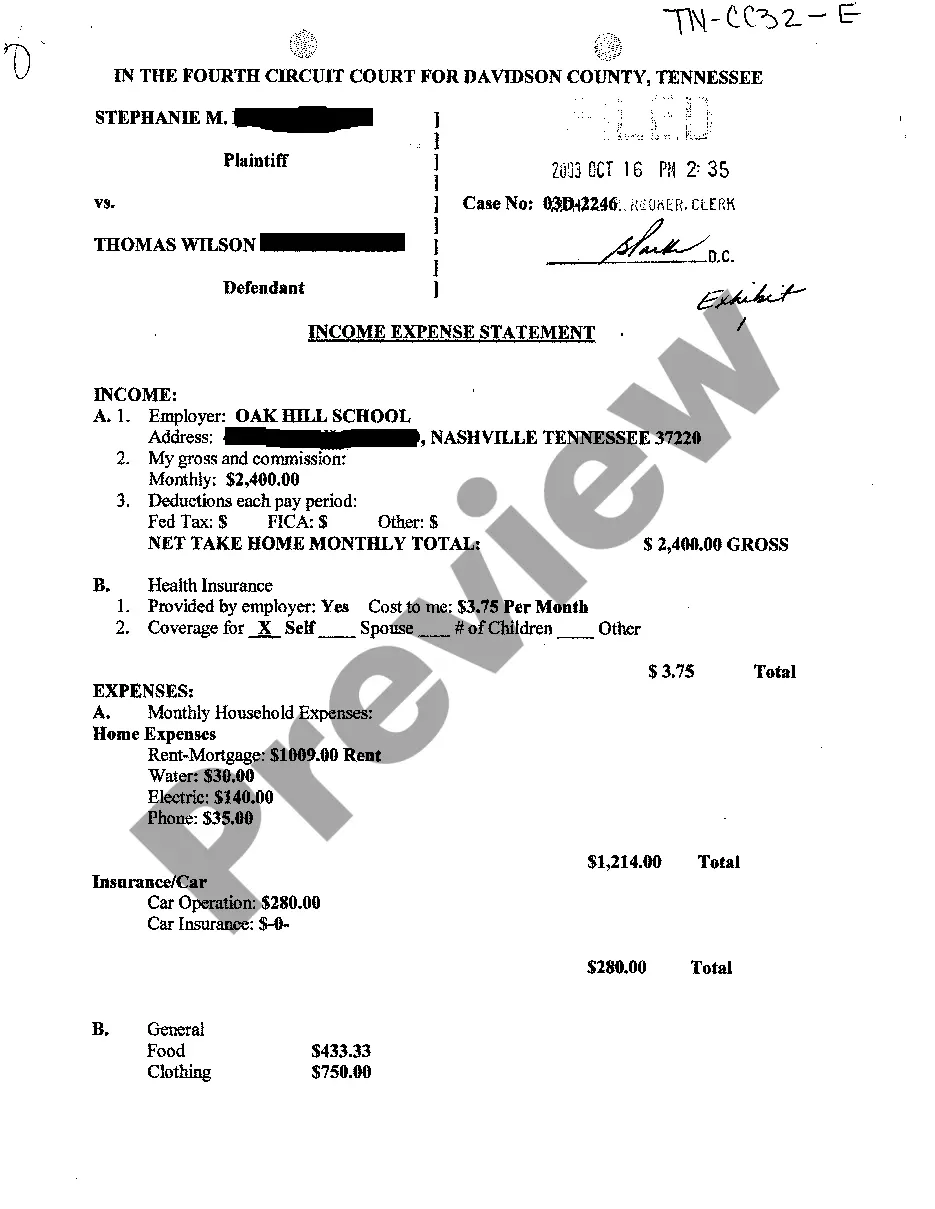

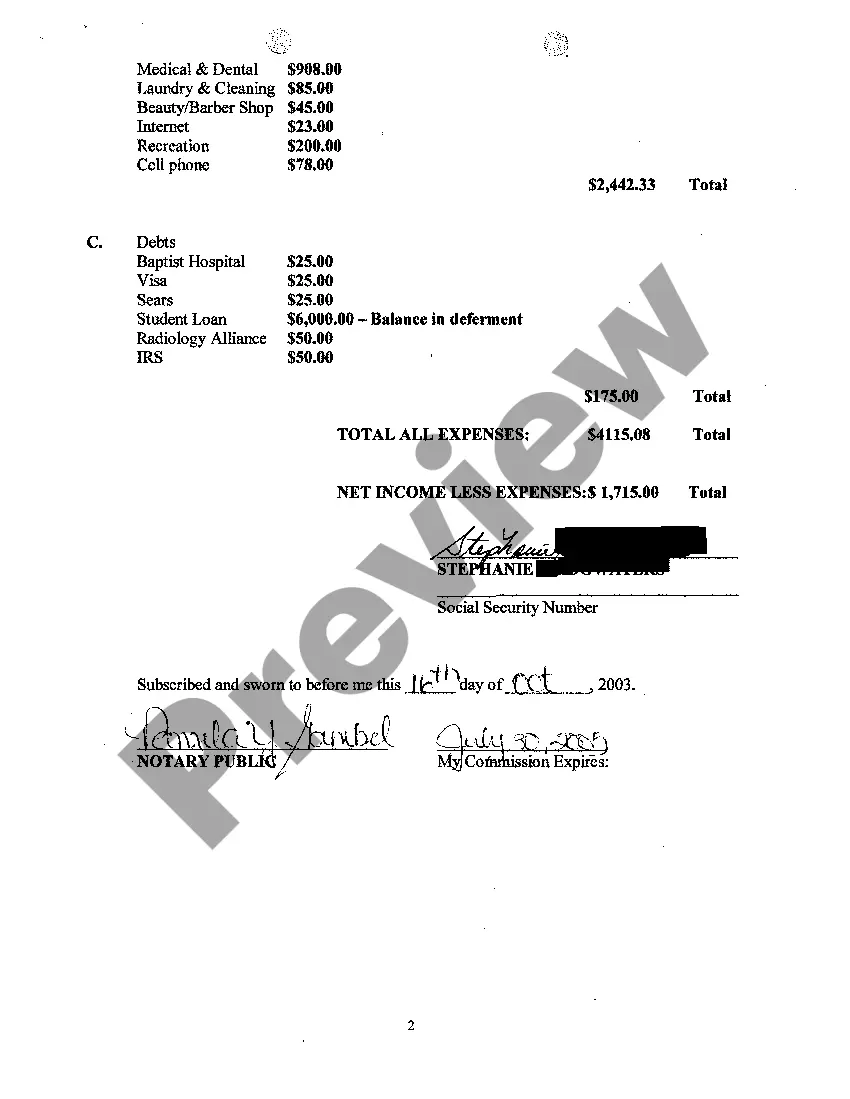

The Clarksville Tennessee Income Expense Statement, also known as the profit and loss statement or the statement of operations, is a financial document that provides a comprehensive overview of an individual or organization's income and expenses within the Clarksville, Tennessee area. This statement is widely used by businesses, non-profit organizations, and individuals to assess their financial performance, identify trends, make informed decisions, and plan for the future. For businesses operating in Clarksville, Tennessee, the Income Expense Statement is a vital tool in measuring profitability and evaluating the financial health of the company. It presents a detailed breakdown of revenue sources and expenses incurred over a specific period, typically monthly, quarterly, or annually. By analyzing this statement, businesses can track their total sales, operating costs, overhead expenses, and other income or expenses relevant to their operations in Clarksville, Tennessee. The Income Expense Statement contains several key components to provide a comprehensive overview of financial performance. These components include: 1. Revenue: This section outlines the sources of income generated by the business in Clarksville, Tennessee. It includes sales revenue from products or services, interest income, rental income, and any other revenue streams pertinent to the business's operations in the area. 2. Cost of Goods Sold (COGS): This section lists the direct costs associated with producing or delivering goods and services in Clarksville. It typically includes the cost of raw materials, direct labor, and production overhead. For service-based businesses, this section might include labor costs directly related to service delivery. 3. Gross Profit: Gross profit is the difference between the revenue and the cost of goods sold. It reflects the profitability before considering operating expenses in Clarksville, Tennessee. 4. Operating Expenses: This section includes all costs incurred while running the business in Clarksville, Tennessee, except for COGS. It consists of categories such as rent, utilities, salaries, advertising, marketing, insurance, depreciation, and general administrative expenses. Each expense is typically listed separately, allowing for detailed analysis and comparison. 5. Net Income/Loss: Net income is the final figure obtained by subtracting all operating expenses from gross profit. If the number is positive, it represents a profitable period for the business, while a negative figure indicates a loss. It is important to note that the Clarksville Tennessee Income Expense Statement may vary depending on the specific industry or organization type. For instance, a non-profit organization would have a slightly different format, highlighting revenue sources such as donations, grants, and special funding, along with program expenses and administrative costs. In conclusion, the Clarksville Tennessee Income Expense Statement is a crucial financial document that provides a detailed breakdown of an individual or organization's income and expenses related to their operations within Clarksville, Tennessee. It allows for effective financial analysis, performance evaluation, budgeting, and decision-making. By utilizing this statement, individuals and businesses can better understand their financial position and make strategic plans to improve profitability and sustainability.

