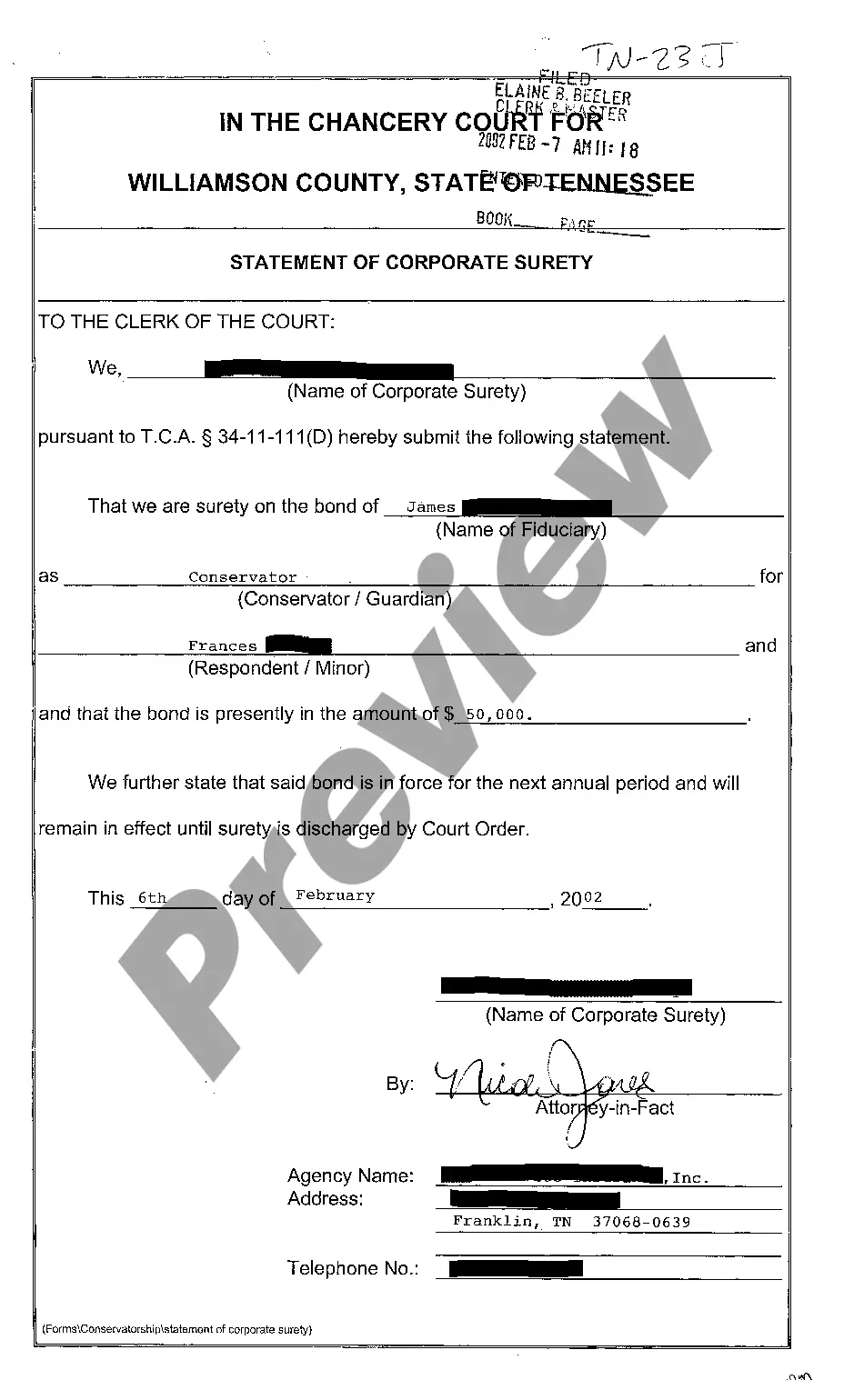

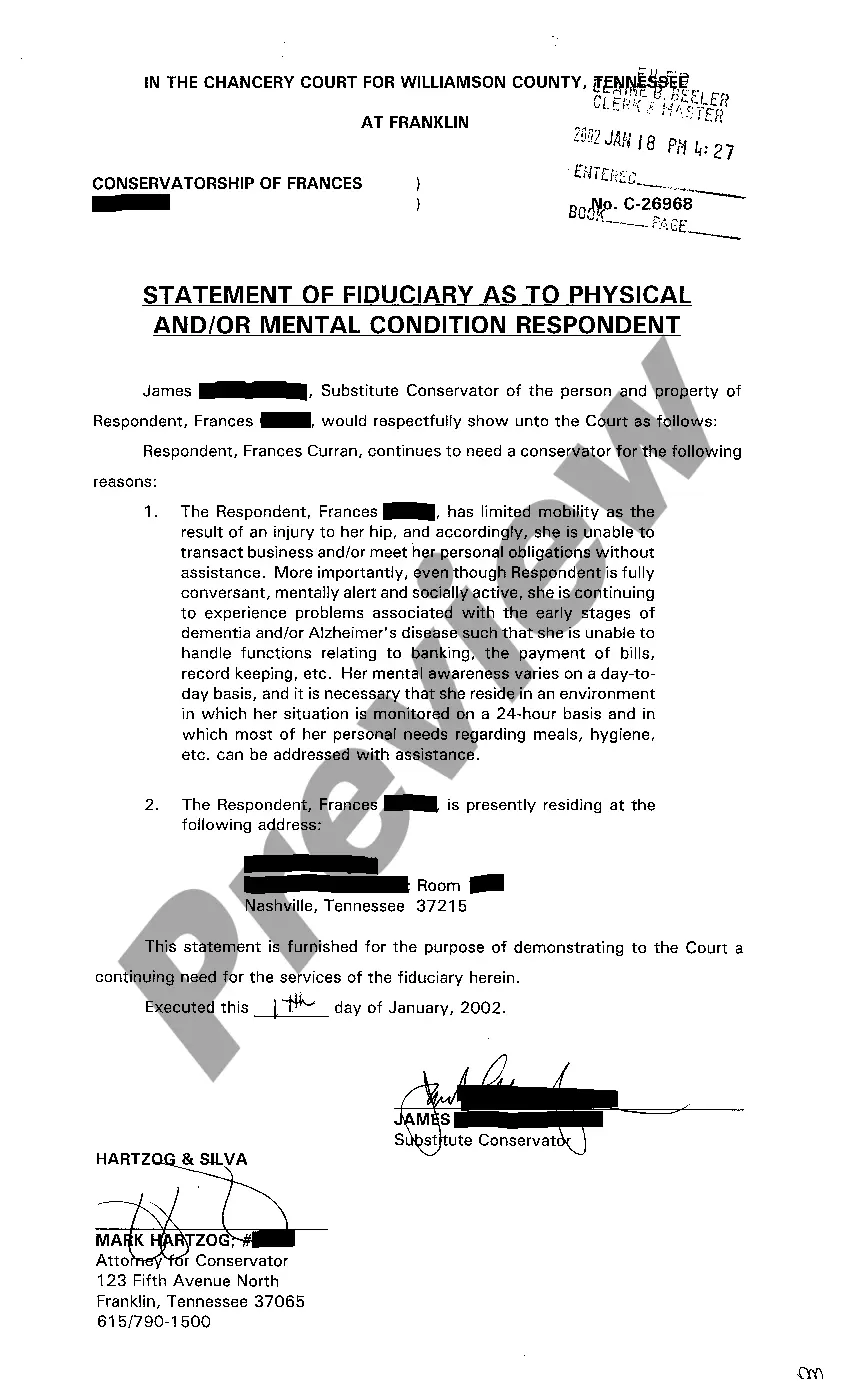

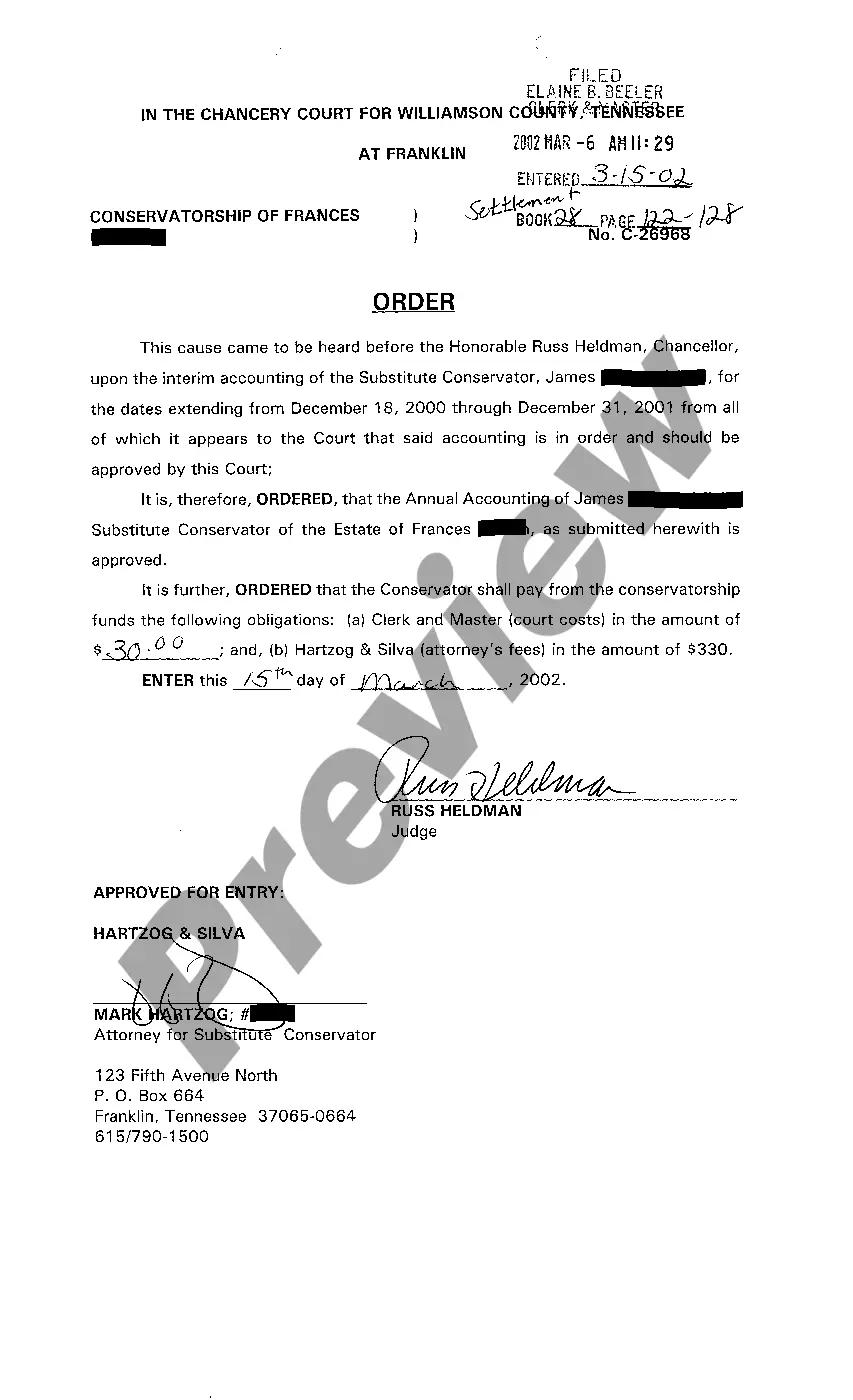

The Chattanooga Tennessee Statement of Corporate Surety is a legal document that serves as a guarantee of payment or performance by a corporation for certain obligations. It is an essential tool used in various business and legal transactions to provide assurance to the parties involved. One type of Chattanooga Tennessee Statement of Corporate Surety is the Performance Bond. This bond ensures that a construction project or contract will be completed according to the terms and conditions agreed upon. It protects the obliged, typically the project owner, from financial loss due to the contractor's failure to fulfill their obligations. Another type is the Payment Bond, which guarantees that subcontractors, laborers, and material suppliers will be paid for their work and supplies in relation to a construction project. This bond is crucial in ensuring timely payments, protecting the rights of those involved, and avoiding potential legal disputes. The License and Permit Bond is yet another type of surety bond in Chattanooga, Tennessee. It is a requirement for many businesses and professionals to obtain certain licenses or permits. This bond assures regulatory authorities and the public that the licensee will comply with applicable laws, regulations, and ethical standards in their industry. In the healthcare field, there is also the Medicare and Medicaid Bond. Healthcare providers