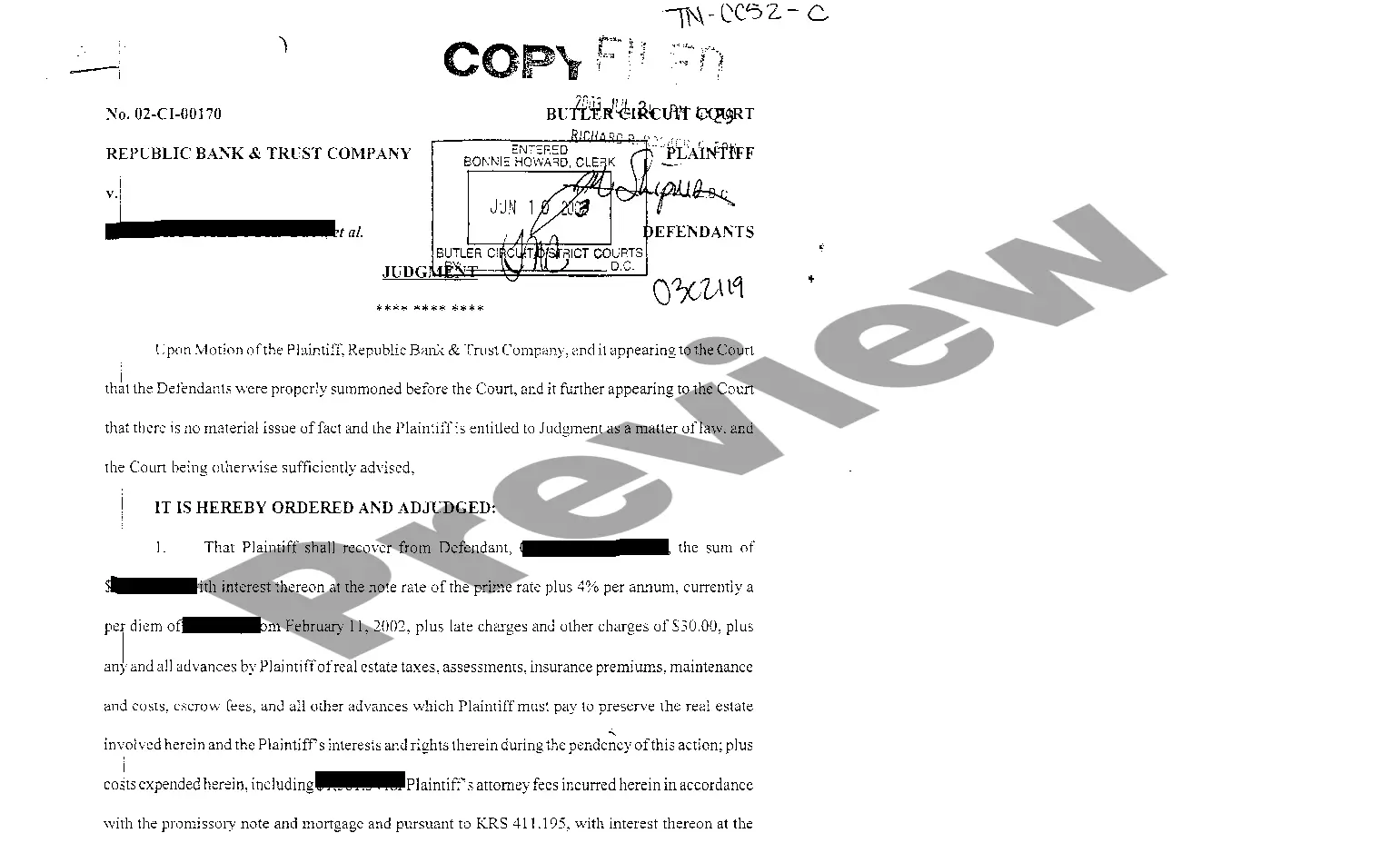

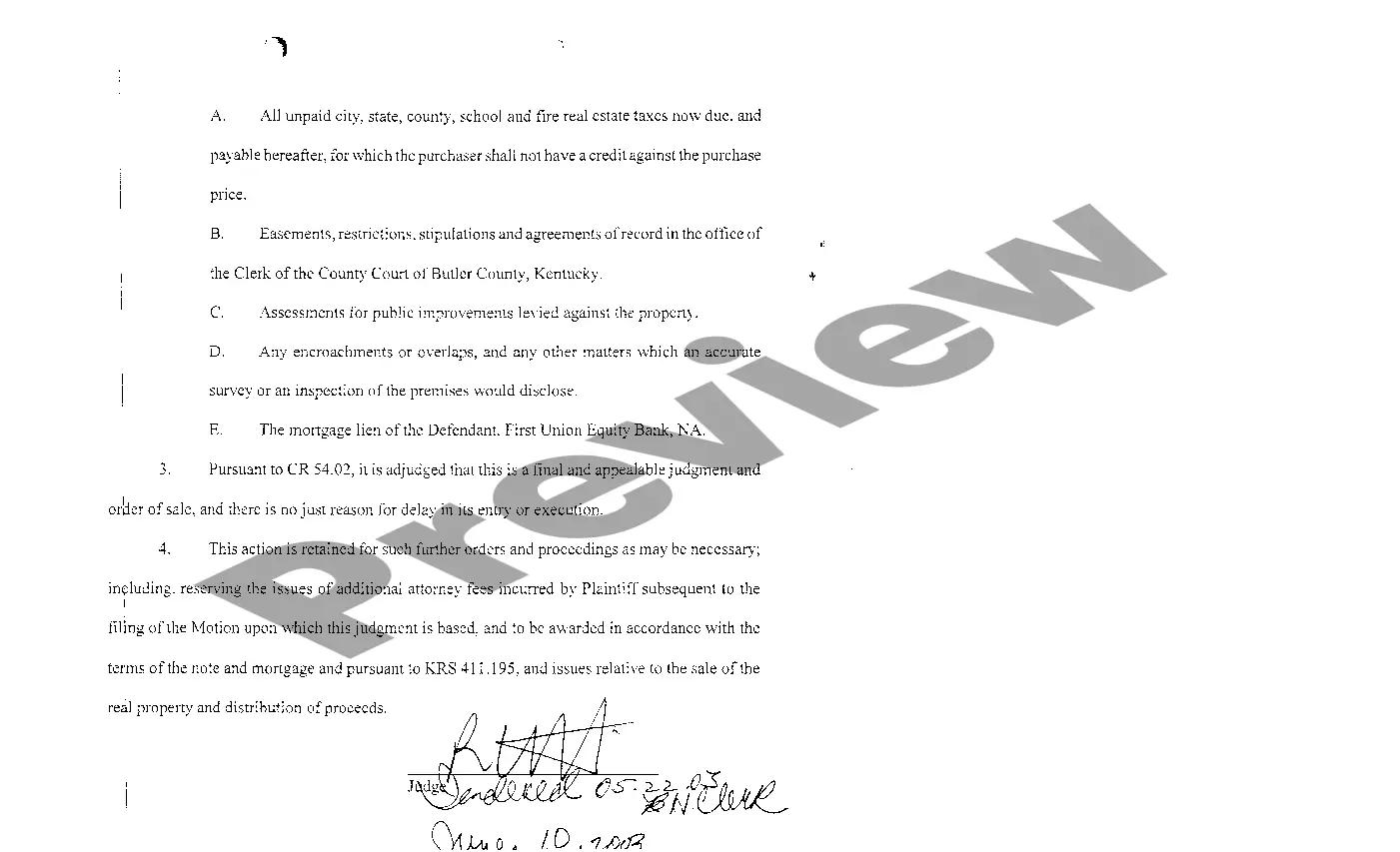

Knoxville Tennessee Judgment for Money Award and Interest refers to the legal process that takes place in Knoxville, Tennessee, whereby a court orders the payment of a specific sum of money, known as a judgment, to a party who has been successful in a civil lawsuit. The judgment is enforceable and legally binding, ensuring that the party who has been wronged receives compensation for their damages, losses, or other remedies. A judgment for money award can arise from various types of legal cases, such as personal injury claims, breach of contract disputes, property damage lawsuits, or even unpaid debts. It is important to note that a judgment may also include not just the initial amount sought, but also additional costs, interest, and attorney's fees. When it comes to interest on judgments in Knoxville, Tennessee, there are different types involved. One such type is post-judgment interest. This occurs when a judgment is rendered, and interest begins to accrue on the awarded amount until it is fully paid. The interest rate for post-judgment interest in Tennessee is determined annually and is based on the average United States Prime Rate. Another type of interest that may apply to a Knoxville Tennessee judgment for money award is prejudgment interest. Prejudgment interest is the interest that accrues on the amount sought by the party who has been wronged from the time the claim is made until the judgment is actually entered. The purpose of prejudgment interest is to compensate the aggrieved party for the delay in receiving their rightful compensation. It is worth noting that the specific rules and regulations regarding judgments for money awards and interest may vary slightly depending on the nature of the case, the court involved, and the specific circumstances of the judgment. Therefore, it is essential to consult with a qualified attorney well-versed in Knoxville, Tennessee, civil litigation to ensure compliance with all legal requirements and to protect your rights throughout the judgment process.

