Chattanooga Tennessee Appeal Bond: Understanding the Importance of Obtaining this Legal Safeguard In the realm of legal procedures in Chattanooga, Tennessee, an appeal bond plays a crucial role in ensuring fairness and protecting the rights of both individuals and businesses involved in a legal dispute. An appeal bond, often referred to as a supersedes bond, serves as a financial guarantee that the party appealing the court's decision will fulfill their obligations if the appeal is unsuccessful. An appeal bond acts as a vital security measure to prevent the losing party from being unjustly harmed by a frivolous appeal. It helps to mitigate the risk of significant financial losses that could result from delaying payments or disregarding court orders during the appeal process. There are primarily three types of appeal bonds available in Chattanooga, Tennessee, catering to different situations and legal requirements: 1. Stay of Execution Appeals Bond: This type of appeal bond is commonly used when a judgment requires the appealing party to make payments to the winning party. It stays the execution of the judgment while the appeal is pending, protecting the appellant from immediate financial obligations. 2. Cost Bond: Also known as a cost appeal bond, it guarantees the payment of court costs and other expenses associated with the appeals process. This bond ensures that the appellant will cover expenses that may arise during the appeal, such as filing fees, transcription costs, and the costs of reproducing evidence. 3. Blanket Bond or Supersedes Bond: Fulfilling the requirements of both the stay of execution and cost bonds, this comprehensive bond covers both payment obligations and appeals process expenses. It combines the benefits of both bonds, providing a more extensive safeguard for the appellant. To obtain an appeal bond in Chattanooga, Tennessee, one must typically work with a reputable surety bond provider. Surety bond companies, authorized and licensed by the state, offer these bonds to guarantee the financial accountability of the appellant. The bond's cost is usually a percentage of the total judgment amount, determined based on several factors, such as the credit history and financial capabilities of the appellant. Appellants seeking an appeal bond in Chattanooga, Tennessee, should be aware that the bond's conditions and requirements are set by the court. Compliance with these conditions is crucial to avoid potential penalties or invalidation of the bond during the appeal process. In conclusion, a Chattanooga Tennessee appeal bond is a vital tool for individuals and businesses involved in legal disputes, providing a safety net and ensuring fairness during the appeals process. Whether it is a stay of execution appeal bond, a cost bond, or a blanket bond combination, securing the appropriate bond is critical to protect the interests of all parties involved. Collaborating with a trusted surety bond provider is essential to navigate the complexities of obtaining an appeal bond effectively and efficiently.

