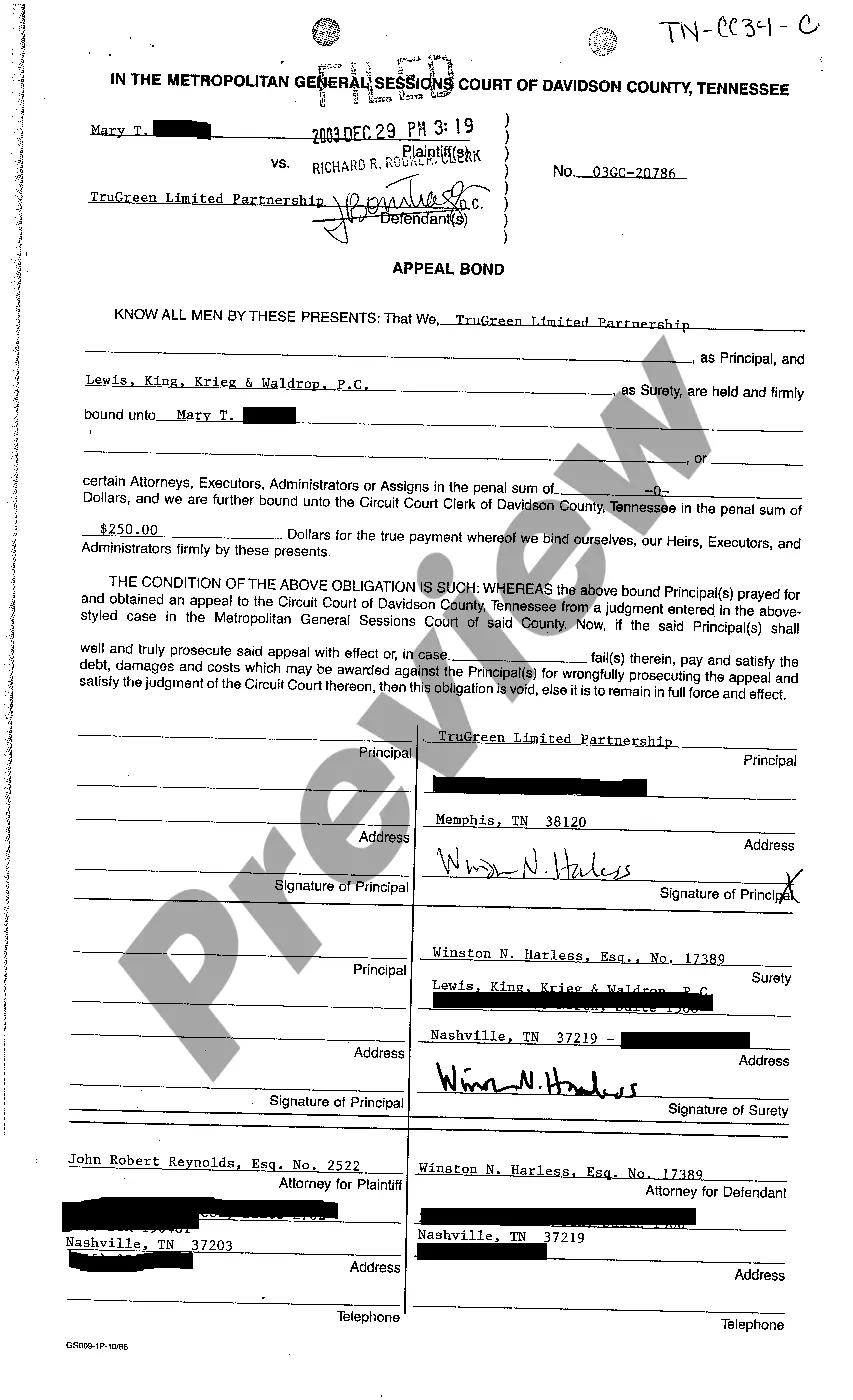

A Memphis Tennessee Appeal Bond is a type of surety bond that is required by the court when an individual or company wants to appeal a decision that was made in a lower court. It is a financial guarantee that ensures that the appellant will fulfill their obligations and the court will be compensated if the appeal is unsuccessful. There are different types of Memphis Tennessee Appeal Bonds, including supersedes bonds and release of lien bonds. A supersedes bond is the most common type, and it is used to stop the enforcement of a judgment while the appeal is pending. It allows the appellant to retain possession of their property or assets until a final decision is reached. A release of lien bond is specifically used in cases where a lien has been placed on property or assets and the appellant wants to have it released pending the outcome of the appeal. To obtain a Memphis Tennessee Appeal Bond, the appellant must work with a licensed surety bond provider. The provider will evaluate the applicant's financial standing and creditworthiness to determine the bond premium. The premium is usually a percentage of the total bond amount, which is determined by the court. The purpose of the Memphis Tennessee Appeal Bond is to safeguard the appealed's interests and provide a source of compensation in case the appeal is unsuccessful. It ensures that the appellant cannot delay payment or transfer assets during the appeal process. If the appellant fails to fulfill their obligations, the bond can be used to cover any financial losses incurred by the appealed. In summary, a Memphis Tennessee Appeal Bond is a necessary financial instrument required by the court when appealing a decision made in a lower court. It ensures compliance with the court ruling and provides financial protection to the appealed. The different types of Memphis Tennessee Appeal Bonds include supersedes bonds and release of lien bonds.

Memphis Tennessee Appeal Bond

Description

How to fill out Memphis Tennessee Appeal Bond?

Are you looking for a trustworthy and inexpensive legal forms supplier to buy the Memphis Tennessee Appeal Bond? US Legal Forms is your go-to option.

No matter if you need a basic agreement to set regulations for cohabitating with your partner or a set of documents to move your divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and framed based on the requirements of separate state and county.

To download the document, you need to log in account, locate the needed template, and click the Download button next to it. Please remember that you can download your previously purchased document templates anytime in the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Memphis Tennessee Appeal Bond conforms to the laws of your state and local area.

- Read the form’s description (if provided) to learn who and what the document is good for.

- Start the search over if the template isn’t suitable for your legal situation.

Now you can create your account. Then pick the subscription plan and proceed to payment. As soon as the payment is done, download the Memphis Tennessee Appeal Bond in any provided format. You can get back to the website when you need and redownload the document free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about wasting your valuable time researching legal paperwork online for good.