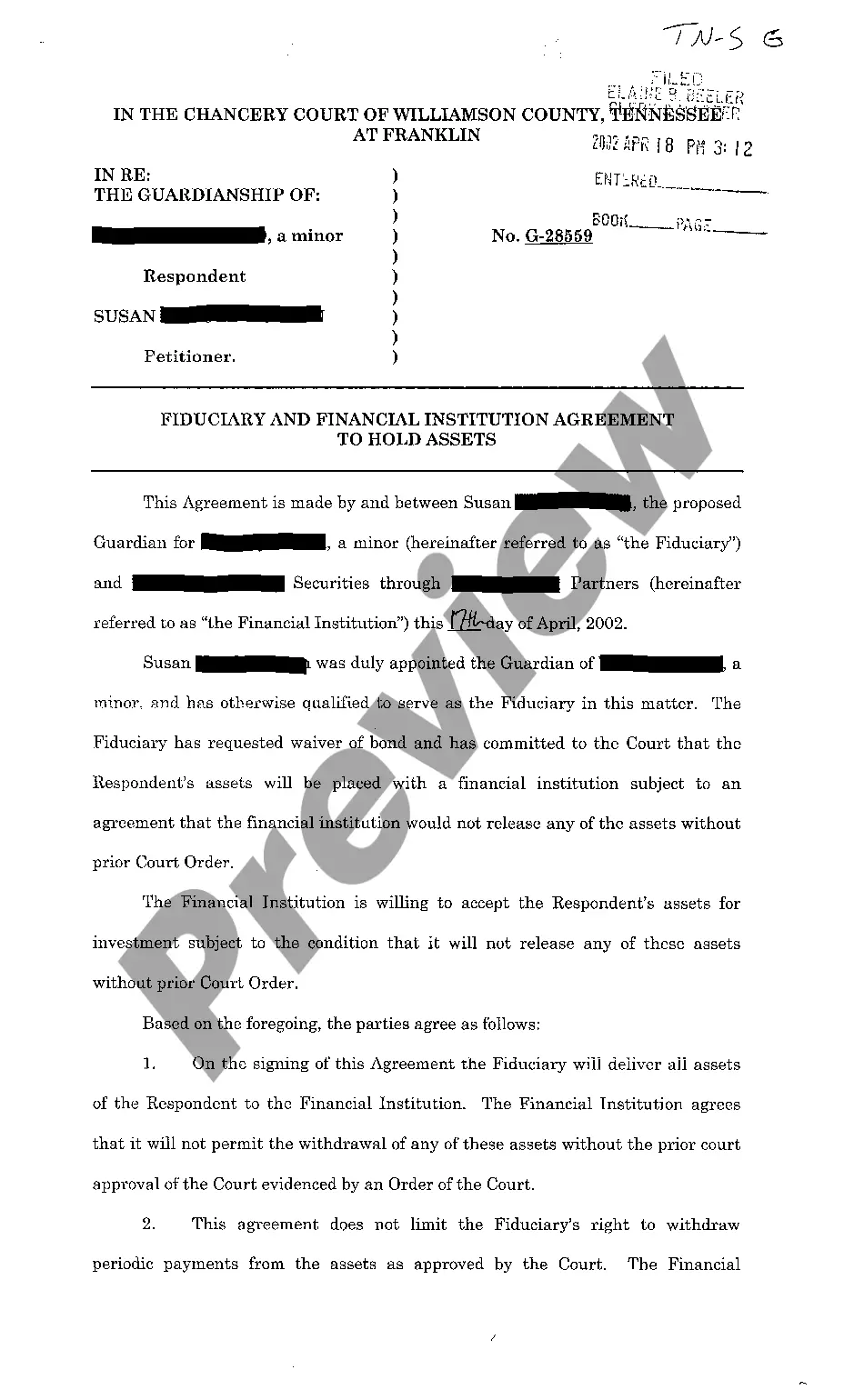

Clarksville, Tennessee Fiduciary and Financial Institution Agreements are legal agreements that establish a relationship between two parties, typically involving fiduciary duties and financial obligations. These agreements ensure that both parties fulfill their responsibilities and protect the interests of all involved. One type of Clarksville, Tennessee Fiduciary Agreement is a Trustee Agreement. In this agreement, a trustee is appointed to manage assets or property on behalf of another party, known as the beneficiary. The trustee holds a legal duty to act in the best interests of the beneficiary and must adhere to specific guidelines outlined in the agreement. Another type is a Power of Attorney Agreement, which grants an individual the authority to act on behalf of another person in financial or legal matters. The appointed individual, known as the agent or attorney-in-fact, must act responsibly and make decisions that align with the best interests of the principal. In the realm of financial institutions, Clarksville, Tennessee Financial Institution Agreements include various types. One common agreement is a Banking Services Agreement, which outlines the terms and conditions for using the services of a specific bank. This agreement may cover matters such as account maintenance, transaction limits, fees, and responsibilities of both the bank and the customer. Additionally, a Loan Agreement is a financial institution agreement that governs the terms and conditions of a loan between a lender and a borrower. This agreement specifies the loan amount, interest rates, repayment schedule, and any collateral or security involved. Clarksville, Tennessee Fiduciary and Financial Institution Agreements are essential for ensuring transparency, accountability, and legal protection in financial relationships. These agreements lay the foundation for a mutually beneficial partnership, providing clarity on roles, responsibilities, and expectations for all parties involved. It is important to consult with legal professionals to draft and review these agreements to ensure compliance with applicable laws and regulations.