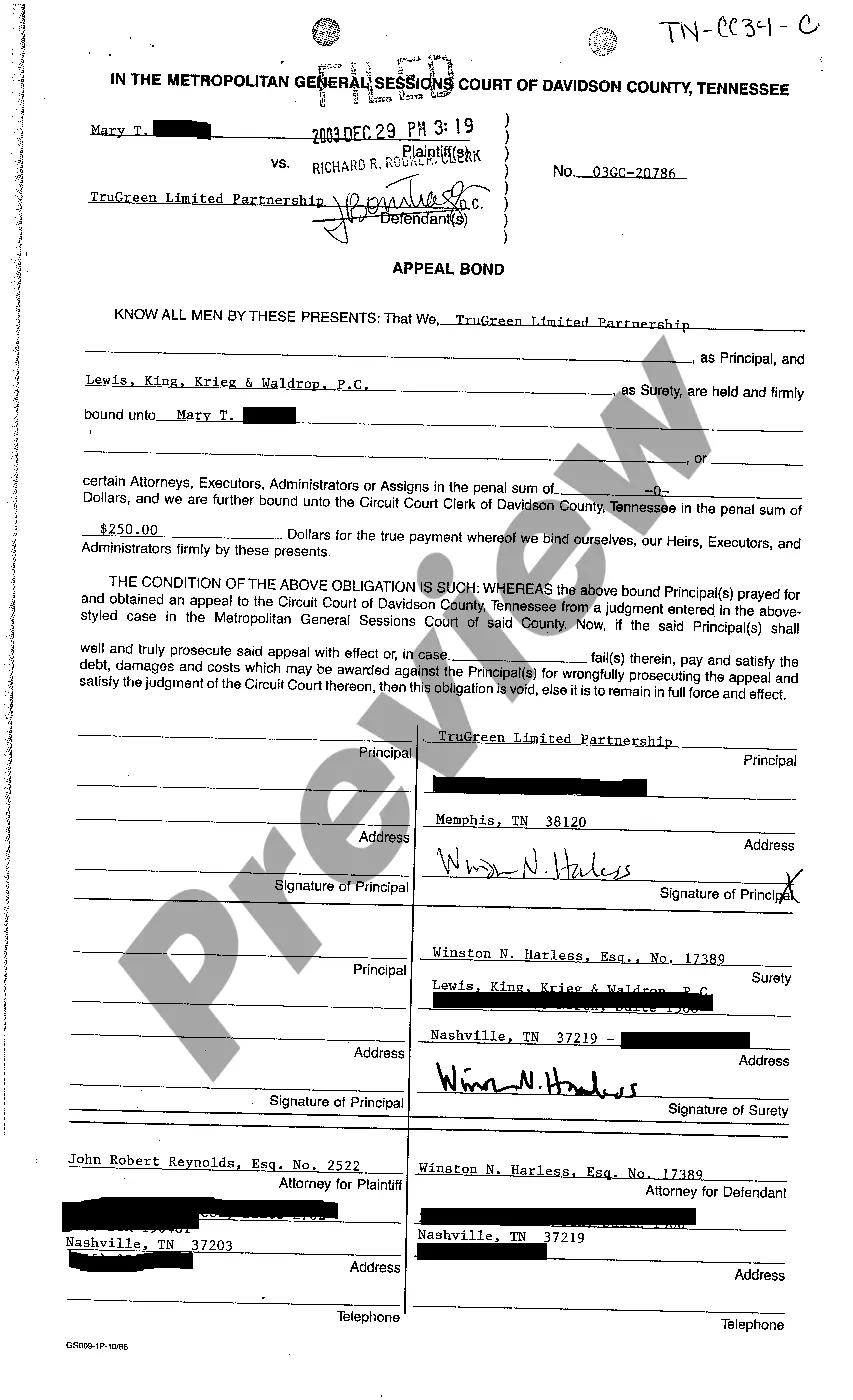

Chattanooga Tennessee Appeal Bond

State:

Tennessee

City:

Chattanooga

Control #:

TN-CC34-03

Format:

PDF

Instant download

This form is available by subscription

Description

A03 Appeal Bond

Chattanooga Tennessee Appeal Bond: Understanding the Importance of Obtaining this Legal Safeguard In the realm of legal procedures in Chattanooga, Tennessee, an appeal bond plays a crucial role in ensuring fairness and protecting the rights of both individuals and businesses involved in a legal dispute. An appeal bond, often referred to as a supersedes bond, serves as a financial guarantee that the party appealing the court's decision will fulfill their obligations if the appeal is unsuccessful. An appeal bond acts as a vital security measure to prevent the losing party from being unjustly harmed by a frivolous appeal. It helps to mitigate the risk of significant financial losses that could result from delaying payments or disregarding court orders during the appeal process. There are primarily three types of appeal bonds available in Chattanooga, Tennessee, catering to different situations and legal requirements: 1. Stay of Execution Appeals Bond: This type of appeal bond is commonly used when a judgment requires the appealing party to make payments to the winning party. It stays the execution of the judgment while the appeal is pending, protecting the appellant from immediate financial obligations. 2. Cost Bond: Also known as a cost appeal bond, it guarantees the payment of court costs and other expenses associated with the appeals process. This bond ensures that the appellant will cover expenses that may arise during the appeal, such as filing fees, transcription costs, and the costs of reproducing evidence. 3. Blanket Bond or Supersedes Bond: Fulfilling the requirements of both the stay of execution and cost bonds, this comprehensive bond covers both payment obligations and appeals process expenses. It combines the benefits of both bonds, providing a more extensive safeguard for the appellant. To obtain an appeal bond in Chattanooga, Tennessee, one must typically work with a reputable surety bond provider. Surety bond companies, authorized and licensed by the state, offer these bonds to guarantee the financial accountability of the appellant. The bond's cost is usually a percentage of the total judgment amount, determined based on several factors, such as the credit history and financial capabilities of the appellant. Appellants seeking an appeal bond in Chattanooga, Tennessee, should be aware that the bond's conditions and requirements are set by the court. Compliance with these conditions is crucial to avoid potential penalties or invalidation of the bond during the appeal process. In conclusion, a Chattanooga Tennessee appeal bond is a vital tool for individuals and businesses involved in legal disputes, providing a safety net and ensuring fairness during the appeals process. Whether it is a stay of execution appeal bond, a cost bond, or a blanket bond combination, securing the appropriate bond is critical to protect the interests of all parties involved. Collaborating with a trusted surety bond provider is essential to navigate the complexities of obtaining an appeal bond effectively and efficiently.

How to fill out Chattanooga Tennessee Appeal Bond?

If you’ve already used our service before, log in to your account and save the Chattanooga Tennessee Appeal Bond on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Make certain you’ve located an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Chattanooga Tennessee Appeal Bond. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!