Clarksville Tennessee Income Expense Statement

Description

How to fill out Clarksville Tennessee Income Expense Statement?

If you’ve previously utilized our service, Log In to your account and store the Clarksville Tennessee Income Expense Statement on your device by clicking the Download button. Ensure your subscription is active. If it isn’t, renew it as per your payment arrangement.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have lifetime access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to access it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional requirements!

- Confirm you’ve located an appropriate document. Review the details and use the Preview feature, if available, to verify that it suits your requirements. If it’s not suitable, utilize the Search tab above to find the right one.

- Purchase the document. Click the Buy Now button and select a monthly or yearly subscription model.

- Establish an account and proceed with payment. Enter your credit card information or use the PayPal option to finalize the transaction.

- Obtain your Clarksville Tennessee Income Expense Statement. Choose the file format for your document and save it to your device.

- Complete your form. Print it out or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

An income and expense statement includes detailed information on all income sources and expenditures related to your business. Common entries consist of sales revenue, operational expenses, employee wages, and any additional costs that impact your financial results. This report is vital for understanding your business's financial standing. To make reporting easier, utilize the Clarksville Tennessee Income Expense Statement, which helps organize and present your financial data clearly.

To write an income and expense statement, start by listing all sources of income for the designated period. Next, categorize your expenses, detailing fixed costs, variable costs, and any other relevant spending. Finally, subtract total expenses from total income to find your net profit or loss. For guidance, the Clarksville Tennessee Income Expense Statement offers templates and tips to assist in creating this document effortlessly.

The income and expenses statement provides a snapshot of your business's financial performance over a specific period. It summarizes total income earned and total expenses incurred, helping you understand profitability. This statement is crucial for making informed business decisions. For easy creation of this document, consider our Clarksville Tennessee Income Expense Statement, which simplifies the process.

An income and expense report typically includes all revenue generated by the business alongside all incurred expenses. For a comprehensive overview, it details categories such as sales, operating costs, wages, and other expenditures. This report allows you to assess your financial health effectively. Utilizing our Clarksville Tennessee Income Expense Statement can streamline creating and analyzing this essential document.

