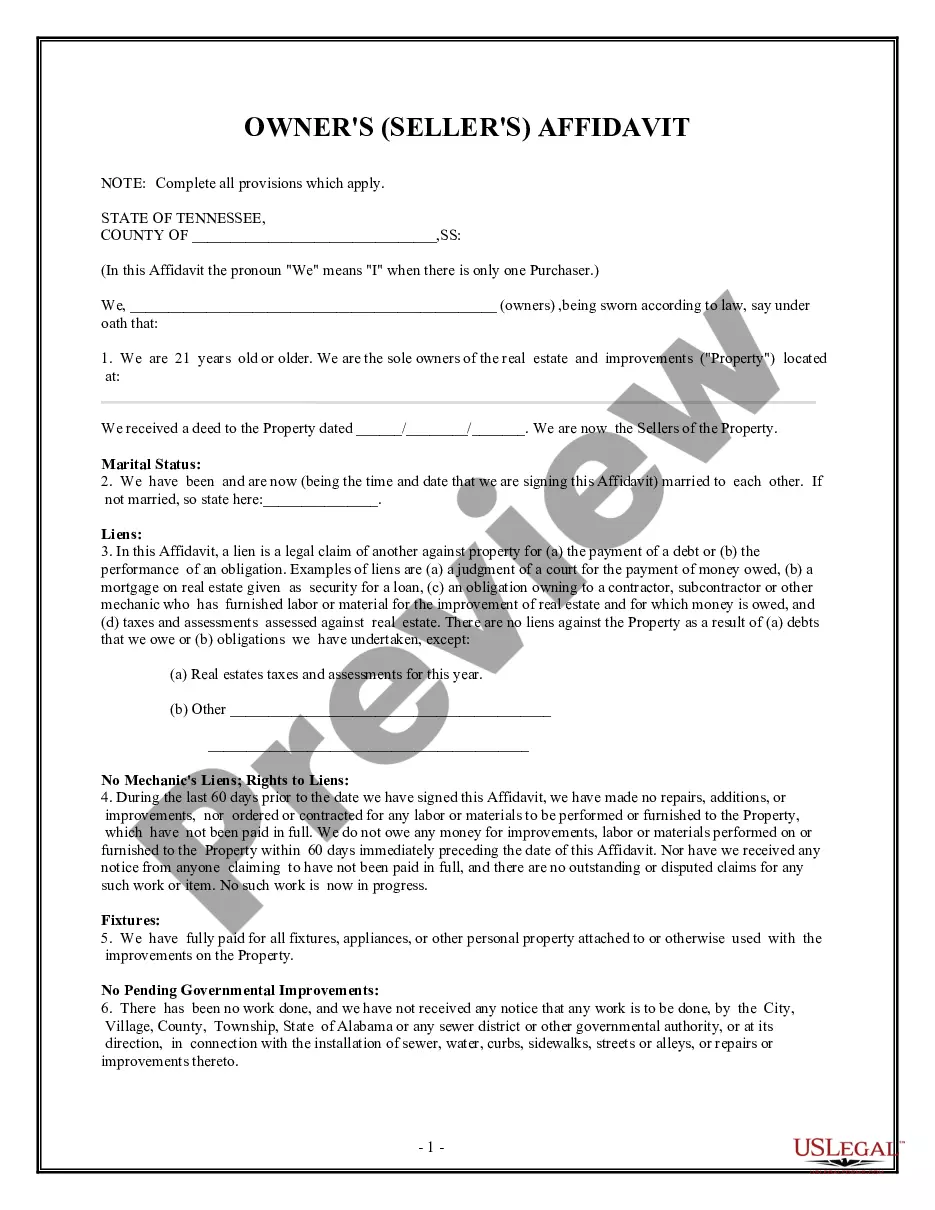

This Owner/Seller Affidavit is for seller(s) to sign at the time of closing certifying that, among other assurances, there are no liens on the property being sold, that they are the owners of the property, that there are no mechanic liens on the property and other certifications. This form must be signed and notarized.

Keywords: Knoxville Tennessee, Owner's Affidavit of No Liens, Seller's Affidavit of No Liens, types Title: Understanding Knoxville Tennessee Owner's or Seller's Affidavit of No Liens: Types and Detailed Description Introduction: When engaging in real estate transactions in Knoxville, Tennessee, it is crucial for both buyers and sellers to understand the importance of an Owner's or Seller's Affidavit of No Liens. This legal document serves to protect the buyer by confirming that the property being sold is free from any outstanding liens or encumbrances. In Knoxville, there are different types of these affidavits, each designed to address specific scenarios. This article will provide a detailed explanation of the purpose and different types of Knoxville Tennessee Owner's or Seller's Affidavit of No Liens. 1. Standard Owner's or Seller's Affidavit of No Liens: The standard Owner's or Seller's Affidavit of No Liens in Knoxville, Tennessee, is commonly used for traditional residential or commercial property sales. This affidavit verifies that the property is free from any unpaid debts, judgments, or liens on its title. It demonstrates the seller's commitment to providing a clear and marketable title to the buyer upon the completion of the sale. 2. Knoxville Tennessee Owner's or Seller's Affidavit for property under foreclosure: This specific affidavit is required when selling a property that is currently undergoing foreclosure proceedings. It assures the buyer that the property will be sold free and clear of any liens resulting from the foreclosure process, ensuring the buyer will not face additional financial burdens after purchasing the property. 3. Knoxville Tennessee Owner's or Seller's Affidavit for construction projects: For construction projects, especially those involving subcontractors and suppliers, an Owner's or Seller's Affidavit of No Liens is essential. This type of affidavit ensures that the seller can provide the buyer with a clear title, free from any potential claims related to unpaid construction costs or materials. 4. Knoxville Tennessee Owner's or Seller's Affidavit for tax-related liens: In cases where there might be outstanding tax-related liens on the property, such as unpaid property tax or income tax liens, this type of affidavit is necessary. The seller must provide assurance that all tax obligations are satisfied or will be paid off from the proceeds of the sale before transferring the property to the buyer. Conclusion: Knoxville Tennessee Owner's or Seller's Affidavit of No Liens plays a vital role in real estate transactions, ensuring the buyer receives a property free from any undisclosed or unresolved liens. By understanding the different types of affidavits for specific situations, buyers can proceed with confidence in their investment. Whether it's a standard affidavit, one for foreclosures, construction projects, or tax-related concerns, sellers must accurately complete the appropriate affidavit to maintain transparency and protect all parties involved in the transaction.