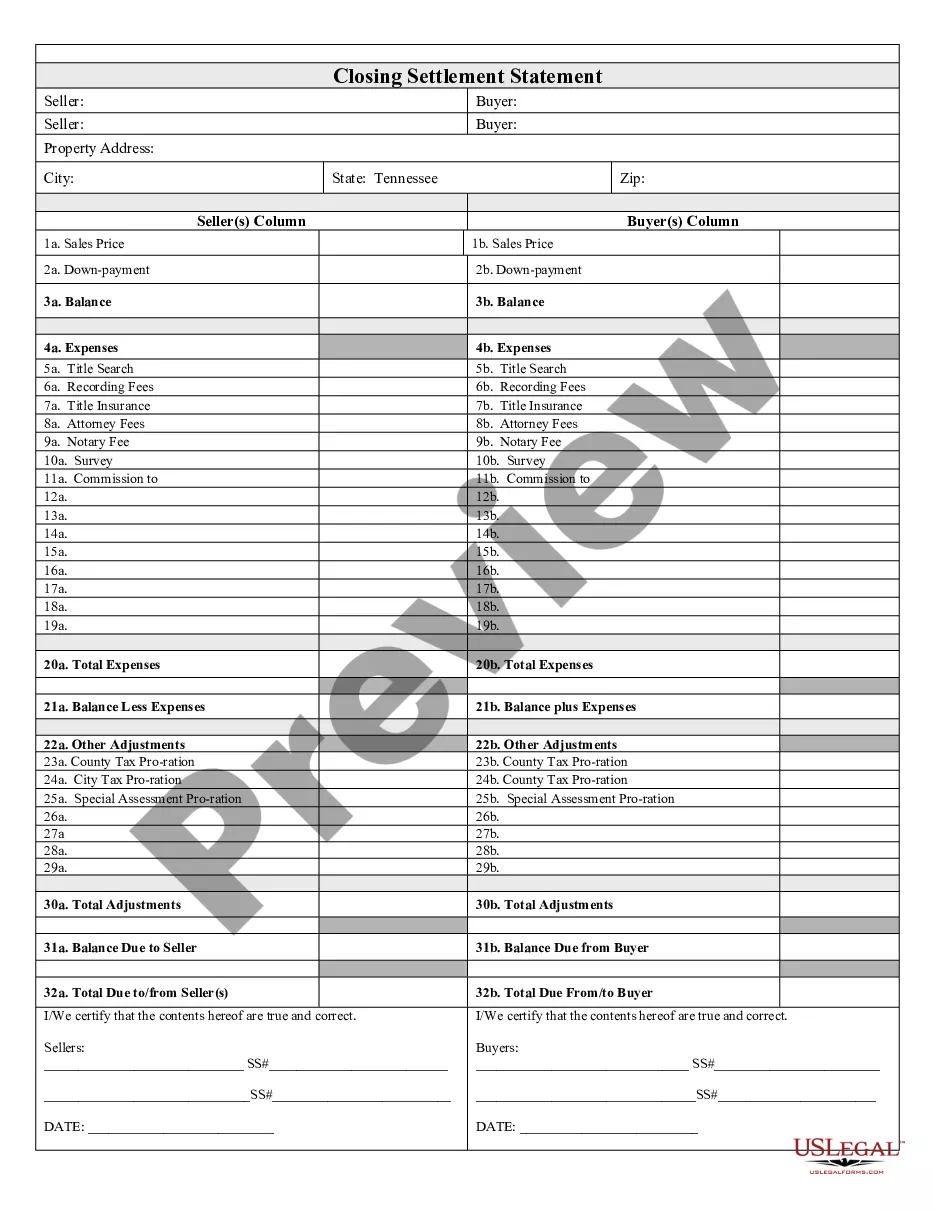

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Memphis Tennessee Closing Statement

Description

How to fill out Tennessee Closing Statement?

Are you searching for a reliable and budget-friendly provider of legal documents to purchase the Memphis Tennessee Closing Statement? US Legal Forms is your ideal choice.

Whether you require a basic agreement to establish regulations for living together with your partner or a collection of forms to facilitate your separation or divorce through the legal system, we have you covered. Our website provides more than 85,000 current legal document templates for personal and business use. All templates we offer are not generic but tailored to the specifics of individual states and regions.

To obtain the document, you must sign in to your account, locate the necessary form, and click the Download button next to it. Please remember that you can access your previously purchased form templates at any time in the My documents section.

Is this your first visit to our site? No problem. You can create an account in just a few minutes, but before doing so, ensure you fulfill the following.

Now you can register your account. Next, choose your subscription plan and proceed with the payment. After completing the payment, download the Memphis Tennessee Closing Statement in any offered format. You can revisit the website at any time and redownload the document without incurring any additional fees.

Locating current legal forms has never been simpler. Try US Legal Forms today and say goodbye to wasting your precious time searching for legal paperwork online.

- Verify whether the Memphis Tennessee Closing Statement complies with the regulations of your state and locality.

- Review the details of the form (if available) to determine for whom and what the document is designed.

- Restart your search if the form does not suit your particular situation.

Form popularity

FAQ

? Civil Court Main Office. General Sessions Court Clerk, Civil Division. 140 Adams, Room 106. Memphis, Tennessee 38103-2093.East Office. General Sessions Court Clerk, Civil Division. 1075 Mullins Station Road. Room W115.Hickory Hill Office. General Sessions Court Clerk, Civil Division. (Inside the Hickory Ridge Mall) 3768 S.

How to Write a Tennessee Quitclaim Deed Preparer's name and address. Full name and mailing address of the person to whom the recorded deed should be sent. County where the real property is located. The consideration paid for the property. Grantor's name and address. Grantee's name and address.

To present a deed to be recorded in Shelby County, go to the Register of Deeds, located at 1075 Mullins Station Rd., Suite 165, Memphis, TN 38134. For general information, call 901.379. 7500. They are open M-F from 8am-pm.

The Register of Deeds files certain legal documents mainly pertaining to or affecting real estate and provides public access to these records.

In either case, you can contact your local county Assessor with questions about ownership. You can find the contact information for your local Assessor at this link.

Finally, quit claim deeds are another common way that properties are conveyed in the State of Tennessee. Quit claim deeds are often used to convey property from one person to another or to add additional people to title.

Under Tennessee law, a quitclaim deed must be in writing and signed by the grantor. Either the deed must have two witnesses, or the grantor's signature must be acknowledged before a notary public or other public official. The deed must be recorded, and you will likely pay a Realty Transfer Tax and filing fees.

The best way to know if a property has a lien is to conduct a title deed search online via the county recorder, county assessor, county clerk's website, or visit their office. Also, real estate buyers can choose to work with a title agent to conduct a lien search on the property.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

By mail to City of Memphis Treasury, 125 N Main St, Room 375, Memphis, TN 38103, with bill stub and check or money order.