A Chattanooga Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principle is a legal document that serves as a guarantee or assurance for the payment of costs that may be awarded against the principle. This bond ensures that the principal will fulfill their financial obligations in case they are held liable for costs associated with legal proceedings, such as court fees, attorney fees, and other expenses. The purpose of a Chattanooga Tennessee Cost Bond is to protect the opposing party or parties involved in a legal dispute from potential financial loss if the principal fails to pay the awarded costs. By obtaining this bond, the principal demonstrates their commitment to fulfilling their financial responsibilities, giving confidence to the opposing party that they will not suffer any financial burden due to the principal's actions. There are different types of Chattanooga Tennessee Cost Bonds to Act as Surety for Payments of Costs Awarded Against the Principle, including: 1. Plaintiff's Cost Bond: This type of bond is obtained by the plaintiff in a legal case to provide assurance that they will cover any costs that are awarded against them if they lose the case. It is designed to protect the defendant from incurring expenses unnecessarily. 2. Defendant's Cost Bond: Conversely, the defendant can obtain a Defendant's Cost Bond to act as surety for payment of costs awarded against them. This bond ensures that the defendant will be accountable for any costs if they lose the case. It provides protection to the plaintiff so that they can confidently pursue their claims knowing that their costs will be covered in case of winning the case. 3. Appeal Cost Bond: In situations where the principal wants to appeal a judgment or decision made in a lower court, they may need to provide an Appeal Cost Bond. This bond ensures that if the appeal is unsuccessful, the principal will pay any costs awarded against them by the higher court. Regardless of the type of Chattanooga Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principle, it is essential for the bond to be obtained from a reputable surety or insurance company. These bonds are legal documents that are typically required by the court before a case proceeds, and failure to obtain the bond can result in delays or even dismissal of the case. It is advised to consult with a legal professional to determine the specific type and requirements for obtaining the appropriate cost bond in Chattanooga, Tennessee.

Chattanooga Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal

Description

How to fill out Chattanooga Tennessee Cost Bond To Act As Surety For Payments Of Costs Awarded Against The Principal?

Acquiring validated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms collection.

It’s a web-based repository of over 85,000 legal documents for both personal and professional requirements as well as various real-world scenarios.

All the files are correctly organized by field of application and jurisdictional areas, so finding the Chattanooga Tennessee Cost Bond to Serve as Surety for Payments of Costs Awarded Against the Principal becomes as straightforward as 1-2-3.

Maintaining documentation organized and compliant with legal standards holds great significance. Utilize the US Legal Forms collection to always have vital document templates for any situation readily available!

- Ensure to check the Preview mode and document description.

- Confirm that you’ve chosen the correct one that fulfills your requirements and aligns with your local jurisdiction standards.

- Look for an alternative template, if necessary.

- If you notice any discrepancies, use the Search tab above to find the appropriate one.

- If it meets your criteria, proceed to the following step.

Form popularity

FAQ

Tennessee Supersedeas Bond (Appeal Bond ~ Tennessee) A judicial bond is a type of financial assurance filed with the court that guarantees that should the appellant NOT prevail that he or she will comply with the original judgment and with any other orders issued by the court pertaining to the same.

You only have 60 days to appeal after you find out that there is a problem. You can ask someone to help you file an appeal. Usually, your appeal is decided within 90 days after you file it.

An appeal bond, sometimes called a supersedeas bond, is required when a defendant wants to appeal an adverse judgment or order. The bond guarantees that if the defendant (principal) loses the appeal, the amount of the judgment and, in some cases, accrued interest, expenses and legal fees, will be paid.

- The appeal to the Court of Appeals in cases decided by the Regional Trial Court in the exercise of its original jurisdiction shall be taken by filing a notice of appeal with the court which rendered the judgment or final order appealed from and serving a copy thereof upon the adverse party.

To get a Tennessee surety bond, people generally go to a surety bonding company. You are able to get a surety bond through a general insurance company, but choosing a surety bond company often means you can get better quotes.

An appeal is the legal process to ask a higher court to review a decision by a judge in a lower court (trial court) because you believe the judge made a mistake. A litigant who files an appeal is called an appellant. A litigant against whom the appeal is filed is called an appellee.

