Knoxville Tennessee Confirmation of Accounting is a crucial process employed by businesses, organizations, and individuals to verify the accuracy and completeness of their financial records. This in-depth examination ensures that all financial transactions have been accurately recorded and provides reassurance to stakeholders, such as shareholders, investors, and regulatory bodies. The purpose of Knoxville Tennessee Confirmation of Accounting is to validate the reliability and integrity of financial statements, including income statements, balance sheets, and cash flow statements. It involves a meticulous review of all financial activities, including revenues, expenses, assets, and liabilities, to ensure compliance with generally accepted accounting principles (GAAP) and relevant regulatory standards. There are various types of Knoxville Tennessee Confirmation of Accounting, each serving a specific purpose within the financial auditing process. Some common types include: 1. External Audit: This is conducted by independent certified public accounting (CPA) firms, hired by organizations to provide an objective assessment of their financial records. These audits comply with the guidelines set by the American Institute of Certified Public Accountants (AICPA) and other regulatory bodies. 2. Internal Audit: Internal audit functions are performed by professionals within an organization to evaluate and improve its internal controls, risk management processes, and operational efficiency. The objective is to provide management with insights and recommendations to enhance financial performance and mitigate potential risks. 3. Tax Audit: This type of confirmation of accounting specifically focuses on verifying the accuracy and appropriateness of tax-related transactions and filings. Tax audits can be conducted by the Internal Revenue Service (IRS) or the Tennessee Department of Revenue to ensure compliance with tax laws and regulations. 4. Forensic Audit: Forensic auditing involves investigating potential fraud or financial misconduct within an organization. It aims to identify and gather evidence that can be used in legal proceedings or disciplinary actions against individuals involved in fraudulent activities. During Knoxville Tennessee Confirmation of Accounting, auditors employ a range of methods and techniques to examine financial documents, track transactions, conduct interviews with relevant personnel, and test the internal controls implemented by an organization. This comprehensive approach helps auditors form an independent opinion about the accuracy and reliability of the financial statements. In conclusion, Knoxville Tennessee Confirmation of Accounting plays a pivotal role in ensuring the credibility and transparency of financial records. It provides essential assurance to stakeholders and helps organizations maintain compliance with accounting standards and regulations. Different types of audits, such as external, internal, tax, and forensic audits, cater to specific needs and objectives, all contributing to the overall accuracy and integrity of financial reporting.

