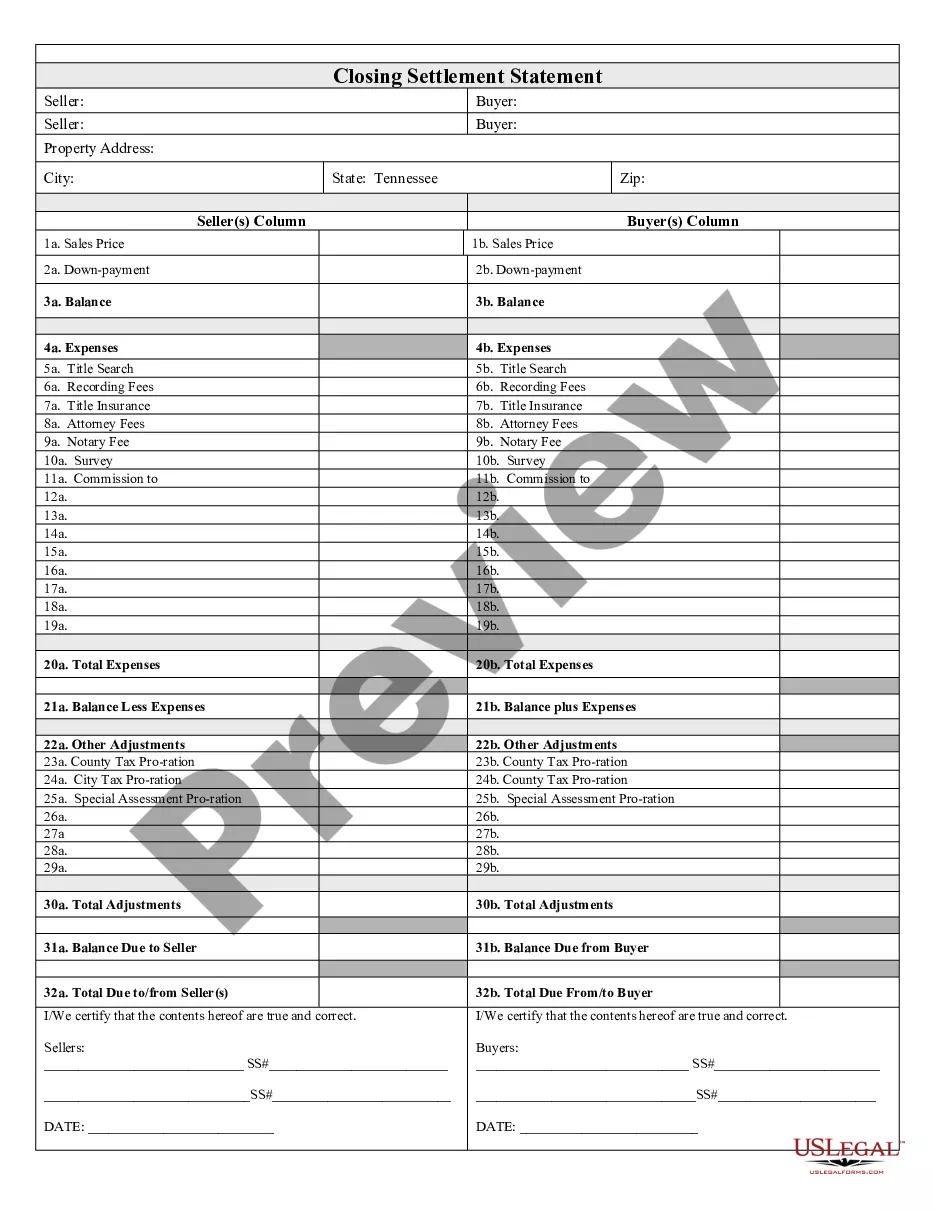

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Knoxville Tennessee Closing Statement

Description

How to fill out Tennessee Closing Statement?

We consistently endeavor to minimize or thwart legal repercussions when navigating intricate legal or financial issues.

To achieve this, we seek attorney services that are typically quite expensive. However, not all legal issues are equally complicated.

