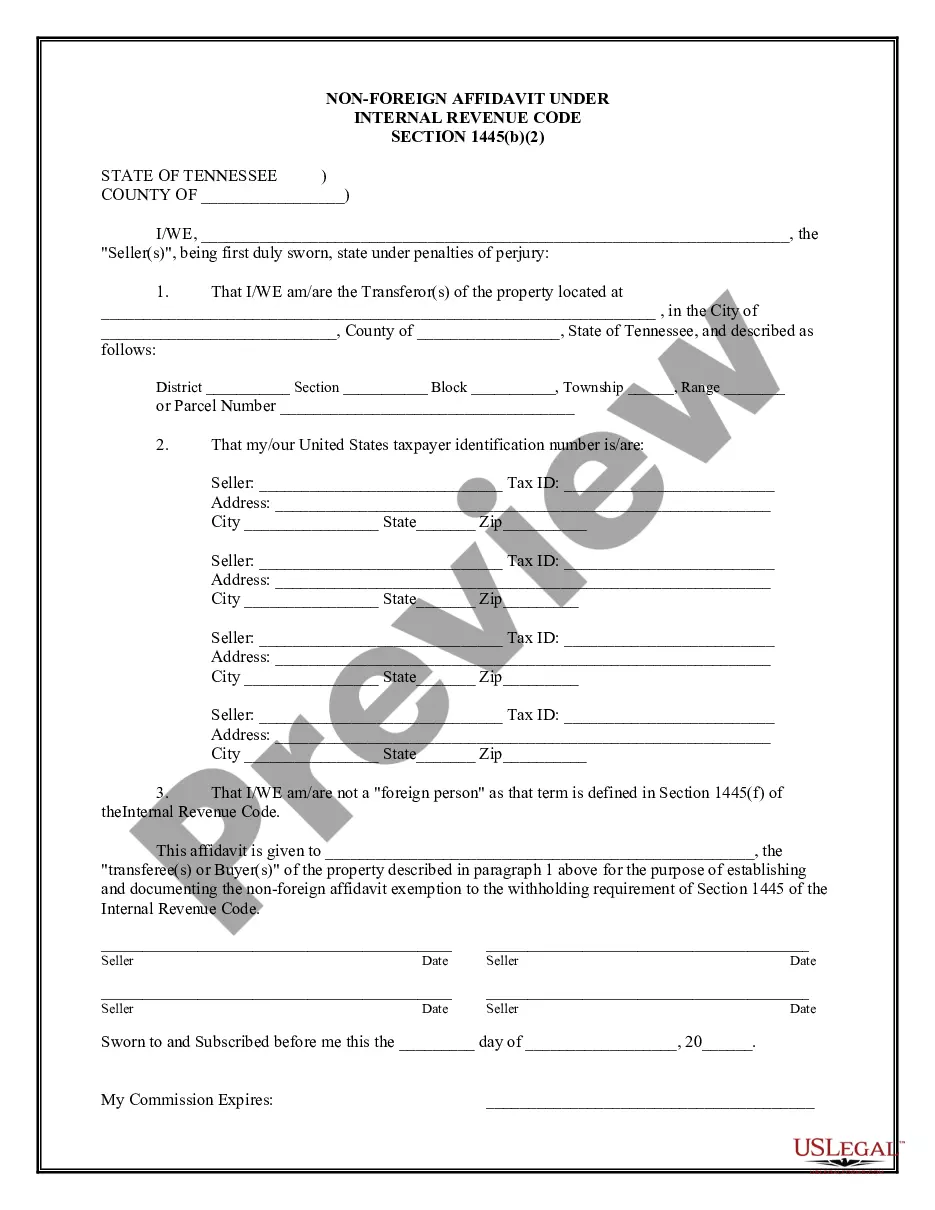

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

A Knoxville Tennessee Non-Foreign Affidavit Under IRC 1445 is a legal document that verifies the status of an individual or entity as a non-foreign person for tax withholding purposes. This affidavit is specifically required under section 1445 of the Internal Revenue Code (IRC) in the context of real estate transactions. This affidavit is essential when a non-U.S. resident sells or transfers real property located in the United States. The purpose of the affidavit is to ensure proper withholding of taxes on the real estate transaction proceeds, as required by the IRS. The Knoxville Tennessee Non-Foreign Affidavit Under IRC 1445 declares that the seller or transferor of the property is not a foreign person as defined by the IRS regulations. A foreign person is generally someone who is not a U.S. citizen, permanent resident, or does not meet specific criteria determining their domestic status. By signing this affidavit, the individual or entity confirms that they are not subject to any withholding tax obligations under the provisions of section 1445. The affidavit includes details such as the name, address, and taxpayer identification number of the seller or transferor. To ensure compliance, it is crucial to complete the Knoxville Tennessee Non-Foreign Affidavit accurately and truthfully. Falsely claiming non-foreign status can result in severe penalties and legal complications. Therefore, it is advisable to seek professional guidance or consult a tax attorney familiar with the IRC regulations and requirements. Different types or variations of the Knoxville Tennessee Non-Foreign Affidavit Under IRC 1445 may exist based on specific transaction types or unique circumstances. For example, there could be variations tailored to real estate transfers involving partnerships, corporations, trusts, or individuals with specific tax-related statuses. It is important to carefully review the affidavit form provided by the relevant authorities, such as the Knoxville Tennessee county's office or the IRS, to ensure compliance with any specific instructions or requirements. The use of templates or standardized forms can be highly beneficial for accurately completing the Knoxville Tennessee Non-Foreign Affidavit Under IRC 1445. In summary, the Knoxville Tennessee Non-Foreign Affidavit Under IRC 1445 is a crucial legal document required in real estate transactions to verify the non-foreign status of sellers or transferors. By accurately completing and filing this affidavit, individuals and entities can ensure compliance with tax withholding obligations and avoid