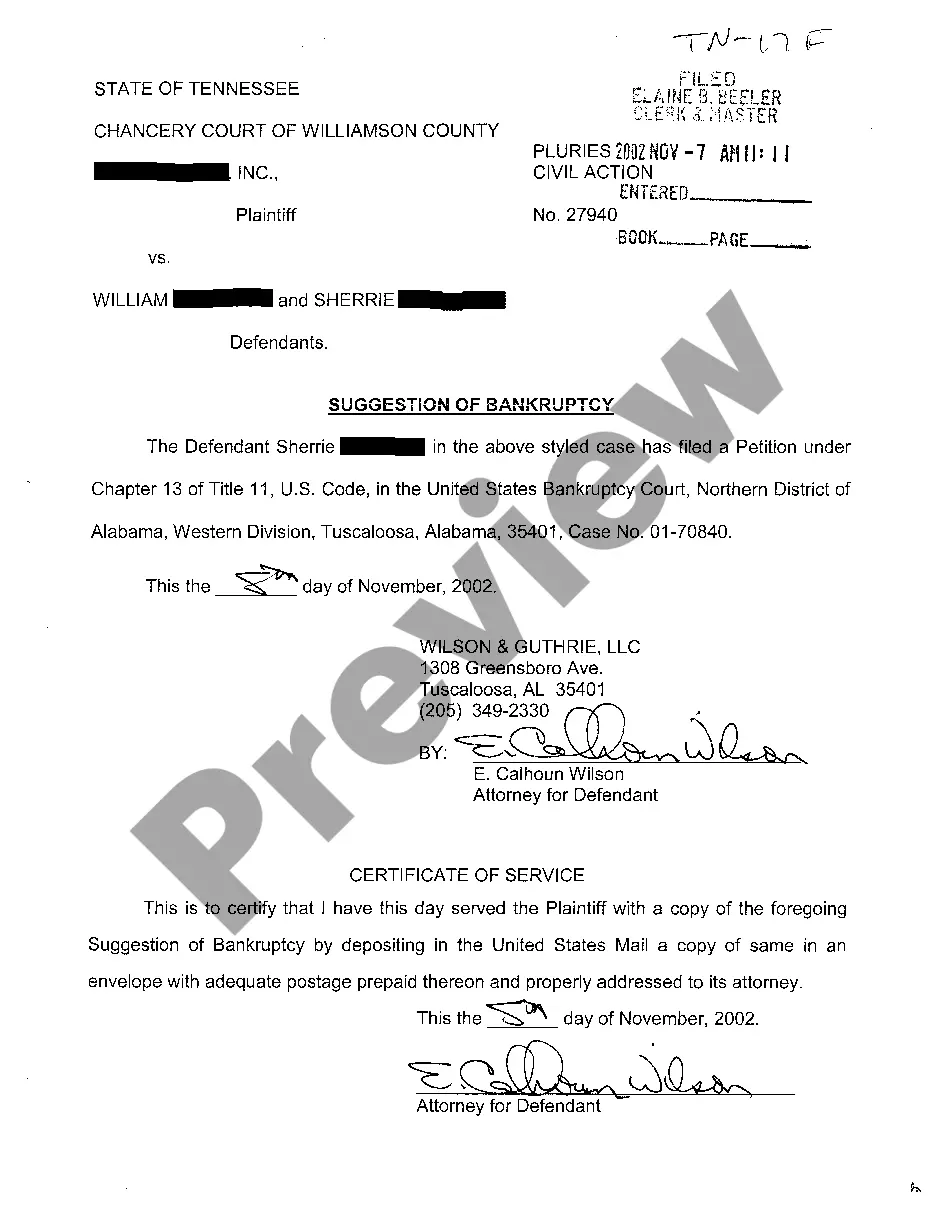

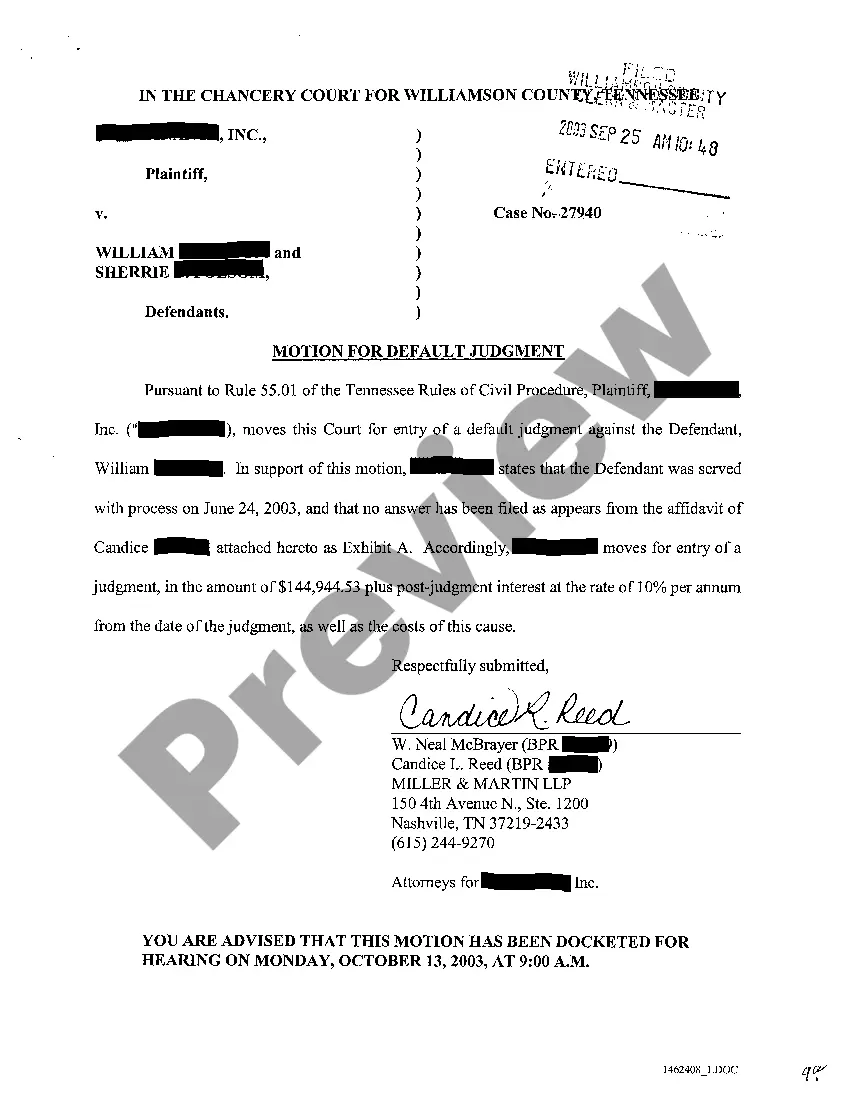

Memphis Tennessee Suggestion of Bankruptcy by Defendant to the Court is a legal document filed by a defendant in a court case in the city of Memphis, Tennessee, informing the court of the defendant's intent to file for bankruptcy. This suggestion is usually made as a defense or as a means to request a temporary stay or dismissal of the ongoing litigation until the defendant's bankruptcy proceedings are concluded. Keywords for this description include "Memphis Tennessee" to indicate the jurisdiction where the suggestion is being made, "suggestion of bankruptcy" to highlight the purpose of the filing, "defendant" to identify the party making the suggestion, and "court" to specify the recipient of the document. Depending on the specific circumstances, there are different types of Memphis Tennessee Suggestion of Bankruptcy by Defendant to the Court. These can include: 1. Suggestion of Bankruptcy for Dismissal: In some cases, a defendant may argue that their bankruptcy filing indicates their inability to meet financial obligations in the lawsuit. Therefore, the defendant may request the court to dismiss the case against them, as their financial recovery will be handled through bankruptcy proceedings. 2. Suggestion of Bankruptcy for Stay: In some instances, the defendant may request the court to grant a temporary stay in the ongoing litigation. This allows the bankruptcy proceedings to take priority and be completed before further action is taken in the original case. 3. Suggestion of Bankruptcy for Settlement: Alternatively, the defendant may propose a settlement agreement to the court and other parties involved, suggesting that their bankruptcy filing indicates the need for a revised resolution due to their financial circumstances. It's important to note that the specifics and requirements of a Memphis Tennessee Suggestion of Bankruptcy by Defendant to the Court may vary depending on local rules and regulations. The filing must adhere to the relevant bankruptcy laws and court procedures of the state, as well as any specific guidelines set by the court where the case is being heard.

