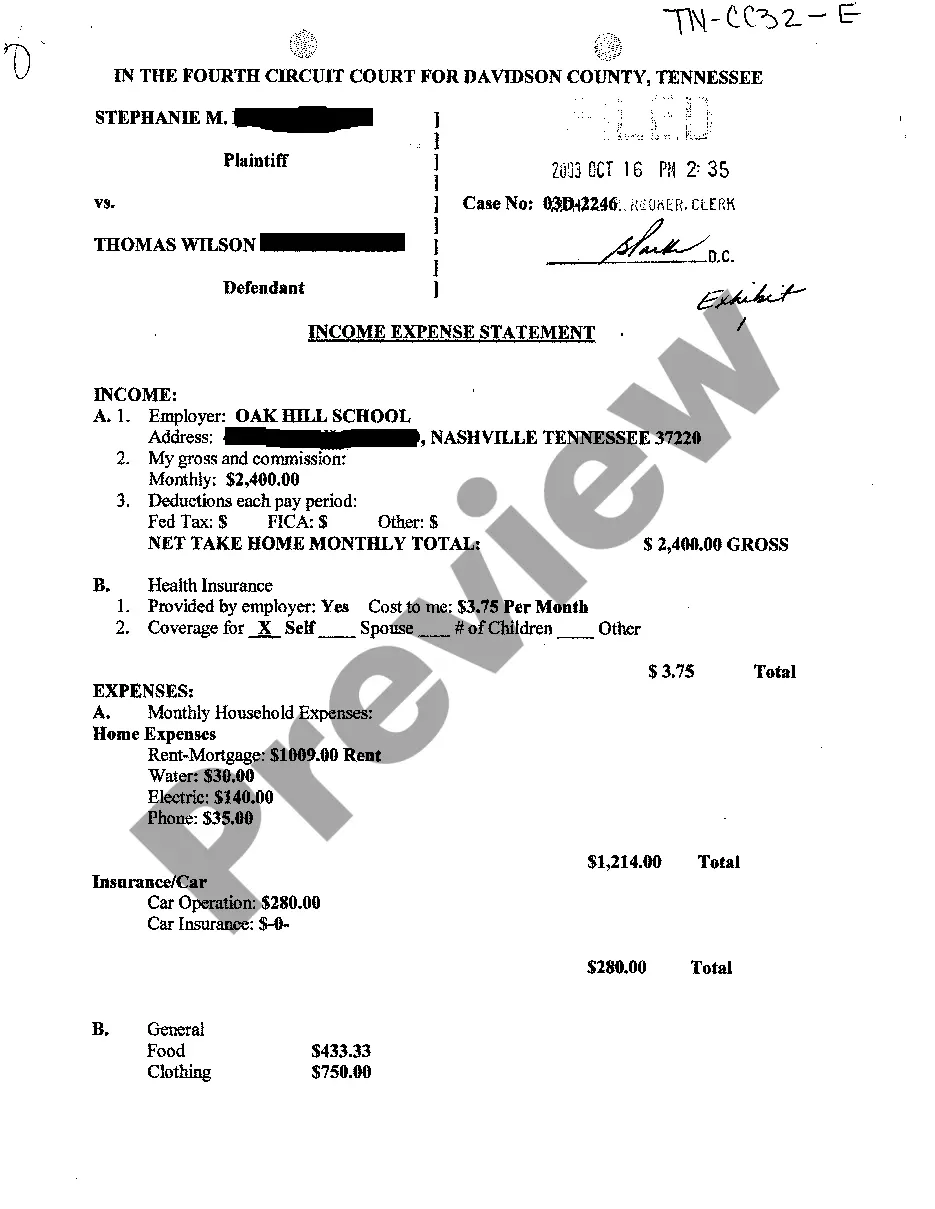

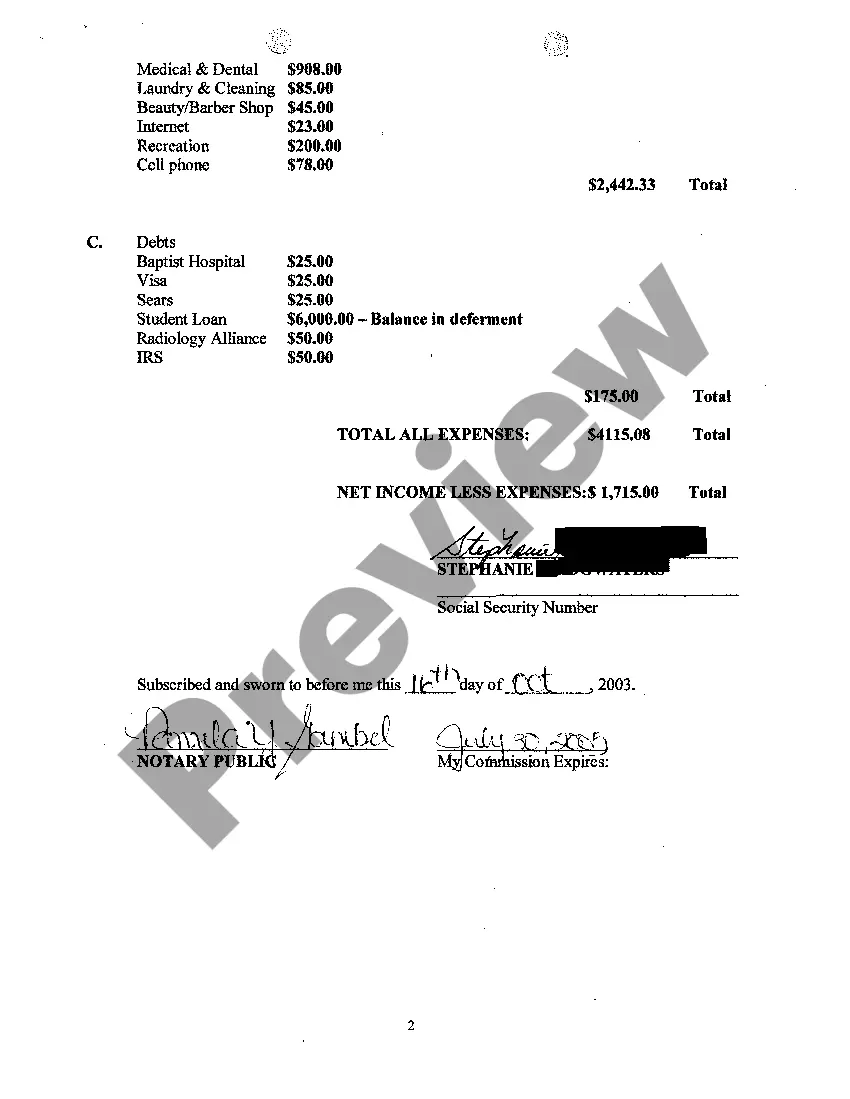

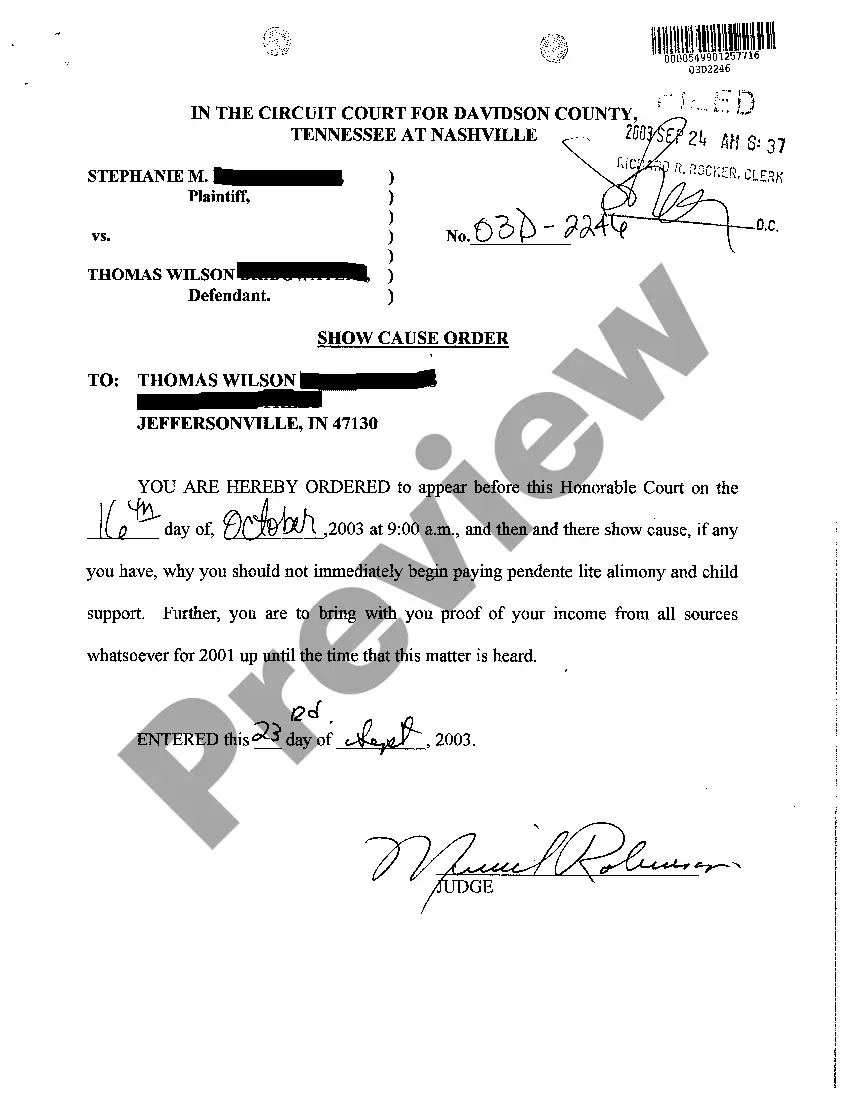

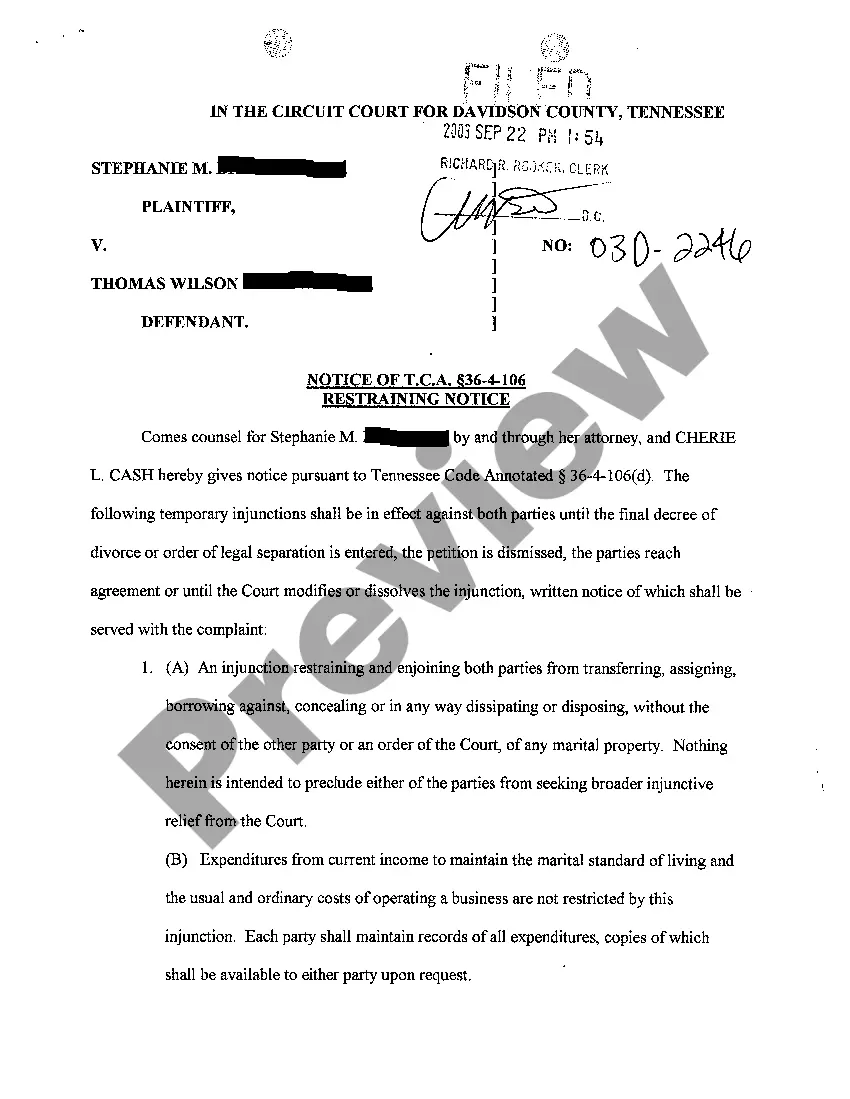

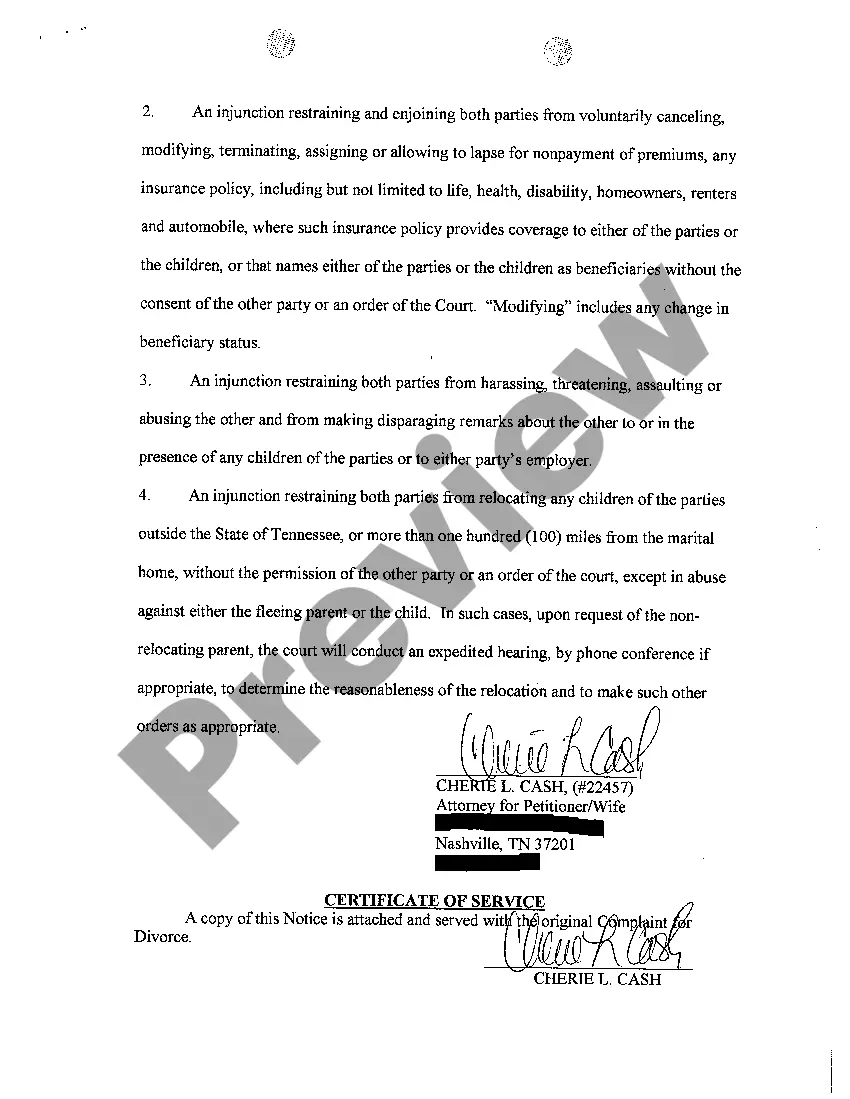

The Knoxville Tennessee Income Expense Statement is a crucial financial document that provides a detailed breakdown of the income and expenses incurred by individuals, businesses, or organizations in Knoxville, Tennessee. It serves as a comprehensive record of the financial activities, showing where the money comes from (income) and where it is spent (expenses). This statement is an essential tool for assessing financial health, determining profitability, and making informed financial decisions. Keywords: Knoxville Tennessee, income expense statement, financial