any potential penalties or legal complications.A Knoxville Tennessee Non-Foreign Affidavit Under IRC 1445 is a legal document that verifies the status of an individual or entity as a non-foreign person for tax withholding purposes. This affidavit is specifically required under section 1445 of the Internal Revenue Code (IRC) in the context of real estate transactions. This affidavit is essential when a non-U.S. resident sells or transfers real property located in the United States. The purpose of the affidavit is to ensure proper withholding of taxes on the real estate transaction proceeds, as required by the IRS. The Knoxville Tennessee Non-Foreign Affidavit Under IRC 1445 declares that the seller or transferor of the property is not a foreign person as defined by the IRS regulations. A foreign person is generally someone who is not a U.S. citizen, permanent resident, or does not meet specific criteria determining their domestic status. By signing this affidavit, the individual or entity confirms that they are not subject to any withholding tax obligations under the provisions of section 1445. The affidavit includes details such as the name, address, and taxpayer identification number of the seller or transferor. To ensure compliance, it is crucial to complete the Knoxville Tennessee Non-Foreign Affidavit accurately and truthfully. Falsely claiming non-foreign status can result in severe penalties and legal complications. Therefore, it is advisable to seek professional guidance or consult a tax attorney familiar with the IRC regulations and requirements. Different types or variations of the Knoxville Tennessee Non-Foreign Affidavit Under IRC 1445 may exist based on specific transaction types or unique circumstances. For example, there could be variations tailored to real estate transfers involving partnerships, corporations, trusts, or individuals with specific tax-related statuses. It is important to carefully review the affidavit form provided by the relevant authorities, such as the Knoxville Tennessee county's office or the IRS, to ensure compliance with any specific instructions or requirements. The use of templates or standardized forms can be highly beneficial for accurately completing the Knoxville Tennessee Non-Foreign Affidavit Under IRC 1445. In summary, the Knoxville Tennessee Non-Foreign Affidavit Under IRC 1445 is a crucial legal document required in real estate transactions to verify the non-foreign status of sellers or transferors. By accurately completing and filing this affidavit, individuals and entities can ensure compliance with tax withholding obligations and avoid any potential penalties or legal complications.