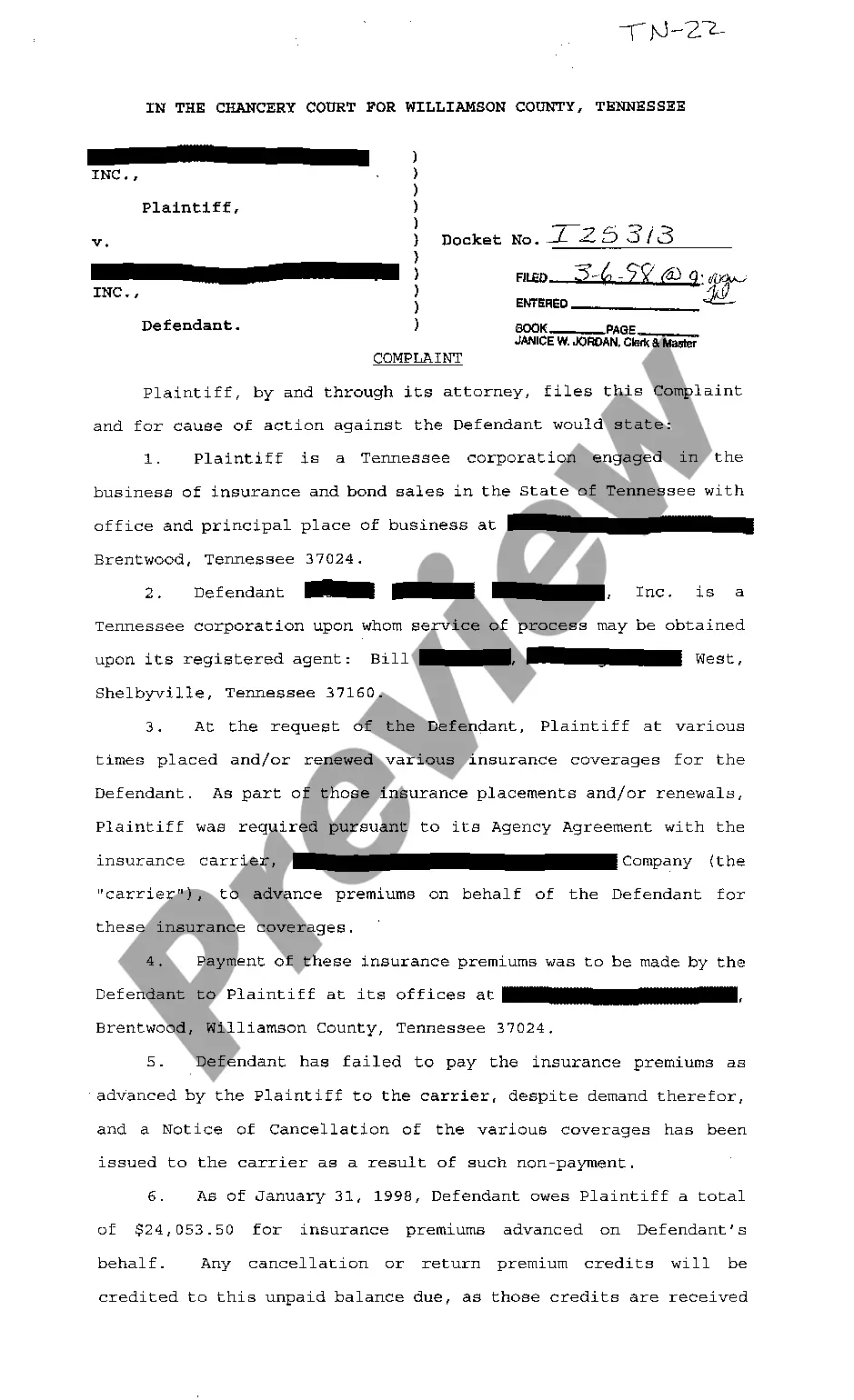

The Memphis Tennessee Complaint to collect advance made of insurance premiums refers to a specific type of complaint filed by policyholders to insurance companies in order to seek reimbursement for prepaid insurance premiums. Insurance premiums are the regular payments policyholders make to their insurance companies in exchange for coverage. In some cases, policyholders may choose to pay their premiums in advance, either for convenience or to take advantage of potential discounts offered by the insurance company. However, there may be instances where the policyholder needs to cancel or terminate their insurance policy before the expiry date. In such cases, the policyholder becomes eligible for a refund of the remaining portion of the prepaid premium. If an insurance company fails to provide the promised reimbursement, policyholders have the right to file a complaint with the appropriate authorities in Memphis, Tennessee. These complaints are designed to address any dispute between the policyholder and the insurance company regarding the collection of advance payments made for insurance premiums. Some common types of Memphis Tennessee Complaints related to the collection of advance insurance premiums include: 1. Delayed Refund Complaints: These complaints arise when insurance companies fail to promptly process and refund the prepaid premium amount after a policy cancellation or termination. The policyholder may allege unwarranted delays or lack of responsiveness from the insurance company, leading to financial inconvenience. 2. Partial Refund Complaints: In certain cases, a policyholder may request a partial refund of the prepaid premium if a policy is canceled before its intended expiration date. However, if the insurance company only offers a partial refund or no refund at all, the policyholder may file a complaint to seek the full reimbursement they believe they are entitled to. 3. Unfair Deduction Complaints: When a policyholder cancels their insurance policy, the insurance company may deduct certain fees or charges from the prepaid premium being refunded. However, if the policyholder considers these deductions to be excessive or unfair, they may file a complaint to challenge the insurance company's deduction practices. 4. Non-Responsive Complaints: This type of complaint arises when the policyholder encounters difficulties in contacting the insurance company or receiving a satisfactory response to their refund request. Delays in communication or lack of proper customer service can lead to frustration, prompting the policyholder to file a complaint. It is important to include relevant keywords such as "Memphis Tennessee Complaint," "advance made of insurance premiums," "refunds," "prepaid premiums," "delayed refund," "partial refund," "unfair deductions," and "non-responsive" when discussing and researching this specific type of complaint in Memphis, Tennessee.

Memphis Tennessee Complaint to collect advance made of insurance premiums

Description

How to fill out Memphis Tennessee Complaint To Collect Advance Made Of Insurance Premiums?

We always strive to reduce or prevent legal damage when dealing with nuanced law-related or financial affairs. To accomplish this, we sign up for attorney services that, usually, are extremely expensive. However, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of using services of legal counsel. We offer access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Memphis Tennessee Complaint to collect advance made of insurance premiums or any other document quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again in the My Forms tab.

The process is just as effortless if you’re unfamiliar with the website! You can create your account in a matter of minutes.

- Make sure to check if the Memphis Tennessee Complaint to collect advance made of insurance premiums adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Memphis Tennessee Complaint to collect advance made of insurance premiums is suitable for your case, you can pick the subscription option and make a payment.

- Then you can download the document in any suitable file format.

For over 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!