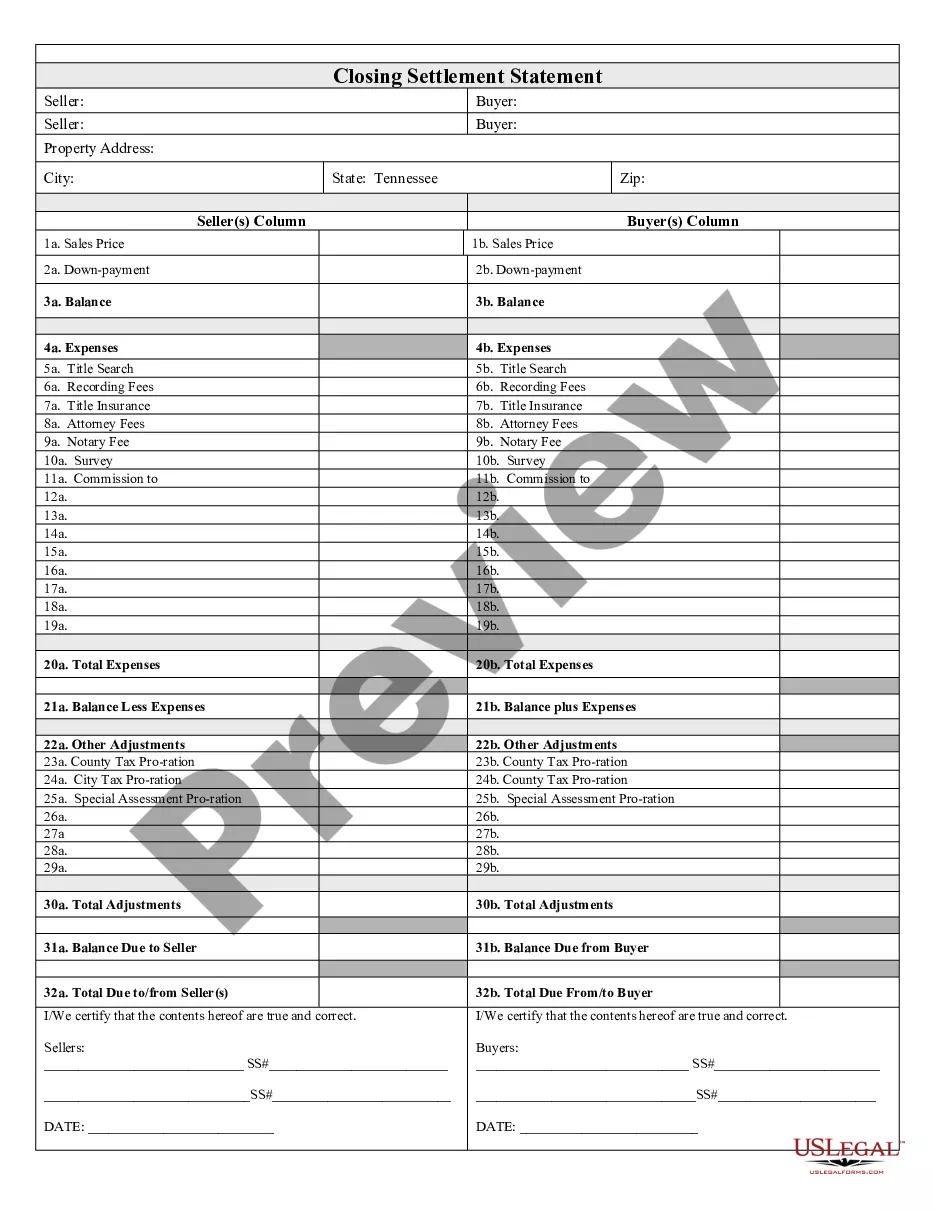

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Nashville Tennessee Closing Statement

Description

How to fill out Tennessee Closing Statement?

Utilize the US Legal Forms and gain immediate access to any document you require.

Our advantageous platform, featuring a vast array of documents, simplifies the process of locating and acquiring nearly any document template you desire.

You can export, fill out, and authorize the Nashville Tennessee Closing Statement within a few minutes instead of spending hours online searching for a suitable template.

Leveraging our collection is a superb method to enhance the security of your record submissions.

The Download button will be visible on all the documents you access.

Additionally, you can discover all previously saved documents in the My documents section.

- Our skilled legal experts consistently examine all documents to ensure the templates are pertinent to a specific area and comply with current laws and regulations.

- How can you obtain the Nashville Tennessee Closing Statement.

- If you possess an account, simply sign in to your account.

Form popularity

FAQ

The best way to know if a property has a lien is to conduct a title deed search online via the county recorder, county assessor, county clerk's website, or visit their office. Also, real estate buyers can choose to work with a title agent to conduct a lien search on the property.

The Tennessee State Library and Archives has microfilmed copies of older deeds for every county in Tennessee. The deeds records are arranged by the name of the seller/buyer (grantor/grantee).

To obtain a copy of a deed or document from a deeds registry, you must: Go to any deeds office (deeds registries may not give out information acting on a letter or a telephone call). Go to the information desk, where an official will help you complete a prescribed form and explain the procedure.

The Register of Deeds files certain legal documents mainly pertaining to or affecting real estate and provides public access to these records.

The Register of Deeds files certain legal documents mainly pertaining to or affecting real estate and provides public access to these records.

Every Tennessee county has a county register responsible for maintaining the county's land records. A deed must be filed in the register of deeds of the county where the property is located.

Document Copies by Mail You can always call the office first at 615-862-6790, and we will tell you the information that you need to include in your request.

The Tennessee State Library and Archives has microfilmed copies of older deeds for every county in Tennessee. The deeds records are arranged by the name of the seller/buyer (grantor/grantee). We do not have a means to search for a deed record by knowing the area, address, or longitude & latitude of the property.

The title deeds to a property with a mortgage are usually kept by the mortgage lender. They will only be given to you once the mortgage has been paid in full. But, you can request copies of the deeds at any time.