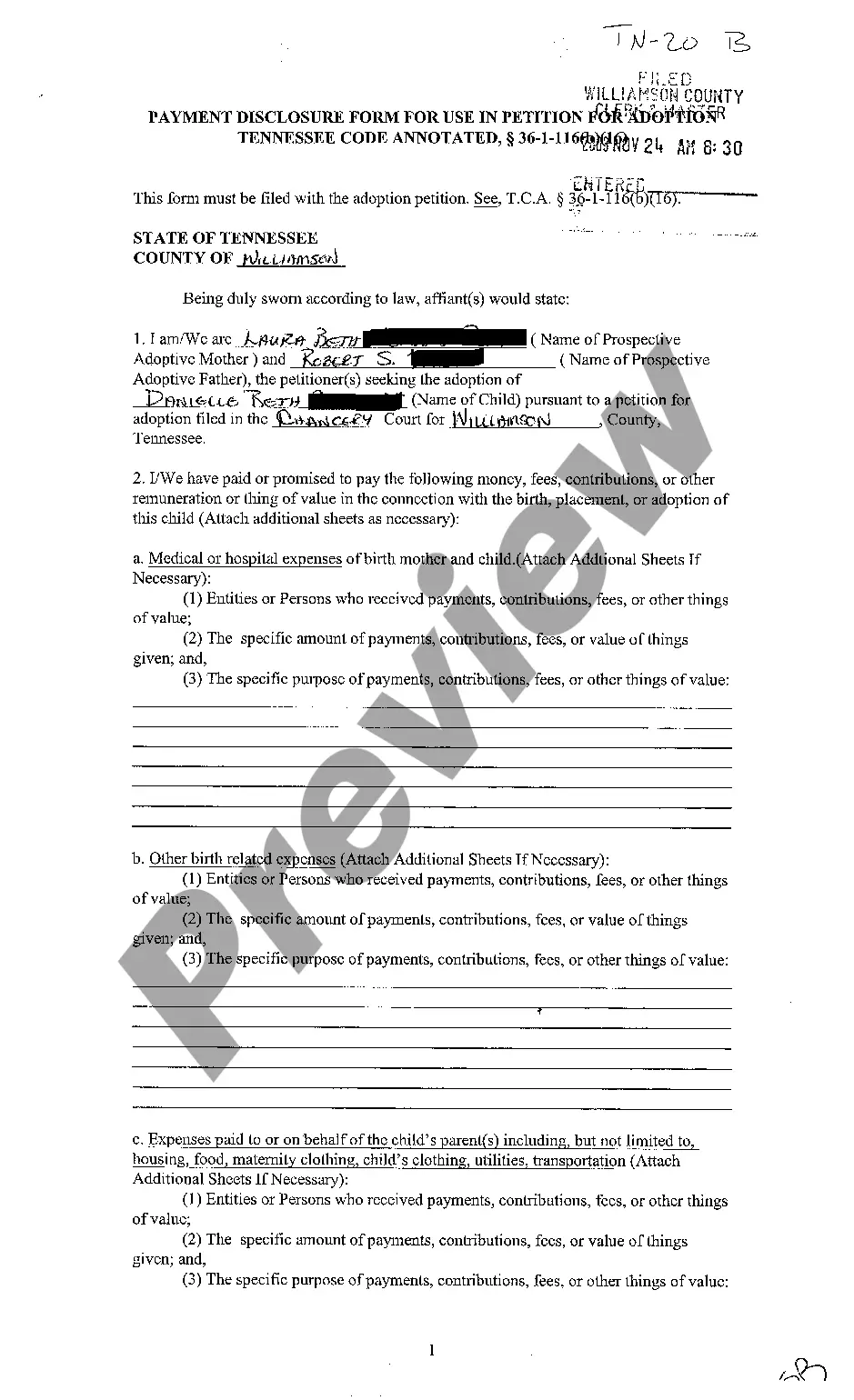

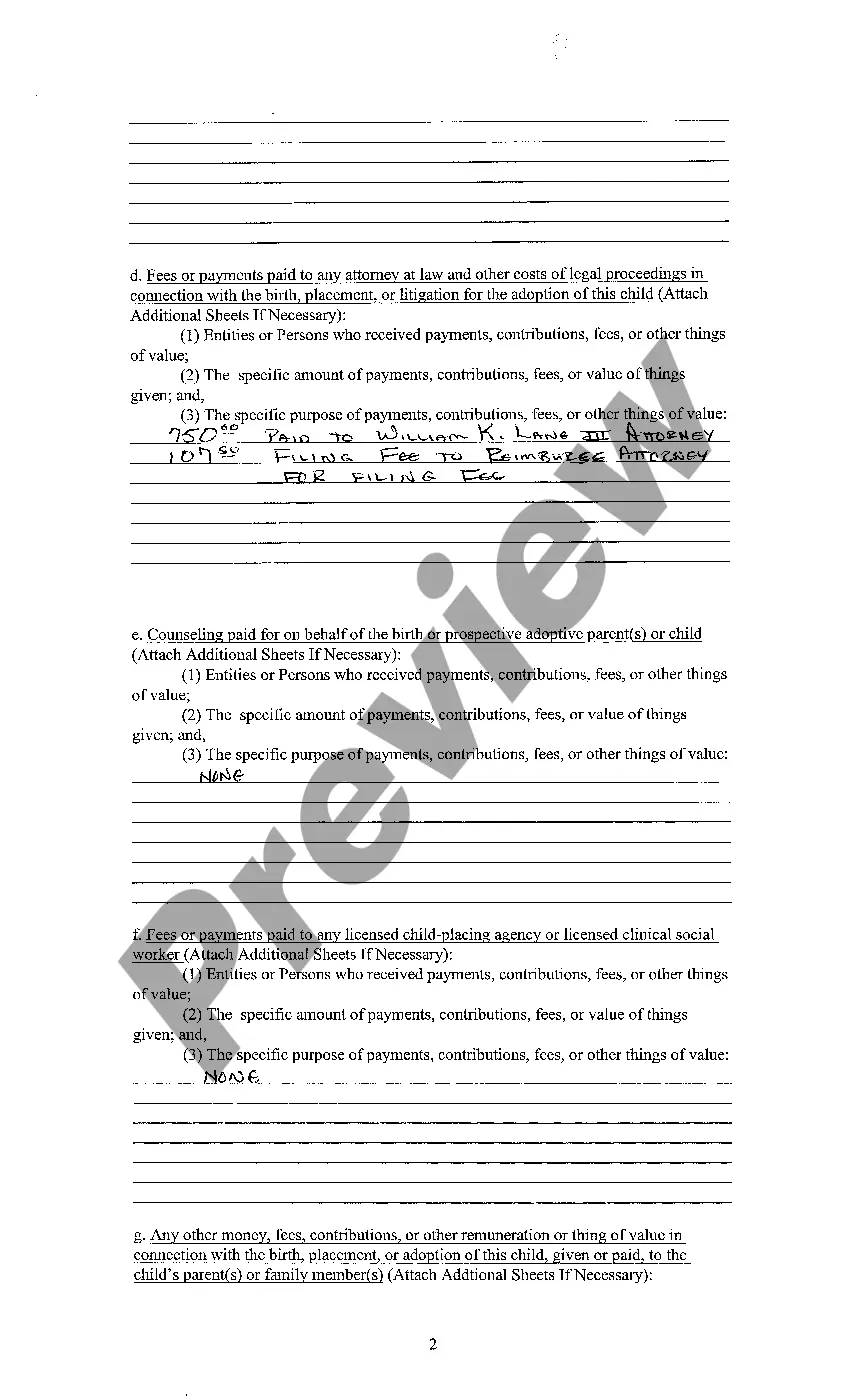

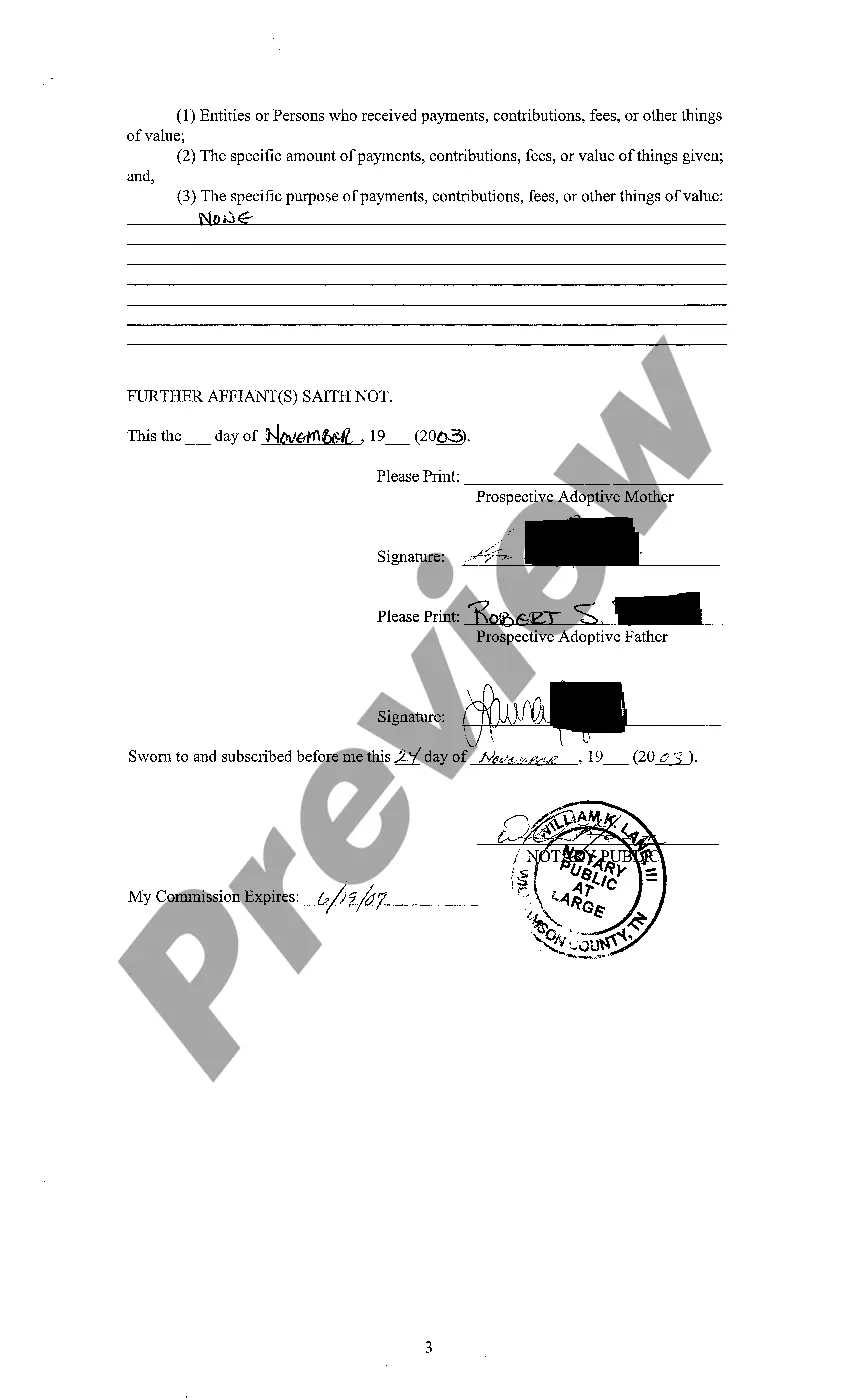

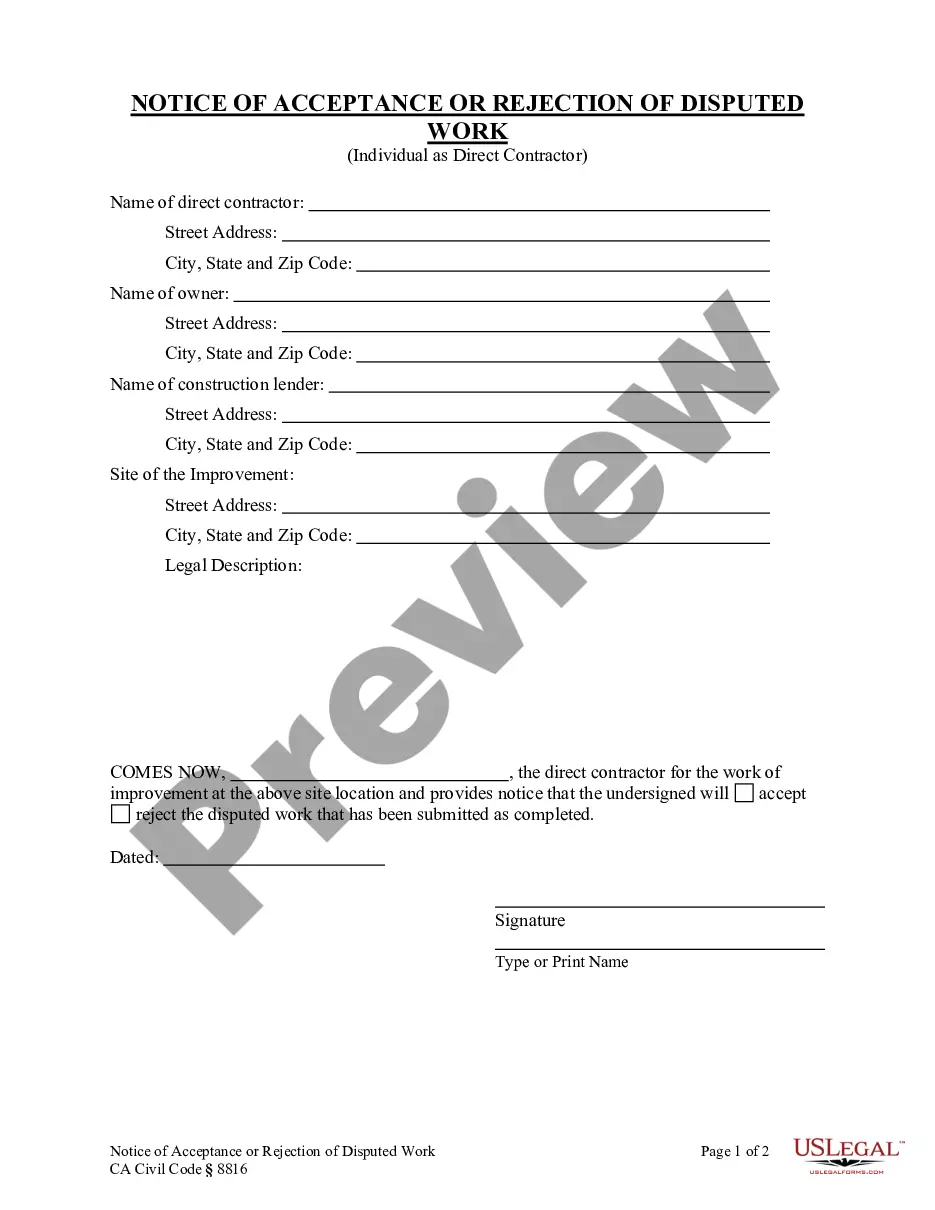

The Memphis Tennessee Payment Disclosure Form is a legally mandated document designed to provide transparency and clarity between businesses and consumers regarding the payment terms and conditions for goods and services offered. It outlines the various charges, fees, and payment options associated with a specific transaction. This form is a crucial tool for both businesses and consumers in Memphis, Tennessee, as it helps prevent misunderstandings, disputes, and potential legal issues related to payments. The Payment Disclosure Form includes relevant keywords such as: 1. Payment Terms: This