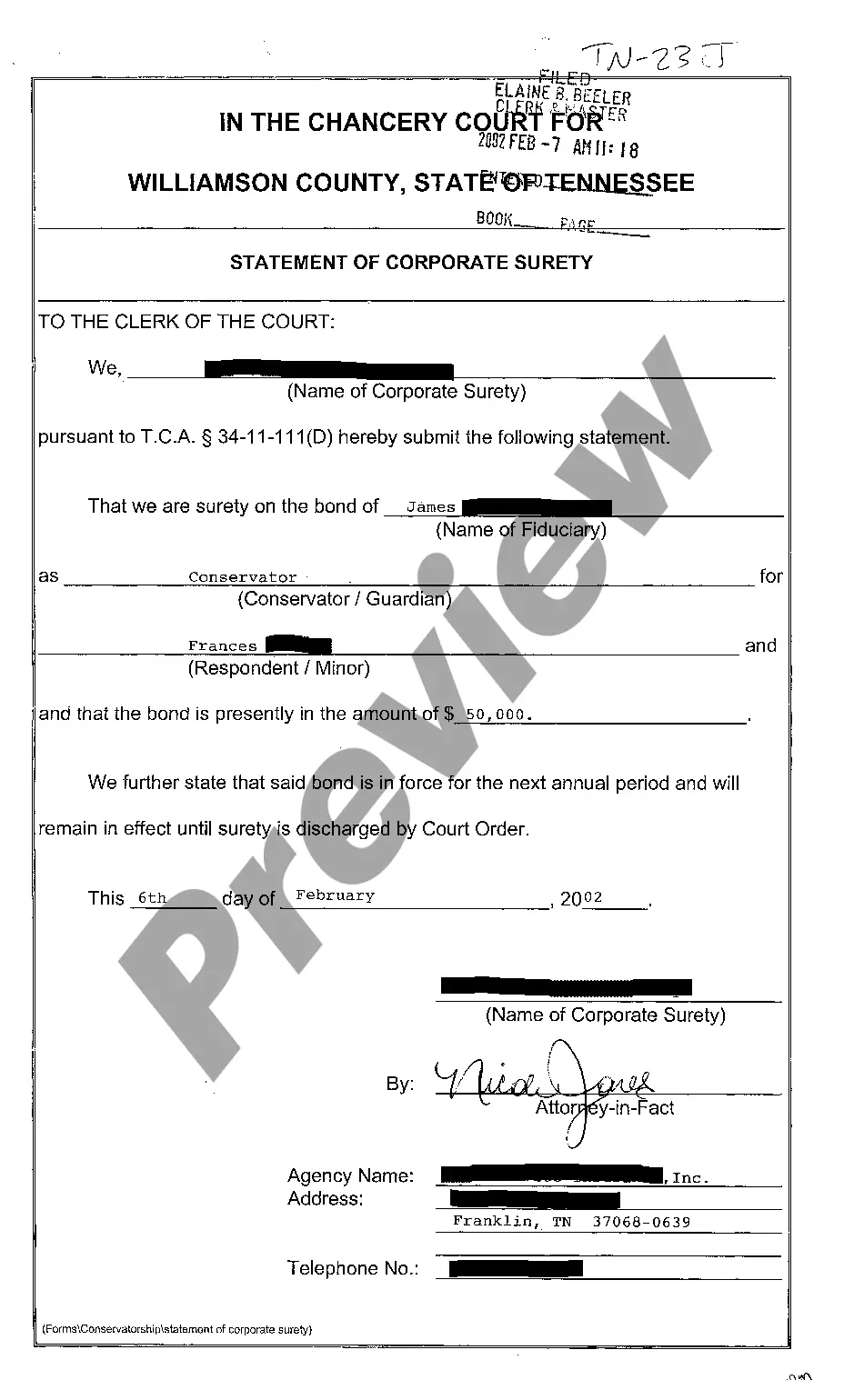

Clarksville Tennessee Statement of Corporate Surety

Description

How to fill out Tennessee Statement Of Corporate Surety?

