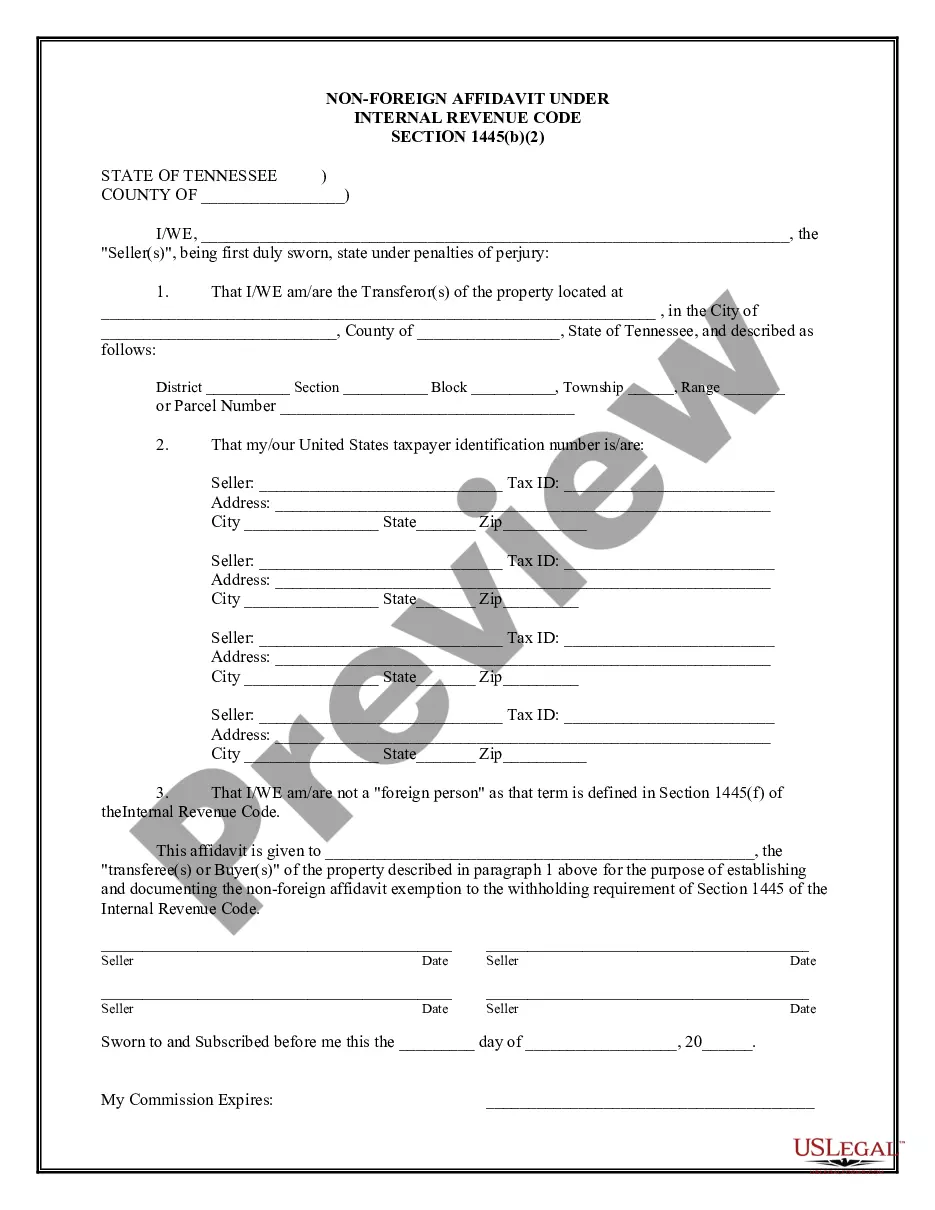

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Chattanooga Tennessee Non-Foreign Affidavit Under IRC 1445: A Comprehensive Guide Introduction: The Chattanooga Tennessee Non-Foreign Affidavit under IRC 1445 is a legal document required by the Internal Revenue Service (IRS) for real estate transactions involving non-U.S. citizens or non-resident aliens. This affidavit is specifically designed to comply with the regulations set forth in Section 1445 of the Internal Revenue Code (IRC). Let's delve into the essentials of this affidavit, its purpose, and various types associated with it. Definition and Purpose: The Chattanooga Tennessee Non-Foreign Affidavit under IRC 1445 is a legally binding document that buyers and/or sellers of real estate properties must complete as part of the property transfer process. The purpose is to verify the residency status of the transferee and determine the tax implications associated with the sale or transfer of real property. Types of Chattanooga Tennessee Non-Foreign Affidavit Under IRC 1445: There are two main types of non-foreign affidavits under IRC 1445 applicable in Chattanooga, Tennessee: 1. Buyer's Non-Foreign Affidavit: A buyer's non-foreign affidavit is completed by the purchaser (transferee) of real estate who is not a U.S. citizen or a resident alien. This affidavit declares the buyer's residency status and certifies that they are not considered a "foreign person" as defined by the IRC 1445 regulations. By submitting this affidavit, the buyer confirms their compliance with tax withholding obligations imposed by the IRS upon the transfer of real property. 2. Seller's Non-Foreign Affidavit: A seller's non-foreign affidavit is completed by the seller (transferor) of a real estate property who is not a U.S. citizen or resident alien. This affidavit certifies the seller's residency status and affirms that they are not a "foreign person." It is crucial for the seller to provide this affidavit to the buyer, ensuring the buyer's compliance with tax withholding requirements during the property transfer process. Completion and Content: To complete a non-foreign affidavit under IRC 1445 in Chattanooga, Tennessee, the following information is typically required: 1. Buyer/Seller Information: — Full legaNamam— - Current address - Taxpayer Identification Number (TIN), such as a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) 2. Certification of Non-Foreign Status: — Declaration of U.S. citizenship or resident alien status — Confirmation that the individual is not considered a "foreign person" — Statement regarding any substantial U.S. presence or connection 3. Signatures and Date: — The affidavit must be signed and dated by the buyer or seller, certifying the accuracy and truthfulness of the provided information. Conclusion: The Chattanooga Tennessee Non-Foreign Affidavit under IRC 1445 serves as a vital document in real estate transactions involving non-U.S. citizens or non-resident aliens. Both the buyer and the seller need to properly complete and submit the relevant affidavit to ensure compliance with IRS regulations and fulfill their tax obligations. By accurately disclosing residency status, this affidavit assists in determining any required