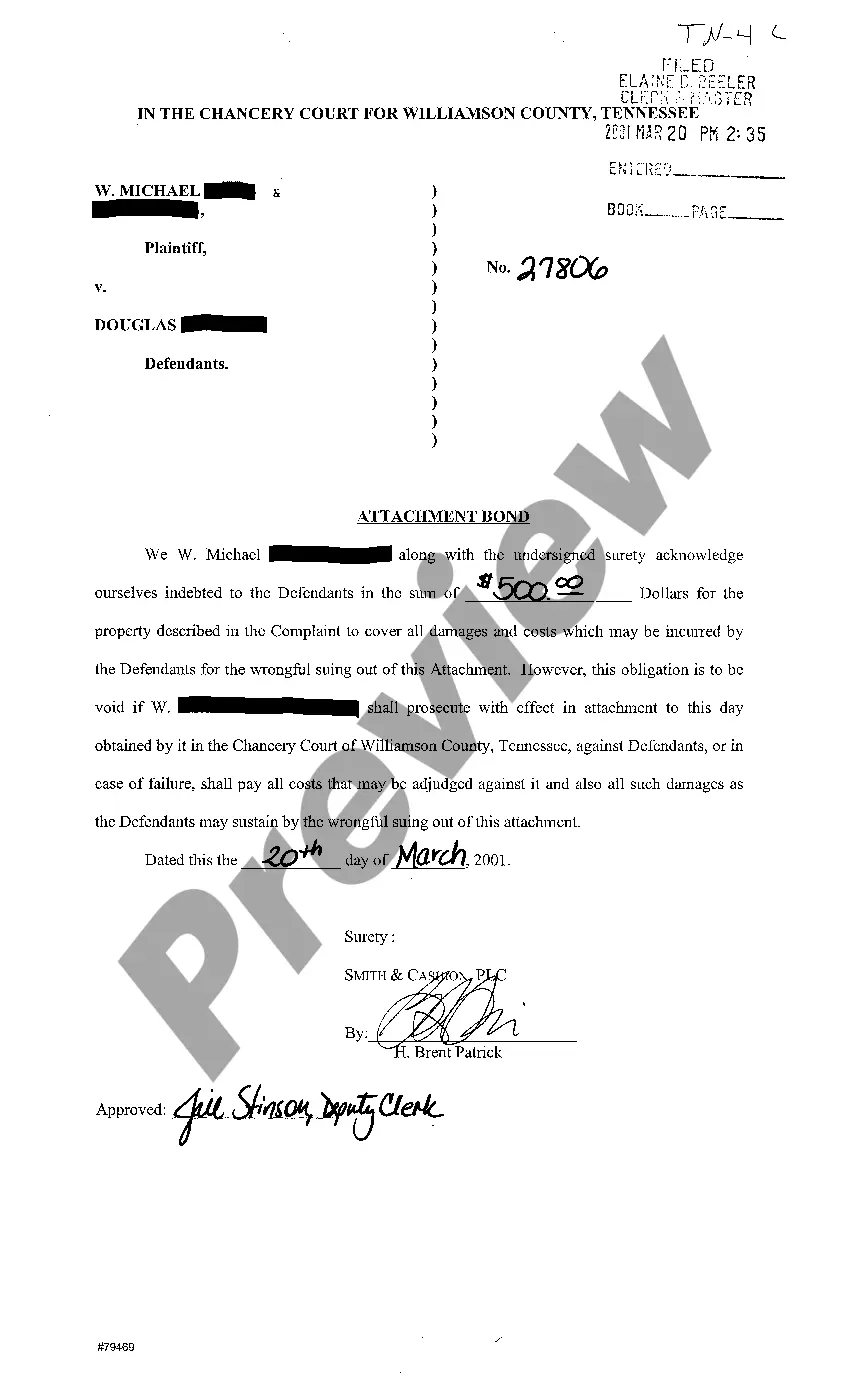

Knoxville Tennessee Attachment Bond is a legal instrument that serves as a guarantee against any potential losses or damages incurred during a specific contractual agreement. This bond is designed to establish a sense of trust and assurance between multiple parties involved in a given project or business transaction within the city of Knoxville, Tennessee. There are several types of Knoxville Tennessee Attachment Bonds, each catering to specific needs and circumstances. The most common types include: 1. Performance Attachment Bond: This type of bond ensures that the principal party adheres to the terms and conditions stated in the contract. It guarantees that the obliged will be compensated if the principal fails to fulfill their obligations. 2. Payment Attachment Bond: Also known as a labor and material bond, this type of bond guarantees the payment of subcontractors, suppliers, and other parties involved in a construction project. It offers protection against non-payment or default by the principal. 3. Bid Attachment Bond: This bond is typically required during the bidding process of a construction project. It ensures that the winning bidder will enter into a contract and provide the required performance and payment bonds if awarded the project. 4. Maintenance Attachment Bond: After the completion of a project, a maintenance bond may be required to guarantee against any defects or faults in the workmanship or materials used. It provides coverage for a specified period, usually one or two years, ensuring that the principal will address any issues promptly. Knoxville Tennessee Attachment Bonds are crucial in numerous industries, including construction, real estate, and service contracts. They ensure that projects are completed successfully, payments are made promptly, and all parties involved are protected from potential financial losses. When obtaining an attachment bond in Knoxville, it is essential to work with a licensed and reputable surety bond company that specializes in providing these types of bonds. Understanding the specific requirements and regulations set forth by the state of Tennessee is crucial to ensure compliance and a seamless bond issuance process.

Knoxville Tennessee Attachment Bond

Description

How to fill out Knoxville Tennessee Attachment Bond?

Take advantage of the US Legal Forms and have instant access to any form sample you need. Our helpful website with a large number of documents makes it simple to find and obtain virtually any document sample you need. You are able to export, complete, and certify the Knoxville Tennessee Attachment Bond in a matter of minutes instead of surfing the Net for hours trying to find a proper template.

Utilizing our library is a wonderful strategy to improve the safety of your form submissions. Our professional attorneys regularly check all the records to ensure that the templates are relevant for a particular state and compliant with new acts and regulations.

How do you get the Knoxville Tennessee Attachment Bond? If you already have a subscription, just log in to the account. The Download option will appear on all the samples you view. Moreover, you can get all the previously saved documents in the My Forms menu.

If you don’t have an account yet, follow the instructions listed below:

- Open the page with the template you require. Ensure that it is the template you were seeking: examine its title and description, and use the Preview function when it is available. Otherwise, use the Search field to find the appropriate one.

- Start the saving process. Select Buy Now and choose the pricing plan you like. Then, sign up for an account and pay for your order utilizing a credit card or PayPal.

- Save the file. Pick the format to obtain the Knoxville Tennessee Attachment Bond and change and complete, or sign it according to your requirements.

US Legal Forms is one of the most considerable and trustworthy template libraries on the web. Our company is always happy to help you in any legal procedure, even if it is just downloading the Knoxville Tennessee Attachment Bond.

Feel free to take full advantage of our service and make your document experience as efficient as possible!