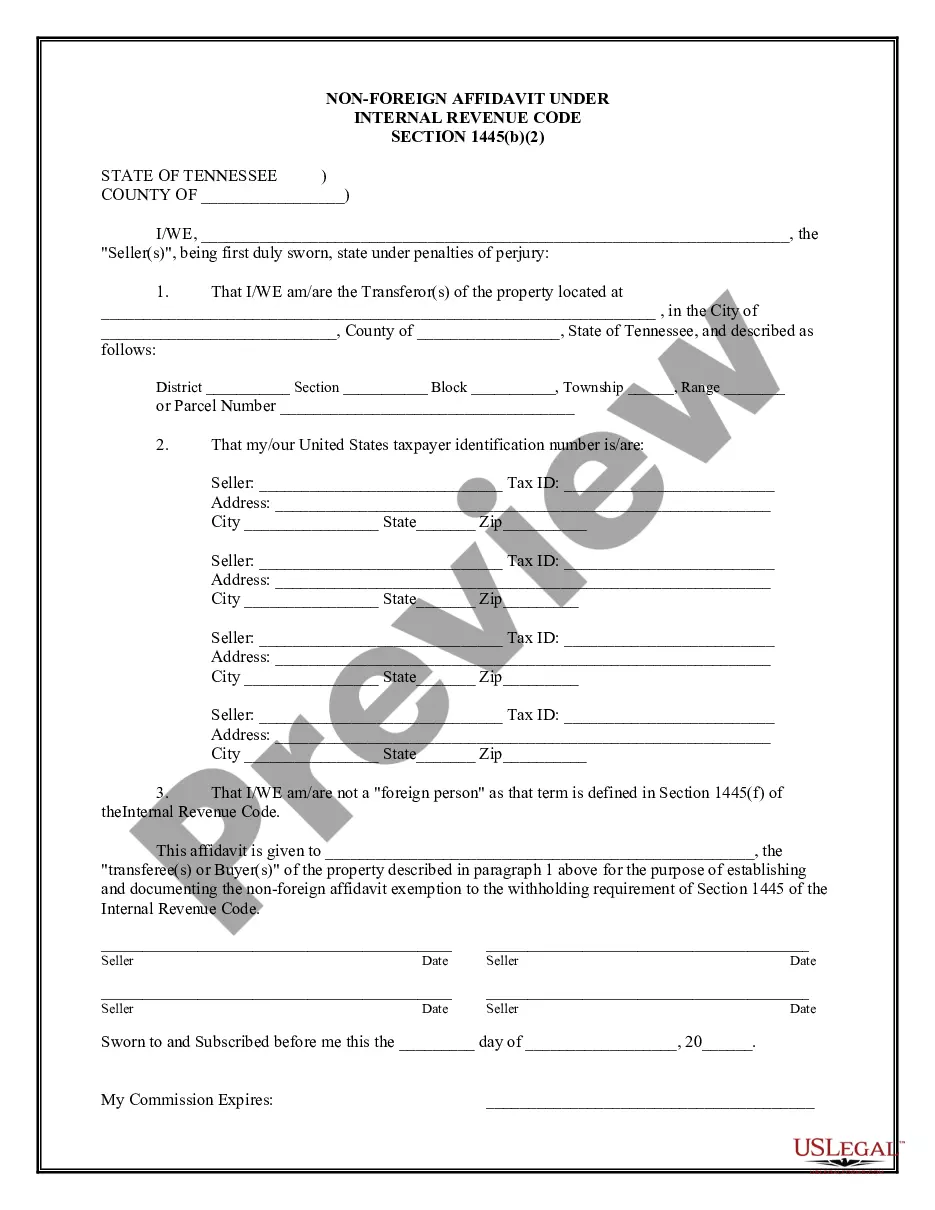

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

The Clarksville Tennessee Non-Foreign Affidavit under IRC 1445 is a legal document required in real estate transactions involving non-foreign sellers in Clarksville, Tennessee. This affidavit ensures compliance with the Internal Revenue Code (IRC) Section 1445, which relates to the withholding of tax on dispositions of U.S. real property interests by foreign persons. When a foreign person sells their property in the United States, the IRS imposes a withholding tax to ensure the collection of any potential taxes owed by the seller. However, if the seller can prove their status as a non-foreign individual, they may be exempt from this withholding requirement. The Clarksville Tennessee Non-Foreign Affidavit Under IRC 1445 serves as an official statement made by a seller, attesting that they are not a foreign person as defined by the IRC. This affidavit is crucial for both the buyer and the seller, as it verifies the seller's eligibility for a withholding tax exemption, saving them unnecessary tax expenses. Different types of the Clarksville Tennessee Non-Foreign Affidavit Under IRC 1445 may include variations based on the specific circumstances of the transaction. For instance, there could be separate affidavits for individuals, corporations, partnerships, or trusts. Each type of affidavit will contain the necessary information and statements relating to the specific entity or individual. When completing the Clarksville Tennessee Non-Foreign Affidavit Under IRC 1445, sellers will typically provide details such as their full legal name, social security number or tax identification number, address, and other pertinent information to establish their non-foreign status. Additionally, they will need to affirm that they are not a foreign person and that they meet the criteria outlined in the IRC 1445 regulations. Buyers or agents involved in the transaction will carefully review the Non-Foreign Affidavit to ensure its accuracy and completeness. Failing to provide or falsely completing the affidavit can result in severe consequences, including penalties and potential future tax liability. In summary, the Clarksville Tennessee Non-Foreign Affidavit Under IRC 1445 is a crucial legal document that verifies a seller's non-foreign status during a real estate transaction. Ensuring compliance with the IRC 1445 regulations is essential for both buyers and sellers to avoid unnecessary tax complications.The Clarksville Tennessee Non-Foreign Affidavit under IRC 1445 is a legal document required in real estate transactions involving non-foreign sellers in Clarksville, Tennessee. This affidavit ensures compliance with the Internal Revenue Code (IRC) Section 1445, which relates to the withholding of tax on dispositions of U.S. real property interests by foreign persons. When a foreign person sells their property in the United States, the IRS imposes a withholding tax to ensure the collection of any potential taxes owed by the seller. However, if the seller can prove their status as a non-foreign individual, they may be exempt from this withholding requirement. The Clarksville Tennessee Non-Foreign Affidavit Under IRC 1445 serves as an official statement made by a seller, attesting that they are not a foreign person as defined by the IRC. This affidavit is crucial for both the buyer and the seller, as it verifies the seller's eligibility for a withholding tax exemption, saving them unnecessary tax expenses. Different types of the Clarksville Tennessee Non-Foreign Affidavit Under IRC 1445 may include variations based on the specific circumstances of the transaction. For instance, there could be separate affidavits for individuals, corporations, partnerships, or trusts. Each type of affidavit will contain the necessary information and statements relating to the specific entity or individual. When completing the Clarksville Tennessee Non-Foreign Affidavit Under IRC 1445, sellers will typically provide details such as their full legal name, social security number or tax identification number, address, and other pertinent information to establish their non-foreign status. Additionally, they will need to affirm that they are not a foreign person and that they meet the criteria outlined in the IRC 1445 regulations. Buyers or agents involved in the transaction will carefully review the Non-Foreign Affidavit to ensure its accuracy and completeness. Failing to provide or falsely completing the affidavit can result in severe consequences, including penalties and potential future tax liability. In summary, the Clarksville Tennessee Non-Foreign Affidavit Under IRC 1445 is a crucial legal document that verifies a seller's non-foreign status during a real estate transaction. Ensuring compliance with the IRC 1445 regulations is essential for both buyers and sellers to avoid unnecessary tax complications.