If you are looking for a suitable form, it’s impossible to find a more convenient location than the US Legal Forms site – one of the largest online collections.

With this collection, you can acquire a vast array of templates for commercial and personal use by categories and regions, or keywords.

With our enhanced search feature, locating the latest Clarksville Tennessee Statement of Corporate Surety is as simple as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Choose the format and save it to your device.

- Furthermore, the relevance of each document is verified by a team of experienced attorneys who routinely examine the templates on our platform and update them in line with the latest state and county requirements.

- If you are already familiar with our system and possess an account, all you need to obtain the Clarksville Tennessee Statement of Corporate Surety is to Log In to your profile and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the instructions below.

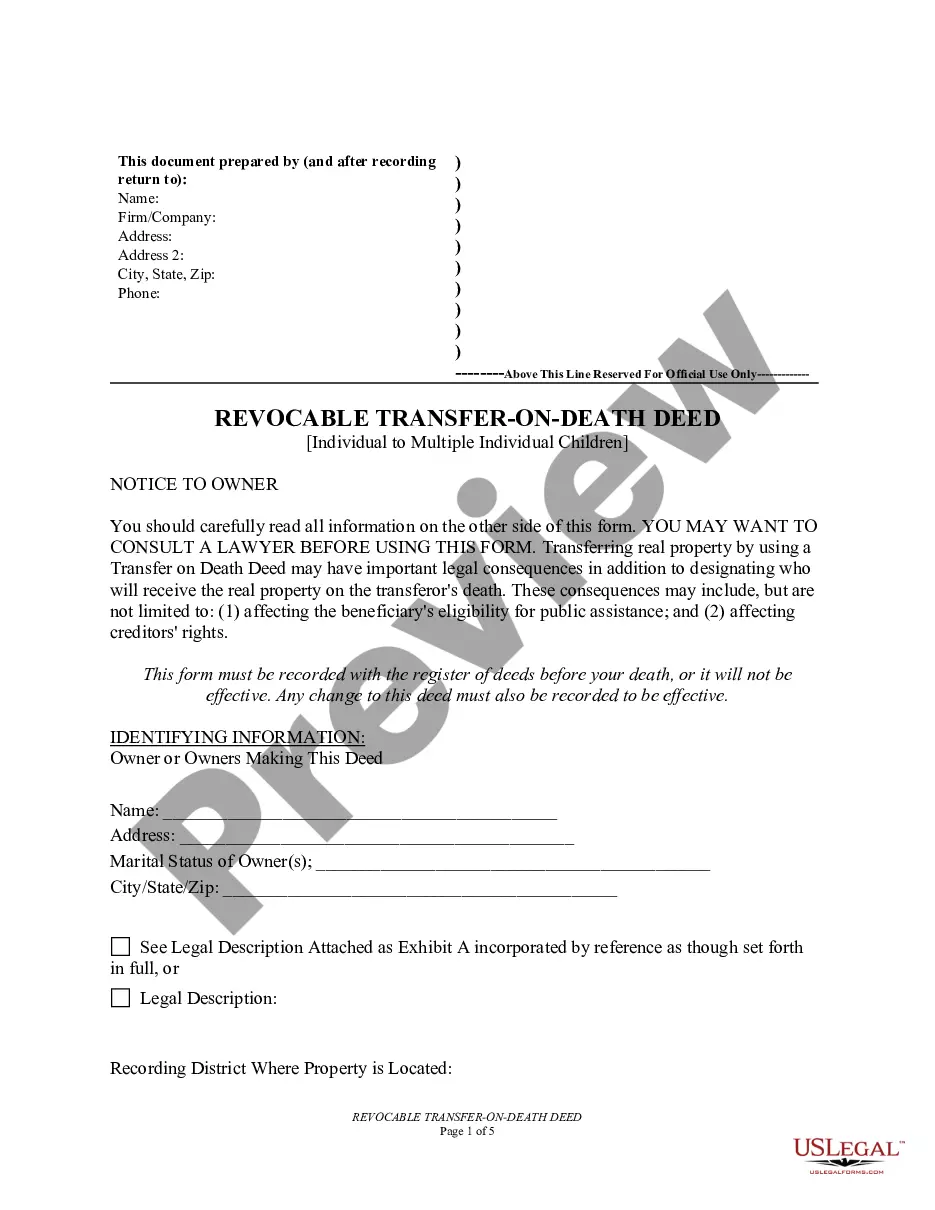

- Ensure you have selected the sample you require. Review its description and utilize the Preview option to examine its content. If it does not meet your requirements, employ the Search field located at the top of the screen to find the correct document.

- Verify your choice. Click the Buy now button. After that, choose your preferred subscription option and provide the necessary information to create an account.