document, breakdown, income, expenses, individuals, businesses, organizations, comprehensive record, financial activities, money, financial health, profitability, financial decisions. There are different types of Knoxville Tennessee Income Expense Statements that cater to specific entities: 1. Personal Income Expense Statement: This statement is used by individuals or households residing in Knoxville, Tennessee. It lists personal sources of income, such as salaries, wages, or rental income, and outlines various expenses like rent/mortgage payments, utility bills, groceries, transportation costs, and entertainment expenses. A personal income expense statement helps individuals track their spending habits, manage their budget, and assess their financial situation. 2. Business Income Expense Statement: This statement is utilized by businesses operating in Knoxville, Tennessee. It outlines the revenue generated from sales, services, investments, or loans, and provides a detailed breakdown of expenses, including rent, payroll, inventory costs, utilities, marketing expenses, and taxes. A business income expense statement helps business owners evaluate their financial performance, identify profit margins, and make informed decisions about strategies to improve profitability. 3. Nonprofit Organization Income Expense Statement: This statement is specific to nonprofit organizations established in Knoxville, Tennessee. It records the sources of income for nonprofits, such as donations, grants, fundraising events, or program fees, and presents a detailed breakdown of expenses related to program costs, salaries, administrative expenses, marketing efforts, and overhead. The nonprofit income expense statement helps these organizations monitor their financial stability, allocate resources effectively, and comply with reporting requirements. In conclusion, the Knoxville Tennessee Income Expense Statement is a vital financial tool used by individuals, businesses, and nonprofit organizations to track their incomes and expenses accurately. It enables them to evaluate profitability, make informed financial decisions, and effectively manage their finances. Whether it is a personal, business, or nonprofit income expense statement, this document is instrumental in maintaining financial stability and achieving financial goals.