Memphis Tennessee Suggestion of Bankruptcy by Defendant to the Court

Description

How to fill out Memphis Tennessee Suggestion Of Bankruptcy By Defendant To The Court?

Are you searching for a dependable and budget-friendly provider of legal documents to obtain the Memphis Tennessee Suggestion of Bankruptcy by Defendant to the Court? US Legal Forms is your optimal choice.

Whether you require a straightforward arrangement to establish guidelines for living together with your partner or a collection of forms to facilitate your divorce through the court, we have you covered. Our platform features over 85,000 current legal document templates for personal and business use. All templates we provide are specific and tailored according to the requirements of respective states and regions.

To access the form, you must Log In to your account, find the desired form, and click the Download button next to it. Please note that you can redownload your previously acquired document templates anytime in the My documents section.

Are you unfamiliar with our website? No problem. You can easily create an account, but before you do, ensure to follow these steps.

Now you can register your account. Then choose your subscription plan and proceed to payment. Once the payment is completed, you can download the Memphis Tennessee Suggestion of Bankruptcy by Defendant to the Court in any of the available file formats. You can return to the website anytime and redownload the form at no extra cost.

Obtaining updated legal forms has never been simpler. Try US Legal Forms now, and stop wasting your precious time searching for legal documents online for good.

- Verify if the Memphis Tennessee Suggestion of Bankruptcy by Defendant to the Court complies with the laws of your state and locality.

- Review the form's specifications (if available) to determine its applicability to your situation.

- Start a new search if the form does not fit your legal needs.

Form popularity

FAQ

A suggestion of bankruptcy is a document filed in a Nebraska county or district court collection lawsuit. It provides notice to the court, the collection agency that filed the lawsuit, and the employers with wage garnishments, that the defendant has filed bankruptcy in the United States Bankruptcy Court.

Bankruptcy attorneys in Tennessee cost between $1,100 ? $1,200. Written by Upsolve Team. The price of a personal bankruptcy attorney in Tennessee is around $1,150.00 (Low: $1,100.00.

A Bankruptcy petition is a collection of forms also known as schedules that disclose all of your financial information to the Bankruptcy Court. These forms will list all of your assets (real and personal property), monthly income and expenses and most importantly the liabilities and debts you wish to eliminate.

For Chapter 7 bankruptcy, the current court cost for Tennessee (2020) is $338. However, if your income is less than 1.5x the poverty level, the bankruptcy court may waive that fee. Attorney fees for Chapter 7 are typically paid upfront and average $1,200 depending on the complexity of your case.

Bankruptcy is a legal proceeding initiated when a person or business is unable to repay outstanding debts or obligations. The bankruptcy process begins with a petition filed by the debtor, which is most common, or on behalf of creditors, which is less common.

The cost to file bankruptcy in Tennessee is $338 for a Chapter 7 bankruptcy and $313 for a Chapter 13 bankruptcy, but the answer becomes more nuanced if you decide to file with a bankruptcy attorney and if you are trying to get the filing fees waived.

Steps in a Tennessee Bankruptcy learn about Chapters 7 and 13. check whether bankruptcy will erase debt. find out if you can keep property. determine whether you qualify. consider hiring a bankruptcy lawyer. stop paying qualifying debts. gather necessary financial documents. take a credit counseling course.

The biggest difference between Chapter 7 and Chapter 13 is that Chapter 7 focuses on discharging (getting rid of) unsecured debt such as credit cards, personal loans and medical bills while Chapter 13 allows you to catch up on secured debts like your home or your car while also discharging unsecured debt.

A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. In other words, the debtor is no longer legally required to pay any debts that are discharged.

Bankruptcy is a process under federal law designed to help people and businesses get protection from their creditors. An important goal of bankruptcy is to give individuals with debt problems a chance for a fresh financial start. For some elders, bankruptcy does this by eliminating the legal obligation to pay debts.