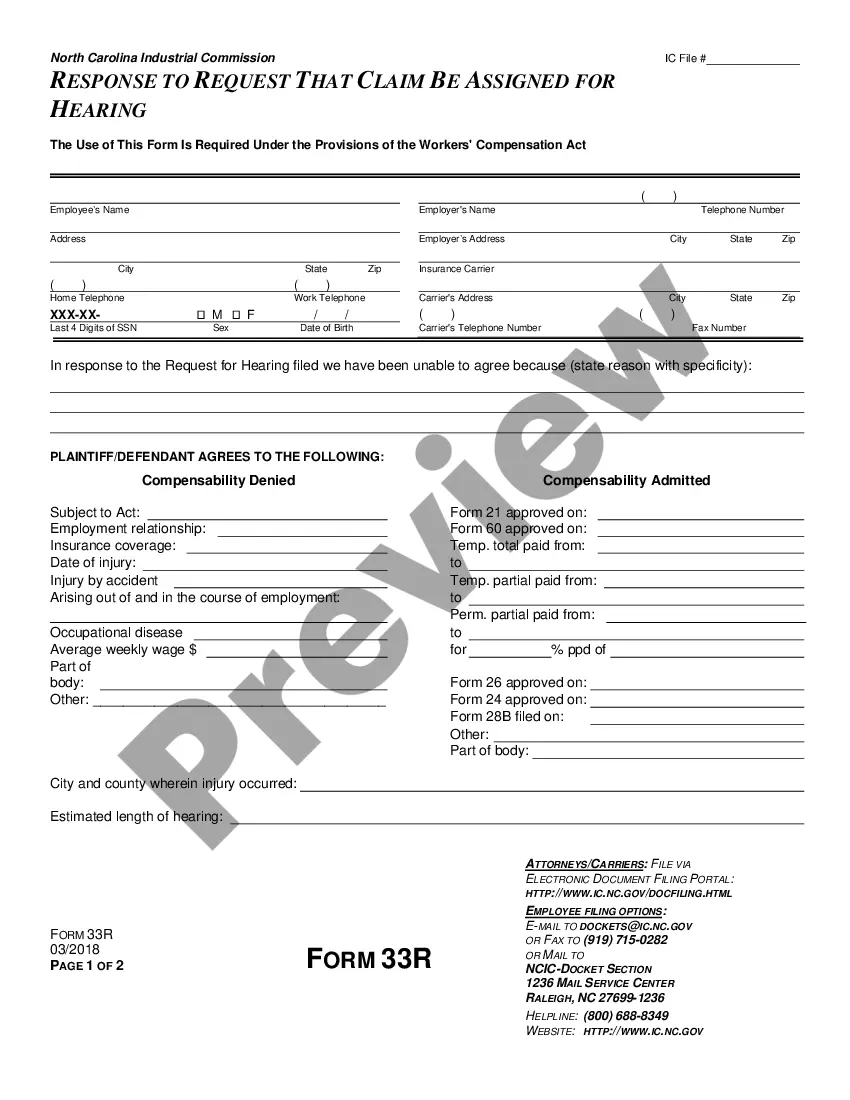

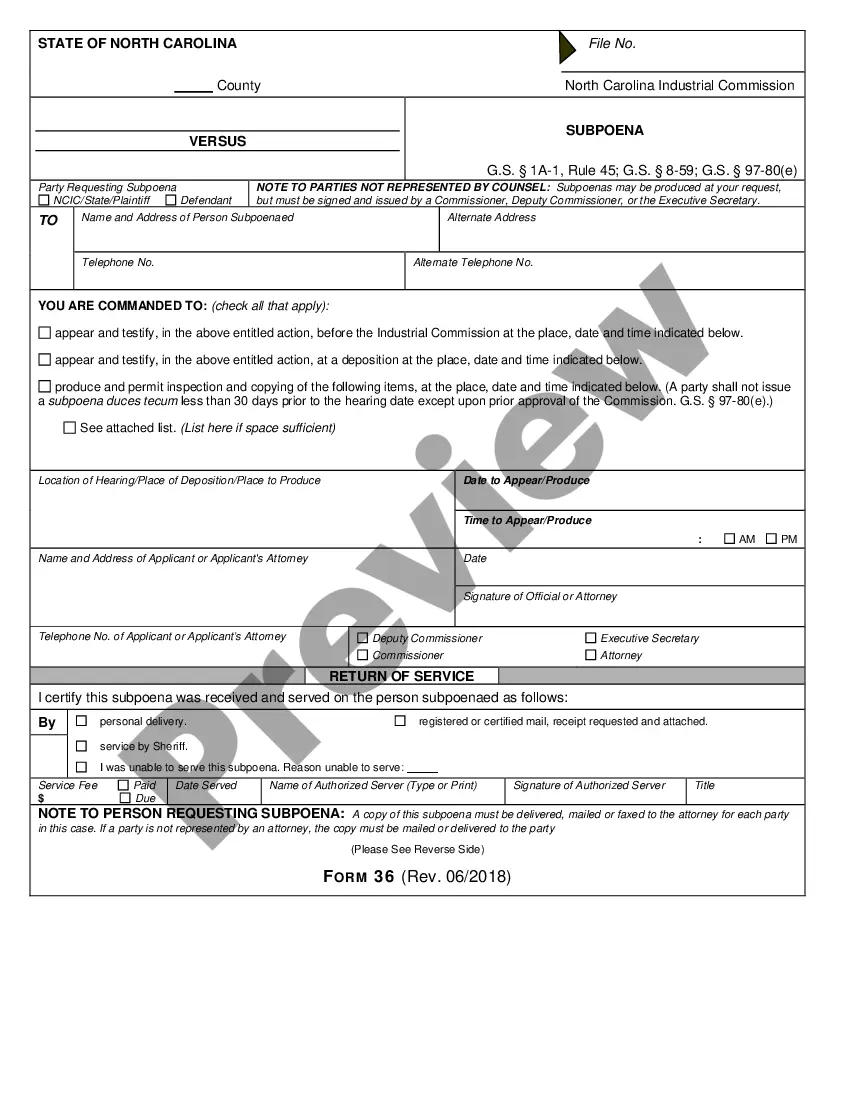

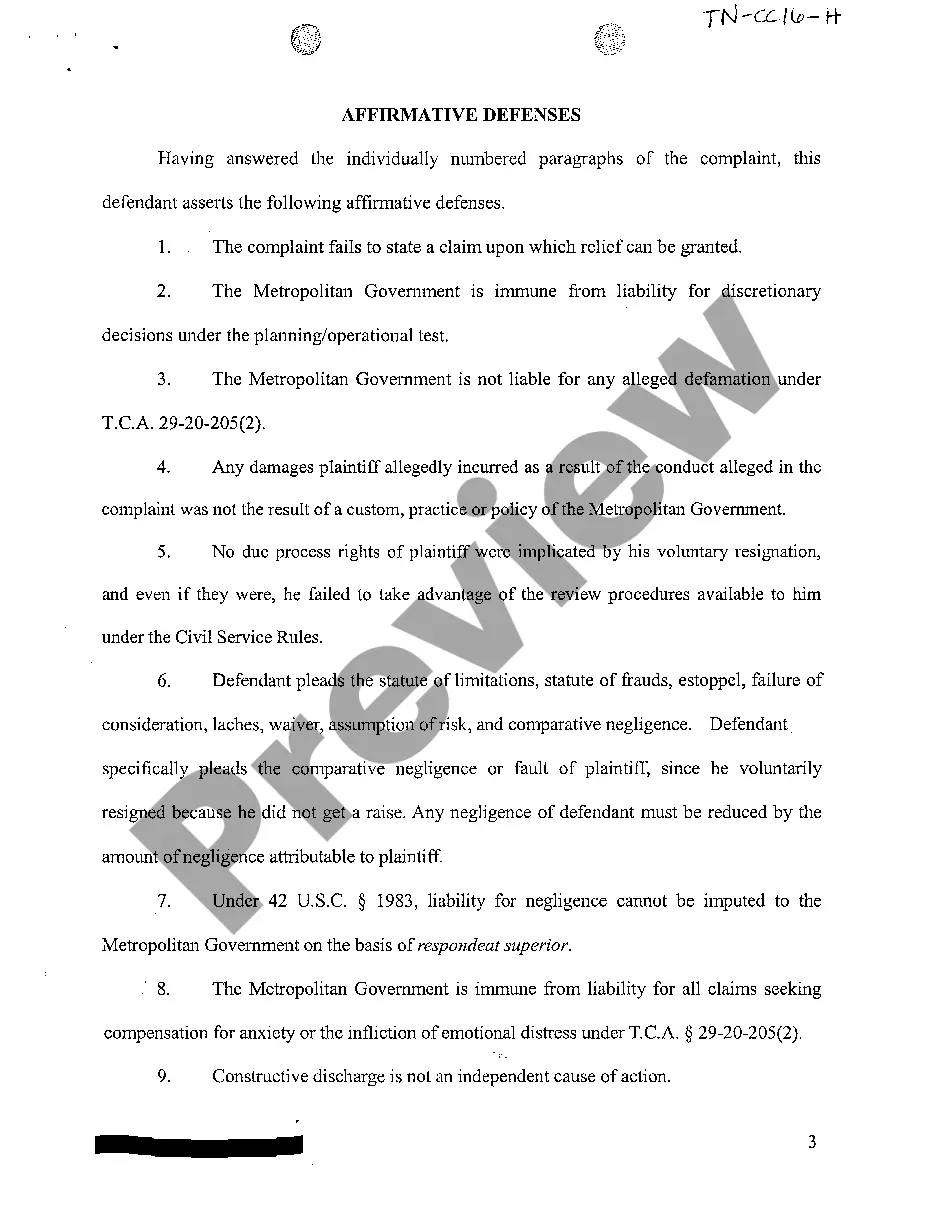

A Memphis Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principle is a type of financial assurance commonly used in legal proceedings to ensure that the principal party fulfills their obligation to pay costs awarded by a court. These bonds are typically required when a party files an appeal or applies for a stay of execution, and are meant to protect the opposing party from any financial losses they may incur due to delays or other actions taken by the principal. In the state of Tennessee, there are different types of cost bonds that may be used depending on the specific situation. These include the supersedes bond, which is required when a judgment debtor wishes to stay the enforcement of a judgment pending the outcome of an appeal. Another type is the statutory bond, which is used when a party is required by law to provide a bond to satisfy any costs that may be awarded against them. The Memphis Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principle typically involves three parties: the principal (the party who is required to provide the bond), the obliged (the party who is entitled to receive the payment of costs), and the surety (the entity providing the bond). The principal is usually responsible for obtaining the bond and must pay a premium, which is a percentage of the bond amount, to the surety company. The surety company, in turn, agrees to be responsible for paying the