Knoxville Tennessee Judgment for Money Award and Interest

Description

How to fill out Knoxville Tennessee Judgment For Money Award And Interest?

If you’ve previously employed our service, Log In to your account and retrieve the Knoxville Tennessee Judgment for Money Award and Interest on your device by clicking the Download button. Ensure your subscription is active. If it’s not, renew it according to your payment plan.

If this is your initial experience with our service, follow these straightforward steps to acquire your document.

You have continuous access to all documents you have purchased: you can find it in your profile under the My documents menu whenever you wish to reuse it. Utilize the US Legal Forms service to effortlessly find and save any template for your personal or business needs!

- Verify you’ve located the correct document. Browse through the description and use the Preview option, if available, to confirm it fits your needs. If it’s not suitable, utilize the Search tab above to find the right one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process your payment. Provide your credit card information or utilize the PayPal option to finish the transaction.

- Acquire your Knoxville Tennessee Judgment for Money Award and Interest. Select the file format for your document and save it to your device.

- Complete your document. Print it or use professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Interest is allowed on most judgments entered in the federal courts from the date of judgment until paid.

HOW TO CALCULATE POST JUDGMENT INTEREST Take your judgment amount and multiply it by your post judgment rate (%). Take the total and divide it by 365 (the number of days in a year). You will end up with the amount of post judgment interest per day.

Judgment debts accrue simple interest at a rate of 8% a year until payment, unless rules of court provide otherwise, pursuant to section 17 of the Judgments Act 1838 (JA 1838) and the Judgment Debts (Rate of Interest) Order 1993, SI 1993/564.

Compute the number of days that passed between the anniversary date of order and the date they pay. Do not count the first day of the judgment. Divide the number of days by 365 to get the rate amount for formula. Multiply by the official Tennessee Judgment Interest Rate.

HOW TO CALCULATE POST JUDGMENT INTEREST Take your judgment amount and multiply it by your post judgment rate (%). Take the total and divide it by 365 (the number of days in a year). You will end up with the amount of post judgment interest per day.

Judgment debts accrue simple interest at a rate of 8% a year until payment, unless rules of court provide otherwise, pursuant to section 17 of the Judgments Act 1838 (JA 1838) and the Judgment Debts (Rate of Interest) Order 1993, SI 1993/564. This rate has applied to judgments since 1 April 1993.

How much interest can I add? The law allows you to add 10% interest per year to your judgment. To calculate this amount, multiply the unpaid judgment by 10%.

For most types of debt, the rate is usually 8%. To calculate this, use the steps below: Work out the yearly interest: take the amount you're claiming and multiply it by 0.08 (which is 8%). Work out the daily interest: divide your yearly interest from step 1 by 365 (the number of days in a year).

Official State Codes - Links to the official online statutes (laws) in all 50 states and DC.... Legal Maximum Rate of Interest10% (§47-14-103)Interest Rates on Judgments10% or at contract rate (§47-14-121)2 more rows