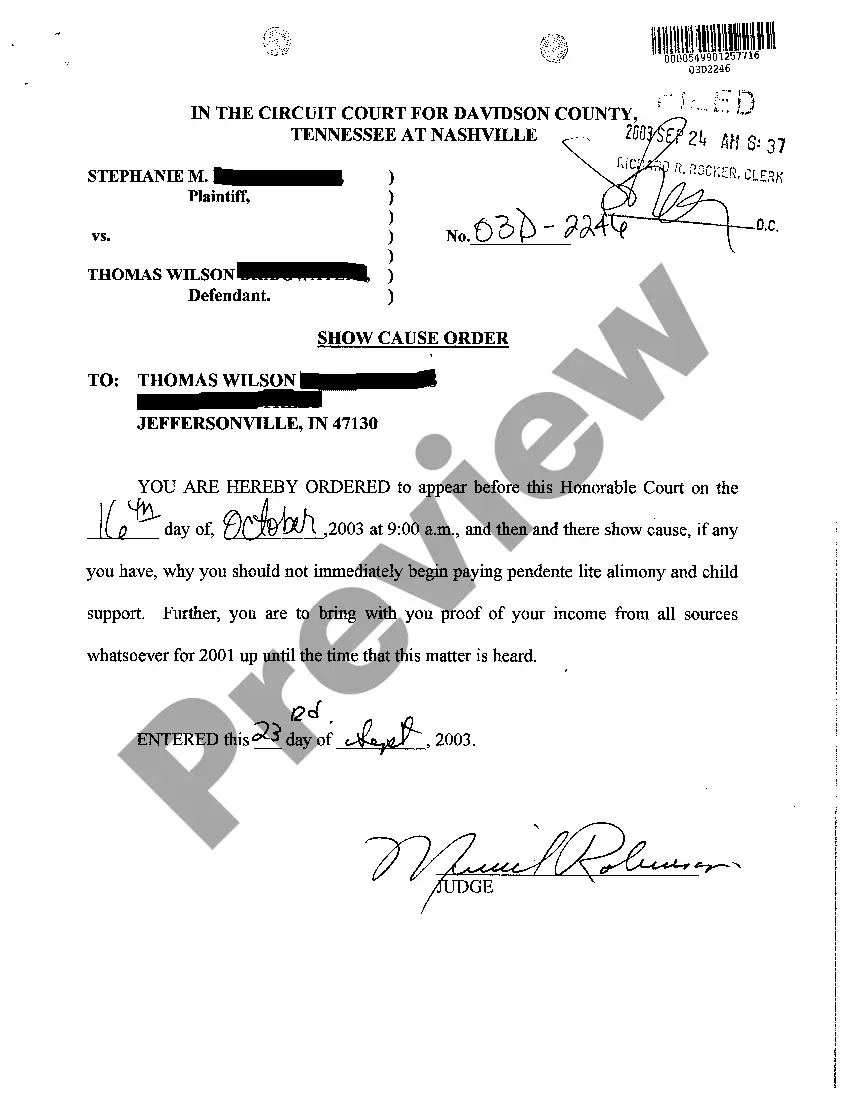

If the opposing party in a legal matter refuses to provide their declaration of disclosure, you will need to address this with the court. You can request a motion to compel, ensuring that they comply with the legal requirements. In such cases, ensure your Clarksville Tennessee Income Expense Statement is as detailed and accurate as possible to support your position.

The purpose of an income and expense declaration is to inform the court about your financial situation. This declaration affects the outcome of legal matters that involve financial support, such as custody case evaluations in Clarksville, Tennessee. A detailed Clarksville Tennessee Income Expense Statement can strengthen your position and provide transparency during legal proceedings.

Yes, filling out an income and expense declaration is typically mandatory in Clarksville, Tennessee. This declaration provides essential information about your financial situation, which can influence court decisions on matters like child custody and support. Utilizing a well-structured Clarksville Tennessee Income Expense Statement ensures clarity and accuracy in your financial disclosure.

In many legal proceedings in Clarksville, Tennessee, you are required to fill out a declaration. This document outlines specific financial details and ensures transparency in your financial dealings. The Clarksville Tennessee Income Expense Statement is a crucial part of this declaration, as it highlights your income and expenditures.

Yes, completing an income and expenditure form is often necessary in Clarksville, Tennessee. This form helps establish your financial position, especially in legal situations such as divorce or child support cases. By providing a clear picture of your finances, the Clarksville Tennessee Income Expense Statement can assist the court in making informed decisions.

Clarksville is widely regarded as a nice place to live, offering a mix of urban and suburban lifestyles. Residents appreciate the welcoming neighborhoods, good schools, and active community life. From parks to cultural events, there are plenty of ways to enjoy life in Clarksville. As you consider your living options, a Clarksville Tennessee Income Expense Statement can aid in understanding the financial aspects of your potential new home.

Interesting Questions

More info

We are available every day from 8:00 a.m. to 10:00 p.m.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.