costs awarded against the principle if they fail to do so. The bond also establishes a maximum limit of liability, which is the total amount that the surety company is obligated to pay. Obtaining a Memphis Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principle can be a complex process, involving the submission of various documents and financial information. It is important for parties involved in legal proceedings in Memphis, Tennessee to work closely with a knowledgeable bond provider to ensure the proper type of bond is obtained and all necessary requirements are met. Thus, a Memphis Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principle is a financial instrument that guarantees the payment of costs awarded by a court and protects the opposing party from any financial losses. The different types of cost bonds in Tennessee include the supersedes bond and the statutory bond, each serving specific purposes in legal proceedings. It involves three parties — the principalobligedeestreetet— - with the surety providing the bond and agreeing to pay costs if the principal fails to do so. Overall, it is crucial for parties involved in legal proceedings in Memphis, Tennessee to understand and adhere to the requirements of obtaining this type of bond with the assistance of a reputable bond provider.

Memphis Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal

Description

How to fill out Memphis Tennessee Cost Bond To Act As Surety For Payments Of Costs Awarded Against The Principal?

Are you searching for a reliable and cost-effective legal documents provider to purchase the Memphis Tennessee Cost Bond to Serve as Surety for Costs Awarded Against the Principal.

US Legal Forms is your preferred option.

Whether you require a simple contract to establish rules for living together with your partner or a collection of paperwork to facilitate your separation or divorce via the court, we have you covered.

Our platform offers over 85,000 current legal document templates for individual and business purposes. All templates we provide are tailored and comply with the specific needs of particular states and regions.

Examine the form’s details (if available) to determine who the form is intended for and its specific applications.

If the form doesn’t meet your unique circumstance, restart your search.

- To obtain the form, you must Log In to your account, search for the necessary form, and click the Download button next to it.

- Please keep in mind that you can access your previously acquired document templates at any time in the My documents section.

- Is this your first visit to our platform? No problem.

- You can create an account in just a few minutes, but first, ensure you do the following.

- Check if the Memphis Tennessee Cost Bond to Serve as Surety for Funds Awarded Against the Principal aligns with the laws of your state and local jurisdiction.

Form popularity

Interesting Questions

More info

For all types of bond claims. See how surety bond costs vary.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.