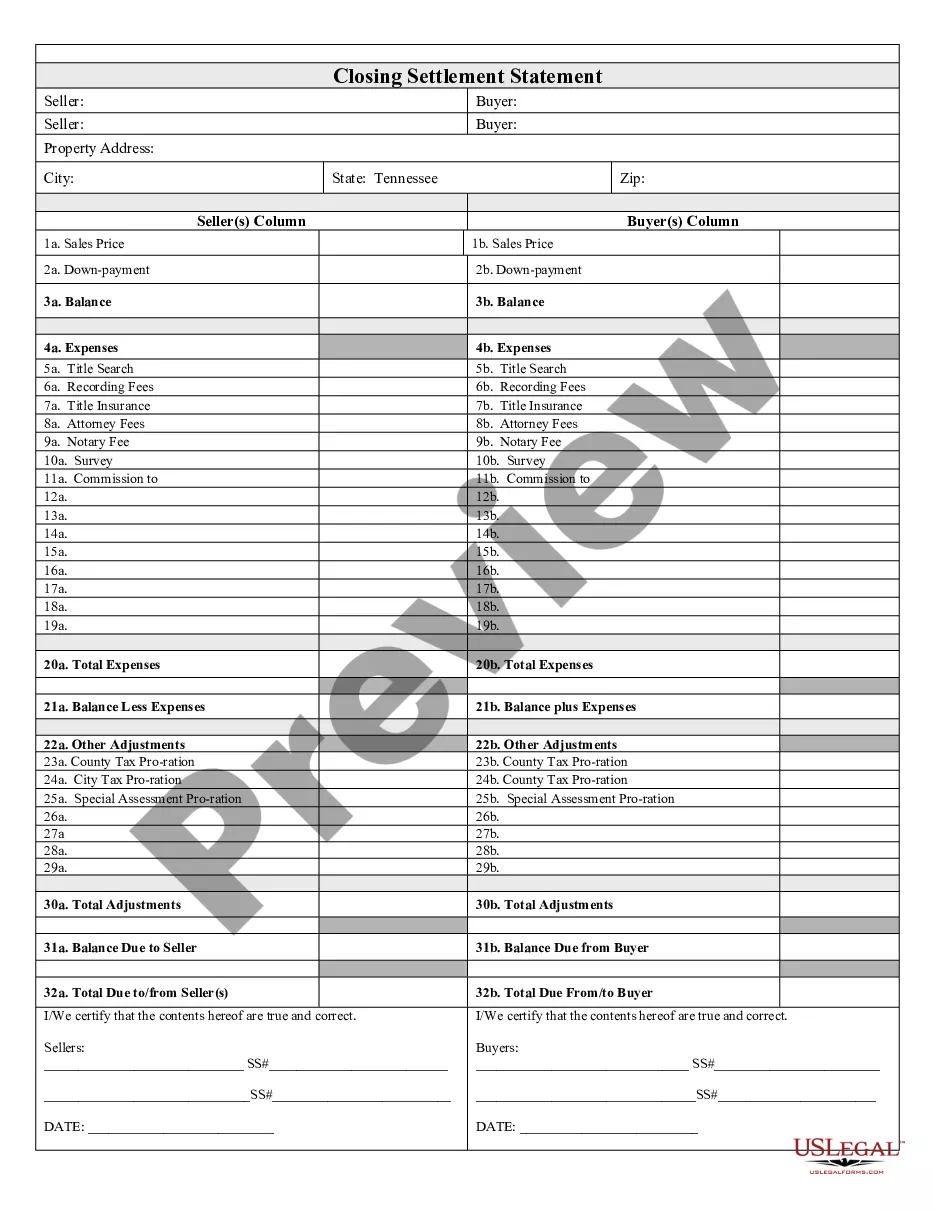

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Clarksville Tennessee Closing Statement

Description

How to fill out Tennessee Closing Statement?

If you are looking for an appropriate form, it’s exceedingly challenging to find a superior location than the US Legal Forms website – arguably the most extensive collections online.

Here, you can discover a vast array of form examples for business and personal purposes categorized by type and state, or keywords.

With the efficient search functionality, locating the latest Clarksville Tennessee Closing Statement is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Receive the template. Choose the desired file format and download it to your device.

- Furthermore, the validity of each document is confirmed by a team of skilled attorneys who regularly review the templates on our site and update them according to the latest state and county laws.

- If you are already familiar with our service and possess an account, all you need to do to acquire the Clarksville Tennessee Closing Statement is to Log In to your profile and click the Download button.

- If you are using US Legal Forms for the first time, just adhere to the instructions below.

- Ensure you have accessed the template you require. Review its description and utilize the Preview option to examine its contents. If it doesn’t suit your requirements, make use of the Search feature at the top of the page to find the appropriate document.

- Confirm your selection. Click the Buy now button. After that, choose the desired payment plan and provide your details to create an account.

Form popularity

FAQ

In Clarksville, Tennessee, the responsibility for preparing closing documents generally falls on the closing agent or attorney. They ensure that all necessary paperwork is correctly filled out and ready for signing. This includes the closing statement, title documents, and various disclosures. Having a dedicated professional handle these documents minimizes errors and enhances the efficiency of the closing process.

The final closing statement in Clarksville, Tennessee, is prepared by the closing agent, often a title company or real estate attorney. They compile the most recent financial information to accurately reflect the transaction's details. This preparation typically occurs shortly before the closing meeting. By having this statement ready, you can ensure a smoother closing process.

The final closing statement is generally provided by the closing agent before the actual closing takes place. This document outlines the final figures for the transaction, including any changes made since the preliminary statement. It ensures that all parties involved understand their financial commitments. Therefore, having a clear final closing statement is essential for a successful closing.

To record a closing statement in Clarksville, Tennessee, you must submit it to the appropriate county office, typically the Register of Deeds. This process involves filing the document along with any required fees. By recording the closing statement, you establish a public record of the transaction, which can be useful for future reference. This step also protects your ownership rights.

The closing statement in Clarksville, Tennessee, is usually prepared by the closing agent, which could be an attorney or a title company representative. This professional gathers all necessary financial details related to the transaction. They ensure that all expenses, credits, and debits are accurately reflected. This clarity is essential for both buyers and sellers.

In Clarksville, Tennessee, the overall closing is typically managed by the closing attorney or title company. They coordinate all necessary parties to ensure a smooth process. This includes communication between the buyer, seller, and various financial institutions. Understanding who leads this process helps everyone involved feel assured and informed.

Clarksville, TN, is located in Montgomery County. This county is known for its vibrant community and dynamic real estate market. When preparing your Clarksville Tennessee Closing Statement, knowing that you're in Montgomery County can be helpful for understanding local regulations and processes.

The district code for Clarksville, TN, is 065. This code is essential for identifying the area in various governmental and administrative functions. Understanding this code can also support you in navigating any necessary paperwork linked to your Clarksville Tennessee Closing Statement.

If you live in Clarksville, TN, you are likely served by the Clarksville-Montgomery County School System. This school board district is dedicated to providing quality education to students in the area. Knowing your school district can influence various decisions, including those tied to your real estate investments and your Clarksville Tennessee Closing Statement.

Montgomery County is part of the 19th Judicial District. This district plays a crucial role in governing various legal matters, including real estate transactions. For residents managing their Clarksville Tennessee Closing Statement, familiarity with this district can be immensely beneficial.