A Nashville Tennessee Order to Withhold Income for Child Support is a legal document issued by the courts to enforce child support payments. It is an essential tool that ensures timely and consistent financial support for the well-being and upbringing of a child. The order authorizes the withholding of a parent's income, directly from their paycheck, to meet their child support obligations. Child support is a crucial responsibility that both parents are expected to fulfill. However, in cases where a non-custodial parent fails to meet their obligations, the custodial parent can seek assistance from the court system. The Nashville Tennessee Order to Withhold Income for Child Support becomes an effective means to enforce payments and ensure the financial stability of the child. Key features of the Nashville Tennessee Order to Withhold Income for Child Support include: 1. Statutory Authority: The order is legally binding and derives its power from Tennessee child support laws. It provides a legal framework for the systematic collection of child support. 2. Income Withholding: The order requires the non-custodial parent's employer to withhold a specific amount from their income for child support. This ensures regular and consistent payments without relying on the parent's willingness to comply voluntarily. 3. Employer Compliance: The order mandates employers to comply and promptly send the withheld amounts to the Tennessee Child Support Payment Center. Employers are legally obligated to cooperate and follow the instructions outlined in the order. 4. Notification: The order typically requires the non-custodial parent's employer to be notified of the income withholding. This ensures both parties are aware of the process and allows for transparency in the enforcement of child support payments. Types of Nashville Tennessee Orders withholding Income for Child Support: 1. Initial Withholding Order: This type of order is issued when child support payments are being established for the first time. It sets the foundation for future income withholding processes. 2. Modification Order: If there is a significant change in circumstances, such as a change in income, the custodial parent can request a modification of the existing order. This modification could entail altering the withholding amount to reflect the updated financial situation of the non-custodial parent. 3. Contempt Order: In the event of consistent non-compliance with the child support order, a contempt order can be requested to hold the delinquent parent accountable. It may lead to legal consequences, such as fines, wage garnishment, or even imprisonment. In conclusion, a Nashville Tennessee Order to Withhold Income for Child Support is a legal tool that ensures the consistent financial support of a child. It authorizes the withholding of a non-custodial parent's income to fulfill their child support obligations. It is crucial for upholding the best interests of the child and promoting their well-being.

Nashville Tennessee Order to Withhold Income for Child Support

Description

How to fill out Nashville Tennessee Order To Withhold Income For Child Support?

Finding verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Nashville Tennessee Order to Withhold Income for Child Support gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, obtaining the Nashville Tennessee Order to Withhold Income for Child Support takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few more steps to make for new users.

Follow the guidelines below to get started with the most extensive online form library:

