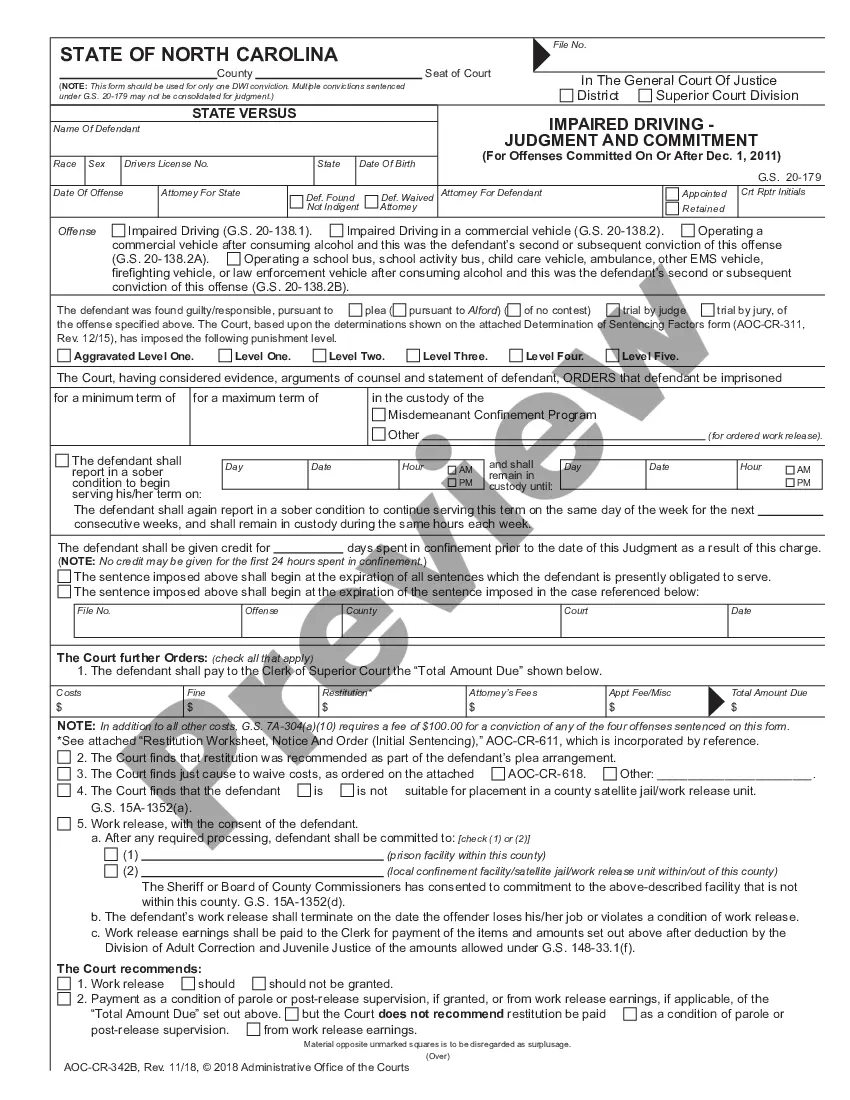

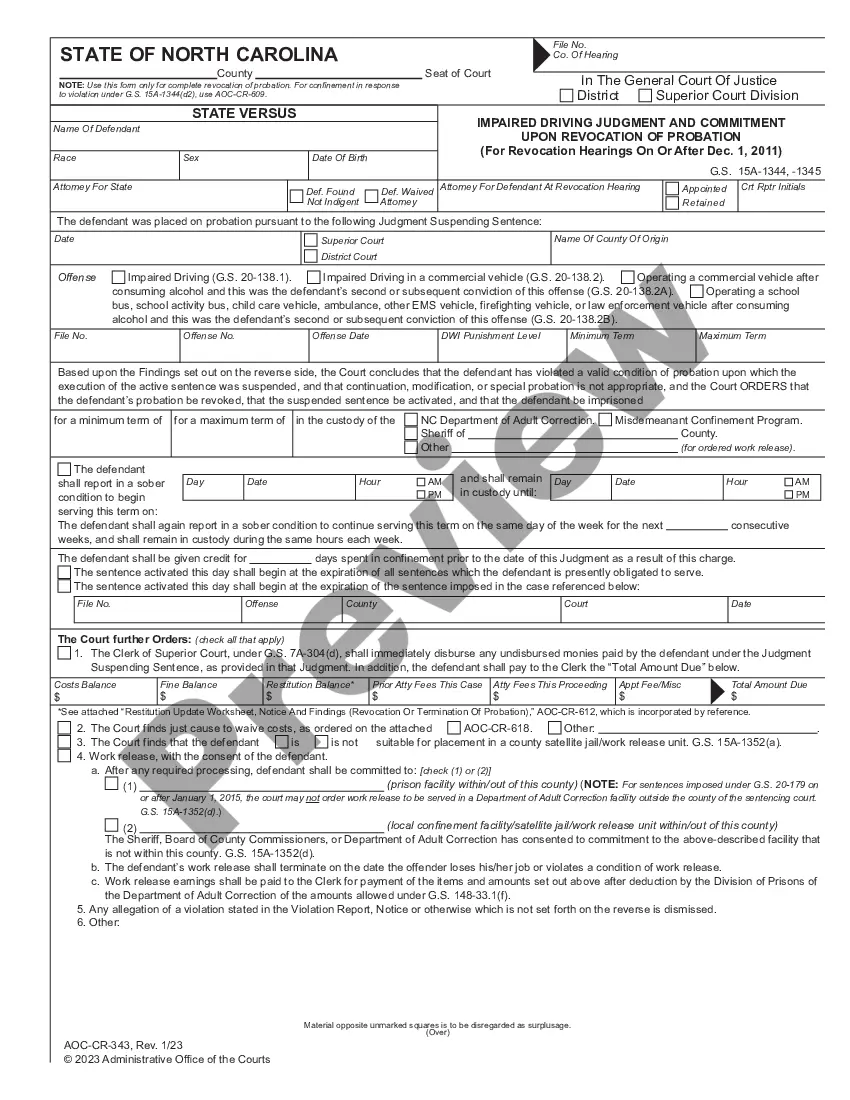

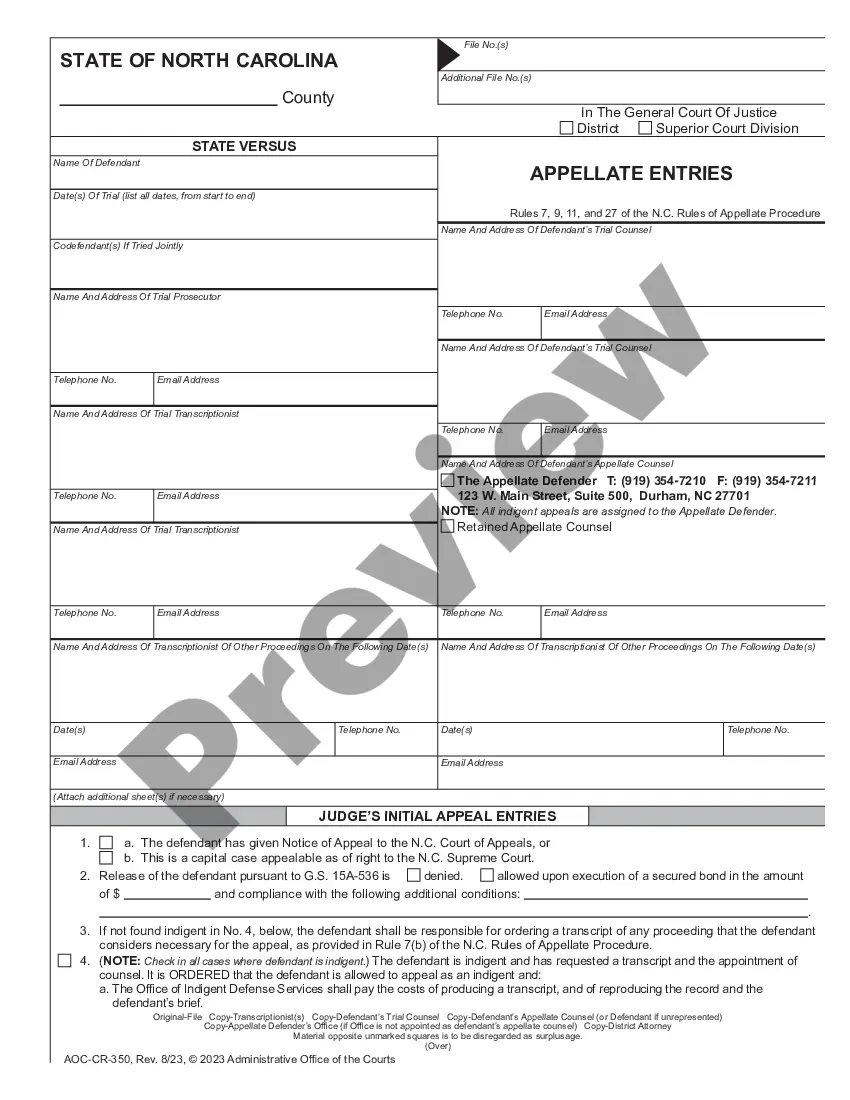

The Memphis Tennessee Agreement to Sell Payments — part 2 is a legal document that outlines the terms and conditions for selling payments in the state of Tennessee, specifically in the city of Memphis. This agreement is used when an individual or entity wishes to sell their future periodic payments in exchange for a lump sum of cash. The agreement includes several key components to ensure a fair and proper transaction. It starts by identifying the parties involved, including the seller and the buyer. It also includes their contact information, such as names, addresses, and phone numbers, to facilitate communication throughout the process. The agreement specifies the terms of the sale, including the nature of the payments being sold. There may be different types of Memphis Tennessee Agreement to Sell Payments — part 2, such as structured settlement payments, lottery winnings, annuities, or any other contractual agreements that involve periodic payments. It is important to clearly mention the type of payments being sold in the document. The agreement outlines the payment schedule of the future installments being sold, including the amount and frequency of each payment. It also states the total lump sum amount agreed upon by the parties. The seller agrees to transfer their rights to the future payments to the buyer in exchange for the agreed lump sum. This ensures that the seller receives immediate financial liquidity instead of waiting for the future payment installments. Furthermore, the agreement includes