Title: Understanding Clarksville Tennessee Complaints Regarding Advance Collection of Insurance Premiums Introduction: In Clarksville, Tennessee, complaints related to the collection of advance payments for insurance premiums have garnered attention. This article aims to provide a detailed description of these complaints, shedding light on the various types of complaints and their implications for both insurance providers and policyholders. 1. Clarksville Tennessee Complaints: Clarksville residents have voiced concerns about insurance companies collecting advances for premiums. These complaints are widespread and involve various aspects. It is crucial to address these concerns to establish a fair and transparent system for both insurance providers and policyholders. 2. Advance Collection System: The advance collection of insurance premiums is a common practice that ensures policyholders maintain continuous coverage. Typically, insurance providers collect premiums in advance to ensure uninterrupted coverage and mitigate the risks associated with non-payment. This method allows insurers to offer coverage while securing their financial stability. 3. Types of Complaints: a. Excessive Advance Premiums: — Policyholders complain about insurance companies demanding excessively high advance payment amounts, impacting affordability. — Some may find it difficult to manage the upfront financial burden while maintaining other necessary expenses. b. Lack of Transparency: — Complaints arise when policyholders find it challenging to comprehend the complex calculation methods employed for determining advance premium amounts. — Lack of transparency in this process detracts from trust and confidence in insurance providers. c. Inadequate Notice Period: — Some policyholders complain about insufficient notice periods provided by insurers before collecting advanced premiums. — Inadequate time for policyholders to plan their finances leads to resentment and potential difficulties in making payments on time. d. Difficult Cancellation and Refund Policies: — Complaints surround the challenging process of canceling policies and obtaining refunds for advanced premiums. — Policyholders express frustration due to lengthy bureaucratic procedures, delays, and stringent eligibility criteria. 4. Implications for Insurance Providers: Insurance companies need to address these complaints to maintain positive customer relationships and enhance their market reputation. Proactive measures to improve transparency, provide clear communication, and allow reasonable refund policies will help maintain policyholder satisfaction. 5. Implications for Policyholders: Policyholders should be aware of their rights and review insurance terms and conditions thoroughly. Before committing to an insurance policy, individuals should compare different providers, evaluate advance premium requirements, and understand cancellation and refund policies to make informed decisions. Conclusion: Clarksville, Tennessee, witnesses various complaints concerning insurance companies' collection of advance payments for insurance premiums. By addressing concerns related to excessive premiums, transparency, notice periods, and cancellation processes, insurers can restore confidence in their services. Likewise, policyholders should exercise due diligence before committing to insurance policies, ensuring they understand the terms and conditions to avoid any disputes related to advance premiums.

