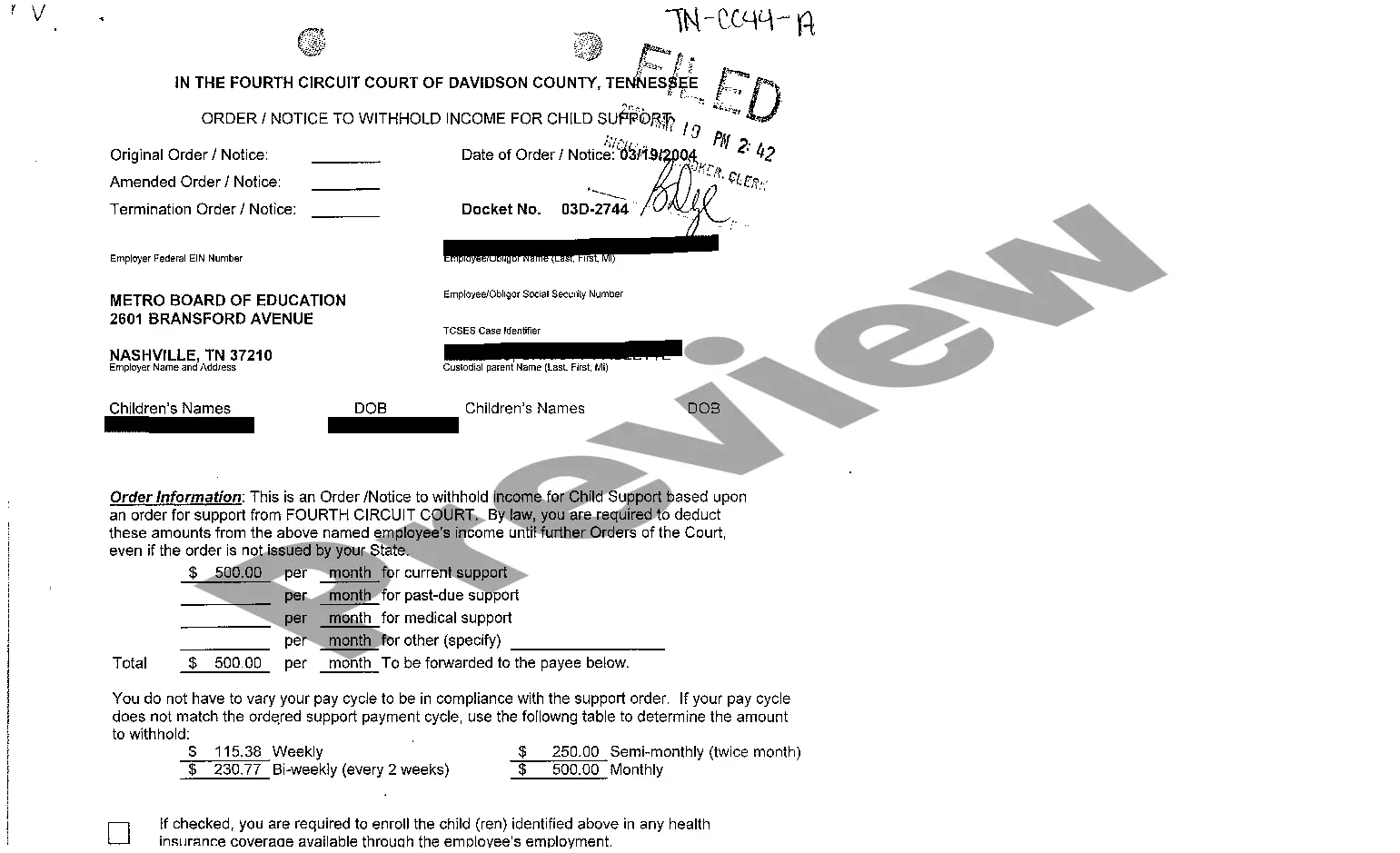

A Nashville Tennessee Order to Withhold Income for Child Support is a legal document issued by the court that establishes the payment of child support through an automatic withholding mechanism. This order ensures that child support payments are deducted directly from the parent's income source, such as wages or salaries, before they receive their paycheck. The main purpose of a Nashville Tennessee Order to Withhold Income for Child Support is to ensure consistent and timely child support payments, therefore assisting custodial parents in meeting the financial needs of their children. By implementing this order, the court aims to provide stability and financial security for the child, minimizing the risk of missed or late payments. There are different types of Nashville Tennessee Orders withholding Income for Child Support that cater to varying circumstances. These may include: 1. Wage Withholding Order: This is the most common type of order where child support payments are deducted directly from the non-custodial parent's wages or salary. It involves notifying the employer of the non-custodial parent to withhold a certain amount from their income and remit it to the appropriate child support agency. 2. Bank Account Levy Order: In cases where wage withholding is not applicable or insufficient, the court may issue an order to freeze and allocate funds directly from the non-custodial parent's bank account for child support purposes. This ensures that payments are made regardless of the employment situation of the non-custodial parent. 3. Income Withholding for Self-Employed Order: When the non-custodial parent is self-employed or has irregular income, this order requires them to make fixed monthly child support payments directly to the child support agency. This helps maintain consistency in payment despite fluctuations in income. 4. Lottery Intercept Order: If the non-custodial parent owed a significant amount in arrears, the court may authorize a lottery intercept order. This allows the child support agency to collect past-due child support payments from any lottery winnings the non-custodial parent may acquire. 5. Federal Income Tax Refund Offset: In some cases, the court may enable the child support agency to intercept the non-custodial parent's federal income tax refunds to cover overdue child support payments. This ensures that children receive the financial support owed to them even if the non-custodial parent is not making regular payments. Nashville Tennessee Orders withholding Income for Child Support serve as a crucial mechanism in ensuring that children receive the financial support they require. By using these orders, the court aims to enforce regular and consistent child support payments, providing stability and security for the custodial parent and child.

Nashville Tennessee Order to Withhold Income for Child Support

State:

Tennessee

City:

Nashville

Control #:

TN-CC44-01

Format:

PDF

Instant download

This form is available by subscription

Description

A10 Order to Withhold Income for Child Support