Knoxville Tennessee Income Expense Statement

Description

How to fill out Knoxville Tennessee Income Expense Statement?

If you are searching for an appropriate document, it’s impossible to discover a more convenient location than the US Legal Forms website – one of the most extensive collections on the web.

With this collection, you can acquire thousands of templates for commercial and personal purposes categorized by type and region, or keywords.

Utilizing our sophisticated search tool, obtaining the latest Knoxville Tennessee Income Expense Statement is as simple as 1-2-3.

Acquire the form. Specify the format and download it to your device.

Edit the form. Complete, alter, print, and sign the obtained Knoxville Tennessee Income Expense Statement.

- If you are already familiar with our platform and hold an account, all you need to do to obtain the Knoxville Tennessee Income Expense Statement is to Log In to your account and click the Download option.

- If you are using US Legal Forms for the first time, simply adhere to the instructions below.

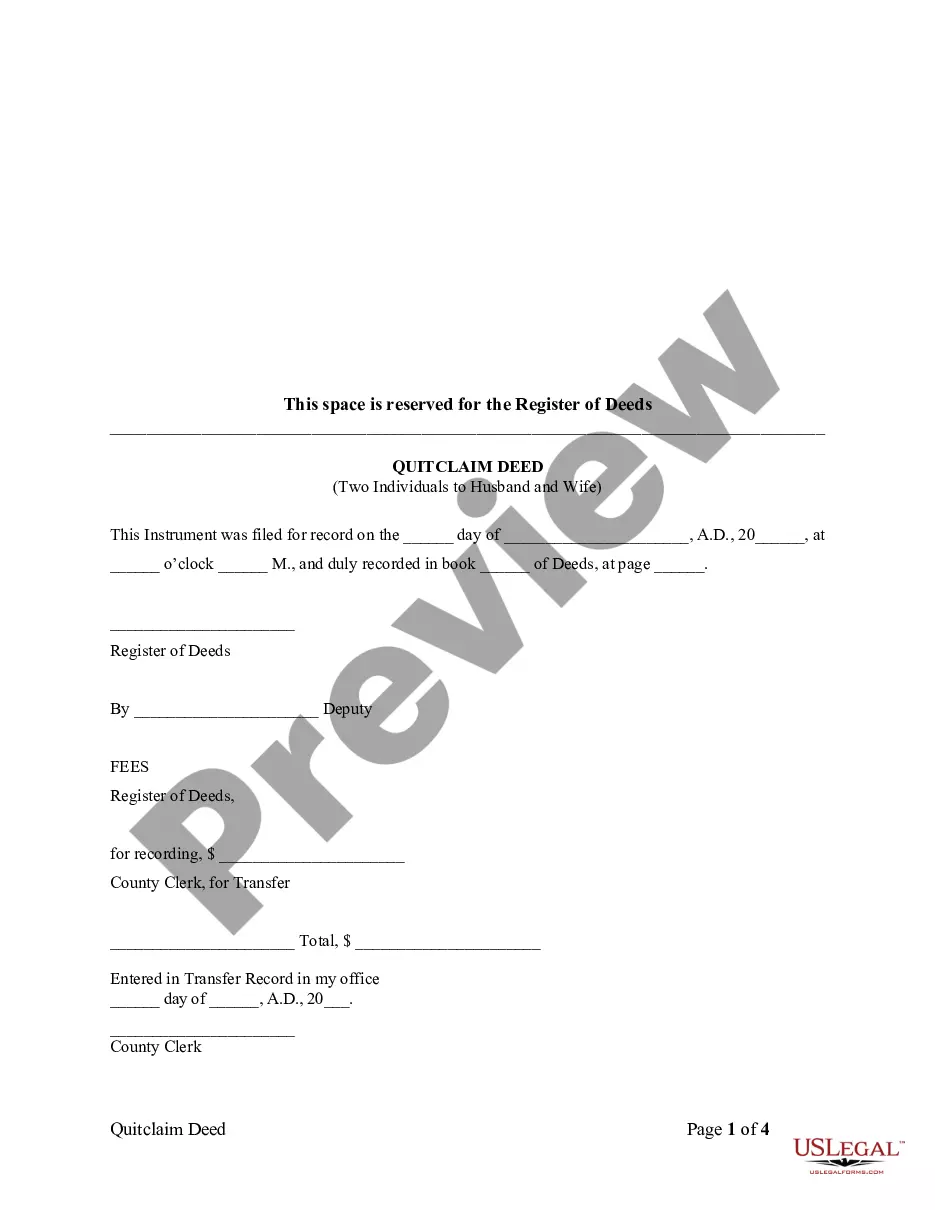

- Ensure you have located the sample you need. Review its details and use the Preview option (if available) to examine its content. If it doesn’t meet your requirements, make use of the Search option at the top of the page to find the correct document.

- Confirm your selection. Click the Buy now option. After that, choose your desired pricing plan and provide the necessary information to create an account.

- Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

To write an income and expense statement, start by listing all sources of income followed by categorizing your expenses. Ensure clarity by detailing each item and totals. Utilizing a template for your Knoxville Tennessee Income Expense Statement can streamline this process and help ensure accuracy in your financial documentation.

If you earn $100,000 in Tennessee, you will retain the entire amount since there is no state income tax. However, you will still need to consider federal tax obligations and other expenses that may apply. When calculating your net income for your Knoxville Tennessee Income Expense Statement, keep these factors in mind to understand your financial position.

Yes, Tennessee is considered a tax-friendly state due to the absence of a personal income tax. This can result in higher disposable income for residents, which benefits both individuals and families. When evaluating your finances and completing your Knoxville Tennessee Income Expense Statement, this tax policy can lead to favorable outcomes.

