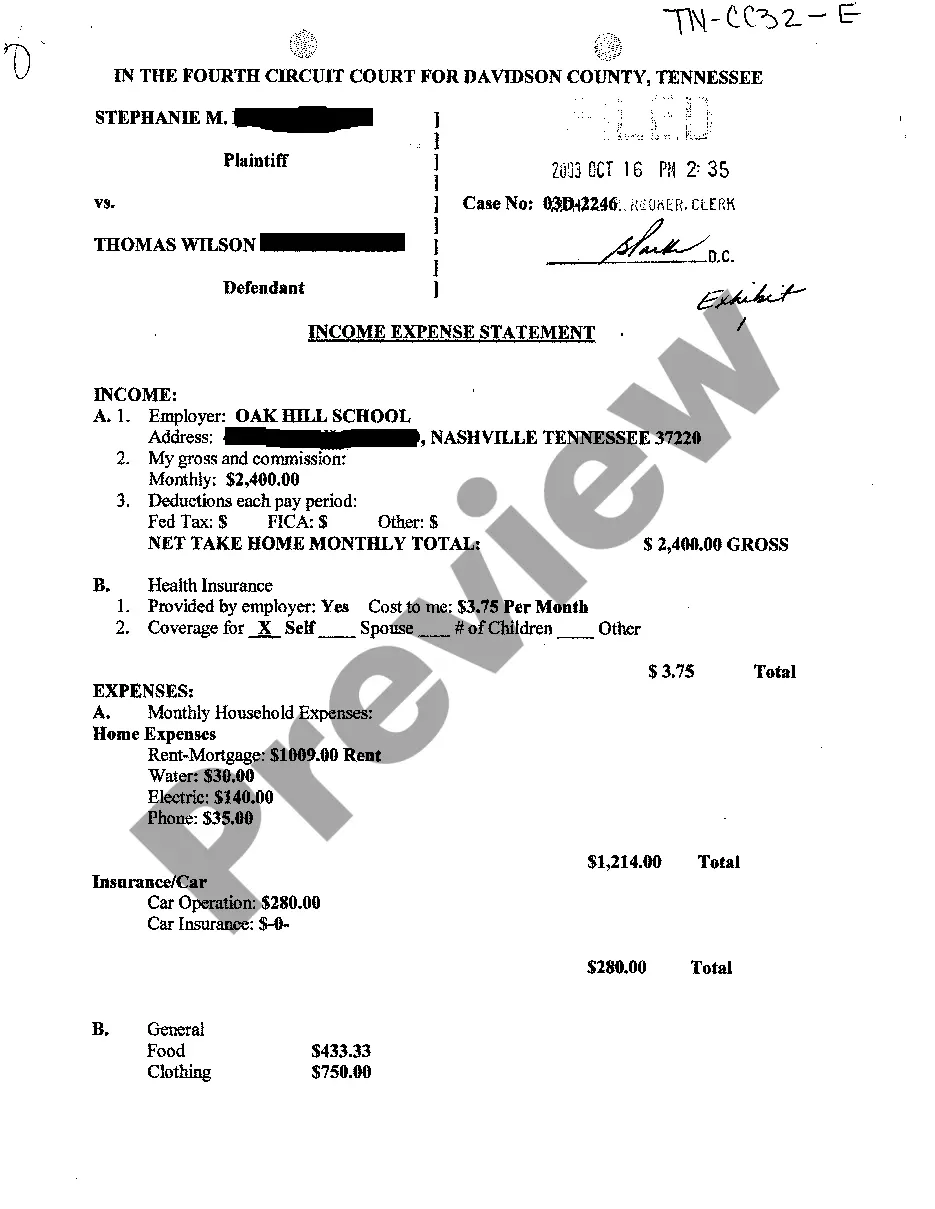

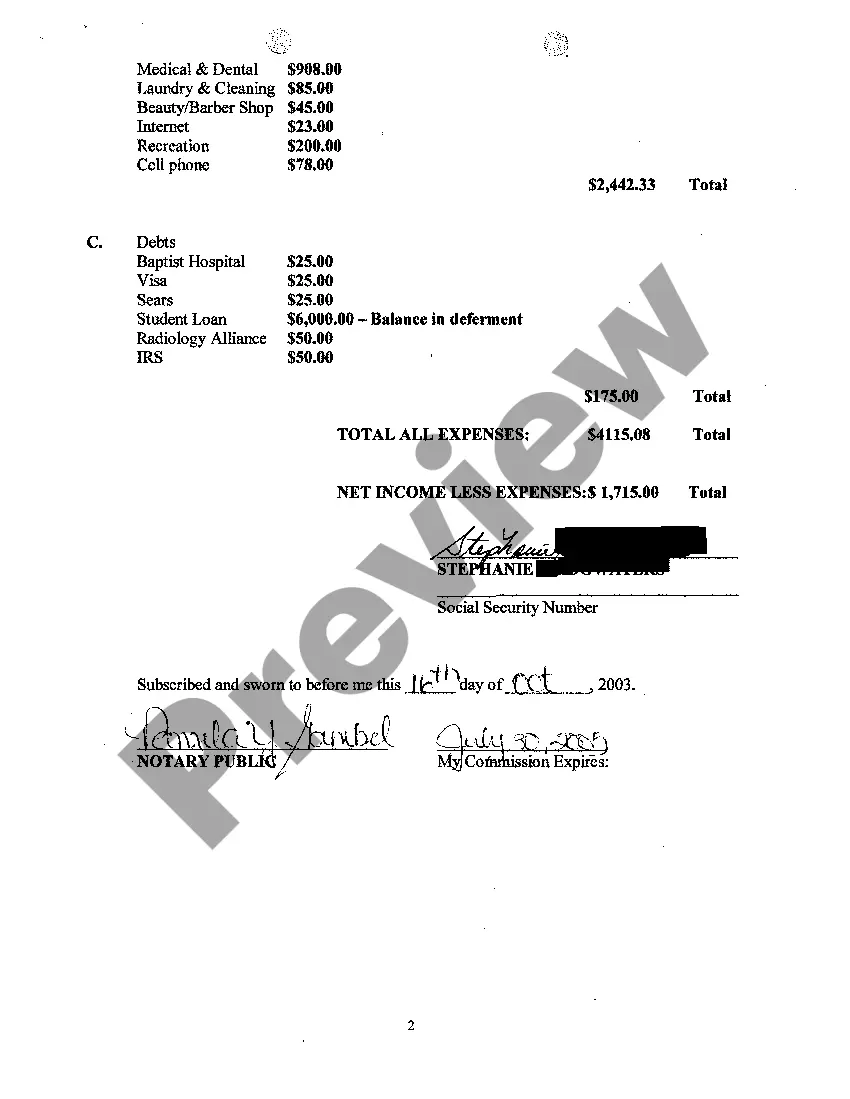

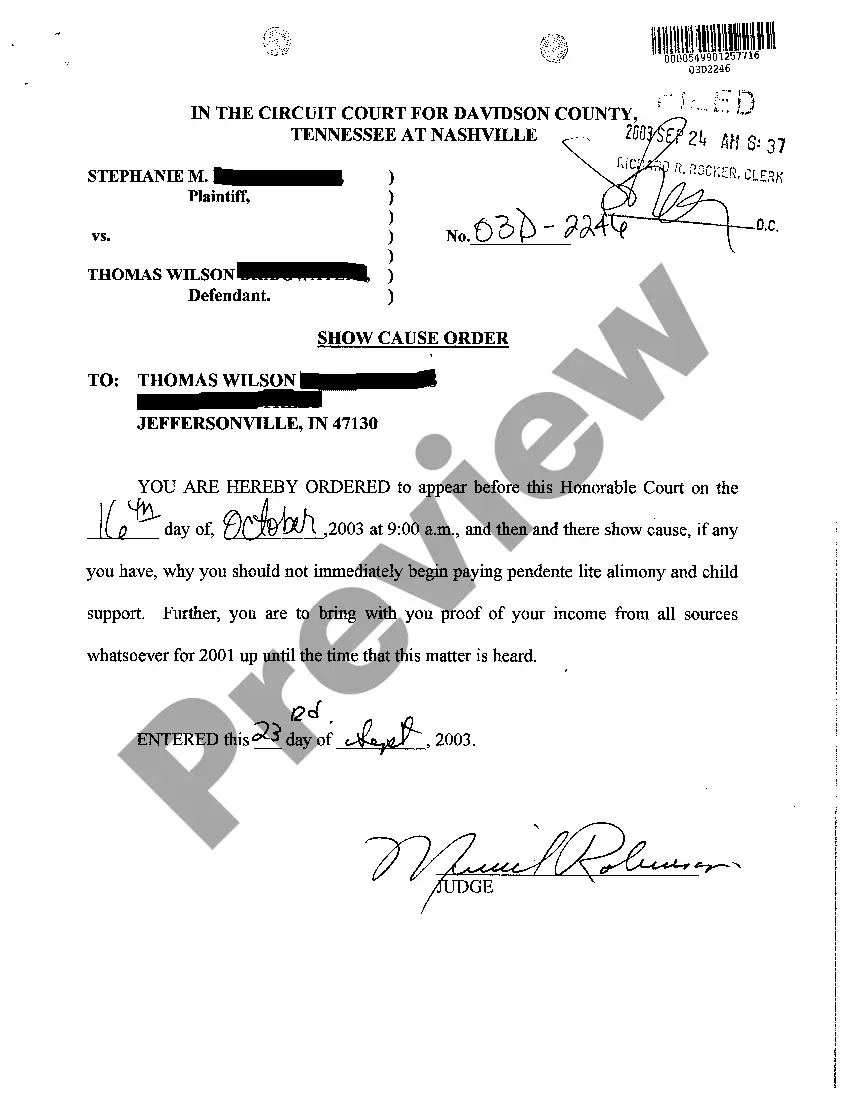

The Memphis Tennessee Income Expense Statement is a financial document that provides a detailed breakdown of the income and expenses of an individual, business, or organization located in Memphis, Tennessee. It is an essential tool for analyzing the financial performance and profitability of the entity. The Income Expense Statement is divided into two main sections: income and expenses. The income section outlines all sources of revenue, including sales of products or services, rental income, investment income, and any other form of income generated by the entity. It provides a comprehensive picture of the total revenue earned during a specific period, such as a month, quarter, or year. On the other hand, the expenses section highlights all costs and expenditures incurred by the entity to operate its business or organization. This includes items such as utilities, rent or mortgage payments, salaries and wages, marketing expenses, office supplies, insurance premiums, and any other expenses associated with the day-to-day activities of the entity. The expenses section aids in identifying areas where expenses can be minimized or optimized to improve