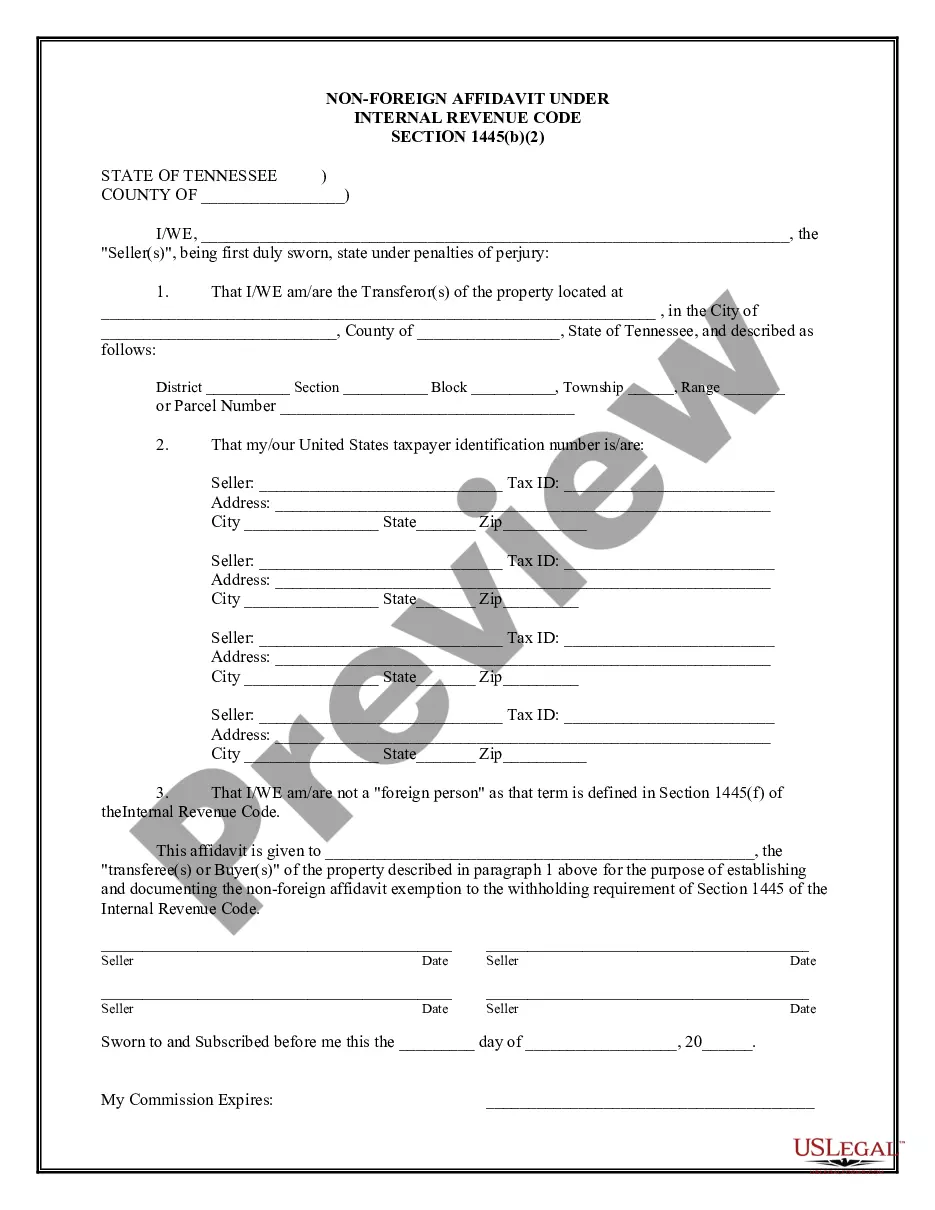

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

The Murfreesboro Tennessee Non-Foreign Affidavit Under IRC 1445 is a legal document required for certain real estate transactions involving non-U.S. individuals or entities. It is used to confirm the tax residency status of the seller or transferor, ensuring compliance with the Internal Revenue Code (IRC) Section 1445. This affidavit serves as a declaration by the seller or transferor that they are not a foreign person under U.S. tax laws. By completing this affidavit, they confirm that they are a U.S. citizen, U.S. resident alien, or domestic entity, thus exempt from the withholding tax obligations imposed by the IRC Section 1445. The Murfreesboro Tennessee Non-Foreign Affidavit Under IRC 1445 is a vital component in property transactions in Murfreesboro, Tennessee involving non-U.S. persons. It helps facilitate the transfer of real estate properties while ensuring compliance with relevant tax regulations. Different types of Murfreesboro Tennessee Non-Foreign Affidavit Under IRC 1445 may include: 1. Individual Non-Foreign Affidavit Under IRC 1445: This type of affidavit is used when the seller or transferor is an individual who is not a foreign person. It requires to be detailed personal information, including the individual's name, address, Social Security number, and proof of U.S. citizenship or residency. 2. Non-Foreign Entity Affidavit Under IRC 1445: This affidavit is applicable when the seller or transferor is a domestic entity, such as a corporation, partnership, limited liability company (LLC), or trust. It involves providing the entity's name, tax identification number, and legal documentation establishing its domestic status. It is crucial to accurately complete and submit the Murfreesboro Tennessee Non-Foreign Affidavit Under IRC 1445 during the property transaction process. Failure to provide this affidavit where required may result in complications, delays, or potential penalties related to withholding taxes by the IRS. Real estate professionals, including title companies, attorneys, and realtors, play a vital role in guiding buyers and sellers through the process of preparing and executing the Murfreesboro Tennessee Non-Foreign Affidavit Under IRC 1445. They ensure the proper completion of the affidavit and its submission in accordance with the relevant regulations, creating a smooth and legally compliant property transfer experience for all parties involved.