Chattanooga, Tennessee Income Expense Statement: A Comprehensive Overview and Different Types The Chattanooga, Tennessee Income Expense Statement is a financial document that provides a detailed breakdown of an individual or entity's income and expenses within a specified period of time in Chattanooga, Tennessee. This statement is essential for analyzing the financial health, profitability, and managing budgets. Keywords: Chattanooga Tennessee, income, expense statement, financial document, breakdown, financial health, profitability, managing budgets. Main Components of the Chattanooga, Tennessee Income Expense Statement: 1. Revenue: The first section of the income expense statement outlines all the sources of income or revenue generated during the specified period. It includes regular income sources like salaries, sales revenue, rental income, interest incomes, dividends, and any other operating income. 2. Cost of Goods Sold (COGS): For businesses engaged in product sales, this section identifies the direct costs involved in producing or purchasing the goods sold. It includes raw materials, manufacturing costs, packaging expenses, shipping costs, and other costs directly related to generating revenue. 3. Gross Profit: The gross profit is derived by subtracting the COGS from the revenue. It shows the amount of profit generated from core operations before considering any indirect expenses. 4. Operating Expenses: This section includes expenses incurred in the day-to-day operations of the business or individual. It incorporates salaries and wages, utility bills, rent, insurance, office supplies, advertising costs, maintenance expenses, and any other expenses necessary for running the business. 5. Income Before Tax: This figure represents the operating profit or loss after deducting operating expenses from gross profit, but before accounting for income tax liabilities. 6. Taxes: This section accounts for all applicable federal, state, and local taxes. It includes income tax, sales tax, property tax, payroll tax, and any other taxes levied on the business or individual's income or activities. 7. Net Income: The final figure, net income, is derived by subtracting the tax amount from the income before tax. It represents the actual profit or loss generated during the specified time period. Different Types of Chattanooga, Tennessee Income Expense Statements: 1. Personal Income Expense Statement: This statement is used by individuals or households to track their personal income and expenses within Chattanooga, Tennessee. It helps in managing personal finances, budgeting, and financial planning. 2. Business Income Expense Statement: This statement is utilized by businesses of various sizes and types operating in Chattanooga, Tennessee. It enables business owners or managers to monitor revenue, control costs, identify areas of improvement, and evaluate overall profitability. 3. Non-Profit Income Expense Statement: Non-profit organizations in Chattanooga, Tennessee use this statement to track their revenue and expenses. It helps in evaluating the organization's financial stability, determining funding sources, and ensuring efficient resource allocation. In conclusion, the Chattanooga, Tennessee Income Expense Statement serves as a crucial financial tool for individuals, businesses, and non-profit organizations. It provides a comprehensive overview of income and expenses, aiding in financial analysis, decision-making, and budget planning. Understanding and analyzing the different types of income expense statements can greatly contribute to effective financial management in Chattanooga, Tennessee.