tax withholding and avoids potential penalties.Chattanooga Tennessee Non-Foreign Affidavit Under IRC 1445: A Comprehensive Guide Introduction: The Chattanooga Tennessee Non-Foreign Affidavit under IRC 1445 is a legal document required by the Internal Revenue Service (IRS) for real estate transactions involving non-U.S. citizens or non-resident aliens. This affidavit is specifically designed to comply with the regulations set forth in Section 1445 of the Internal Revenue Code (IRC). Let's delve into the essentials of this affidavit, its purpose, and various types associated with it. Definition and Purpose: The Chattanooga Tennessee Non-Foreign Affidavit under IRC 1445 is a legally binding document that buyers and/or sellers of real estate properties must complete as part of the property transfer process. The purpose is to verify the residency status of the transferee and determine the tax implications associated with the sale or transfer of real property. Types of Chattanooga Tennessee Non-Foreign Affidavit Under IRC 1445: There are two main types of non-foreign affidavits under IRC 1445 applicable in Chattanooga, Tennessee: 1. Buyer's Non-Foreign Affidavit: A buyer's non-foreign affidavit is completed by the purchaser (transferee) of real estate who is not a U.S. citizen or a resident alien. This affidavit declares the buyer's residency status and certifies that they are not considered a "foreign person" as defined by the IRC 1445 regulations. By submitting this affidavit, the buyer confirms their compliance with tax withholding obligations imposed by the IRS upon the transfer of real property. 2. Seller's Non-Foreign Affidavit: A seller's non-foreign affidavit is completed by the seller (transferor) of a real estate property who is not a U.S. citizen or resident alien. This affidavit certifies the seller's residency status and affirms that they are not a "foreign person." It is crucial for the seller to provide this affidavit to the buyer, ensuring the buyer's compliance with tax withholding requirements during the property transfer process. Completion and Content: To complete a non-foreign affidavit under IRC 1445 in Chattanooga, Tennessee, the following information is typically required: 1. Buyer/Seller Information: — Full legaNamam— - Current address - Taxpayer Identification Number (TIN), such as a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) 2. Certification of Non-Foreign Status: — Declaration of U.S. citizenship or resident alien status — Confirmation that the individual is not considered a "foreign person" — Statement regarding any substantial U.S. presence or connection 3. Signatures and Date: — The affidavit must be signed and dated by the buyer or seller, certifying the accuracy and truthfulness of the provided information. Conclusion: The Chattanooga Tennessee Non-Foreign Affidavit under IRC 1445 serves as a vital document in real estate transactions involving non-U.S. citizens or non-resident aliens. Both the buyer and the seller need to properly complete and submit the relevant affidavit to ensure compliance with IRS regulations and fulfill their tax obligations. By accurately disclosing residency status, this affidavit assists in determining any required tax withholding and avoids potential penalties.