provisions regarding the disclosure and transfer process. The seller is required to provide all necessary documentation and information related to the payments being sold. This may include copies of contracts, payout schedules, and any legal or financial paperwork related to the payments. The agreement also covers important legal aspects, such as representations and warranties made by the parties. Both the seller and the buyer declare that they have the authority to enter into the agreement and that all information provided is accurate and complete to their knowledge. Additionally, the agreement may address other specific terms and conditions, such as applicable laws, dispute resolution mechanisms, and confidentiality clauses. These clauses provide further protection for both parties during the transaction. In summary, the Memphis Tennessee Agreement to Sell Payments — part 2 is a legal document that facilitates the sale of future periodic payments in exchange for a lump sum amount. It outlines the terms and conditions of the sale, including the type of payments being sold, payment schedule, and necessary documentation requirements. Different types of agreements may arise based on the specific nature of the periodic payments involved.

Memphis Tennessee Agreement to Sell Payments - part 2

Description

How to fill out Memphis Tennessee Agreement To Sell Payments - Part 2?

Benefit from the US Legal Forms and get immediate access to any form you require. Our useful platform with a huge number of documents allows you to find and get almost any document sample you will need. It is possible to export, complete, and certify the Memphis Tennessee Agreement to Sell Payments - part 2 in just a matter of minutes instead of surfing the Net for hours looking for the right template.

Using our library is an excellent way to raise the safety of your form submissions. Our professional lawyers regularly check all the documents to make sure that the templates are relevant for a particular state and compliant with new acts and polices.

How can you get the Memphis Tennessee Agreement to Sell Payments - part 2? If you have a profile, just log in to the account. The Download option will be enabled on all the samples you look at. In addition, you can get all the earlier saved files in the My Forms menu.

If you haven’t registered an account yet, stick to the instruction below:

- Open the page with the form you require. Ensure that it is the form you were hoping to find: examine its title and description, and use the Preview function if it is available. Otherwise, utilize the Search field to look for the needed one.

- Launch the saving process. Click Buy Now and select the pricing plan you prefer. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Export the file. Choose the format to obtain the Memphis Tennessee Agreement to Sell Payments - part 2 and edit and complete, or sign it according to your requirements.

US Legal Forms is one of the most significant and reliable form libraries on the internet. Our company is always ready to help you in virtually any legal process, even if it is just downloading the Memphis Tennessee Agreement to Sell Payments - part 2.

Feel free to make the most of our form catalog and make your document experience as convenient as possible!