Many of them can be managed independently.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it. If you happen to misplace the document, you can always retrieve it again in the My documents tab. The process is equally straightforward for first-time visitors! You can set up your account in just minutes. Be sure to verify that the Knoxville Tennessee Closing Statement adheres to the laws and regulations of your state and locality. Furthermore, it's vital that you review the form's description (if provided), and if you find any inconsistencies with what you originally sought, consider searching for an alternative template. Once you've confirmed that the Knoxville Tennessee Closing Statement is appropriate for your needs, you can choose the subscription option and complete your payment. Then you can download the document in any format available. For over 24 years, we've assisted millions by providing customizable and up-to-date legal forms. Take advantage of US Legal Forms today to conserve time and resources!

- Our platform empowers you to handle your own affairs without the need for an attorney.

- We offer access to legal form templates that are not always readily available.

- Our templates are tailored to specific states and regions, which greatly streamlines the search process.

- Utilize US Legal Forms whenever you need to acquire and download the Knoxville Tennessee Closing Statement or any other form quickly and securely.

Form popularity

FAQ

Probating a will in Knox County, TN, involves several steps, starting with filing the will in the local probate court. You will also need to submit a petition for probate and potentially notify all beneficiaries. The process typically requires organizing the assets and settling debts, which can be complex. For more assistance, see how the Knoxville Tennessee Closing Statement can help streamline document preparation for you.

To look up court cases in Knoxville, TN, you can visit the Knox County Courthouse or check their official website. Many records are available online through the state’s court database, making it easy to find information about specific cases. You can search by name, case number, or date. Utilizing the Knoxville Tennessee Closing Statement resources can guide you through any necessary documentation.

In Tennessee, property taxes are usually prorated at closing. This means the seller pays for the portion of the tax year they owned the property, while the buyer covers the remainder. Be sure to review the Knoxville Tennessee Closing Statement to understand the specific allocation of property tax responsibilities. An organized approach ensures a clear and fair transaction for both parties.

Closing on a house in Tennessee typically takes between 30 to 60 days. This timeframe can depend on various factors such as obtaining financing and completing inspections. A smooth process can lead to a quicker closing, however, it's essential to prepare for potential delays. Understanding the Knoxville Tennessee Closing Statement process can help you navigate your closing more efficiently.

You can find your closing statement by contacting your closing agent or the attorney who facilitated the transaction. The Knoxville Tennessee Closing Statement is generally provided at the closing meeting and should also be included in your transaction documents. If you cannot locate it, reaching out to your real estate agent or the title company can help you obtain a copy. Ensuring you have access to this document helps in understanding all financial details of your transaction.

To calculate closing costs for the seller in Tennessee, you need to account for various fees such as real estate agent commissions, title insurance, and attorney fees. The Knoxville Tennessee Closing Statement will typically outline these costs in detail. You may also need to include prorated property taxes and any outstanding mortgage balance. Getting in touch with a local real estate expert can help you understand these charges better.

A closing statement in a CV is a summary of your qualifications, achievements, and career goals that you present to potential employers. It provides a concise overview of your professional journey and outlines what you can offer to the organization. This component is crucial as it often leaves a lasting impression. Crafting an effective closing statement will help you stand out in your job applications, just like a clear Knoxville Tennessee Closing Statement sets expectations in real estate transactions.

The closing statement is an essential document used during the finalization of a real estate transaction. It provides a comprehensive summary of the financial details relevant to the sale, including the responsibilities of both the buyer and seller. In Knoxville, Tennessee, it ensures that all parties have a clear understanding of their financial commitments. By reviewing the Knoxville Tennessee Closing Statement, you can avoid any misunderstandings at the closing table.

The preparation of a closing statement usually takes a few days before the actual closing date. Once all parties have provided the necessary documentation, a title company or real estate attorney generates the closing statement. In Knoxville, Tennessee, it is advisable to allow sufficient time for any last-minute questions or adjustments. Having a clear and accurate Knoxville Tennessee Closing Statement can significantly streamline the closing process.

A closing statement is a document that outlines the final details of a real estate transaction. In Knoxville, Tennessee, this statement summarizes all the financial aspects of the sale, including closing costs, credits, and debits. It serves as a comprehensive record to ensure that all parties are aware of their financial obligations and entitlements. Understanding the Knoxville Tennessee Closing Statement helps buyers and sellers finalize their transactions confidently.