the overall financial health of the entity. In addition to the general Income Expense Statement, there may be different types or variations depending on the specific needs and characteristics of the entity. Some common variations include: 1. Personal Income Expense Statement: This type of statement is used by individuals to track their personal income and expenses. It helps individuals gain a better understanding of where their money is coming from and where it is being spent, aiding in budgeting and financial planning. 2. Business Income Expense Statement: This statement is utilized by businesses operating in Memphis, Tennessee, to evaluate their financial performance. It includes revenues generated from sales, services, and other activities specific to the business, as well as all types of expenses incurred in the course of operations. 3. Nonprofit Income Expense Statement: Nonprofit organizations in Memphis, Tennessee, use this statement to assess their financial position and performance. It includes revenue from donations, grants, and fundraising activities, while expenses encompass program costs, administrative expenses, and other expenditures related to the organization's mission. By diligently analyzing the Memphis Tennessee Income Expense Statement, individuals, businesses, and organizations can gain valuable insights into their financial activities, assess their profitability, and make informed decisions to achieve financial stability and growth.

Memphis Tennessee Income Expense Statement

Description

How to fill out Memphis Tennessee Income Expense Statement?

We always want to reduce or prevent legal issues when dealing with nuanced legal or financial affairs. To accomplish this, we sign up for attorney services that, as a rule, are extremely expensive. However, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of an attorney. We offer access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Memphis Tennessee Income Expense Statement or any other form quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it in the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the platform! You can create your account in a matter of minutes.

- Make sure to check if the Memphis Tennessee Income Expense Statement adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Memphis Tennessee Income Expense Statement is suitable for your case, you can pick the subscription option and make a payment.

- Then you can download the document in any available format.

For more than 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!