Clarksville Tennessee Fiduciary and Financial Institution Agreements

Description

How to fill out Clarksville Tennessee Fiduciary And Financial Institution Agreements?

If you are looking for a valid form template, it’s impossible to find a better service than the US Legal Forms site – one of the most comprehensive online libraries. Here you can get a large number of document samples for business and personal purposes by types and states, or key phrases. With our advanced search option, finding the most up-to-date Clarksville Tennessee Fiduciary and Financial Institution Agreements is as elementary as 1-2-3. Furthermore, the relevance of each and every document is proved by a group of expert attorneys that regularly review the templates on our website and update them according to the newest state and county regulations.

If you already know about our platform and have a registered account, all you should do to receive the Clarksville Tennessee Fiduciary and Financial Institution Agreements is to log in to your profile and click the Download button.

If you use US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have chosen the form you want. Look at its information and make use of the Preview option (if available) to see its content. If it doesn’t meet your requirements, use the Search field near the top of the screen to discover the needed document.

- Confirm your selection. Select the Buy now button. Following that, choose your preferred pricing plan and provide credentials to register an account.

- Process the purchase. Utilize your credit card or PayPal account to complete the registration procedure.

- Get the form. Select the file format and download it to your system.

- Make modifications. Fill out, modify, print, and sign the received Clarksville Tennessee Fiduciary and Financial Institution Agreements.

Every single form you save in your profile has no expiry date and is yours permanently. It is possible to gain access to them via the My Forms menu, so if you need to get an additional version for modifying or creating a hard copy, you can return and save it once more whenever you want.

Make use of the US Legal Forms extensive library to get access to the Clarksville Tennessee Fiduciary and Financial Institution Agreements you were looking for and a large number of other professional and state-specific templates on a single platform!

Form popularity

FAQ

To file an annual report for your LLC in Tennessee, visit the Secretary of State’s website. You can complete the filing online, providing essential details about your business. Using platforms like uslegalforms can simplify the process, helping you manage your Clarksville Tennessee Fiduciary and Financial Institution Agreements effectively.

resident fiduciary is an individual or entity that manages the assets of a trust or estate in Tennessee but does not reside in the state. This can include outofstate trustees or executors. Understanding the implications of nonresident fiduciaries is essential for effective Clarksville Tennessee Fiduciary and Financial Institution Agreements.

If you fail to file an annual report for your LLC in Tennessee, you risk losing your business status. This may lead to administrative dissolution, meaning you can no longer legally operate your business. To avoid complications with your Clarksville Tennessee Fiduciary and Financial Institution Agreements, ensure timely filing each year.

Yes, Tennessee provides a grace period for filing annual reports for LLCs. After the due date, you typically have a two-month grace period to file without incurring penalties. However, it's important to note that late fees may apply, and maintaining compliance is crucial for your Clarksville Tennessee Fiduciary and Financial Institution Agreements.

The minimum assets required for a financial advisor can vary widely based on the advisor's business model and services. Many advisors set minimums between $100,000 to $500,000 for investment management services. However, it’s essential to inquire directly with your chosen advisor about their requirements. When considering Clarksville Tennessee Fiduciary and Financial Institution Agreements, ensure you select a financial advisor who aligns with your asset level and financial needs.

To find a certified financial planner fiduciary, start by researching local professionals who specialize in fiduciary services. You can also visit the website of the National Association of Personal Financial Advisors, which lists certified fiduciaries. Additionally, consider using platforms like USLegalForms, where you can discover resources for Clarksville Tennessee Fiduciary and Financial Institution Agreements. This ensures you choose a qualified planner who will prioritize your financial goals.

The seven essential requirements for a deed to be valid in Tennessee include the grantor's and grantee's names, a clear property description, the grantor's signature, delivery of the deed, acceptance by the grantee, proper legal purpose, and recording in the appropriate county. Meeting these criteria is crucial for protecting both parties involved. When engaging with Clarksville Tennessee Fiduciary and Financial Institution Agreements, adhering to these requirements strengthens legal standing.

A warranty deed may be rendered invalid due to several circumstances, such as lacking the required signatures, missing notarization, or containing incorrect information. Additionally, failure to follow state recording procedures can also affect validity. When creating Clarksville Tennessee Fiduciary and Financial Institution Agreements, ensuring accurate and complete documentation is vital to avoid potential issues.

Many banks and credit unions offer fiduciary accounts, designed to serve individuals managing funds on behalf of others under a fiduciary relationship. Notable institutions include national and regional banks as well as specialized financial firms. For those involved in Clarksville Tennessee Fiduciary and Financial Institution Agreements, it's beneficial to explore various options to find the best services that meet your needs.

To be legally valid in Tennessee, a deed must contain specific components, including the parties' names, a clear property description, and appropriate execution by the grantor. Furthermore, it should be recorded in the county where the property is located to provide notice to the public. If you're navigating Clarksville Tennessee Fiduciary and Financial Institution Agreements, aligning with these legal criteria is essential.