A Nashville Tennessee Order to Withhold Income for Child Support is a legal document issued by the court that establishes the payment of child support through an automatic withholding mechanism. This order ensures that child support payments are deducted directly from the parent's income source, such as wages or salaries, before they receive their paycheck. The main purpose of a Nashville Tennessee Order to Withhold Income for Child Support is to ensure consistent and timely child support payments, therefore assisting custodial parents in meeting the financial needs of their children. By implementing this order, the court aims to provide stability and financial security for the child, minimizing the risk of missed or late payments. There are different types of Nashville Tennessee Orders withholding Income for Child Support that cater to varying circumstances. These may include: 1. Wage Withholding Order: This is the most common type of order where child support payments are deducted directly from the non-custodial parent's wages or salary. It involves notifying the employer of the non-custodial parent to withhold a certain amount from their income and remit it to the appropriate child support agency. 2. Bank Account Levy Order: In cases where wage withholding is not applicable or insufficient, the court may issue an order to freeze and allocate funds directly from the non-custodial parent's bank account for child support purposes. This ensures that payments are made regardless of the employment situation of the non-custodial parent. 3. Income Withholding for Self-Employed Order: When the non-custodial parent is self-employed or has irregular income, this order requires them to make fixed monthly child support payments directly to the child support agency. This helps maintain consistency in payment despite fluctuations in income. 4. Lottery Intercept Order: If the non-custodial parent owed a significant amount in arrears, the court may authorize a lottery intercept order. This allows the child support agency to collect past-due child support payments from any lottery winnings the non-custodial parent may acquire. 5. Federal Income Tax Refund Offset: In some cases, the court may enable the child support agency to intercept the non-custodial parent's federal income tax refunds to cover overdue child support payments. This ensures that children receive the financial support owed to them even if the non-custodial parent is not making regular payments. Nashville Tennessee Orders withholding Income for Child Support serve as a crucial mechanism in ensuring that children receive the financial support they require. By using these orders, the court aims to enforce regular and consistent child support payments, providing stability and security for the custodial parent and child.

Free preview

How to fill out Nashville Tennessee Order To Withhold Income For Child Support?

If you’ve already utilized our service before, log in to your account and download the Nashville Tennessee Order to Withhold Income for Child Support on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Make sure you’ve located a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Nashville Tennessee Order to Withhold Income for Child Support. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!