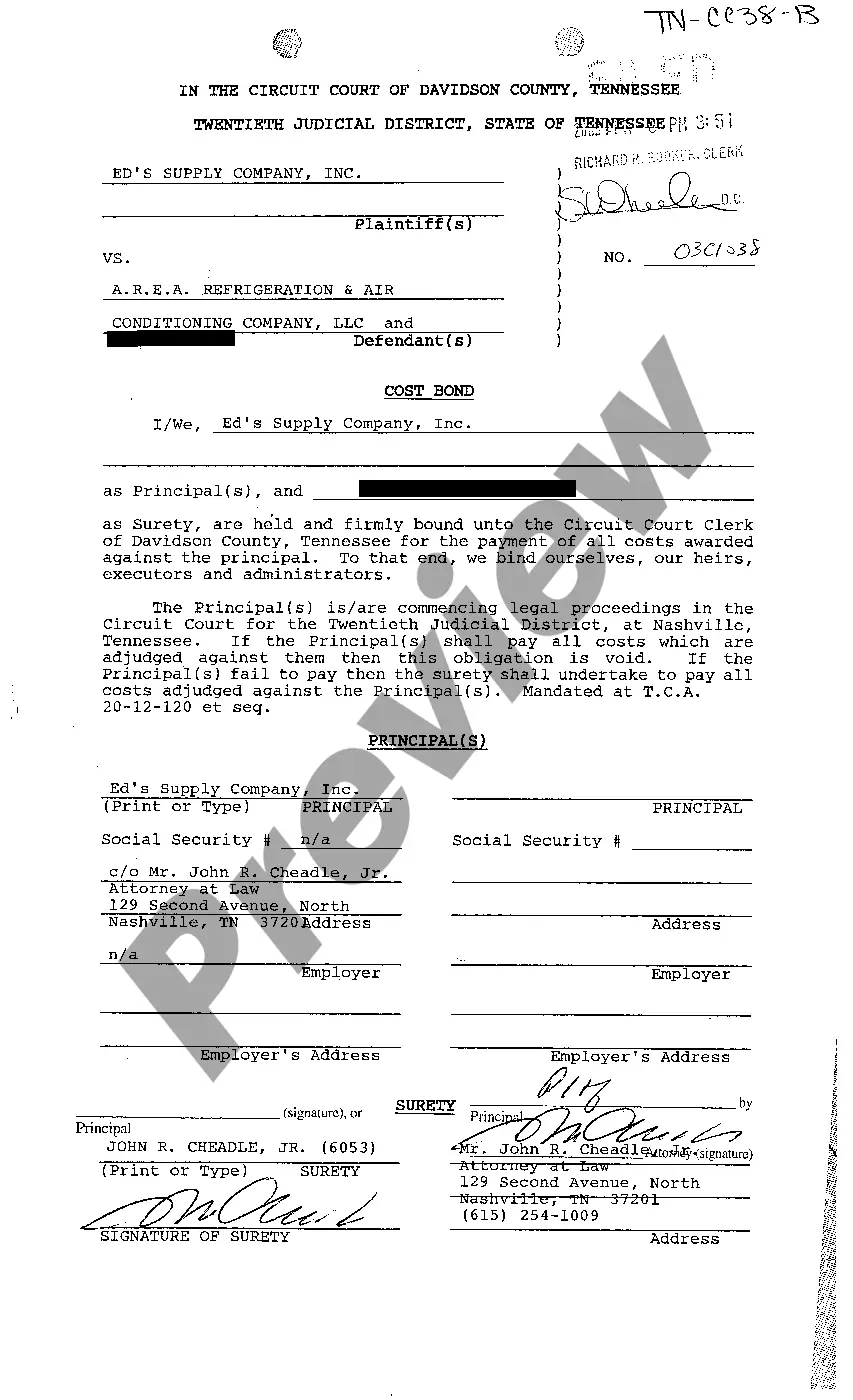

A Memphis Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principle is a type of bond that serves as a financial guarantee for the payment of costs that may be awarded against the principle in a legal proceeding. This bond acts as insurance for the court or opposing party, ensuring that if the principal is unable to pay the costs, the surety company will step in and fulfill the financial obligation. The purpose of this bond is to provide protection and assurance to the court or opposing party that the principal will be able to cover any costs that may arise during the legal process. These costs can include court fees, attorney fees, witness fees, and other expenses associated with the case. There may be various types of Memphis Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principle, including: 1. Cost Bond — This is the general type of bond that covers all costs awarded against the principle. It ensures that the principal will have the financial means to satisfy any expenses that may be incurred throughout the legal process. 2. Appeal Bond — In certain cases, the principal may choose to appeal a court decision. An appeal bond specifically covers the costs that may be awarded during the appellate process. It guarantees that the principal will have the funds necessary to proceed with the appeal and cover any potential costs. 3. Release of Lien Bond — If a court places a lien on the principal's property, a release of lien bond can be obtained to remove the lien. This bond acts as a guarantee that the principal will cover the costs associated with the lien, enabling the property to be released from any financial burden. In order to obtain a Memphis Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principle, the principal will need to work with a surety company or bond provider. They will evaluate the principal's financial standing, creditworthiness, and any other relevant factors to determine the bond amount and premium. Once the bond is issued, the principal is responsible for paying the premium to the surety company. If the principal fails to pay the costs awarded against them, the surety company will step in and fulfill the financial obligation. The principal will then be required to reimburse the surety company for any amounts paid on their behalf. In summary, a Memphis Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principle provides financial assurance for the payment of costs in a legal proceeding. Different types of bonds may be available, including cost bonds, appeal bonds, and release of lien bonds, each serving a specific purpose.

Memphis Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal

Description

How to fill out Memphis Tennessee Cost Bond To Act As Surety For Payments Of Costs Awarded Against The Principal?

Utilize the US Legal Forms and gain immediate entry to any document you desire.

Our valuable website featuring thousands of templates enables you to locate and acquire nearly any document sample you need.

You can download, complete, and sign the Memphis Tennessee Cost Bond to Serve as Surety for Payments of Costs Awarded Against the Principal in just a few minutes instead of spending hours online searching for the correct template.

Utilizing our catalog is an excellent approach to enhance the security of your document filing.

If you do not yet have an account, follow the steps below.

Access the webpage with the template you need. Ensure that it is the document you intended to find: verify its title and description, and utilize the Preview feature if available. If not, use the Search bar to locate the correct one.

- Our skilled attorneys routinely review all documents to ensure that the templates are suitable for a specific state and adhere to new laws and regulations.

- How can you acquire the Memphis Tennessee Cost Bond to Serve as Surety for Payments of Costs Awarded Against the Principal.

- If you already possess a subscription, simply Log In to your account.

- The Download feature will be activated on all the documents you view.

- Additionally, you can access all previously saved documents in the My documents section.