Income tax payable refers to the amount of tax you owe to the government, while income tax expense reflects the total tax allocated to the period based on your income. These figures often differ due to timing differences and varying tax obligations. Accurately differentiating these terms is essential for creating an effective Knoxville Tennessee Income Expense Statement.

In Knoxville, Tennessee, the combined state and local sales tax rate is 9.75%. For income tax, Tennessee does not impose a state income tax, which can be advantageous for residents. Understanding these rates is crucial when preparing your Knoxville Tennessee Income Expense Statement, as it directly impacts your overall financial planning.

The single step income statement offers a straightforward way to view your income tax expense. It combines all revenues and gains at the top, then lists all expenses, including income tax, to present a simple, clear picture of profitability. When preparing your Knoxville Tennessee Income Expense Statement, this method keeps it easy to understand, making it suitable for individuals and small businesses alike.

The finance director of Knox County Tennessee oversees the county's financial operations, manages budgets, and ensures accurate reporting. They play a vital role in maintaining fiscal responsibility in the community. For those seeking detailed financial insights, the Knoxville Tennessee Income Expense Statement can provide useful context regarding local government finances.

Yes, an income statement typically includes income tax expenses as part of its overall financial reporting. This ensures that the net income reflects all financial obligations, including taxes. For a deeper understanding of your own tax implications, reviewing a Knoxville Tennessee Income Expense Statement can help clarify your financial standing.

Upper class income levels in Knoxville, Tennessee, can vary depending on the source and economic indicators used. Generally, households earning above $100,000 per year are considered part of the upper class. Understanding these income levels may lead individuals to request their own Knoxville Tennessee Income Expense Statement for personal financial planning.

The Director of Finance at Metro Nashville handles the city's budgeting, financial reporting, and treasury functions. Their leadership is key to maintaining the financial health of the city. For more detailed financial disclosures, the Knoxville Tennessee Income Expense Statement serves as an excellent example of municipal fiscal reports.