Form popularity

FAQ

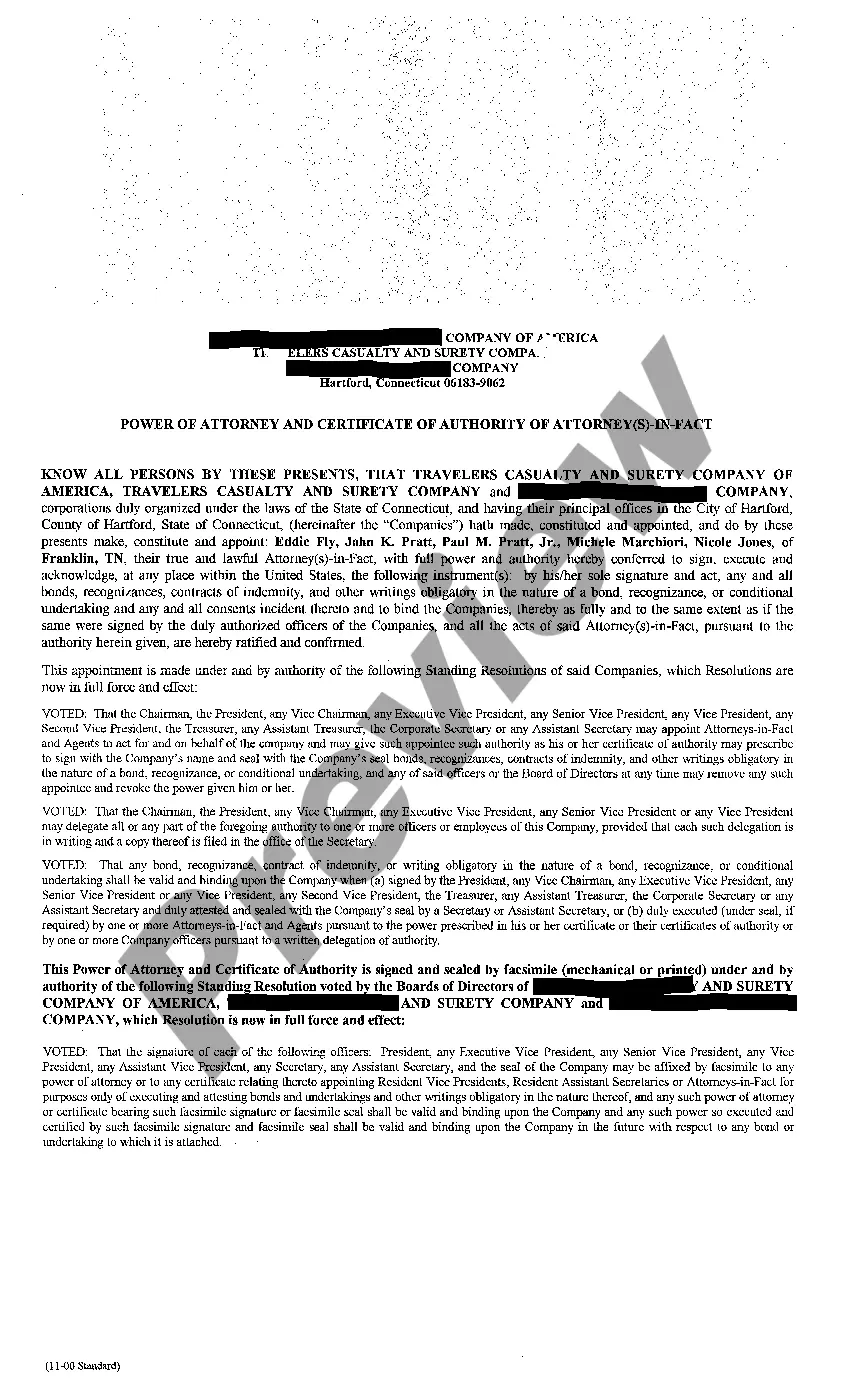

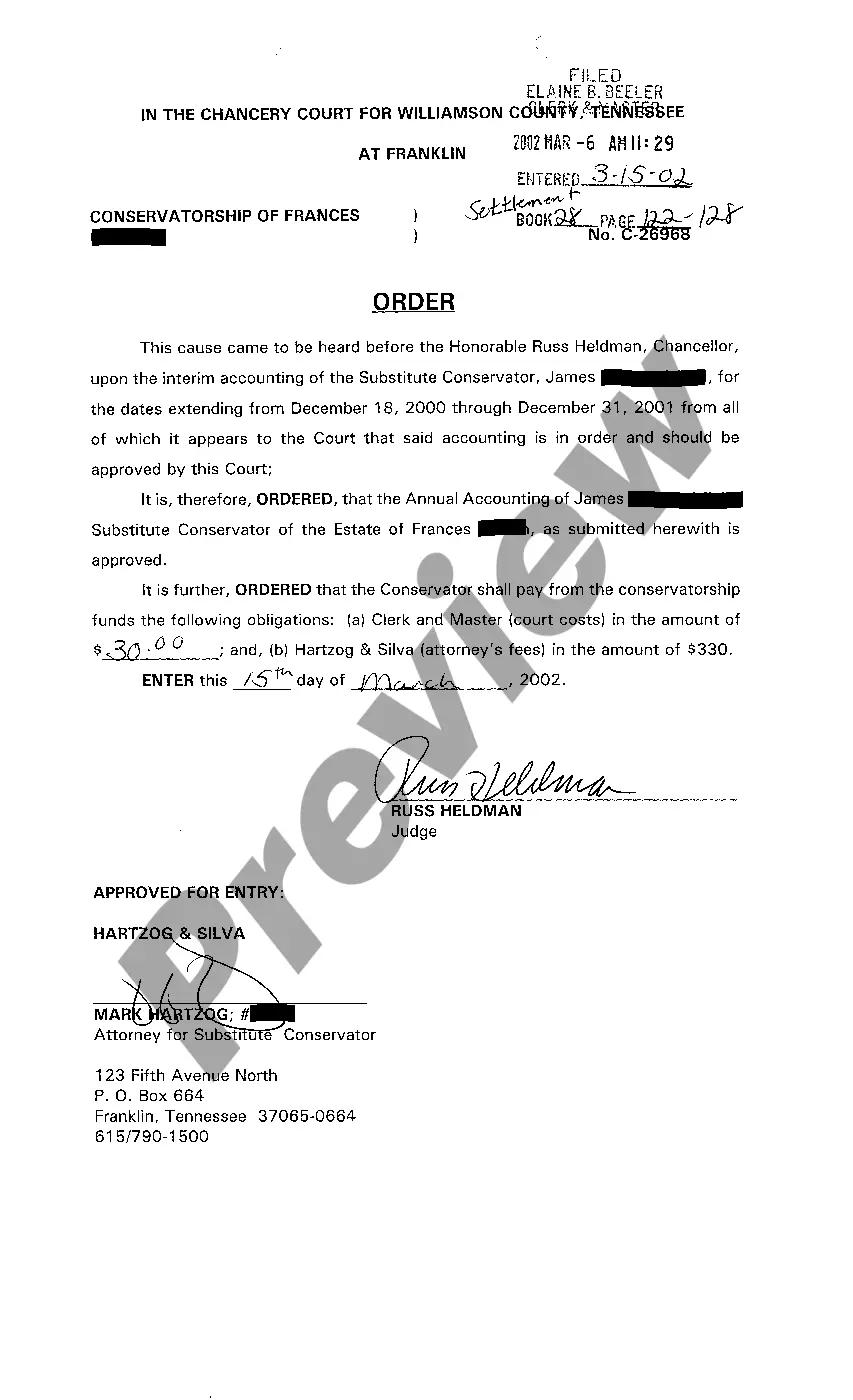

To obtain a surety bond in Tennessee, start by identifying the bond type required for your specific needs. You will then need to contact a licensed surety company or broker who can assist you in the process. It is essential to gather documentation that demonstrates your financial stability and credibility. For clarity on the process specific to a Clarksville Tennessee Statement of Corporate Surety, you can use US Legal Forms to access the necessary forms and guidance.

A surety bond is calculated based on the total bond amount, creditworthiness, and specific risk factors associated with the bonded principal. For example, in Clarksville, Tennessee, a surety provider will evaluate your financial history and industry experience to determine your premium. Engaging with professional platforms like USLegalForms can help you understand these calculations in detail.