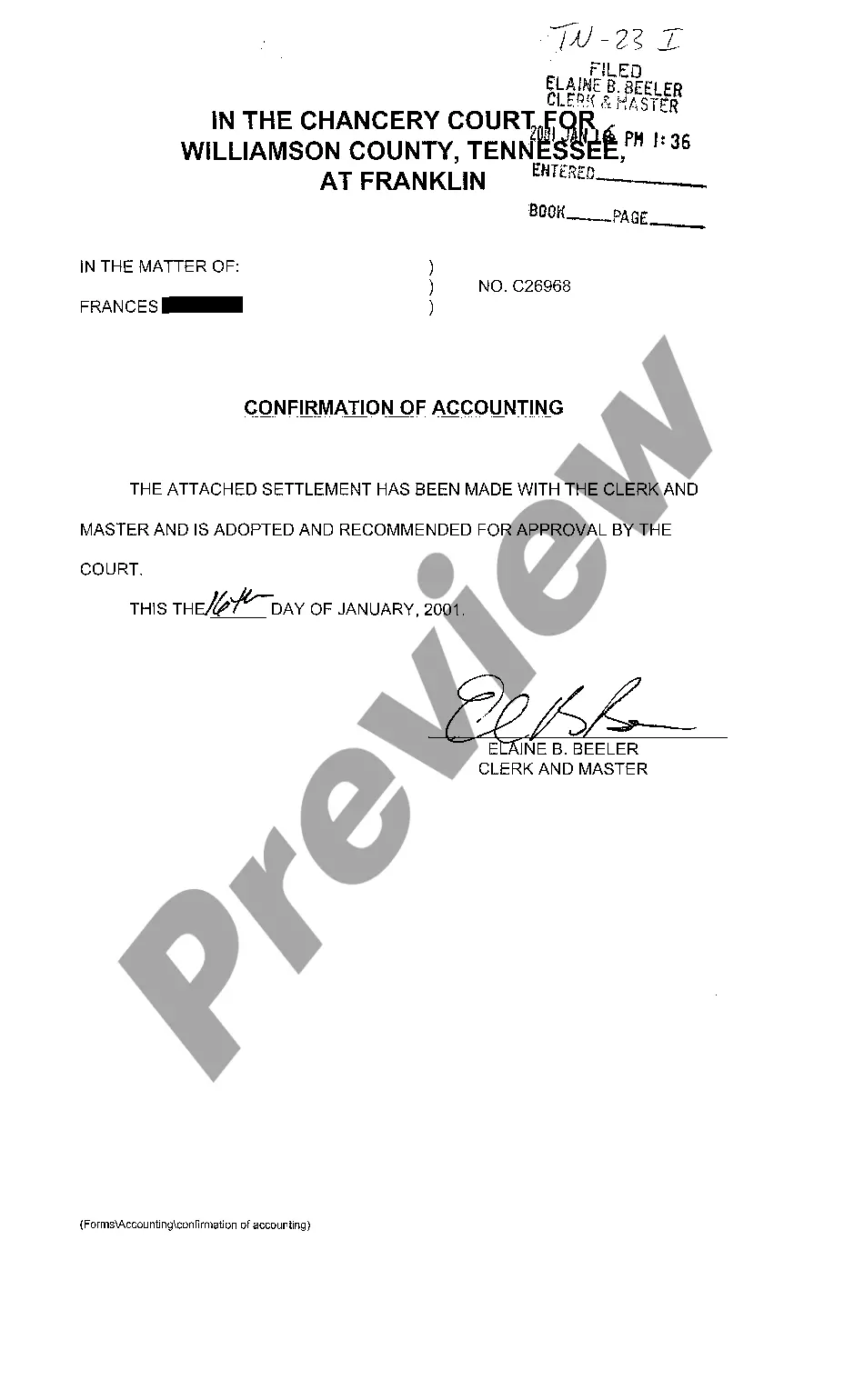

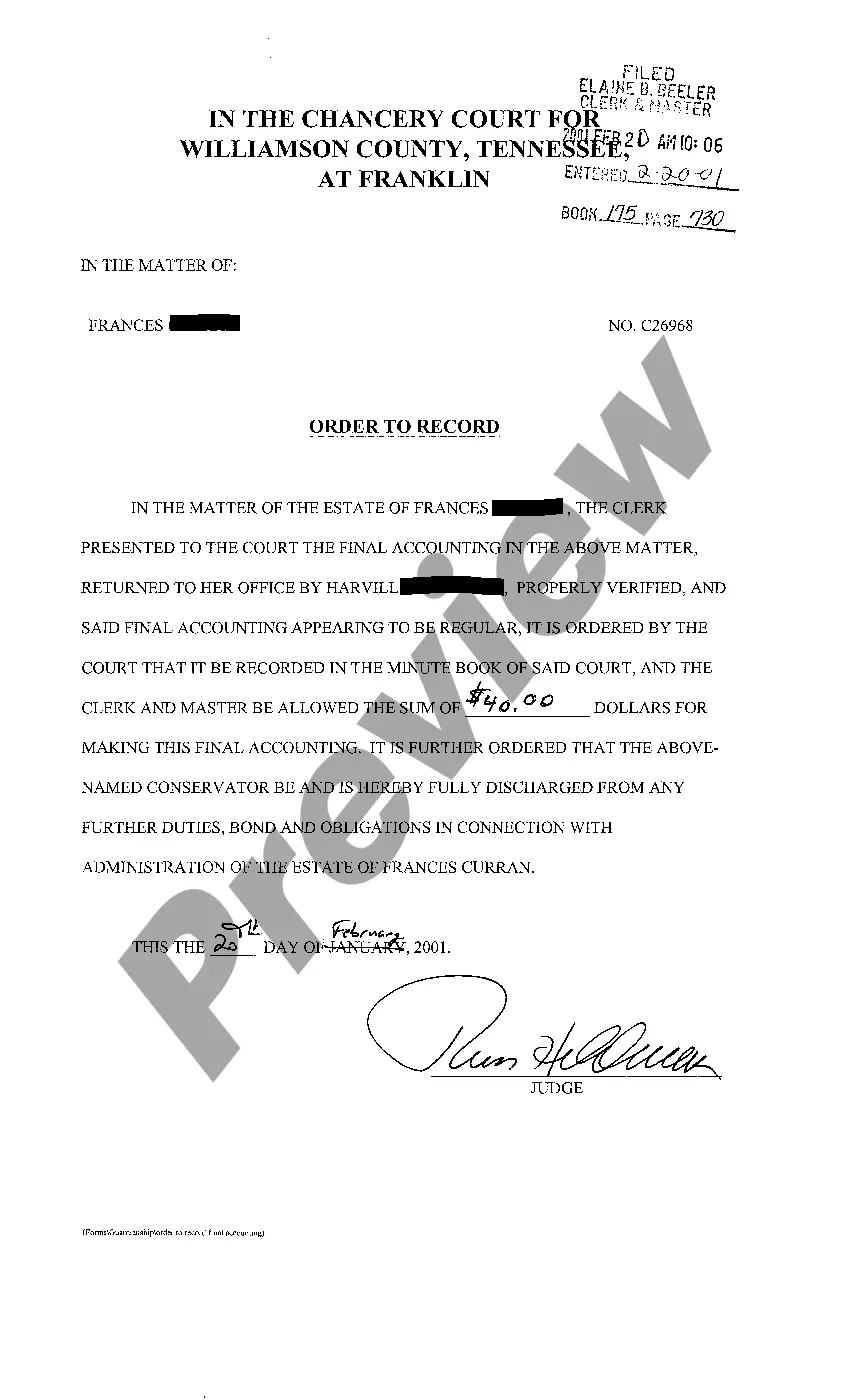

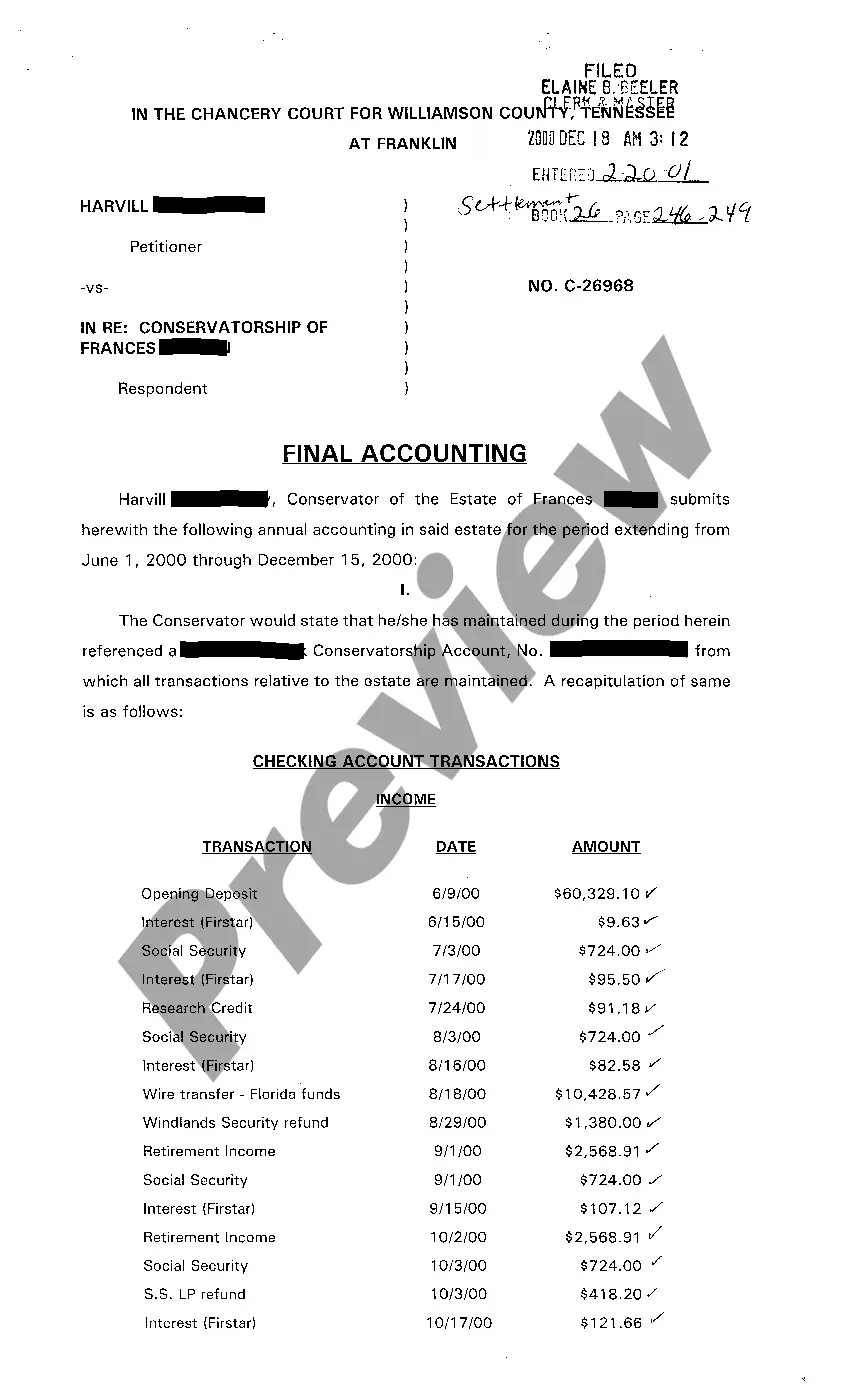

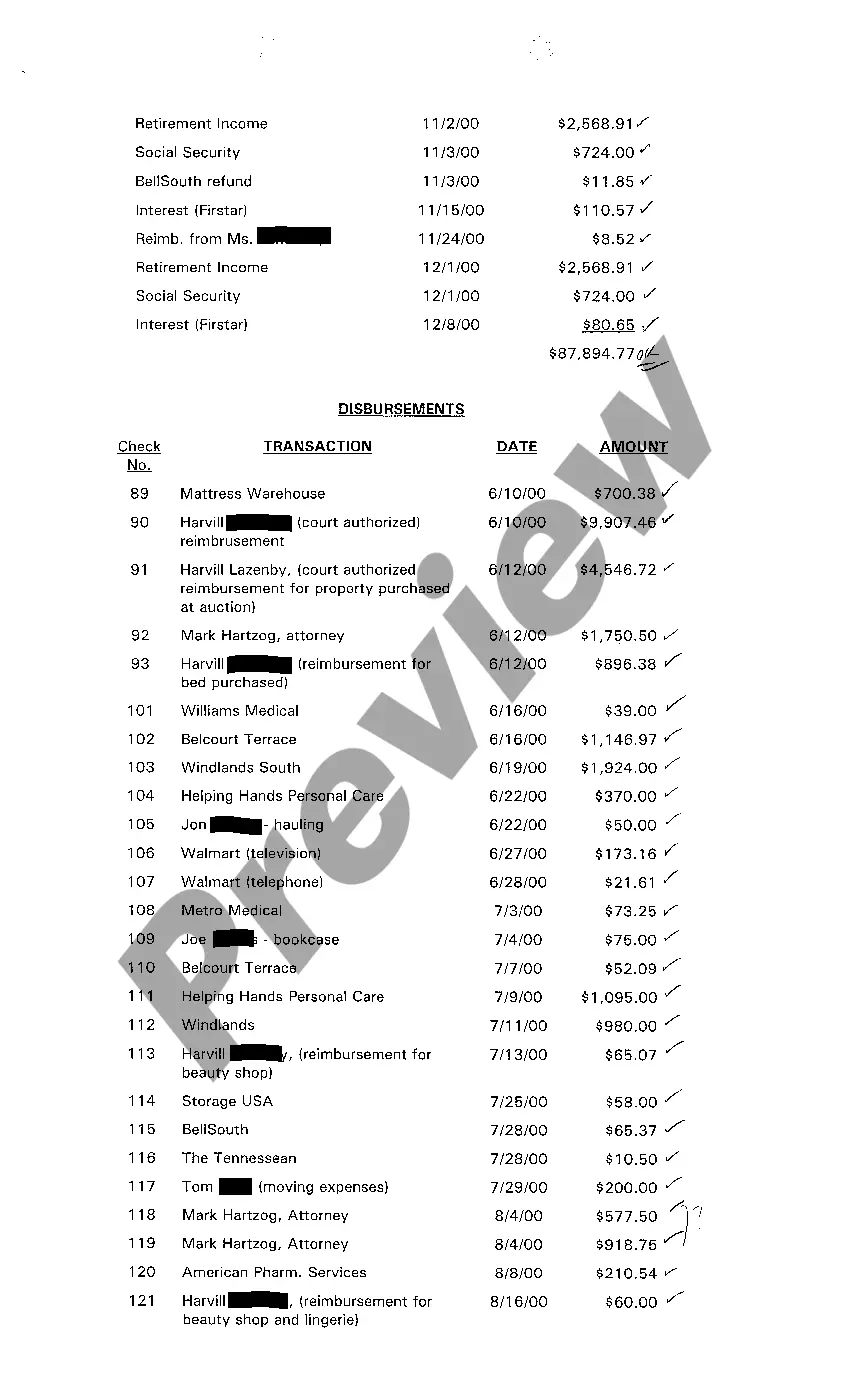

Knoxville Tennessee Confirmation of Accounting

Description

How to fill out Knoxville Tennessee Confirmation Of Accounting?

Benefit from the US Legal Forms and get immediate access to any form sample you require. Our helpful website with thousands of document templates simplifies the way to find and obtain almost any document sample you will need. It is possible to export, complete, and sign the Knoxville Tennessee Confirmation of Accounting in just a matter of minutes instead of browsing the web for hours trying to find a proper template.

Using our catalog is an excellent strategy to improve the safety of your form filing. Our professional lawyers on a regular basis check all the documents to make certain that the forms are relevant for a particular region and compliant with new laws and regulations.

How can you get the Knoxville Tennessee Confirmation of Accounting? If you already have a profile, just log in to the account. The Download option will be enabled on all the documents you look at. In addition, you can get all the previously saved records in the My Forms menu.

If you don’t have an account yet, follow the tips below:

- Find the form you need. Ensure that it is the template you were seeking: examine its name and description, and utilize the Preview function if it is available. Otherwise, make use of the Search field to find the appropriate one.

- Launch the saving procedure. Select Buy Now and select the pricing plan you like. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Save the document. Choose the format to obtain the Knoxville Tennessee Confirmation of Accounting and change and complete, or sign it according to your requirements.

US Legal Forms is one of the most extensive and trustworthy document libraries on the web. Our company is always happy to help you in virtually any legal case, even if it is just downloading the Knoxville Tennessee Confirmation of Accounting.

Feel free to take advantage of our service and make your document experience as efficient as possible!