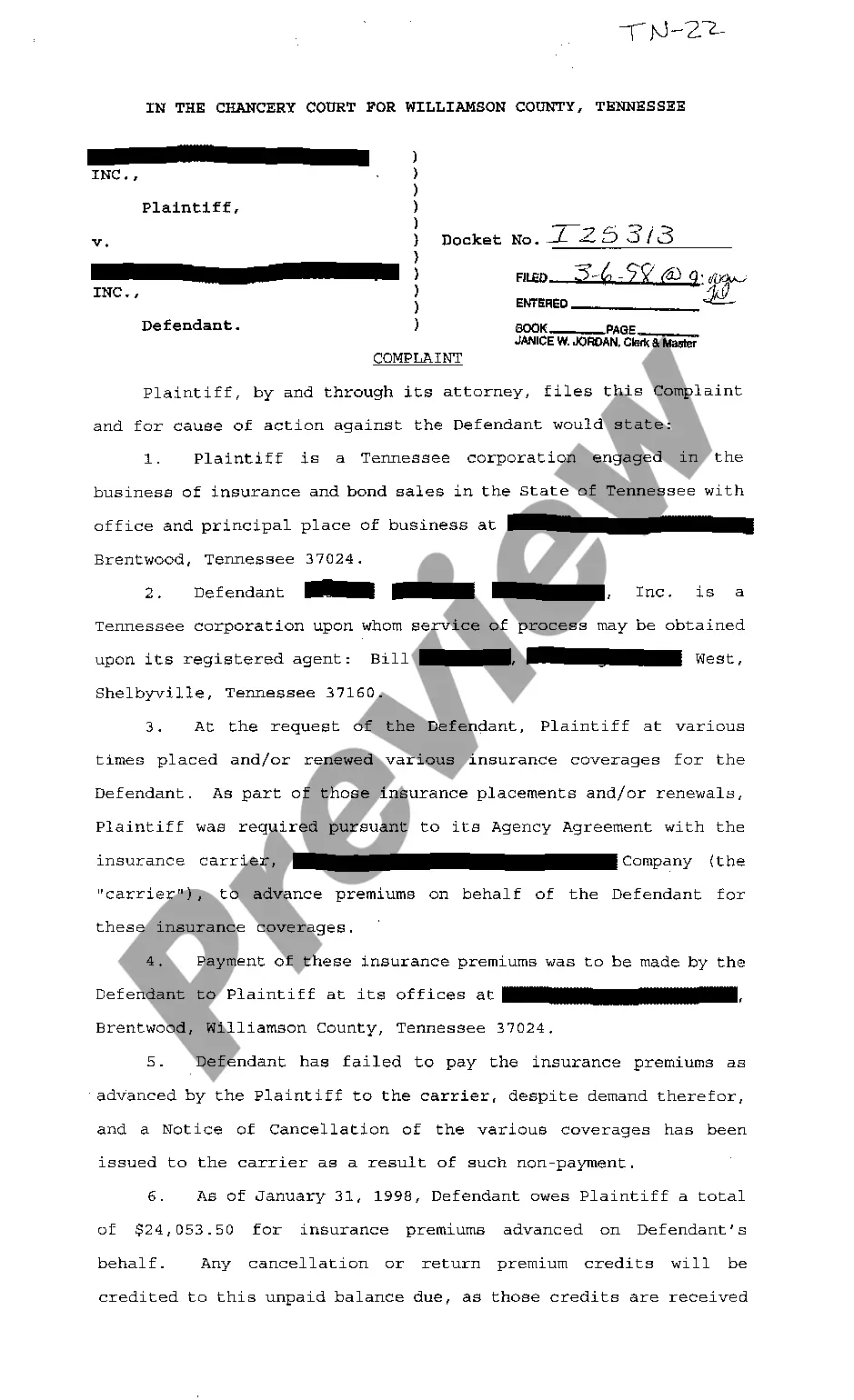

Clarksville Tennessee Complaint to collect advance made of insurance premiums

Description

How to fill out Clarksville Tennessee Complaint To Collect Advance Made Of Insurance Premiums?

If you are searching for a valid form template, it’s impossible to find a more convenient platform than the US Legal Forms site – one of the most extensive libraries on the web. Here you can get a huge number of templates for organization and individual purposes by categories and regions, or keywords. Using our advanced search function, getting the newest Clarksville Tennessee Complaint to collect advance made of insurance premiums is as easy as 1-2-3. Additionally, the relevance of every file is verified by a team of skilled attorneys that on a regular basis check the templates on our website and revise them based on the most recent state and county laws.

If you already know about our system and have a registered account, all you should do to receive the Clarksville Tennessee Complaint to collect advance made of insurance premiums is to log in to your account and click the Download option.

If you make use of US Legal Forms the very first time, just follow the instructions below:

- Make sure you have discovered the sample you need. Check its explanation and use the Preview option to explore its content. If it doesn’t meet your needs, use the Search option near the top of the screen to get the needed record.

- Confirm your choice. Click the Buy now option. After that, choose the preferred pricing plan and provide credentials to register an account.

- Make the purchase. Use your bank card or PayPal account to finish the registration procedure.

- Receive the form. Select the format and download it on your device.

- Make changes. Fill out, edit, print, and sign the obtained Clarksville Tennessee Complaint to collect advance made of insurance premiums.

Every form you save in your account does not have an expiration date and is yours forever. You always have the ability to gain access to them via the My Forms menu, so if you want to have an extra version for editing or creating a hard copy, you may come back and download it again anytime.

Make use of the US Legal Forms extensive catalogue to get access to the Clarksville Tennessee Complaint to collect advance made of insurance premiums you were looking for and a huge number of other professional and state-specific templates in one place!