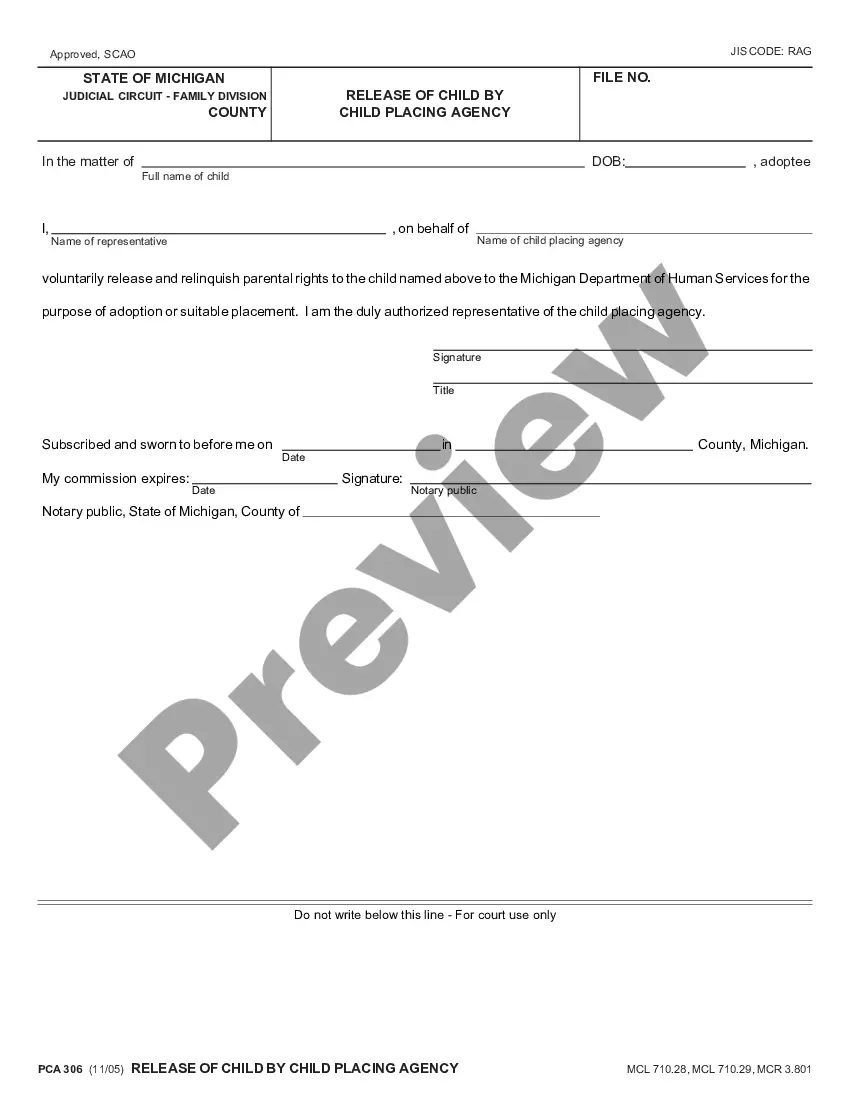

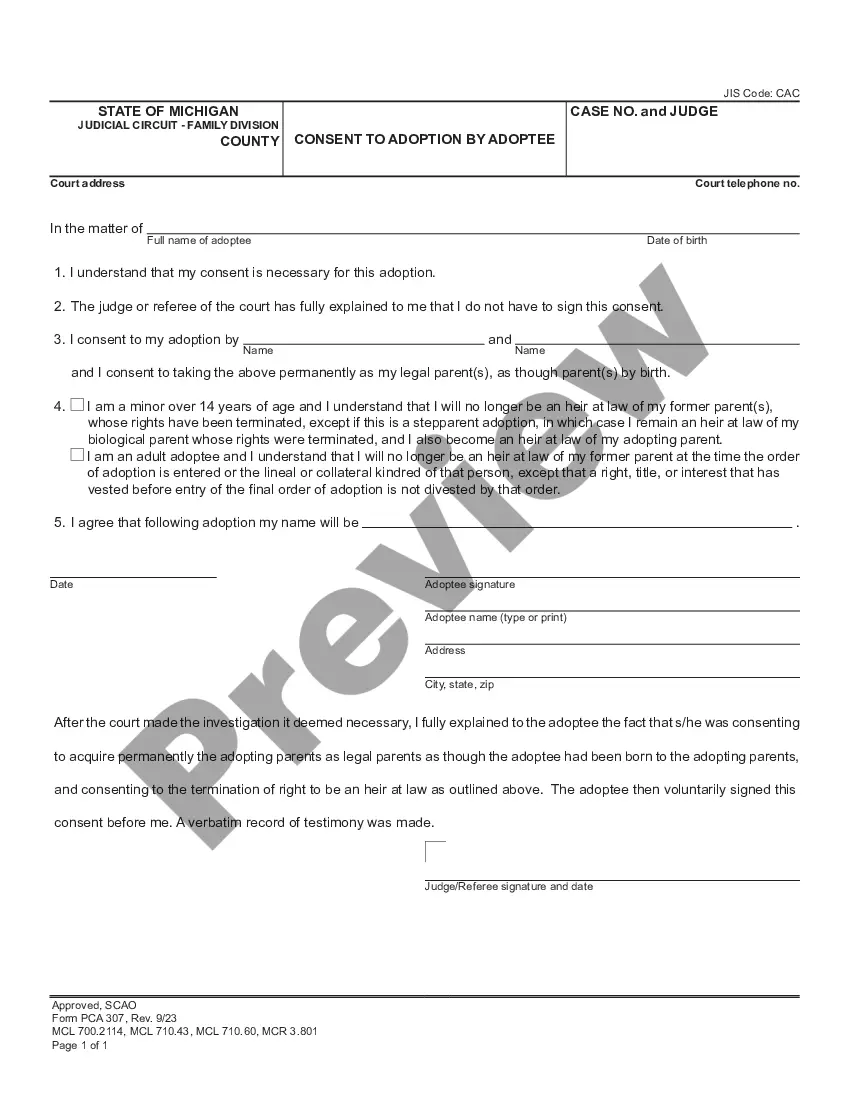

- Look at the Preview mode and form description. Make certain you’ve picked the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Nashville Tennessee Order to Withhold Income for Child Support. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!