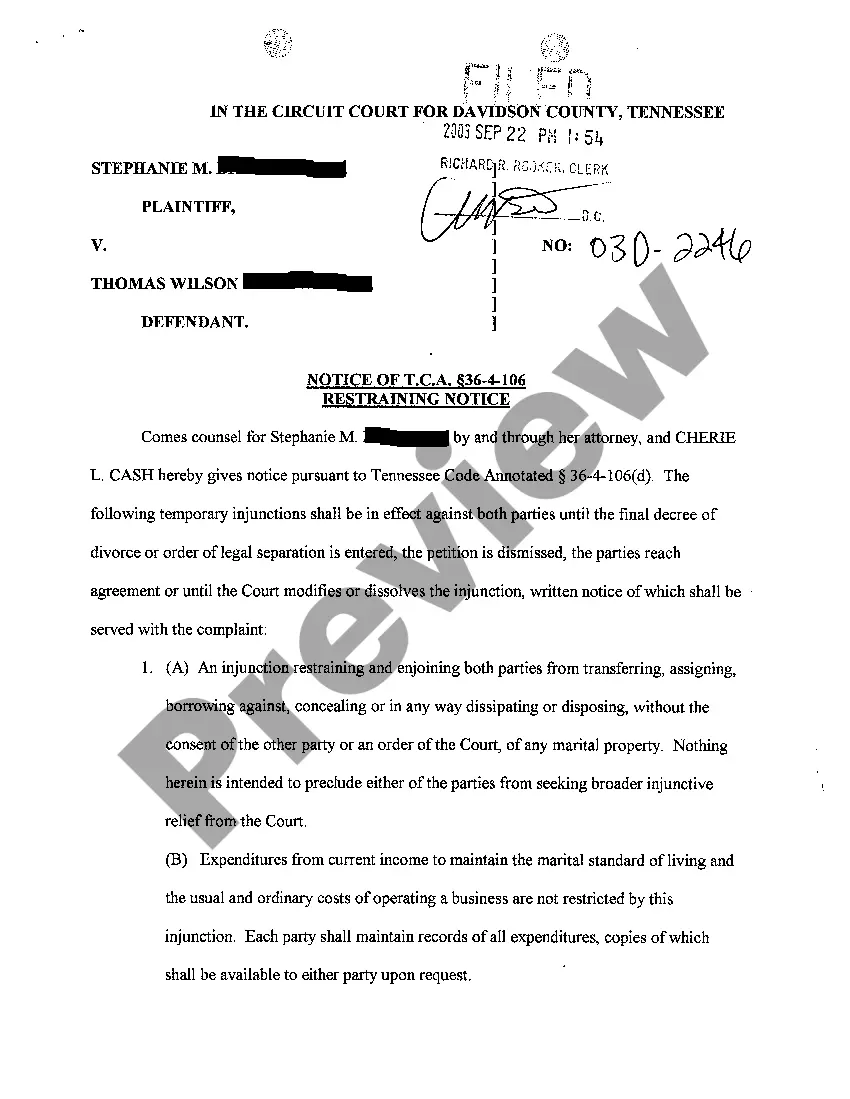

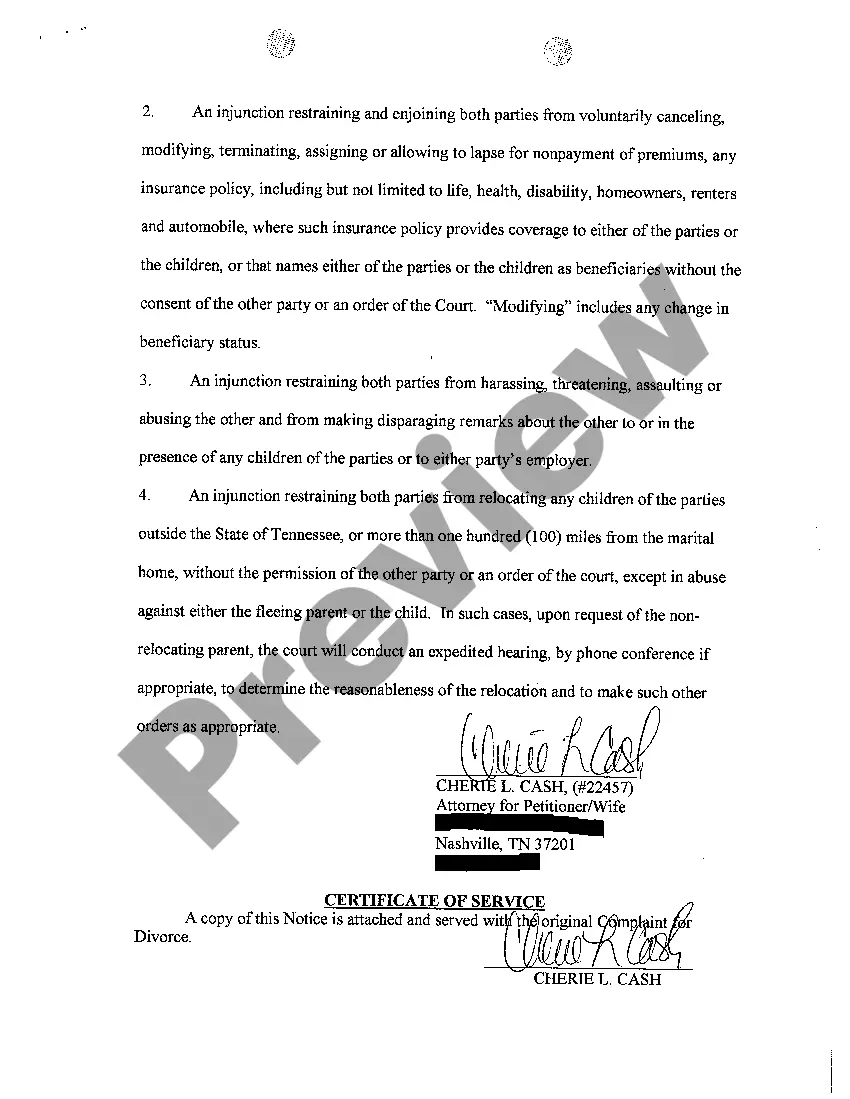

Chattanooga Tennessee Income Expense Statement

Description

How to fill out Chattanooga Tennessee Income Expense Statement?

Take advantage of the US Legal Forms and get instant access to any form template you want. Our useful platform with a large number of document templates makes it easy to find and get almost any document sample you require. You can export, fill, and sign the Chattanooga Tennessee Income Expense Statement in a matter of minutes instead of surfing the Net for several hours trying to find the right template.

Using our library is a great strategy to increase the safety of your document filing. Our experienced lawyers regularly check all the records to ensure that the templates are relevant for a particular region and compliant with new acts and polices.

How do you get the Chattanooga Tennessee Income Expense Statement? If you already have a profile, just log in to the account. The Download button will appear on all the samples you view. Additionally, you can get all the previously saved files in the My Forms menu.

If you don’t have a profile yet, follow the instruction below:

- Open the page with the form you require. Ensure that it is the template you were seeking: check its title and description, and make use of the Preview function when it is available. Otherwise, use the Search field to look for the appropriate one.

- Launch the downloading process. Click Buy Now and select the pricing plan you prefer. Then, create an account and process your order utilizing a credit card or PayPal.

- Download the file. Select the format to obtain the Chattanooga Tennessee Income Expense Statement and change and fill, or sign it according to your requirements.

US Legal Forms is among the most significant and reliable form libraries on the web. We are always ready to assist you in virtually any legal case, even if it is just downloading the Chattanooga Tennessee Income Expense Statement.

Feel free to take advantage of our form catalog and make your document experience as convenient as possible!