section clearly describes the agreed-upon terms, including upfront payments, installment plans, or any other agreed-upon arrangements for the completion of a payment. 2. Purchase Price: Specifies the total cost of the product or service, including taxes, fees, and any applicable discounts. A breakdown of additional charges and their purpose may also be included. 3. Payment Options: Outlines the available methods for customers to make payments, such as cash, credit/debit card, check, or online platforms. It may also include details about any associated processing fees or restrictions. 4. Refund and Cancellation Policies: This section highlights the conditions and procedures for requesting refunds or canceling transactions. It may specify any applicable deadlines, deductions, or non-refundable deposits. 5. Late Payment Charges: Details any penalties or interest rates applicable to late payments. It may specify the consequences of non-payment, such as collections or legal action. 6. Dispute Resolution: Outlines the steps to follow in the event of a payment-related dispute. It may include contact information for the relevant authorities or agencies involved in resolving such issues. 7. Additional Disclosures: Provides space for additional information that the business deems necessary to disclose, such as warranty terms, delivery timelines, or any other relevant terms and conditions. Different types of Memphis Tennessee Payment Disclosure Forms may exist based on the industry or specific transaction. Some common examples could include: — Retail Sales Payment Disclosure Form: Typically used for transactions involving the sale of goods or products at retail establishments. — Service Agreement Payment Disclosure Form: Specific to service-based transactions, such as repair services, professional consultations, or contractor work. — Rental/Lease Payment Disclosure Form: Designed for leasing or rental transactions, whether for residential or commercial properties, vehicles, or equipment. It is essential for businesses to use the appropriate Payment Disclosure Form relevant to their industry and ensure its accurate completion. Consumers should carefully review the form before agreeing to any payment terms to understand their obligations and rights in the transaction.