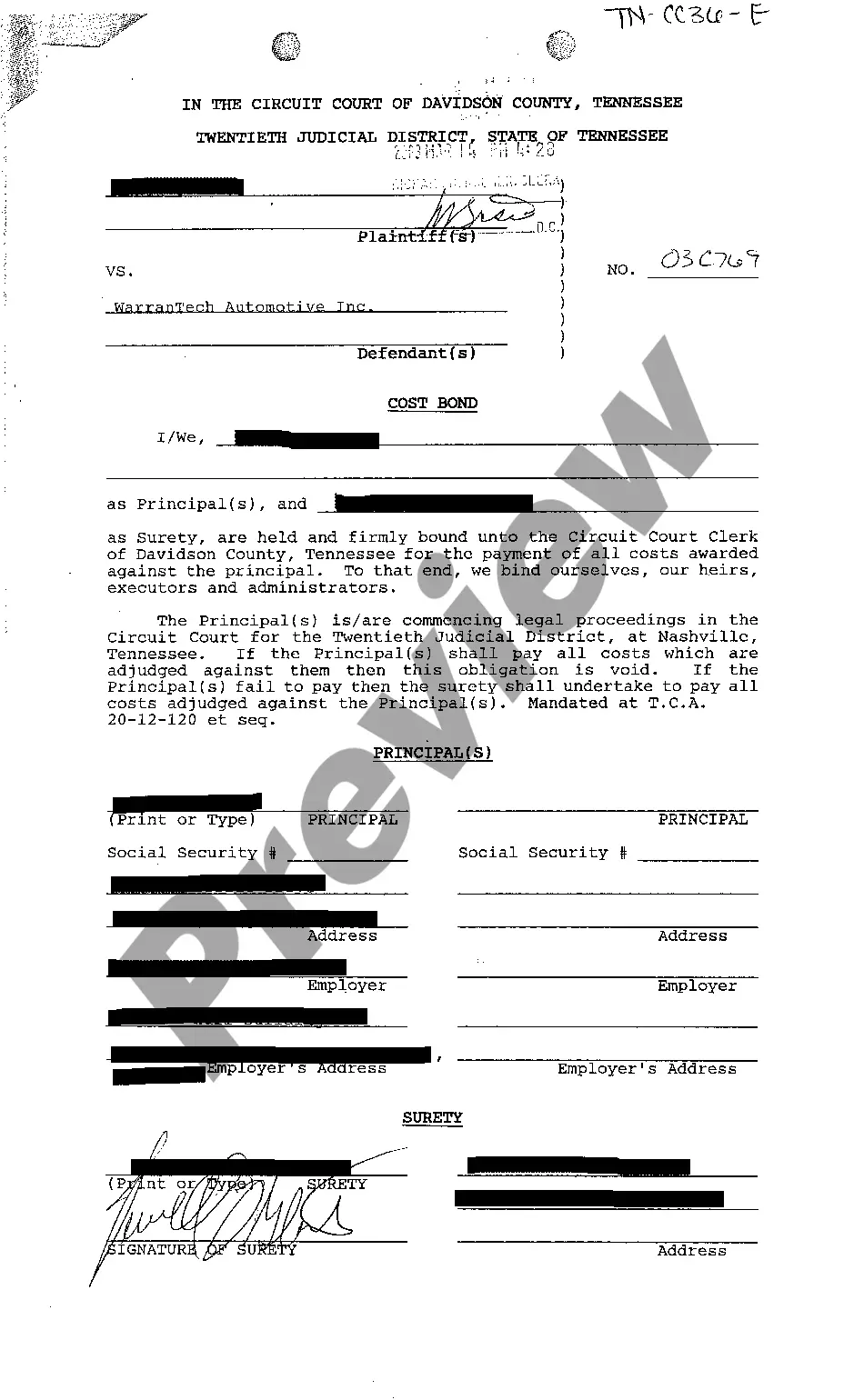

COST BOND. as Surety, are held and firmly bound unto the Circuit Court Clerk of Davidson County, Tennessee, for the payment of all costs awarded against the Principal(s). To that end, we bind ourselves, our heirs, executors, and administrators.

A cost bond is a kind of surety bond that guarantees payment of court expenses. Generally speaking, surety bonds form a legally binding contract, involving three parties: the principal, the obligee, and the surety. The party requesting the bond is the obligee. The party obligated to buy the bond is the principal.