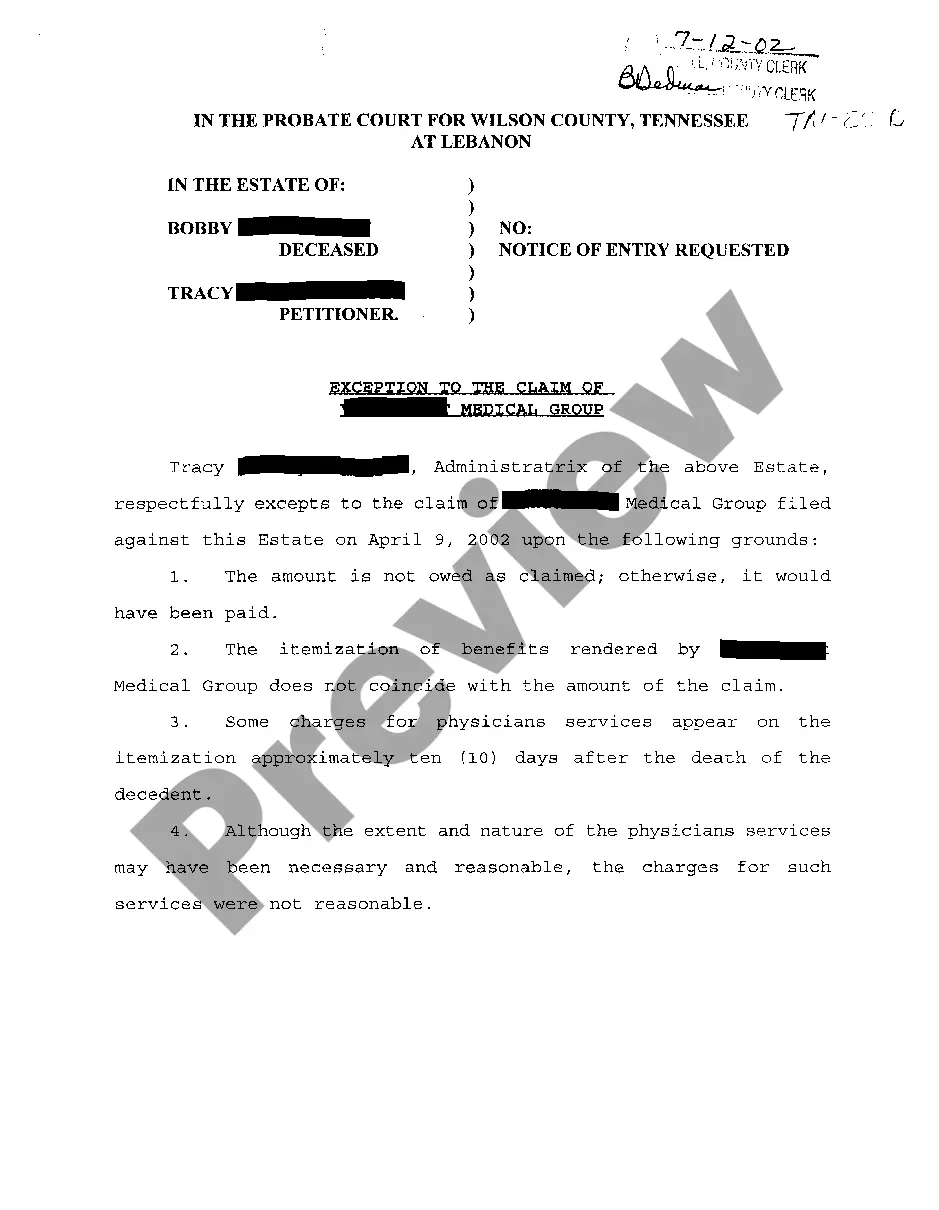

Nashville Tennessee Exception To Claim Against the Estate by Physicians is a legal provision that provides protection to physicians or medical professionals in Nashville, Tennessee against certain claims presented by creditors of a deceased individual's estate. This exception safeguards medical practitioners from potential liability for services rendered to the deceased prior to their demise. There are different types of Nashville Tennessee Exception To Claim Against the Estate by Physicians, each catering to specific scenarios. Some of these exceptions include: 1. Statutory Exception: This exception is based on specific state laws in Nashville, Tennessee, which outline the circumstances under which a physician's claim against the estate may be exempted from being paid out to creditors. 2. Emergency Medical Services Exception: Under this exception, medical professionals who provide emergency medical assistance, such as first responders, paramedics, or emergency room doctors, may be protected from certain claims against the estate if their services were rendered during a life-threatening situation. 3. Limited Liability Exception: This exception may apply to physicians who have limited involvement in the deceased's treatment or are only consulted for a specific aspect of their medical care. In such cases, their claim against the estate can be limited to the scope of their involvement rather than the entirety of the medical expenses. 4. Charitable Services Exception: Medical practitioners who provide services to the deceased on a charitable or pro bono basis may qualify for this exception. It typically applies to situations where physicians offer their expertise for free or at significantly reduced rates to individuals in need. 5. Statute of Limitations Exception: This exception may come into play when the claim is filed after a specific time limit has expired. In Nashville, Tennessee, there is a statute of limitations that dictates the timeframe within which creditors must present their claims against an estate. If the claim is filed beyond this time limit, physicians may benefit from this exception. It's important to note that the specifics and availability of these exceptions may vary based on individual circumstances, state laws, and the nature of the medical services rendered. Seeking legal advice from a qualified attorney specializing in estate law would be prudent to navigate the intricacies of these exceptions and their applicability to a particular case.

