Murfreesboro, Tennessee Appeal Bond: A Comprehensive Overview Featuring Different Types Keywords: Murfreesboro Tennessee, appeal bond, types, purpose, process, cost, obligations, legal system, court, conditions, valid, defendant Introduction: An appeal bond is an essential financial instrument required in Murfreesboro, Tennessee, and other jurisdictions when an individual or entity wishes to appeal a court judgment. This detailed description will provide an overview of what Murfreesboro Tennessee Appeal Bonds are, their purpose, the process involved, and highlight different types that exist in the legal system. Definition and Purpose: The Murfreesboro Tennessee Appeal Bond serves as a form of insurance that guarantees the financial compensation of the opposing party if the appellant loses the appeal. This bond assures the court and the party that a judgment made in the initial case will be satisfied, even if the appeal is not successful. It aims to protect the opposing party's rights and prevent unnecessary delays in the legal system. Types of Murfreesboro Tennessee Appeal Bonds: 1. Supersedes Bond: This is the most common type of appeal bond used in Murfreesboro, Tennessee. It allows the appellant to delay paying the judgment amount during the appeal process. A supersedes bond ensures that if the appellant's appeal is unsuccessful, the opposing party will still be able to collect the original judgment, including any interest or additional costs. 2. Indemnity Bond: An indemnity bond, also known as a cost bond, is specifically used to guarantee the payment of court costs related to the appellant's appeal. It ensures that the appellant will cover all expenses related to the legal proceedings, such as filing fees, deposition costs, and other miscellaneous expenses if they are not prevail in the appeal. 3. Release of Lien Bond: In certain cases, if the judgment includes a lien on a property or asset, a release of lien bond may be required to remove or temporarily suspend the associated lien while the appeal is pending. This bond assures that if the appellant loses the appeal, the opposing party is still entitled to enforce the original judgment and any liens associated with it. Process and Obligations: To obtain a Murfreesboro Tennessee Appeal Bond, the appellant must typically approach a licensed surety bond company. The company will assess the appellant's financial credibility, credit history, and the underlying judgment before providing the bond. The appellant must then sign an agreement and pay a premium, which is a percentage of the bond amount. Once the bond is secured, it must be filed with the court handling the appeal. The bond ensures that the appellant complies with any conditions set forth by the court, such as filing deadlines, continuing obligations, and the payment of any costs or damages resulting from the appeal. Failure to fulfill these obligations may result in the forfeiture of the bond, allowing the opposing party to collect the judgment. Cost and Conditions: The cost of a Murfreesboro Tennessee Appeal Bond varies based on factors such as the bond amount required, the appellant's creditworthiness, and any additional risks involved. The premium for a standard appeal bond typically ranges from 1% to 10% of the bond amount. It is important to note that an appeal bond remains valid until the final resolution of the appeal, which may include multiple levels of review. The appellant must, therefore, maintain the bond's validity until the court process is exhausted entirely or until a settlement is reached. Conclusion: Murfreesboro Tennessee Appeal Bonds play a crucial role within the legal system as they provide assurance and financial security to the opposing party while an appeal is being pursued. By understanding the different types of appeal bonds, their purpose, and the obligations they entail, individuals and entities in Murfreesboro can navigate the appeal process smoothly and efficiently.

