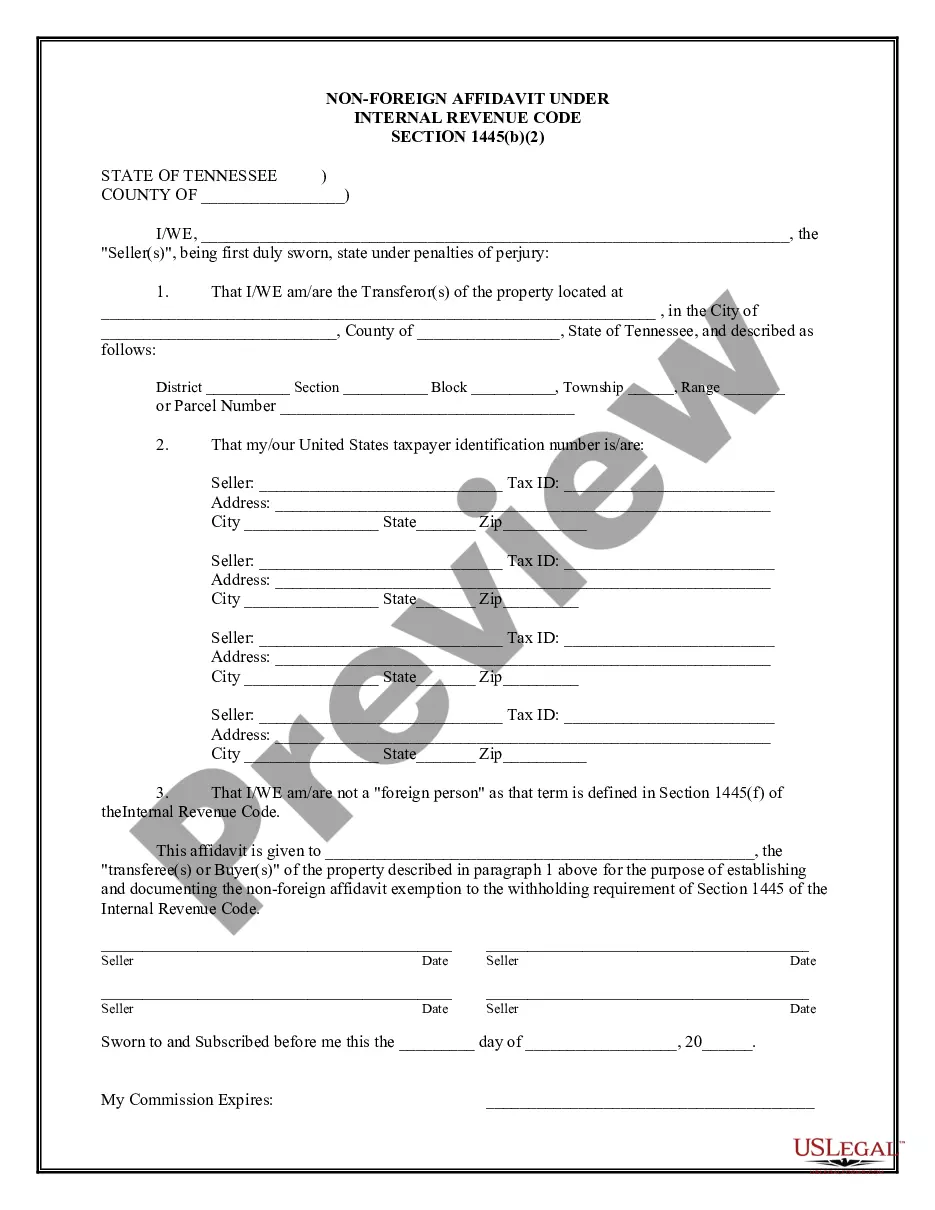

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

The Memphis Tennessee Non-Foreign Affidavit Under IRC 1445 is a legal document that is required by the Internal Revenue Code (IRC) section 1445 for non-foreign individuals or entities involved in the sale or transfer of real property located in Memphis, Tennessee. This affidavit serves as a declaration stating that the seller or transferor is not a foreign person, as defined by the IRC. The purpose of this affidavit is to comply with the provisions of the IRC, which require buyers to withhold tax on certain dispositions of real property by foreign persons. By obtaining a non-foreign affidavit, the buyer is ensuring that they are not obligated to withhold any taxes from the sale or transfer proceeds. The Memphis Tennessee Non-Foreign Affidavit Under IRC 1445 typically includes the following information: 1. Personal Information: The affidavit will require the seller or transferor to provide their full name, address, and contact details. 2. Identification: The affidavit may require the seller or transferor to provide identification documents such as a passport or driver's license to verify their non-foreign status. 3. Declaration of Non-Foreign Status: The affidavit will include a statement where the seller or transferor declares that they are not a foreign person as defined by the IRC. 4. Property Information: The affidavit will require specific details about the real property being sold or transferred, such as the address, legal description, and purchase price. 5. Signature and Notarization: The affidavit must be signed by the seller or transferor in the presence of a notary public, who will then authenticate the signature. It is important to note that there may not be different types of Memphis Tennessee Non-Foreign Affidavit Under IRC 1445. However, variations of this affidavit may exist based on specific local regulations or requirements. It is advisable to consult with a legal professional or the appropriate local authority to ensure compliance with any specific variations or additional documentation needed.The Memphis Tennessee Non-Foreign Affidavit Under IRC 1445 is a legal document that is required by the Internal Revenue Code (IRC) section 1445 for non-foreign individuals or entities involved in the sale or transfer of real property located in Memphis, Tennessee. This affidavit serves as a declaration stating that the seller or transferor is not a foreign person, as defined by the IRC. The purpose of this affidavit is to comply with the provisions of the IRC, which require buyers to withhold tax on certain dispositions of real property by foreign persons. By obtaining a non-foreign affidavit, the buyer is ensuring that they are not obligated to withhold any taxes from the sale or transfer proceeds. The Memphis Tennessee Non-Foreign Affidavit Under IRC 1445 typically includes the following information: 1. Personal Information: The affidavit will require the seller or transferor to provide their full name, address, and contact details. 2. Identification: The affidavit may require the seller or transferor to provide identification documents such as a passport or driver's license to verify their non-foreign status. 3. Declaration of Non-Foreign Status: The affidavit will include a statement where the seller or transferor declares that they are not a foreign person as defined by the IRC. 4. Property Information: The affidavit will require specific details about the real property being sold or transferred, such as the address, legal description, and purchase price. 5. Signature and Notarization: The affidavit must be signed by the seller or transferor in the presence of a notary public, who will then authenticate the signature. It is important to note that there may not be different types of Memphis Tennessee Non-Foreign Affidavit Under IRC 1445. However, variations of this affidavit may exist based on specific local regulations or requirements. It is advisable to consult with a legal professional or the appropriate local authority to ensure compliance with any specific variations or additional documentation needed.