Nashville Tennessee Exception To Claim Against the Estate by Physicians

Description

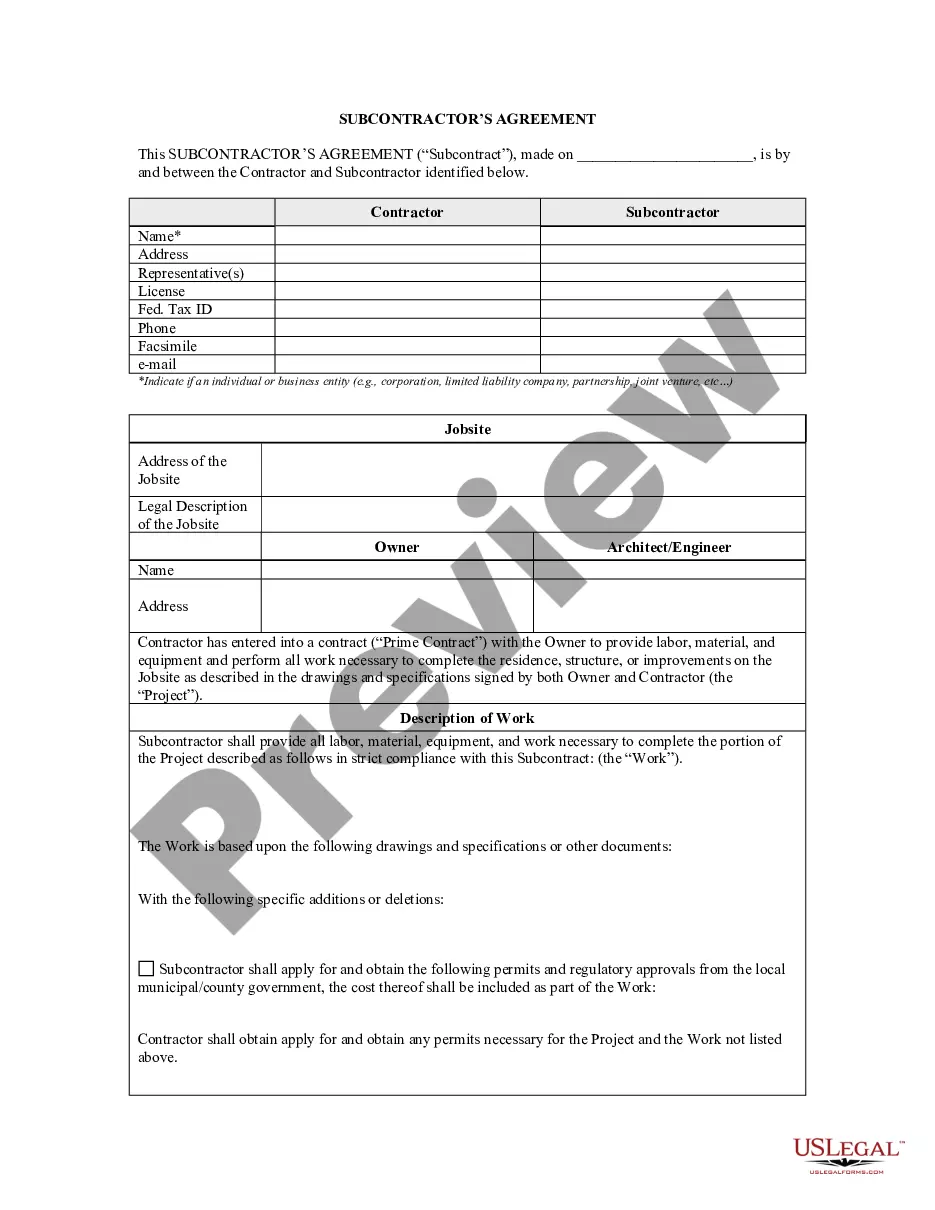

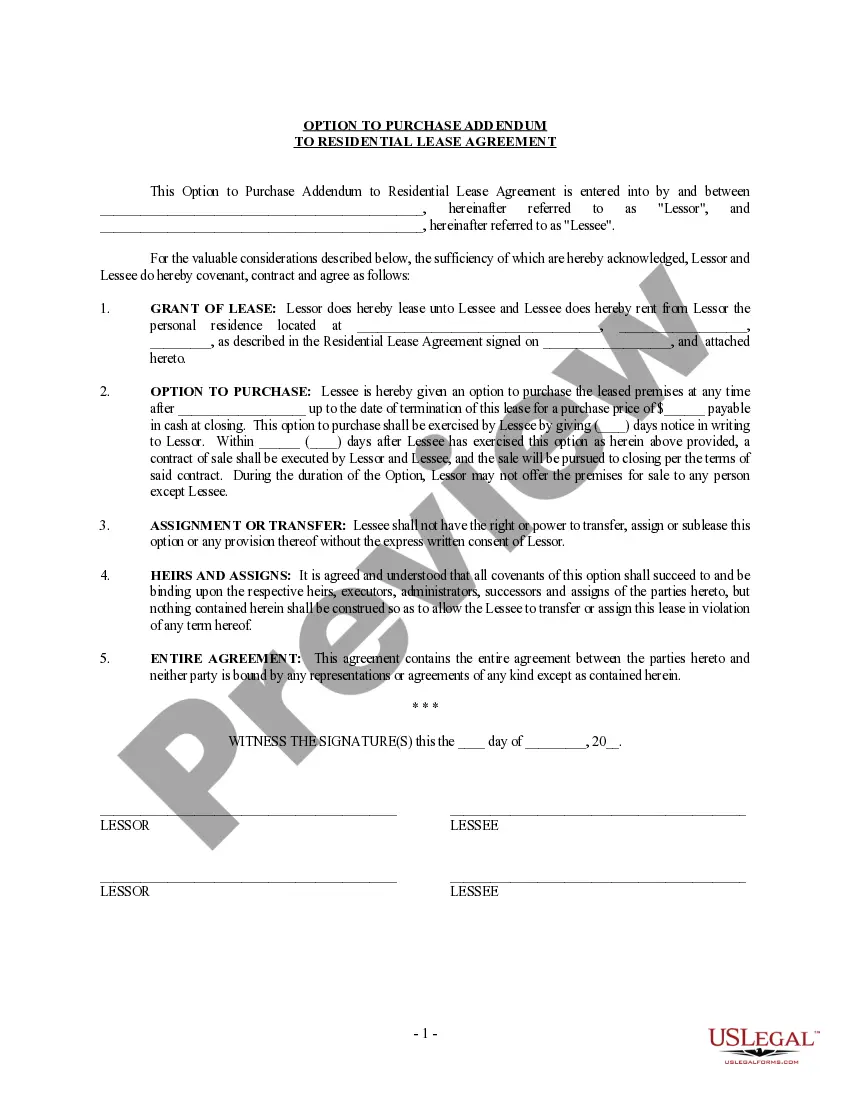

How to fill out Nashville Tennessee Exception To Claim Against The Estate By Physicians?

Finding authentic templates tailored to your regional laws can be challenging unless you utilize the US Legal Forms repository.

It’s an online collection of over 85,000 legal forms catering to both personal and professional requirements as well as various real-life situations.

All documents are systematically organized by application area and jurisdiction, making it simple and quick to retrieve the Nashville Tennessee Exception To Claim Against the Estate by Physicians.

Acquiring and maintaining documentation orderly and in accordance with law is crucial. Leverage the US Legal Forms library to always have necessary document templates readily available for any requirements!

- Verify the Preview mode and form details.

- Ensure that you’ve selected the correct document that fulfills your criteria and aligns with your local jurisdiction standards.

- Search for an alternative template, if necessary.

- If you observe any discrepancies, utilize the Search tab above to locate the appropriate one. If it meets your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

Generally, in Tennessee, probate can take anywhere from six months to a year. However, the process can take longer if there is a dispute over the deceased person's will or any unusual assets or debts involved.

The spouse or civil partner of the deceased. A former spouse or civil partner (if they have not remarried or entered a new civil partnership) Anyone who was living in the same household as the deceased for at least two years immediately preceding their death. Any children of the deceased.