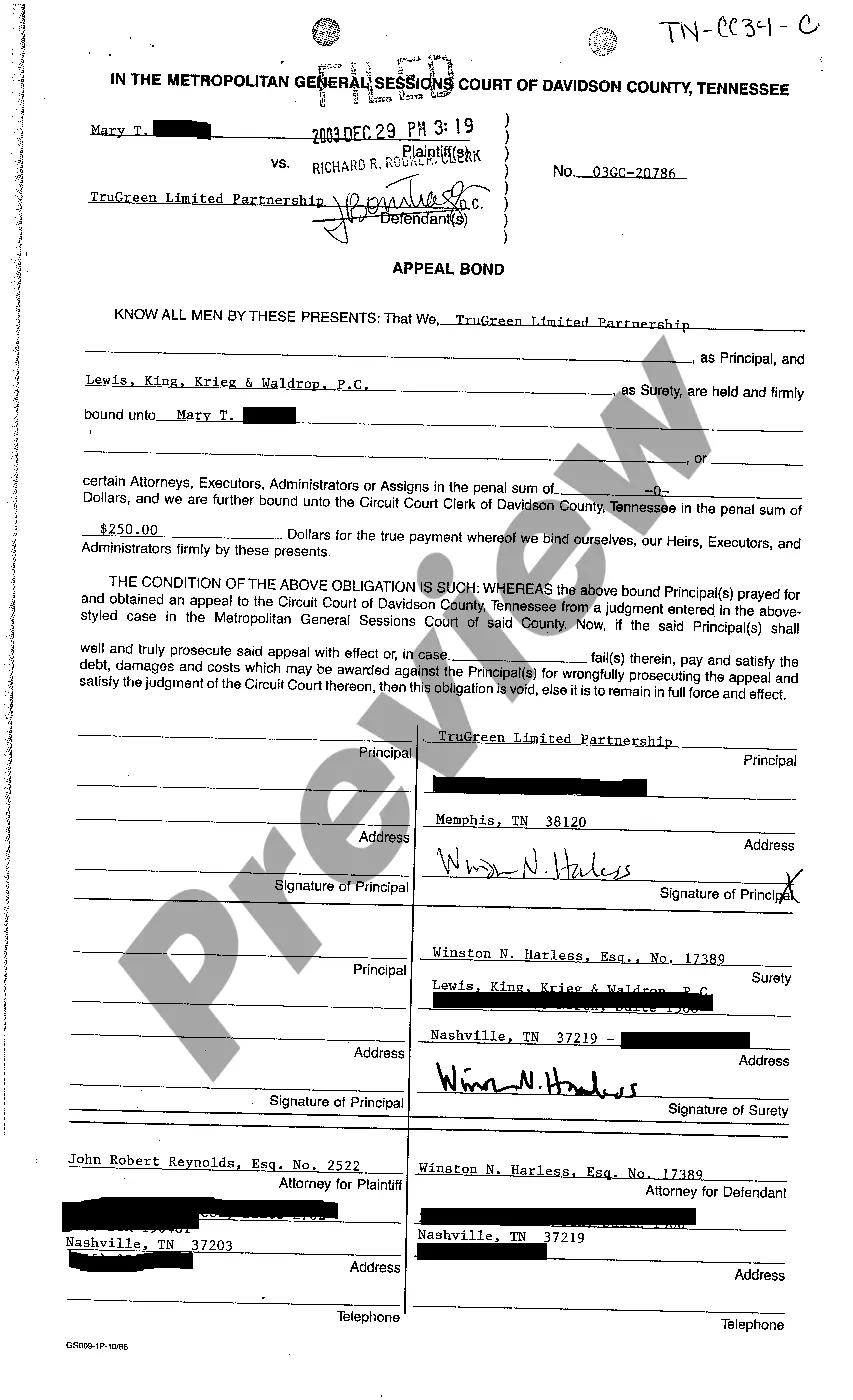

Murfreesboro Tennessee Appeal Bond

Description

How to fill out Murfreesboro Tennessee Appeal Bond?

Regardless of social or professional status, completing law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for a person without any law background to create such paperwork from scratch, mainly because of the convoluted jargon and legal subtleties they entail. This is where US Legal Forms can save the day. Our service offers a massive collection with more than 85,000 ready-to-use state-specific documents that work for practically any legal case. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time using our DYI forms.

Whether you require the Murfreesboro Tennessee Appeal Bond or any other document that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Murfreesboro Tennessee Appeal Bond in minutes using our trusted service. If you are already a subscriber, you can proceed to log in to your account to download the appropriate form.

Nevertheless, if you are unfamiliar with our platform, make sure to follow these steps before downloading the Murfreesboro Tennessee Appeal Bond:

- Be sure the form you have chosen is suitable for your area considering that the rules of one state or area do not work for another state or area.

- Review the form and go through a brief outline (if available) of scenarios the paper can be used for.

- In case the one you selected doesn’t meet your needs, you can start over and search for the suitable form.

- Click Buy now and choose the subscription plan you prefer the best.

- with your login information or register for one from scratch.

- Choose the payment method and proceed to download the Murfreesboro Tennessee Appeal Bond as soon as the payment is through.

You’re good to go! Now you can proceed to print the form or complete it online. In case you have any issues locating your purchased documents, you can easily find them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.