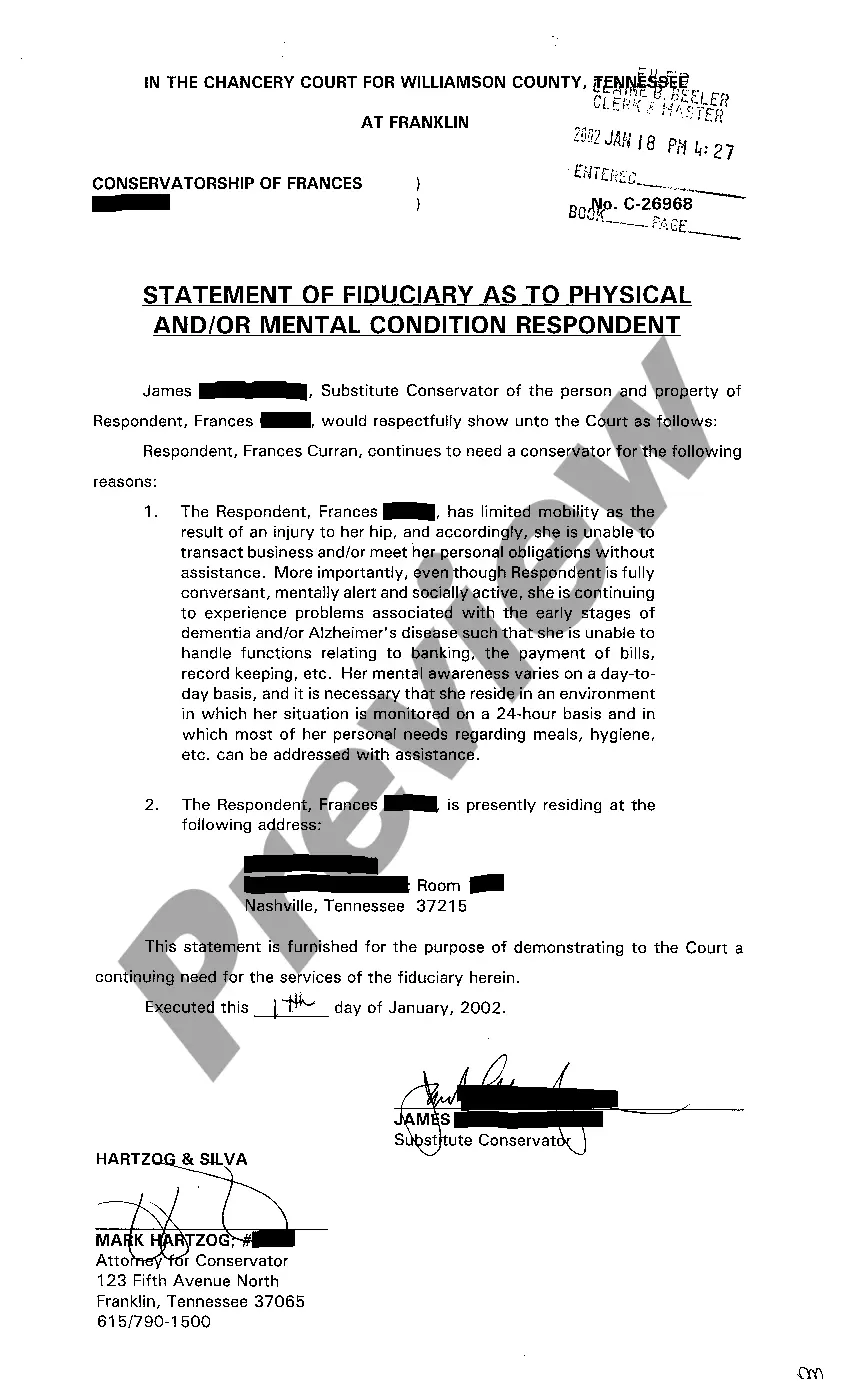

A surety statement is a formal declaration from a surety company that outlines its commitment to ensure the performance of a contract. This document is integral in the context of a Clarksville Tennessee Statement of Corporate Surety, providing clarity on the obligations guaranteed. Understanding the content of this statement helps all parties invloved gain confidence in contractual arrangements.

When someone signs surety, they agree to take responsibility for fulfilling a contract or obligation in case the principal party defaults. This act provides additional security to the other party involved in the agreement. In a Clarksville Tennessee Statement of Corporate Surety, the signer essentially assures that the bonded party will meet their commitments.

Filling out a surety bond application requires providing personal and business information, including financial statements and details about the project. Ensure you include any necessary documentation that supports your application, which may be requested by the surety provider. Utilizing services like USLegalForms can simplify this process, helping to ensure accuracy in your application.

To file a surety claim, you must first notify the surety company about the default related to the bond. Next, prepare and submit all relevant documentation that supports your claim, detailing the nature of the default. Platforms like USLegalForms can guide you through this process to ensure your claim is filed accurately and efficiently.

A surety statement refers to a formal document indicating that a surety company will assume responsibility for a particular bond. In the realm of Clarksville, Tennessee, a Statement of Corporate Surety outlines the conditions and obligations guaranteed by the surety provider. Understanding this statement is crucial for parties involved in contracts requiring surety.

A surety serves as a safeguard for the completion of a project, ensuring that obligations will be fulfilled as promised. In the context of a Clarksville Tennessee Statement of Corporate Surety, it guarantees that if a party defaults on their commitments, the surety company will cover the losses. This mechanism builds trust between parties and is essential in various industries.

To find a company's surety bond, start by checking public records from state agencies or local government websites. Look specifically for the Clarksville Tennessee Statement of Corporate Surety to locate detailed information. You can also utilize services like uslegalforms to facilitate your search, ensuring all necessary data is accessible at your fingertips.

You can find bond information by searching on state government websites or contacting local regulatory agencies. In Clarksville, Tennessee, you may access details about the Clarksville Tennessee Statement of Corporate Surety through official resources. Additionally, platforms like uslegalforms can ease the process, offering organized access to vital bond information.