In Tennessee, the longest period that a creditor ever has to file a claim against an estate is twelve months from the date of the death of the deceased.

Your child or descendants will inherit two thirds of the intestate real estate and whatever personal property remains after your spouse has received their share. If you die intestate, each of your children will receive an ?intestate share? of your property.

The executor has 60 days to start the process by submitting an inventory of the estate's assets, notifying heirs and creditors and asking the state's tax authorities and the Medicaid agency, TennCare, for a release of any claims.

If a personal representative is appointed, creditors now have six (6) months after the appointment to present claims against the decedent's estate. In cases where a personal representative is not appointed, creditors have two (2) years from the date of the decedent's death in which to present claims against the estate.

Non-Probate Tennessee Inheritances Transfer-on-death securities and assets. Life insurance policy payouts. Assets in a living trust. Retirement accounts, such as IRAs. Payable-on-death accounts. Joint-tenancy property. Property owned via tenancy by the entirety.

For small estates, North Carolina has a simplified process which allows you to wrap up the estate without formal probate. This process applies to estates with personal property valued at $20,000, or $30,000 if the surviving spouse inherits everything under state law.

State law allows for two years for the will to be entered into the court records. However, an heir may file sooner if the executor fails to file within 60 days of the death of the person.

Executors must not unreasonably delay distributing the estate for their own gain or any other party. However, even after the executor's year, the court will not order a distribution of the estate if the executors can show there is good reason to wait.