who participate in federal healthcare programs must obtain this bond to demonstrate their financial responsibility and compliance with program requirements. It serves as a guarantee that providers will not engage in fraudulent activities and will properly handle government funds. Whenever a Chattanooga Tennessee Statement of Corporate Surety is required, it is crucial to partner with a reliable and licensed surety bond company. These companies specialize in issuing surety bonds and have thorough knowledge of the legal requirements and procedures involved. In conclusion, the Chattanooga Tennessee Statement of Corporate Surety encompasses various types of surety bonds, including Performance Bonds, Payment Bonds, License and Permit Bonds, and Medicare and Medicaid Bonds. Each type has its own specific purpose and ensures compliance, financial security, and ethical practices in various industries and business transactions.

Chattanooga Tennessee Statement of Corporate Surety

Description

How to fill out Chattanooga Tennessee Statement Of Corporate Surety?

Benefit from the US Legal Forms and get immediate access to any form template you want. Our helpful website with thousands of templates makes it simple to find and obtain almost any document sample you will need. You are able to export, fill, and certify the Chattanooga Tennessee Statement of Corporate Surety in a couple of minutes instead of surfing the Net for many hours trying to find an appropriate template.

Using our collection is a great way to improve the safety of your form submissions. Our experienced legal professionals regularly review all the documents to ensure that the templates are appropriate for a particular state and compliant with new laws and regulations.

How do you obtain the Chattanooga Tennessee Statement of Corporate Surety? If you already have a profile, just log in to the account. The Download button will be enabled on all the samples you look at. Additionally, you can get all the previously saved records in the My Forms menu.

If you don’t have a profile yet, follow the tips below:

- Find the form you require. Make certain that it is the template you were seeking: examine its headline and description, and use the Preview feature when it is available. Otherwise, use the Search field to look for the appropriate one.

- Start the downloading process. Click Buy Now and select the pricing plan that suits you best. Then, create an account and process your order with a credit card or PayPal.

- Save the document. Pick the format to get the Chattanooga Tennessee Statement of Corporate Surety and modify and fill, or sign it according to your requirements.

US Legal Forms is one of the most extensive and trustworthy document libraries on the web. Our company is always ready to help you in any legal procedure, even if it is just downloading the Chattanooga Tennessee Statement of Corporate Surety.

Feel free to take full advantage of our form catalog and make your document experience as straightforward as possible!