Title: Knoxville Tennessee Order to Withhold Income for Child Support: Understanding the Process and Types of Withholding Orders Introduction: In Knoxville, Tennessee, the Order to Withhold Income for Child Support is a legal mechanism designed to ensure that child support payments are made efficiently and consistently. This article aims to provide a detailed overview of what this order entails, its purpose, and the different types of withholding orders available in Knoxville, Tennessee. 1. Definition and Purpose of the Order to Withhold Income for Child Support: The Order to Withhold Income for Child Support is a court-issued document that requires an employer to deduct a specific amount from an employee's wages to fulfill their child support obligations. This order is designed to ensure regular, timely, and predictable child support payments, minimizing non-compliance and ultimately benefiting the child's well-being. 2. Importance of Order to Withhold Income for Child Support: The implementation of an Order to Withhold Income for Child Support offers numerous advantages, including: — Ensures consistent and reliable child support payments. — Reduces the risk of non-payment or late payments. — Simplifies the payment process for both the paying parent and the family court system. — Provides transparency in tracking payments, ensuring accountability and accurate record-keeping. 3. Types of Order to Withhold Income for Child Support in Knoxville, Tennessee: Knoxville offers various types of withholding orders, depending on specific circumstances and needs. Some common types include: a. Income Withholding for Support (TWO): This is the most common form of withholding order, requiring an employer to deduct a specific amount of income from the employee's paycheck and remit it to the appropriate child support agency. Twos can be issued for both current child support obligations and arbitrages (past-due payments). b. Medical Support Withholding Order: In cases where the noncustodial parent also holds medical insurance coverage for the child, this order allows for the withholding of additional funds from their income to contribute to the child's medical expenses and insurance premiums. c. Lump-Sum Payment Order: When a paying parent receives a significant lump-sum payment, such as an inheritance or lottery winnings, this order allows the child support agency to intercept a portion or the entirety of the sum owed for child support before it is received by the paying parent. d. Voluntary Wage Assignment: This is an agreement between the custodial and noncustodial parent, facilitated by the child support agency. It allows for a voluntary deduction from the paying parent's wages, similar to an TWO, but without a court order requirement. Conclusion: The Knoxville Tennessee Order to Withhold Income for Child Support provides a crucial tool for ensuring consistent and timely child support payments. By employing various types of withholding orders, Knoxville's family court system strives to create an efficient and reliable mechanism for supporting children's well-being through a fair collection process. Understanding the different types of withholding orders helps to navigate the child support system effectively, ensuring the best interests of the child are always prioritized.

Knoxville Tennessee Order to Withhold Income for Child Support

State:

Tennessee

City:

Knoxville

Control #:

TN-CC44-01

Format:

PDF

Instant download

This form is available by subscription

Description

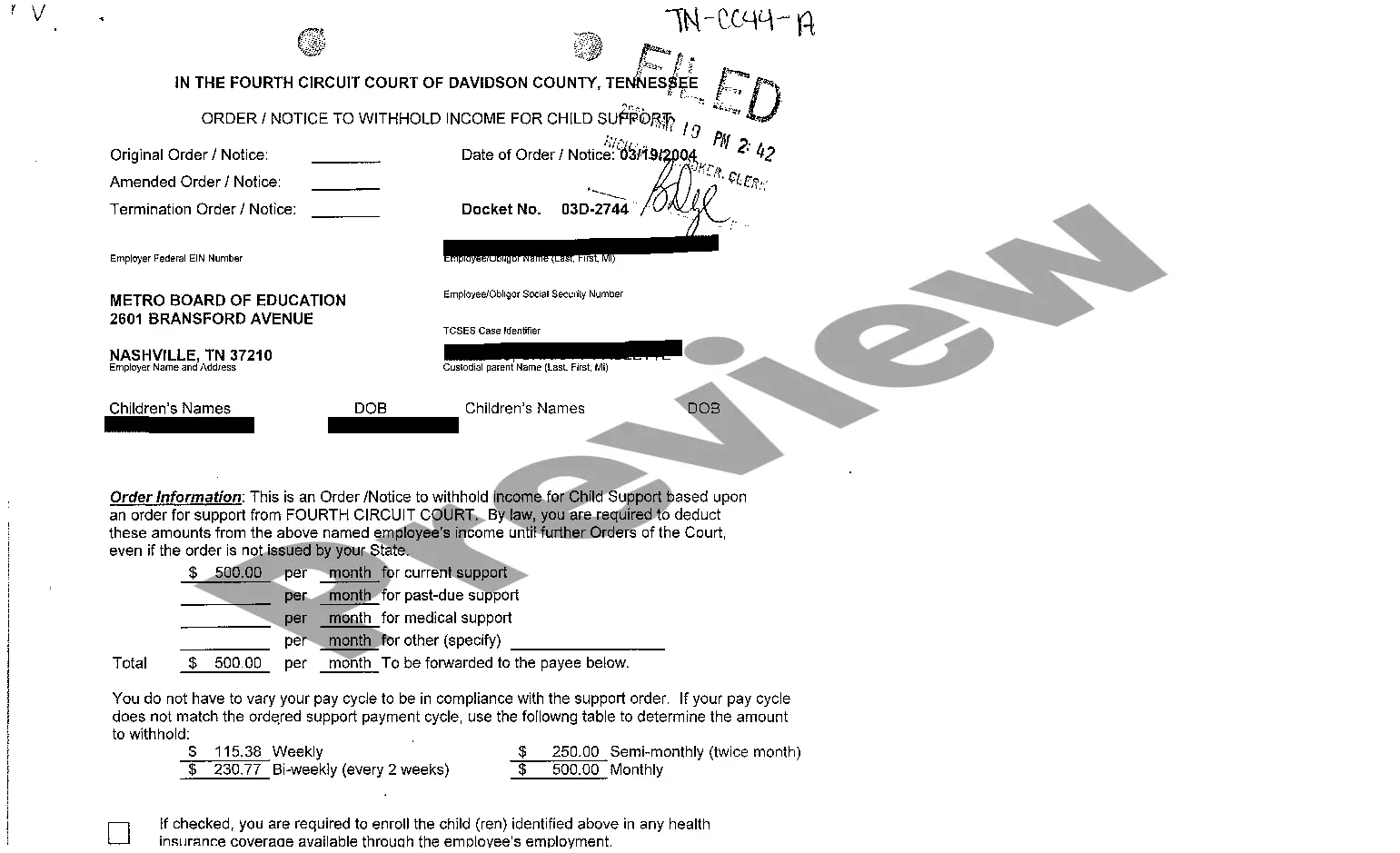

A10 Order to Withhold Income for Child Support

Title: Knoxville Tennessee Order to Withhold Income for Child Support: Understanding the Process and Types of Withholding Orders Introduction: In Knoxville, Tennessee, the Order to Withhold Income for Child Support is a legal mechanism designed to ensure that child support payments are made efficiently and consistently. This article aims to provide a detailed overview of what this order entails, its purpose, and the different types of withholding orders available in Knoxville, Tennessee. 1. Definition and Purpose of the Order to Withhold Income for Child Support: The Order to Withhold Income for Child Support is a court-issued document that requires an employer to deduct a specific amount from an employee's wages to fulfill their child support obligations. This order is designed to ensure regular, timely, and predictable child support payments, minimizing non-compliance and ultimately benefiting the child's well-being. 2. Importance of Order to Withhold Income for Child Support: The implementation of an Order to Withhold Income for Child Support offers numerous advantages, including: — Ensures consistent and reliable child support payments. — Reduces the risk of non-payment or late payments. — Simplifies the payment process for both the paying parent and the family court system. — Provides transparency in tracking payments, ensuring accountability and accurate record-keeping. 3. Types of Order to Withhold Income for Child Support in Knoxville, Tennessee: Knoxville offers various types of withholding orders, depending on specific circumstances and needs. Some common types include: a. Income Withholding for Support (TWO): This is the most common form of withholding order, requiring an employer to deduct a specific amount of income from the employee's paycheck and remit it to the appropriate child support agency. Twos can be issued for both current child support obligations and arbitrages (past-due payments). b. Medical Support Withholding Order: In cases where the noncustodial parent also holds medical insurance coverage for the child, this order allows for the withholding of additional funds from their income to contribute to the child's medical expenses and insurance premiums. c. Lump-Sum Payment Order: When a paying parent receives a significant lump-sum payment, such as an inheritance or lottery winnings, this order allows the child support agency to intercept a portion or the entirety of the sum owed for child support before it is received by the paying parent. d. Voluntary Wage Assignment: This is an agreement between the custodial and noncustodial parent, facilitated by the child support agency. It allows for a voluntary deduction from the paying parent's wages, similar to an TWO, but without a court order requirement. Conclusion: The Knoxville Tennessee Order to Withhold Income for Child Support provides a crucial tool for ensuring consistent and timely child support payments. By employing various types of withholding orders, Knoxville's family court system strives to create an efficient and reliable mechanism for supporting children's well-being through a fair collection process. Understanding the different types of withholding orders helps to navigate the child support system effectively, ensuring the best interests of the child are always prioritized.

Free preview

How to fill out Knoxville Tennessee Order To Withhold Income For Child Support?

If you’ve already used our service before, log in to your account and download the Knoxville Tennessee Order to Withhold Income for Child Support on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Make certain you’ve located the right document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Knoxville Tennessee Order to Withhold Income for Child Support. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!