Memphis Tennessee Payment Disclosure Form

Description

How to fill out Memphis Tennessee Payment Disclosure Form?

Do you require a reliable and cost-effective provider of legal forms to obtain the Memphis Tennessee Payment Disclosure Form? US Legal Forms is your ideal choice.

Whether you need a straightforward agreement to establish guidelines for living together with your partner or a set of documents to facilitate your separation or divorce through the court system, we have you covered. Our website features over 85,000 current legal document templates for personal and business purposes. All templates that we provide are tailored and crafted to meet the standards of specific states and counties.

To download the document, you must Log Into your account, locate the desired form, and click the Download button adjacent to it. Please remember that you can download your previously acquired document templates anytime in the My documents section.

Is this your first time visiting our website? No problem. You can create an account in just a few minutes, but first, ensure that you do the following.

Now you can register for your account. After that, select your subscription plan and move forward with the payment. Once payment is completed, you can download the Memphis Tennessee Payment Disclosure Form in any offered format. You can return to the website any time and redownload the document without incurring additional charges.

Obtaining current legal documents has never been simpler. Try US Legal Forms today and put an end to wasting your precious time searching for legal documents online.

- Verify that the Memphis Tennessee Payment Disclosure Form aligns with the rules of your state and locality.

- Review the description of the form (if available) to understand its intended audience and purpose.

- Restart your search if the form does not suit your legal situation.

Form popularity

FAQ

How to File for Divorce in Tennessee 1) Complete the Divorce Complaint. The first step in filing for divorce in Tennessee is completing the Complaint for Divorce form.2) File the Forms.3) Serve Your Spouse.4) Settlement or Discovery.5) Attend Parenting Class.5) Continued Settlement Efforts or Divorce Trial.

Free Divorce Forms for Couples with NO Children Both spouses must agree on all parts of the divorce. You and your spouse need to agree that you have ?irreconcilable differences? One or both of you must have lived in Tennessee for the last six months or when the decision to divorce was made.

If you desire a legal separation in Tennessee, you must file a request in court. It is important to hire a competent Tennessee legal separation attorney to handle your case. An experienced Tennessee legal separation attorney is very important, since granting a divorce or legal separation is up to the judge.

The forms needed to file for Tennessee divorce are a Complaint for Divorce, Summons, a spouses' personal information form, and any other form required by your local court.

The average cost of divorce in Tennessee is around $10,000 in attorney's fees and about $3,000 in additional expenses. This is slightly higher than the national average. You can expect to pay around $17,000 if you have alimony or property division issues.

In limited circumstances, it is possible to get an ?agreed divorce? in Tennessee without hiring an attorney. The Tennessee Supreme Court has approved divorce forms that, if properly completed, must be accepted by all Tennessee courts that hear divorce cases.

The procedure for filing for a separation in Tennessee is the same as the procedure for filing for divorce. You must file a petition with the court and ask for a hearing. The court can rule on your case 60 days after you file if there are no children. If you and your spouse have children, the waiting period is 90 days.

The process begins with the filing of a petition by one spouse. The petition must state the reasons for the separation, including any violent or abusive behavior on the part of the other spouse. If the court agrees that a judicial separation is necessary, it will order the couple to begin the separation process.

Do I have to go to court for a Tennessee divorce? Not always. If the parties can reach an agreement on all issues, they will ?settle.? A settlement can be reached between the parties by exchanging settlement agreements or at mediation. If a settlement is reached, only one spouse will go to court for the final hearing.

The legal separation process begins when either spouse files a petition with the court. At least one spouse must meet the state's residency requirement (being a Tennessee resident for at least 6 months before filing). The filing spouse must provide the court with the grounds (legal reason) for the request.