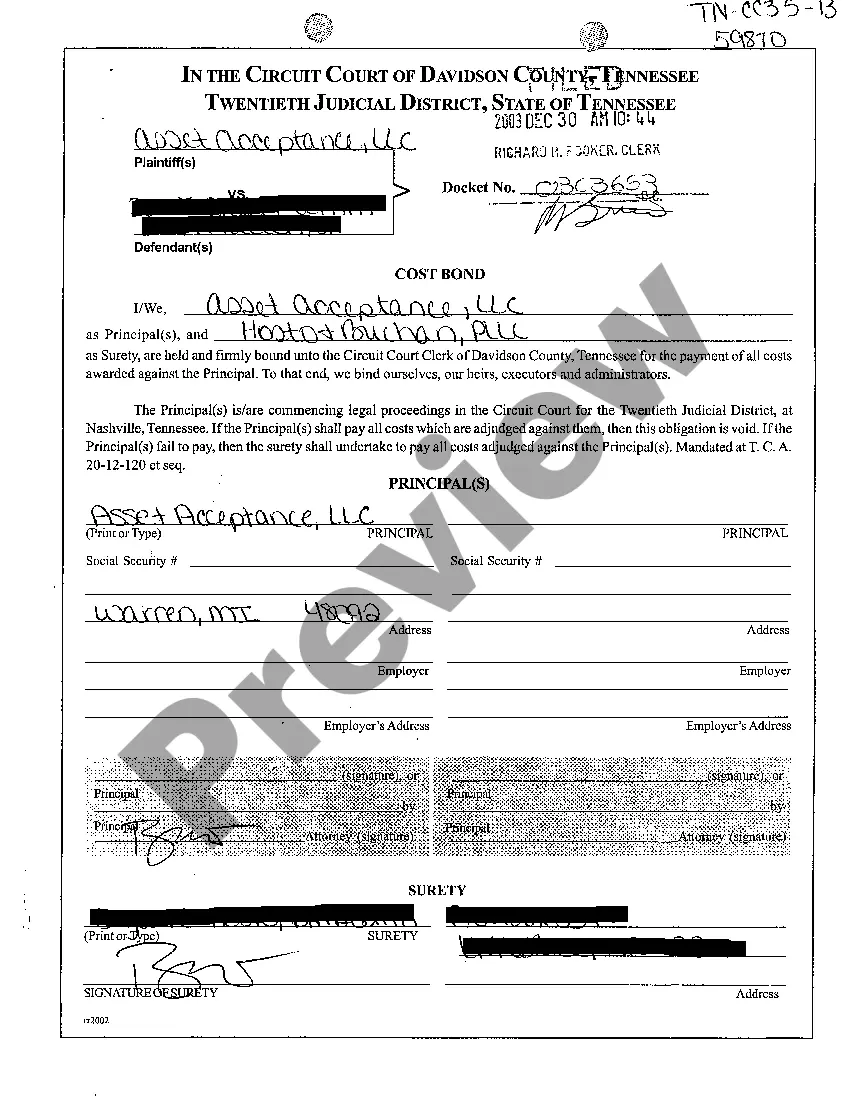

A Knoxville Tennessee Cost Bond is a specific type of surety bond that acts as a guarantee for the payment of costs awarded against the principle in legal proceedings. It is required by the court to ensure that the plaintiff or creditor will be adequately compensated for any costs incurred in the litigation process. The purpose of a Knoxville Tennessee Cost Bond is to protect the prevailing party from financial loss in case the losing party fails to pay the awarded costs. By posting a cost bond, the principal (usually the defendant) provides assurance that they will fulfill their financial obligations and cover any costs that may be ordered by the court. There are different types of Knoxville Tennessee Cost Bonds, each serving a specific purpose. These may include: 1. Appeal Cost Bond: This bond is required when the principal wishes to appeal a court decision. It ensures that if the appeal is unsuccessful, the prevailing party will be compensated for the costs incurred during the appellate process. 2. Supersedes Cost Bond: This type of bond is applicable when the principal seeks to delay the enforcement of a judgment pending appeal. By posting a supersedes cost bond, the principal can stay the execution of the judgment while the appeal is ongoing. It guarantees the payment of costs if the appeal is upheld. 3. Stay of Execution Bond: In cases where the principal intends to halt the execution of a judgment or order, a stay of execution bond may be required. This bond guarantees that the principal will fulfill their obligations and cover any awarded costs during the stay period. When obtaining a Knoxville Tennessee Cost Bond, it is crucial to work with a reputable surety bond provider. The bond amount will vary depending on the specific circumstances of the case and the court's requirements. It is essential to know the local laws and regulations governing the cost bond process to ensure compliance. In conclusion, a Knoxville Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principle is a necessary financial instrument used in legal proceedings. It guarantees the payment of costs awarded by the court and provides assurance to the plaintiff or creditor. By understanding the different types of cost bonds available, principals can navigate the legal process effectively while protecting their financial interests.

Knoxville Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal

State:

Tennessee

City:

Knoxville

Control #:

TN-CC35-02

Format:

PDF

Instant download

This form is available by subscription

Description

A02 Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal

A Knoxville Tennessee Cost Bond is a specific type of surety bond that acts as a guarantee for the payment of costs awarded against the principle in legal proceedings. It is required by the court to ensure that the plaintiff or creditor will be adequately compensated for any costs incurred in the litigation process. The purpose of a Knoxville Tennessee Cost Bond is to protect the prevailing party from financial loss in case the losing party fails to pay the awarded costs. By posting a cost bond, the principal (usually the defendant) provides assurance that they will fulfill their financial obligations and cover any costs that may be ordered by the court. There are different types of Knoxville Tennessee Cost Bonds, each serving a specific purpose. These may include: 1. Appeal Cost Bond: This bond is required when the principal wishes to appeal a court decision. It ensures that if the appeal is unsuccessful, the prevailing party will be compensated for the costs incurred during the appellate process. 2. Supersedes Cost Bond: This type of bond is applicable when the principal seeks to delay the enforcement of a judgment pending appeal. By posting a supersedes cost bond, the principal can stay the execution of the judgment while the appeal is ongoing. It guarantees the payment of costs if the appeal is upheld. 3. Stay of Execution Bond: In cases where the principal intends to halt the execution of a judgment or order, a stay of execution bond may be required. This bond guarantees that the principal will fulfill their obligations and cover any awarded costs during the stay period. When obtaining a Knoxville Tennessee Cost Bond, it is crucial to work with a reputable surety bond provider. The bond amount will vary depending on the specific circumstances of the case and the court's requirements. It is essential to know the local laws and regulations governing the cost bond process to ensure compliance. In conclusion, a Knoxville Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principle is a necessary financial instrument used in legal proceedings. It guarantees the payment of costs awarded by the court and provides assurance to the plaintiff or creditor. By understanding the different types of cost bonds available, principals can navigate the legal process effectively while protecting their financial interests.

How to fill out Knoxville Tennessee Cost Bond To Act As Surety For Payments Of Costs Awarded Against The Principal?

If you’ve already used our service before, log in to your account and download the Knoxville Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your file:

- Ensure you’ve found an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Knoxville Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!